Can I Buy A House With A 524 Credit Score

Dreaming of homeownership but haunted by a less-than-stellar credit score? You might be wondering if a 524 credit score slams the door shut on your property aspirations. The truth is complex, but hope isn't entirely lost.

This article breaks down the realities of buying a house with a 524 credit score, exploring available options and providing crucial next steps for prospective homebuyers. Discover the lenders willing to work with lower scores and what it takes to qualify.

Navigating the Mortgage Maze with a 524 Credit Score

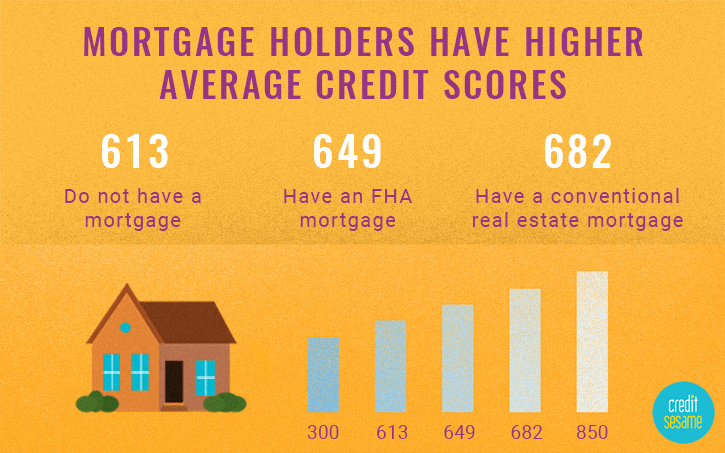

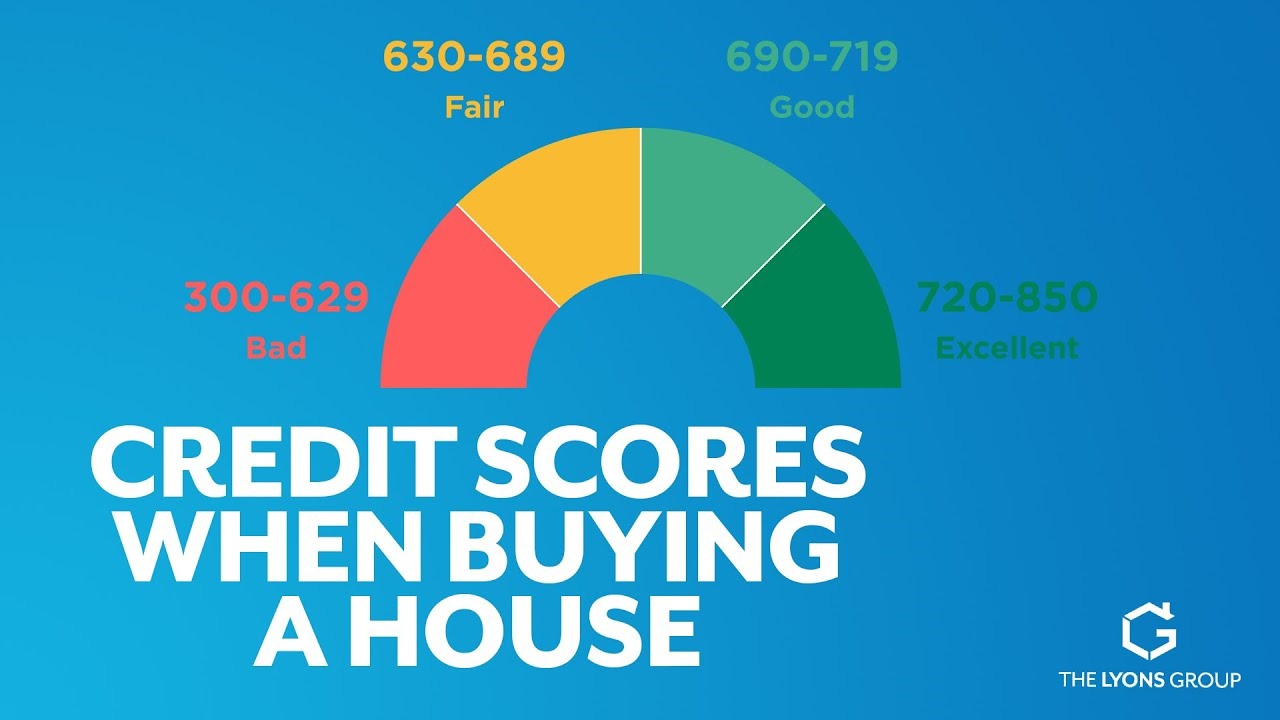

A 524 credit score falls into the "poor" credit range, significantly limiting your mortgage options. Traditional lenders typically require a minimum score of 620 or higher for conventional loans, according to Experian data.

However, government-backed loans offer a potential pathway. The Federal Housing Administration (FHA) loans are often more lenient.

FHA loans generally require a minimum credit score of 500 to qualify, but this often comes with a larger down payment of 10%. If your score is above 580, the down payment requirement is usually lower, around 3.5%.

