The Definition Of Expenses Includes Which Of The Following Statements

The seemingly simple question of what constitutes an expense is at the heart of countless business disputes, tax audits, and financial reporting debates. The precise definition, often taken for granted, can dramatically impact a company's profitability, its tax obligations, and even its overall valuation. A misunderstanding here can lead to severe financial repercussions, highlighting the critical need for clarity.

This article delves into the multifaceted definition of expenses, exploring the criteria used to determine what qualifies as a legitimate business expense. We will examine key accounting principles and relevant regulations, drawing upon authoritative sources like the Financial Accounting Standards Board (FASB) and the Internal Revenue Service (IRS). Our aim is to provide a comprehensive overview of the elements that define an expense and their implications for businesses of all sizes.

Defining Expenses: A Core Accounting Concept

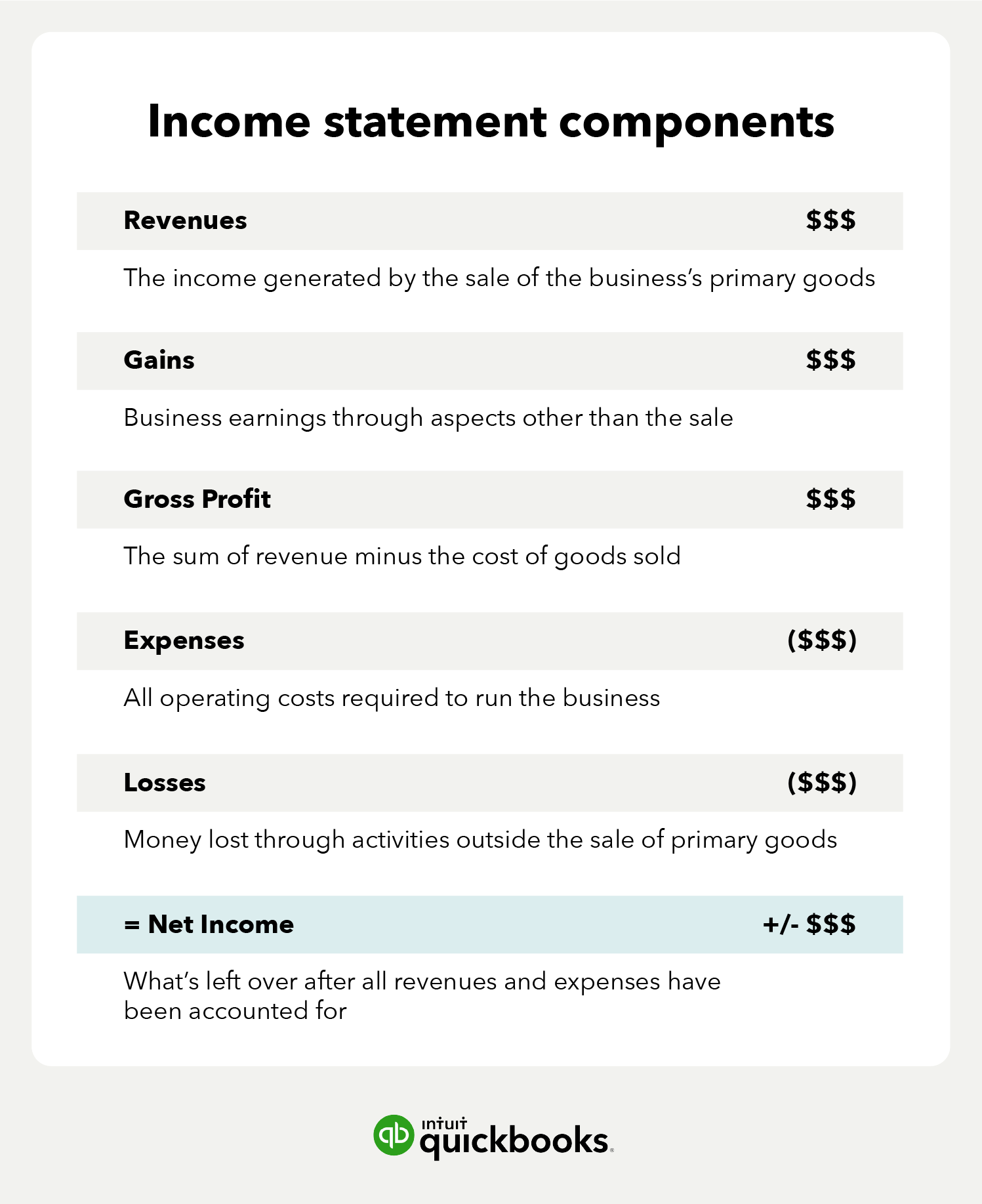

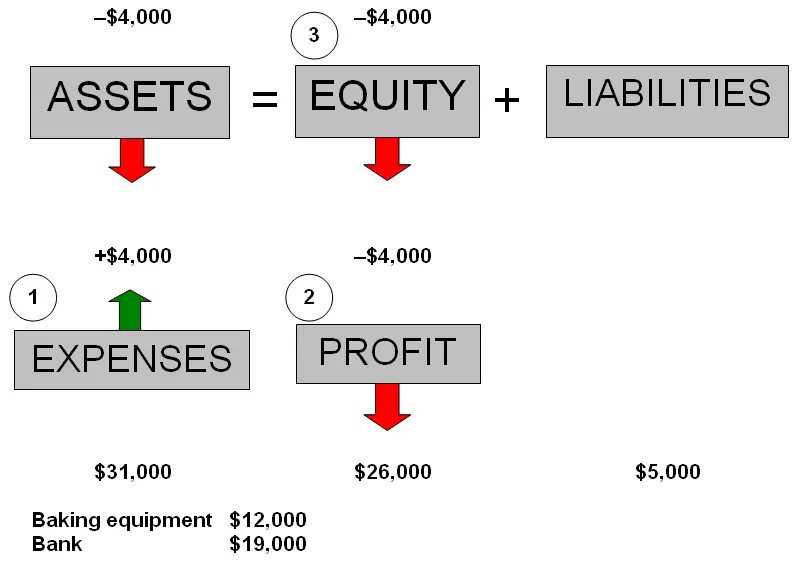

At its core, an expense represents a decrease in economic benefits during an accounting period, resulting in a decrease in equity. This decrease is usually in the form of outflows or depletion of assets or incurrences of liabilities. Understanding this fundamental principle is crucial to accurately classifying transactions.

