Telematics And Usage-based Auto Insurance Trends

The road to auto insurance is undergoing a seismic shift, driven by data and personalized risk assessment. Traditional models, relying on broad demographic factors, are increasingly giving way to telematics and usage-based insurance (UBI). This technological revolution promises fairer premiums, safer driving habits, and a fundamental reshaping of the insurance landscape, but also raises critical questions about privacy and data security.

At the heart of this transformation is the concept of tailoring insurance costs to individual driving behavior. UBI programs utilize telematics devices – either installed in the vehicle or accessed through smartphone apps – to monitor driving habits. The data collected, ranging from speed and braking patterns to mileage and time of day, are then analyzed to determine the policyholder's risk profile and adjust premiums accordingly. This move toward granular risk assessment is poised to disrupt the $300 billion auto insurance market in the United States alone.

The Rise of Usage-Based Insurance

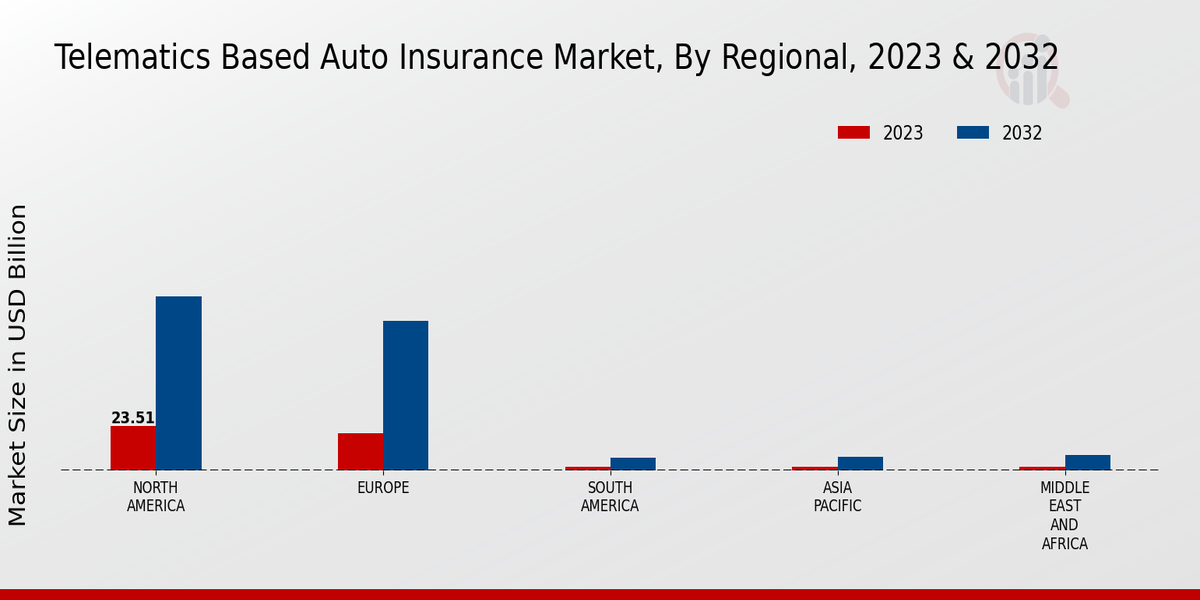

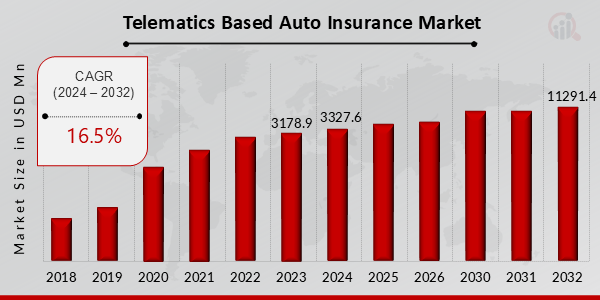

The adoption of UBI is no longer a futuristic fantasy; it's a growing reality. Market research firms like Juniper Research and Allied Market Research project significant growth in the coming years. They estimate that the global telematics market for auto insurance will reach hundreds of billions of dollars within the next decade. This growth is fueled by several factors, including advancements in telematics technology, increasing consumer awareness, and the potential for significant cost savings.

