The Combination Of Whole Life And Level Term

The life insurance landscape is undergoing a subtle but significant shift as financial advisors increasingly advocate for a blended approach, combining the perceived safety of whole life insurance with the affordability of level term life insurance. This strategy, designed to address both long-term security and immediate coverage needs, is gaining traction, but not without raising questions about its suitability for all individuals and families.

This hybrid model aims to offer a middle ground between the guaranteed cash value accumulation of whole life and the cost-effectiveness of level term. It provides a way to secure lifelong coverage while maximizing protection during critical financial periods like raising children or paying off a mortgage. However, critics argue that it might be more complex and potentially less transparent than simpler, more straightforward insurance solutions.

Understanding Whole Life and Level Term: A Refresher

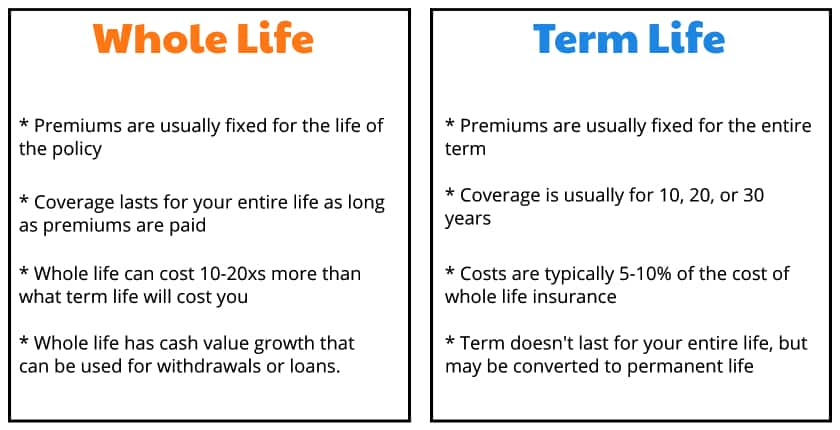

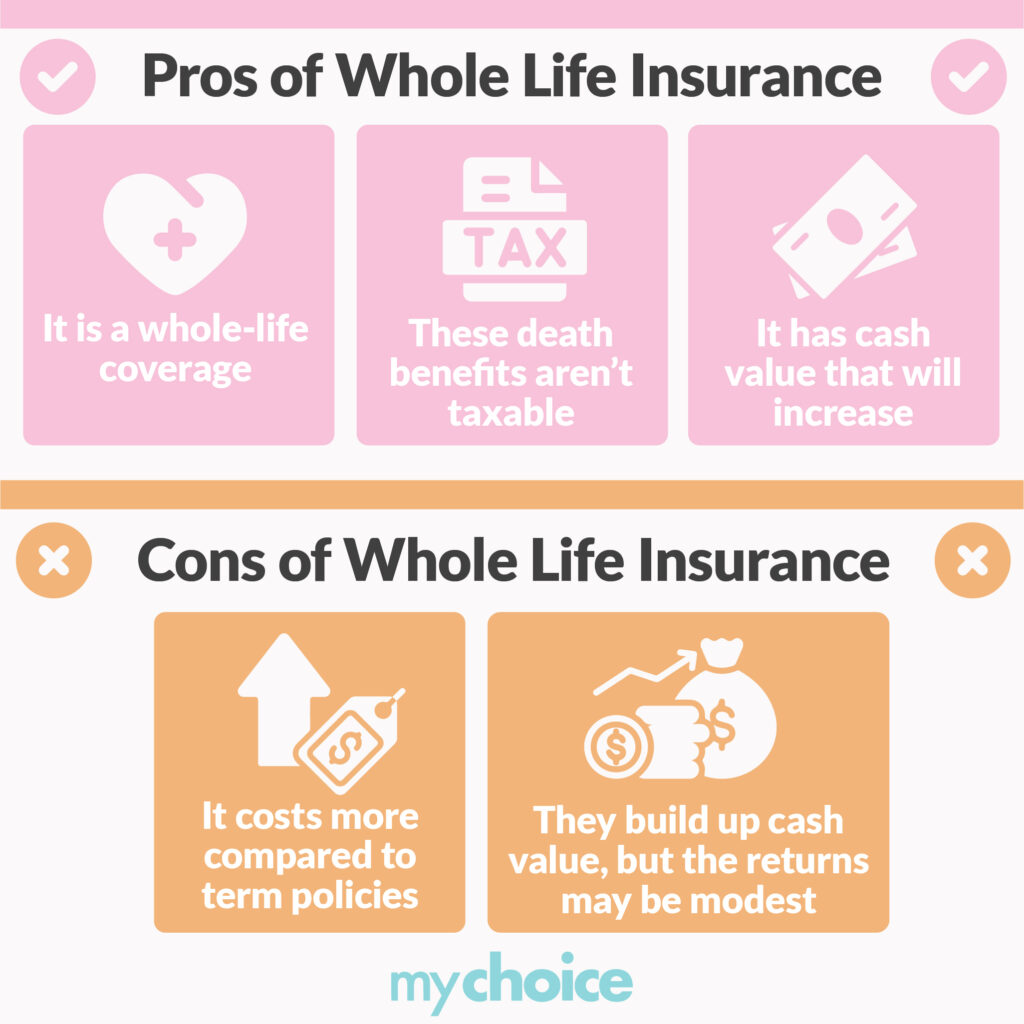

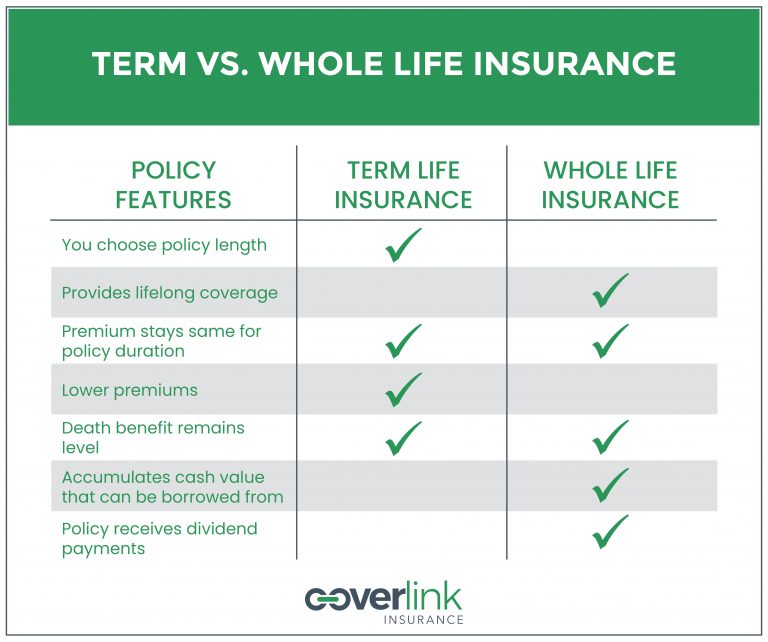

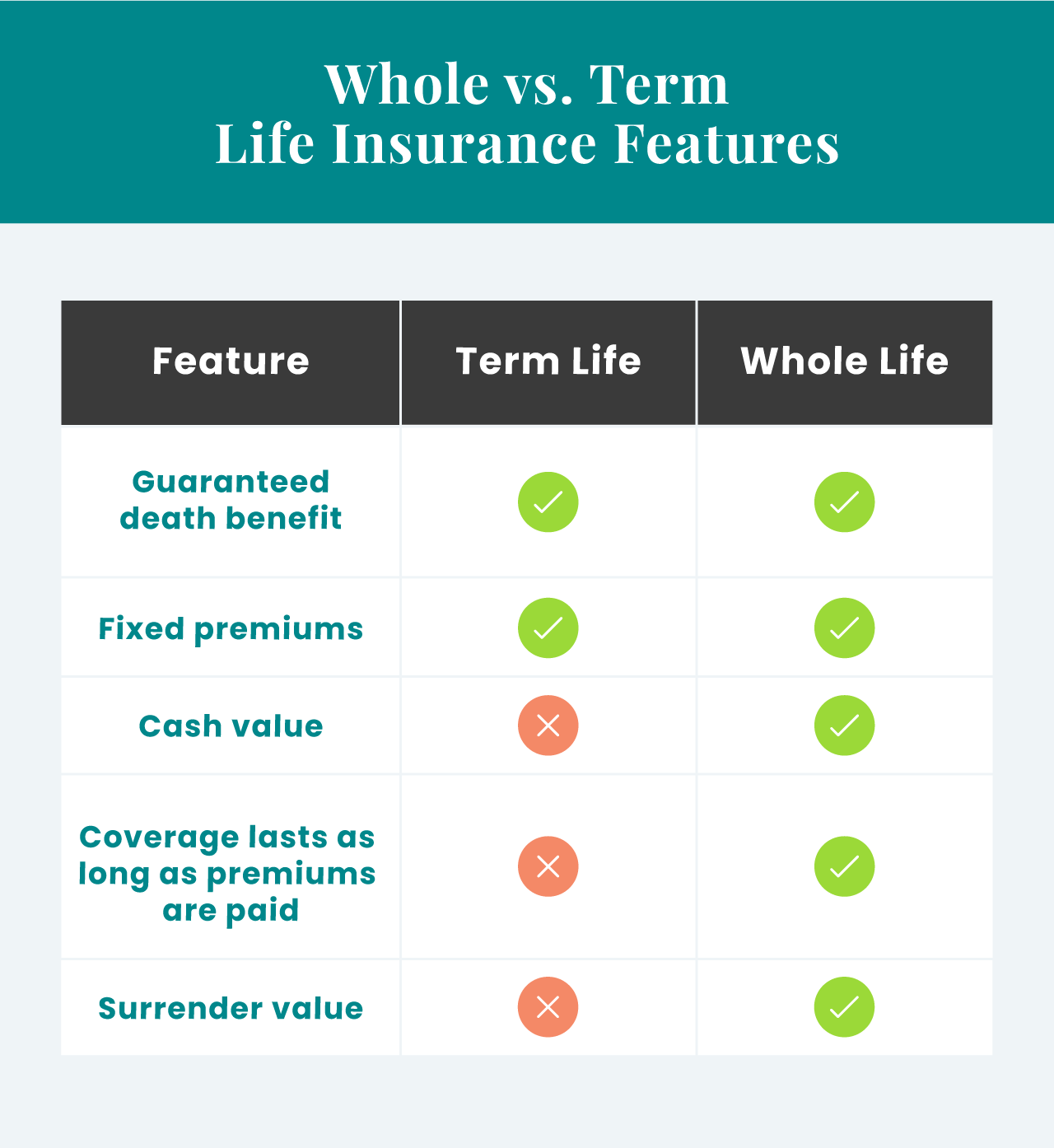

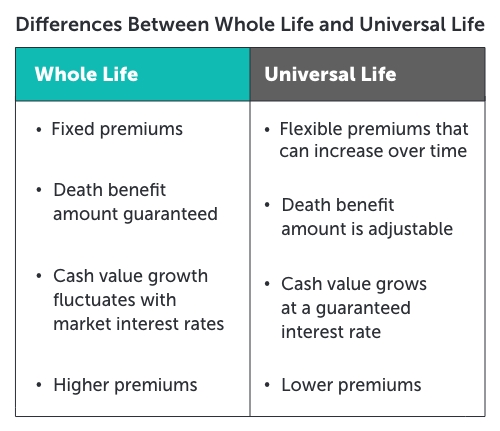

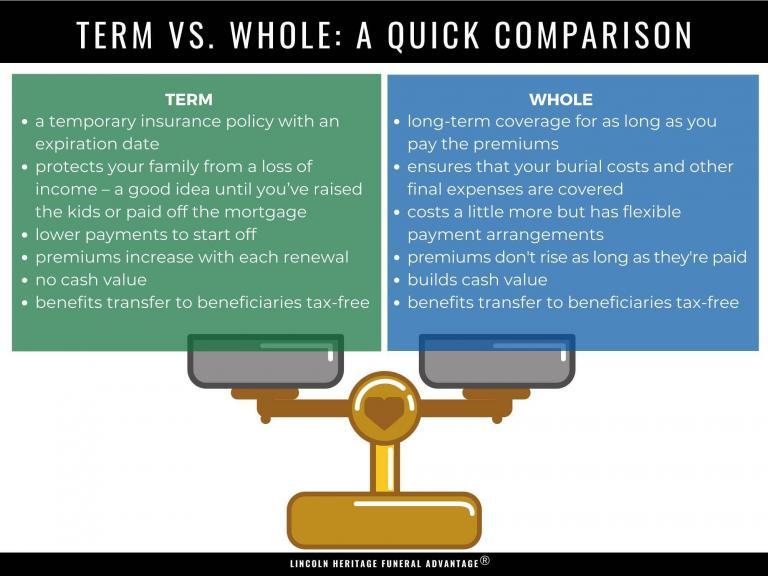

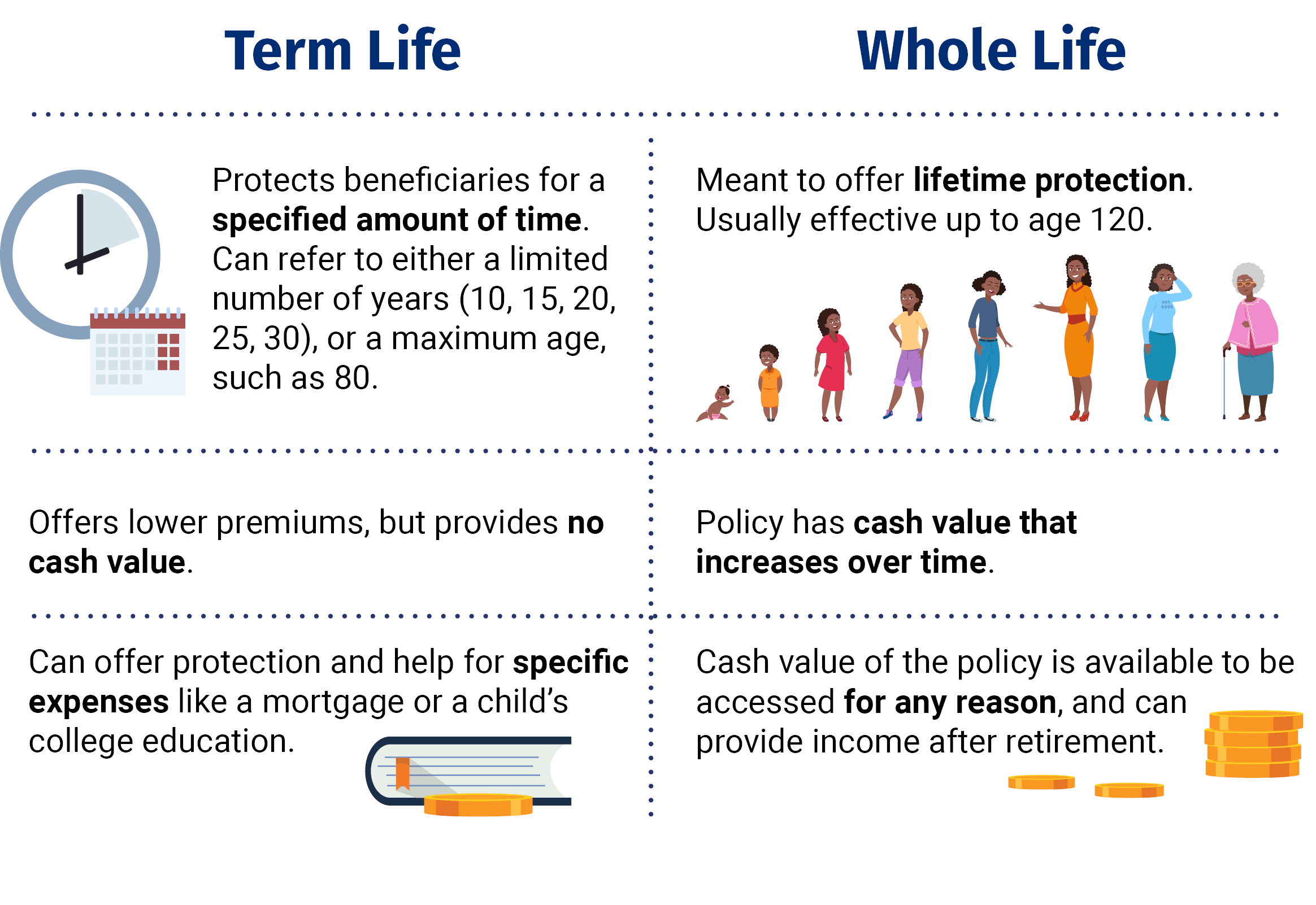