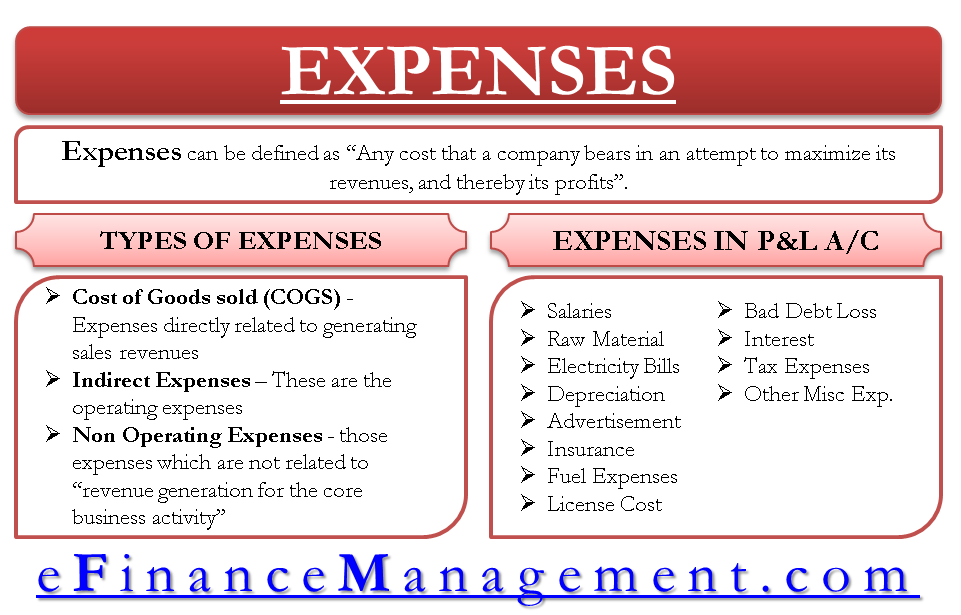

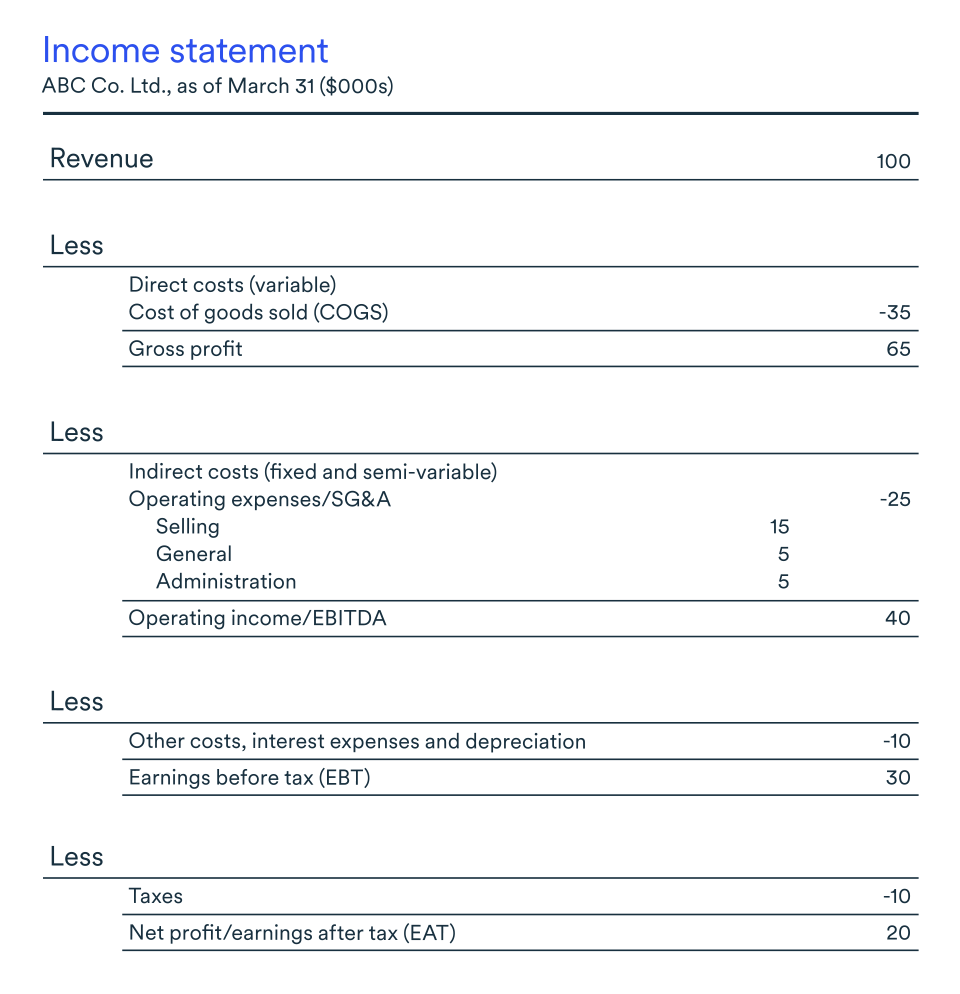

FASB defines expenses in its conceptual framework as outflows or other using up of assets or incurrences of liabilities (or a combination of both) from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity's ongoing major or central operations. Essentially, anything a business spends to generate revenue can generally be considered an expense.

Key Characteristics of an Expense

Several characteristics distinguish an expense from other financial transactions. A genuine expense must be directly related to the revenue-generating activities of the business. It must also result in a reduction of assets or an increase in liabilities.