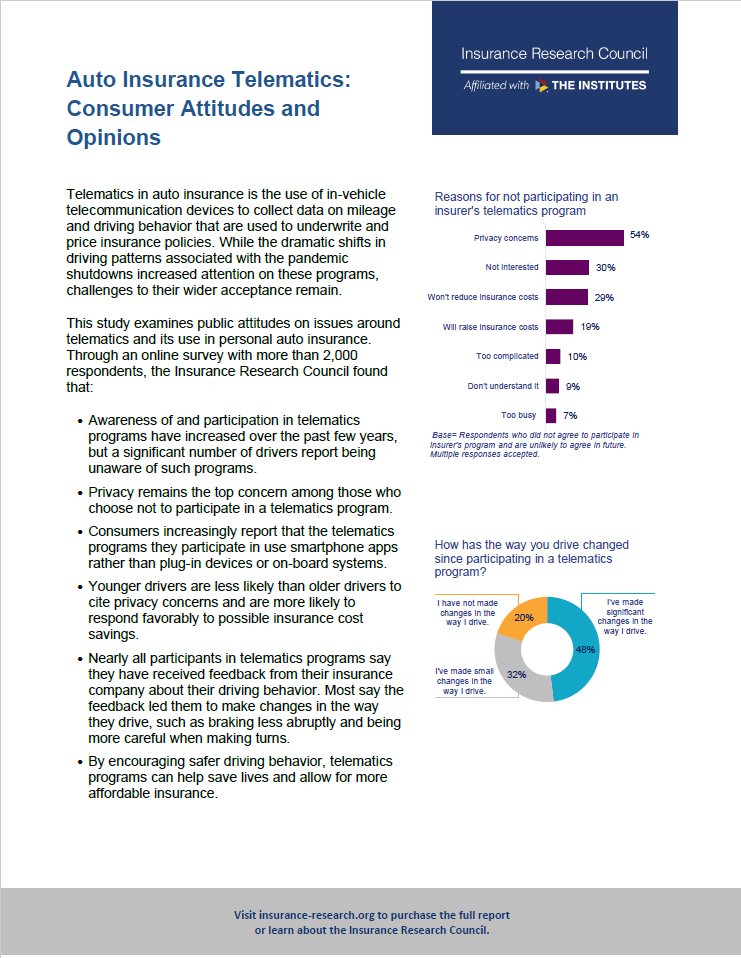

Insurers are increasingly incentivizing drivers to participate in UBI programs. They offer discounts for safe driving habits, potentially leading to substantial savings for careful drivers. Some companies are even gamifying the experience, offering rewards and recognition for achieving certain driving milestones.

Key Features of UBI Programs

UBI programs rely on several key data points to assess driving risk. Hard braking, acceleration, and speeding are common indicators of risky behavior. Mileage is another important factor, with lower mileage typically correlating with lower risk. The time of day is also considered, as driving at night or during rush hour is often associated with a higher probability of accidents.

The collected data is transmitted to the insurance company for analysis. Sophisticated algorithms and machine learning models are then used to identify patterns and trends that can predict the likelihood of an accident. This allows insurers to price policies more accurately and offer personalized discounts to safe drivers.

Benefits and Drawbacks

The potential benefits of UBI are numerous. For safe drivers, it offers the opportunity to save money on their insurance premiums. It can also encourage safer driving habits by providing real-time feedback on driving performance. Furthermore, UBI can promote greater transparency and fairness in the insurance industry.

However, UBI also presents several challenges and concerns. Privacy is a major concern, as drivers may be uncomfortable with the idea of their driving behavior being constantly monitored. Data security is another critical issue, as the data collected by telematics devices could be vulnerable to hacking or misuse.

There are also concerns about potential discrimination. For example, drivers who live in areas with heavy traffic or poor road conditions may be unfairly penalized, even if they are driving safely. Insurers must address these concerns and ensure that UBI programs are fair and equitable for all drivers.

The Regulatory Landscape

The regulatory landscape surrounding UBI is still evolving. Some states have specific regulations governing the use of telematics data for insurance purposes. These regulations often address issues such as data privacy, data security, and the transparency of UBI programs.

The National Association of Insurance Commissioners (NAIC) is working to develop model laws and guidelines for UBI. These efforts aim to promote consistency and consumer protection across different states. The insurance industry itself is also actively involved in shaping the regulatory environment, advocating for policies that support innovation while ensuring responsible data practices.

Looking Ahead

The future of auto insurance is undoubtedly linked to telematics and UBI. As technology continues to advance and data collection becomes more sophisticated, UBI programs will become even more personalized and effective. We can expect to see greater integration of UBI with other technologies, such as autonomous driving systems and connected car platforms.

The key to the successful adoption of UBI lies in addressing the concerns about privacy, data security, and fairness. Insurers must be transparent about how data is collected and used, and they must implement robust security measures to protect driver's personal information. They must also ensure that UBI programs are designed to be fair and equitable for all drivers, regardless of their location or driving conditions.

By addressing these challenges, the auto insurance industry can unlock the full potential of UBI and create a safer, more efficient, and more affordable insurance system for everyone.