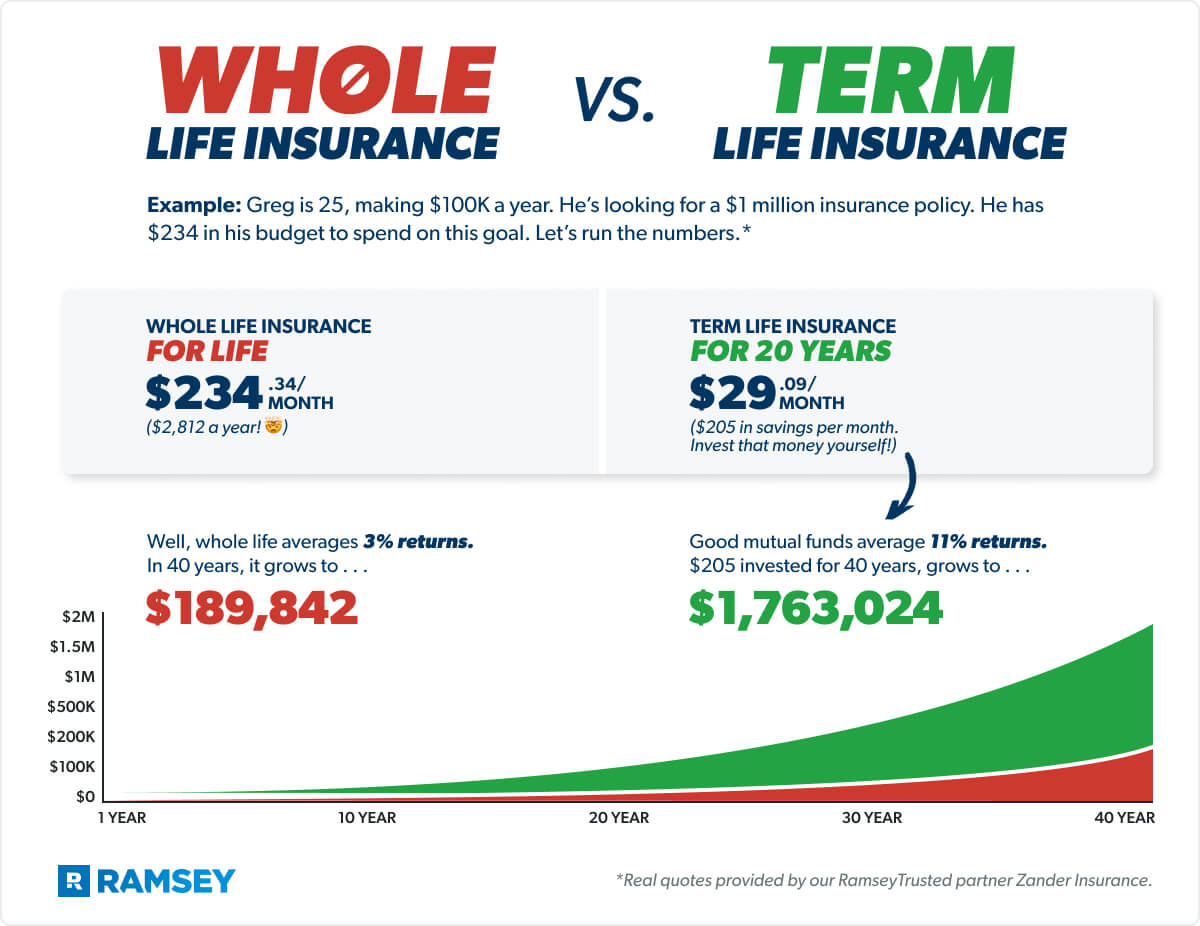

Whole life insurance provides lifelong coverage with a guaranteed death benefit and a cash value component that grows over time on a tax-deferred basis. Premiums are typically higher than term life, reflecting the lifelong coverage and investment aspect.