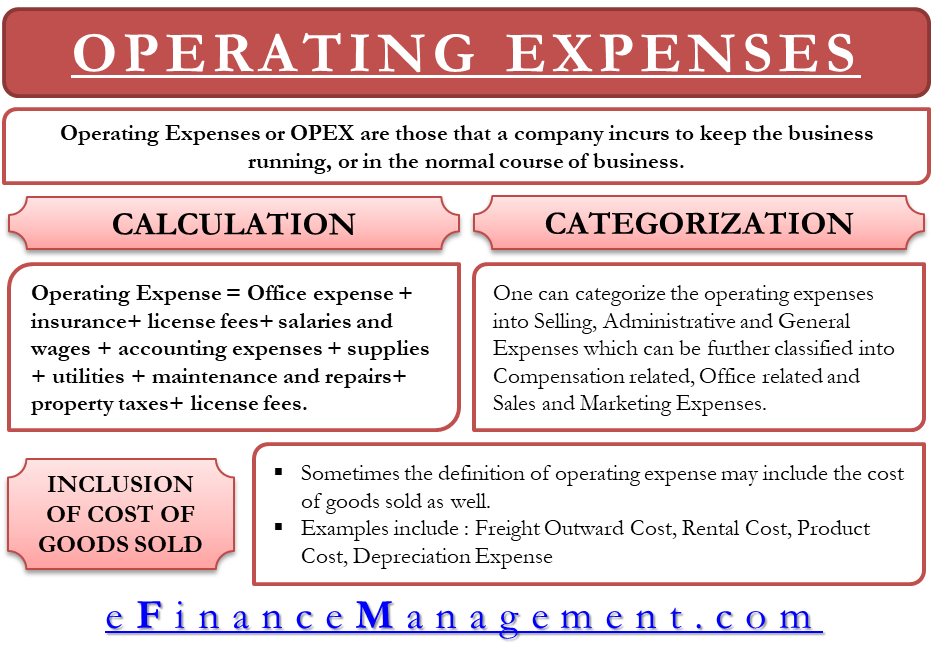

Furthermore, the expense should be incurred in the normal course of business. This distinguishes it from capital expenditures, which are investments in long-term assets.

Elements Included in the Definition

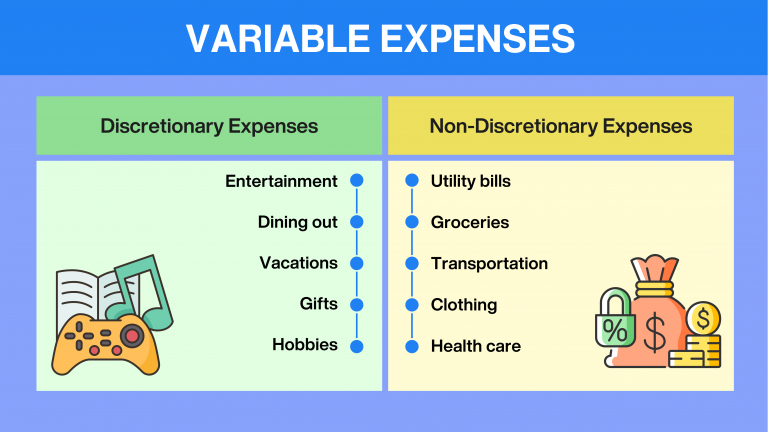

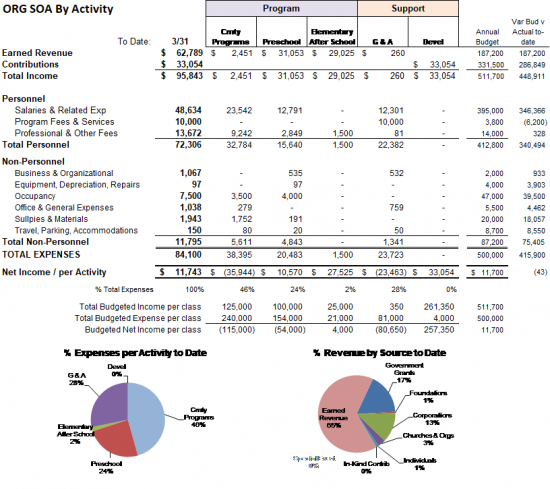

The definition of expenses encompasses several critical elements, each playing a vital role in accurate financial reporting. These elements help distinguish genuine expenses from other types of financial outlays. Recognizing these elements is crucial for businesses of all sizes.

- Outflow or Depletion of Assets: This refers to the reduction in the value of a company's assets, such as cash, inventory, or equipment, due to its use in generating revenue. For instance, the cost of raw materials used in manufacturing a product is considered an outflow of assets.