Understanding Interest Rates and Loan Terms

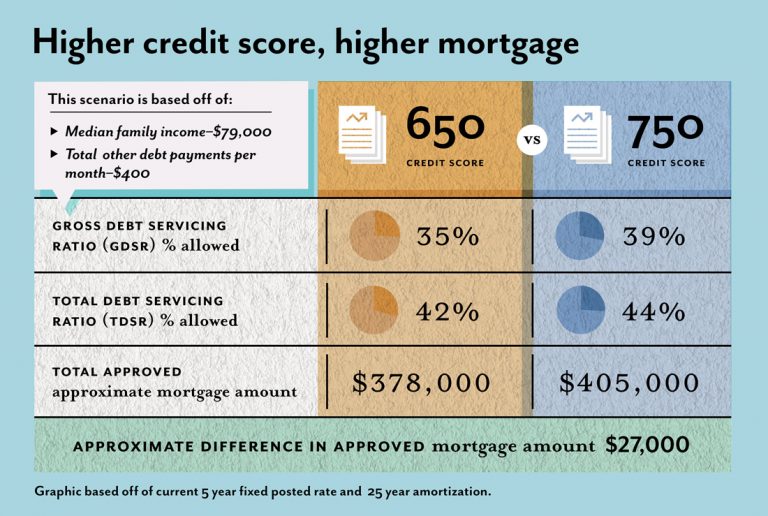

Even with an FHA loan, a lower credit score translates to higher interest rates. Lenders perceive borrowers with poor credit as higher risk.

This increased risk is offset by charging more interest over the life of the loan. Expect to pay significantly more in interest compared to someone with a higher credit score.

Carefully consider the long-term financial implications before committing to a loan with high interest rates. Calculate the total cost of the loan, including principal, interest, taxes, and insurance (PITI).

Exploring Alternative Loan Options

Beyond FHA loans, explore other government-backed options. The U.S. Department of Agriculture (USDA) loans are available in rural areas and often don't require a down payment.

However, USDA loans have specific eligibility requirements regarding location and income. The Department of Veterans Affairs (VA) loans are another option for eligible veterans and active-duty service members.

VA loans often offer favorable terms and may not require a down payment. These loans may allow you to purchase a home with a lower credit score compared to conventional loans.

The Importance of Down Payments and Debt-to-Income Ratio

A larger down payment can significantly improve your chances of approval. It demonstrates financial stability and reduces the lender's risk.

A lower debt-to-income (DTI) ratio is also crucial. Lenders assess your DTI to determine your ability to manage monthly payments.

Calculate your DTI by dividing your total monthly debt payments by your gross monthly income. Aim for a DTI below 43% for better loan approval odds.

Improving Your Credit Score: A Strategic Approach

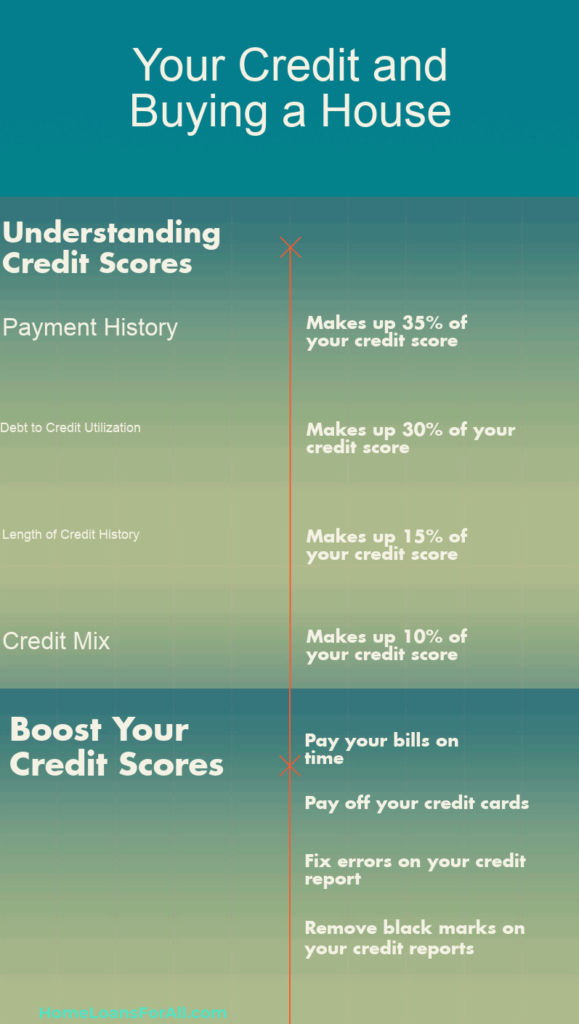

The best long-term strategy is to improve your credit score. Start by reviewing your credit report for errors and disputing any inaccuracies.

Pay down existing debt, especially credit card balances, to lower your credit utilization ratio. Make all payments on time to avoid late fees and negative marks on your credit report.

Consider becoming an authorized user on a credit card held by someone with good credit. This can help boost your score, but only if the primary cardholder manages their account responsibly.

Seeking Professional Guidance

Consult with a mortgage broker or financial advisor to explore your options. They can provide personalized guidance and help you navigate the complex mortgage landscape.

A qualified professional can assess your financial situation and recommend the best course of action. They can also help you understand the terms and conditions of different loan products.

Don't rush into a decision without doing your research and seeking expert advice. Understand the potential risks and rewards before committing to a mortgage.

The Bottom Line: Hope, But with Prudence

While buying a house with a 524 credit score is challenging, it's not impossible. Focus on exploring FHA, USDA, or VA loan options.

Prioritize improving your credit score and saving for a larger down payment. Seek professional guidance to make informed decisions and avoid costly mistakes.

Ultimately, responsible financial planning and diligent effort are key to achieving your homeownership dreams.