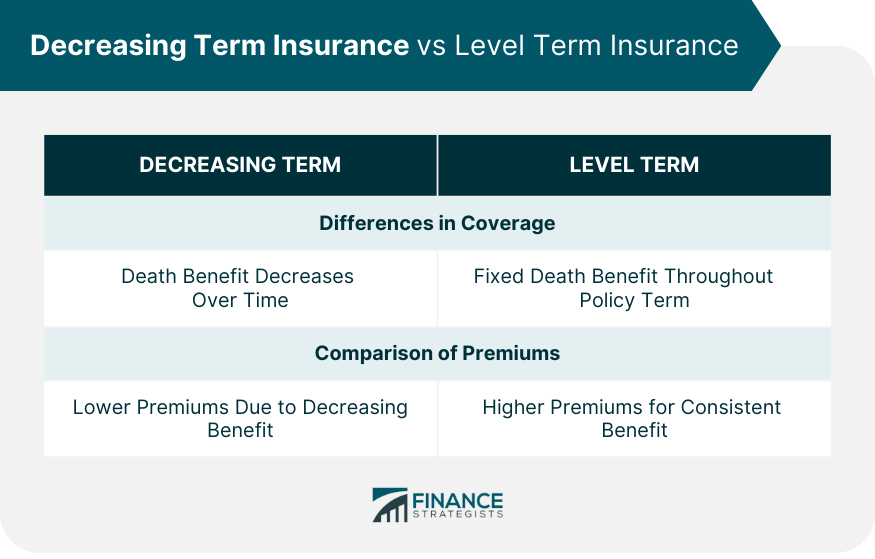

Level term life insurance offers coverage for a specific period (e.g., 10, 20, or 30 years) with premiums that remain the same throughout the term. If the insured dies within the term, the death benefit is paid out; if the term expires, the coverage ceases, unless the policy is renewed or converted. Term life policies are usually less expensive, making them attractive for individuals seeking maximum coverage during specific financial obligations.

The Allure of the Blend: Bridging the Gap

The blended approach typically involves purchasing a smaller whole life policy to secure lifelong coverage and cash value accumulation, complemented by a larger term life policy to address immediate coverage needs. The idea is to provide a foundation of permanent coverage while maximizing protection during high-risk periods, such as the years when a family is dependent on the insured's income.

For example, a 35-year-old might purchase a $100,000 whole life policy and a $500,000 20-year term life policy. This strategy ensures that regardless of when the insured dies, there's at least $100,000 for beneficiaries, with the additional $500,000 providing substantial protection during the first 20 years.

Benefits of the Combined Approach

One of the primary advantages is the ability to balance affordability with long-term security. By combining a smaller whole life policy with a larger term policy, individuals can obtain substantial coverage without breaking the bank.

Another benefit is the potential for cash value accumulation within the whole life component. This cash value can be borrowed against or withdrawn, providing a source of funds for unexpected expenses or retirement needs.

The flexibility to customize coverage to specific needs is also a key advantage. The term life portion can be tailored to match the duration of significant financial obligations, such as a mortgage or child-rearing years.

Potential Drawbacks and Considerations

Despite its advantages, the blended approach is not without its drawbacks. One potential issue is the complexity of managing two separate policies. Individuals need to understand the terms and conditions of both policies and ensure they are adequately coordinated.

Another concern is the potential for higher overall costs compared to a simple term life policy, especially if the term life policy needs to be renewed after its initial term expires. Renewal premiums are typically significantly higher.

Financial advisors who are not well-versed in both whole life and term life may not be able to provide objective and appropriate advice. Consumers should seek guidance from advisors with a proven track record in both types of policies.

Expert Opinions and Industry Insights

According to a recent survey by the Life Insurance Marketing and Research Association (LIMRA), interest in blended life insurance solutions is growing, particularly among younger demographics seeking affordable options with long-term benefits.

“We are seeing a trend towards consumers wanting a more personalized approach to life insurance,” stated David Levenson, President and CEO of LIMRA. “The blended strategy allows for that customization.”

However, Peter Montoya, a financial advisor with decades of experience, cautions, "While the blended approach can be effective, it's crucial to assess each client's individual circumstances and financial goals. A cookie-cutter approach can be detrimental."

Who is the Blended Approach Suitable For?

This strategy is often most suitable for individuals who: want lifelong coverage but cannot afford a large whole life policy on its own; have specific short-term financial obligations they want to cover; desire the potential for cash value accumulation; and are comfortable managing two separate policies.

It may not be ideal for individuals who: are primarily seeking the lowest possible premiums and do not need lifelong coverage; prefer the simplicity of a single policy; or are uncomfortable with the investment aspects of whole life insurance.

Future Trends and Conclusion

As financial literacy increases and consumers demand more personalized financial solutions, the blended approach to life insurance is likely to continue gaining popularity. Technological advancements are also making it easier to compare and manage different types of life insurance policies.

However, it is essential for consumers to approach this strategy with caution and seek professional guidance to ensure it aligns with their individual needs and financial goals. The key is to understand the complexities of both whole life and level term insurance and to carefully evaluate the potential benefits and drawbacks before making a decision.

Ultimately, the best life insurance strategy is one that provides adequate coverage at an affordable price and meets the unique needs of the individual and their family.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)