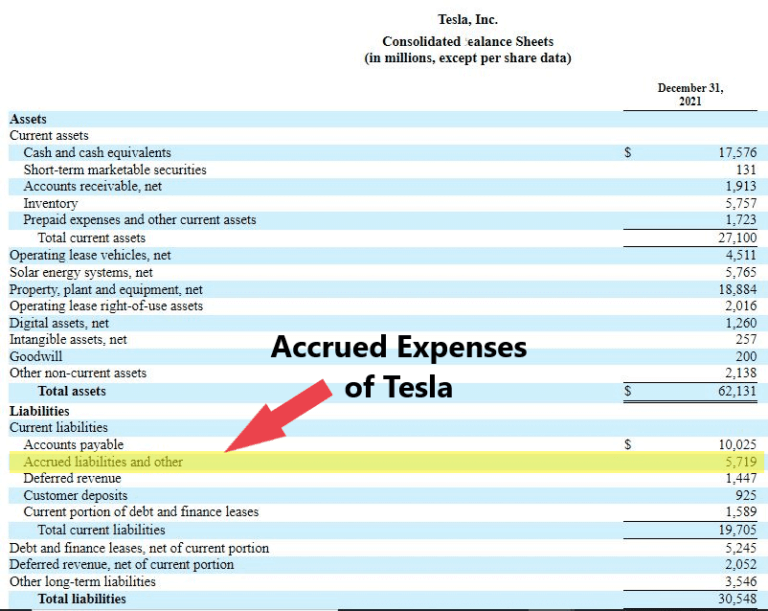

- Incurrence of Liabilities: This involves the creation of an obligation to pay for goods or services received. A classic example is salaries payable to employees for work performed, which represents a liability until paid.

- Relationship to Revenue Generation: Expenses must be directly linked to the process of generating revenue for the business. The cost of advertising, for example, is an expense because it is intended to increase sales.

- Normal Course of Business: The expense should arise from the regular and recurring activities of the business. This helps differentiate between operating expenses and unusual or extraordinary items.

Distinguishing Expenses from Other Transactions

It's essential to differentiate expenses from other transactions, particularly capital expenditures and owner withdrawals. Failing to do so can lead to misrepresentation of a company's financial performance. Accurate categorization is key to sound financial management.

Capital expenditures are investments in long-term assets that will benefit the company for more than one accounting period. For example, purchasing a new building or machinery is a capital expenditure, not an expense. Owner withdrawals, on the other hand, represent funds taken out of the business by the owner for personal use and are not considered expenses.

"The key distinction lies in the long-term benefit versus immediate consumption. Expenses are 'consumed' during the current period, while capital expenditures provide benefits over several periods," according to a statement from an accounting professional.

The Impact of Tax Regulations

Tax regulations play a significant role in determining which expenses are deductible for tax purposes. The IRS has specific rules and guidelines regarding the deductibility of various expenses. Adherence to these regulations is essential to avoid penalties.

Some common deductible expenses include business travel, meals, and entertainment, subject to certain limitations. The IRS provides detailed guidance on what constitutes a legitimate business expense for tax deduction purposes. Businesses must keep accurate records and documentation to support their expense deductions.

Real-World Examples of Expenses

Several everyday examples illustrate the concept of expenses in a business context. These examples highlight how expenses are recognized and recorded in financial statements. Understanding these scenarios provides practical insight into expense management.

Rent paid for office space, salaries paid to employees, utility bills, and advertising costs are all common examples of expenses. Similarly, the cost of goods sold (COGS), which includes the direct costs of producing or acquiring goods for sale, is a significant expense for many businesses. Depreciation expense, which reflects the decline in value of assets over time, is also a critical expense to consider.

Looking Ahead: The Future of Expense Management

Expense management is becoming increasingly sophisticated with the advent of new technologies and regulations. Businesses are adopting cloud-based expense management systems to streamline their expense reporting processes. Automation and data analytics are playing a more prominent role in expense tracking and analysis.

Furthermore, increasing scrutiny from regulatory bodies and stakeholders requires greater transparency and accountability in expense reporting. The need for accurate and reliable expense data is more critical than ever. Companies that prioritize effective expense management are better positioned to improve profitability and maintain financial stability.

Ultimately, understanding the definition of expenses and its various components is essential for sound financial management. By adhering to accounting principles and tax regulations, businesses can ensure accurate financial reporting and optimize their tax obligations. A clear grasp of these concepts leads to better decision-making and improved financial performance.

:max_bytes(150000):strip_icc()/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/expense.asp-final-945ea7ad4a0c4eafb0dcf268e97756fc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)