The Entire Contract Includes The Actual Policy And The

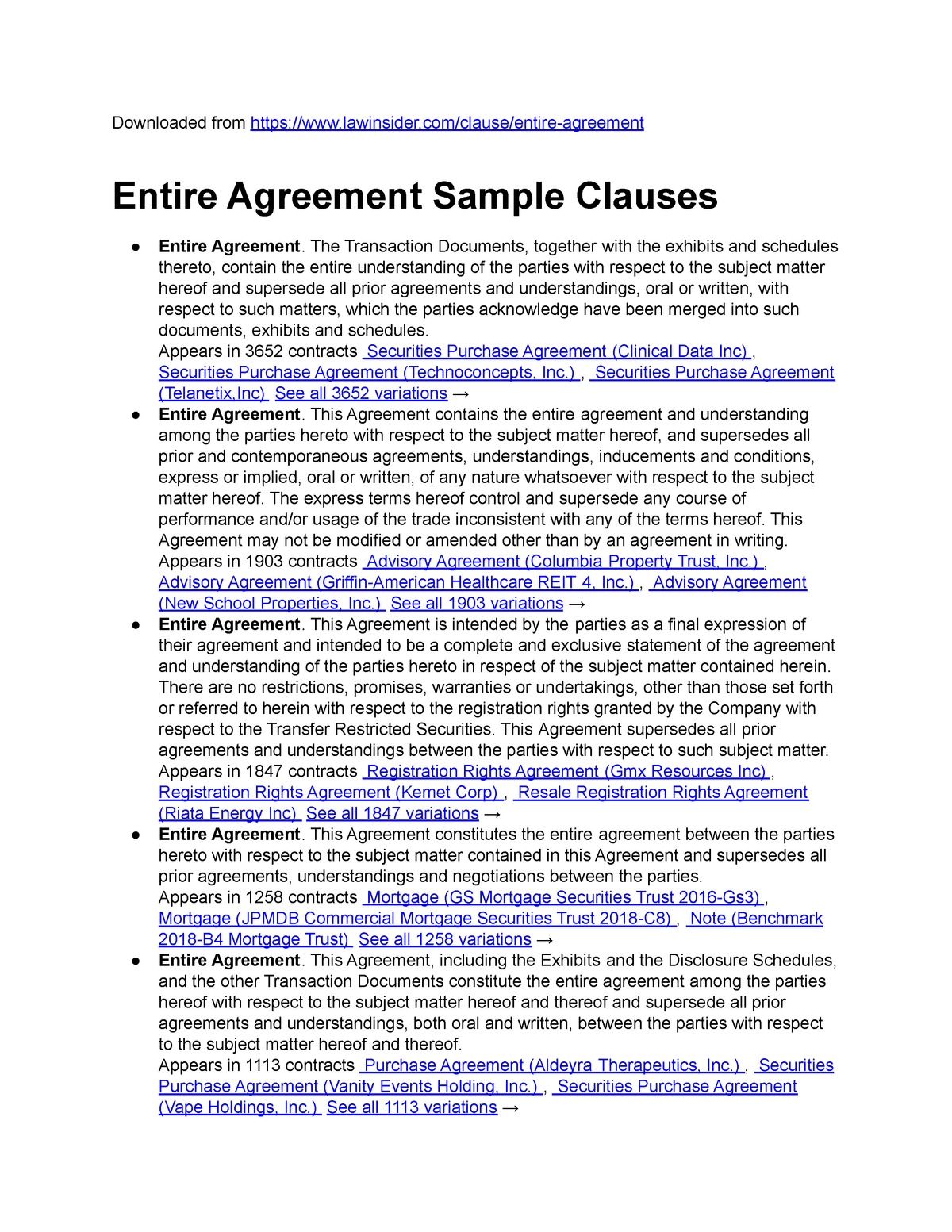

A legal bombshell has dropped, forcing a re-evaluation of countless insurance policies and contracts nationwide. Courts are now clarifying that the entire policy, including associated documents referenced within the main agreement, constitutes the complete contract.

This landmark shift, emphasizing that "The Entire Contract Includes The Actual Policy And The", exposes a potential chasm between what policyholders believed they were covered for and the fine print often buried in referenced documents. The immediate ramifications could involve significant legal challenges and increased scrutiny of insurance industry practices.

Impact on Insurance Claims

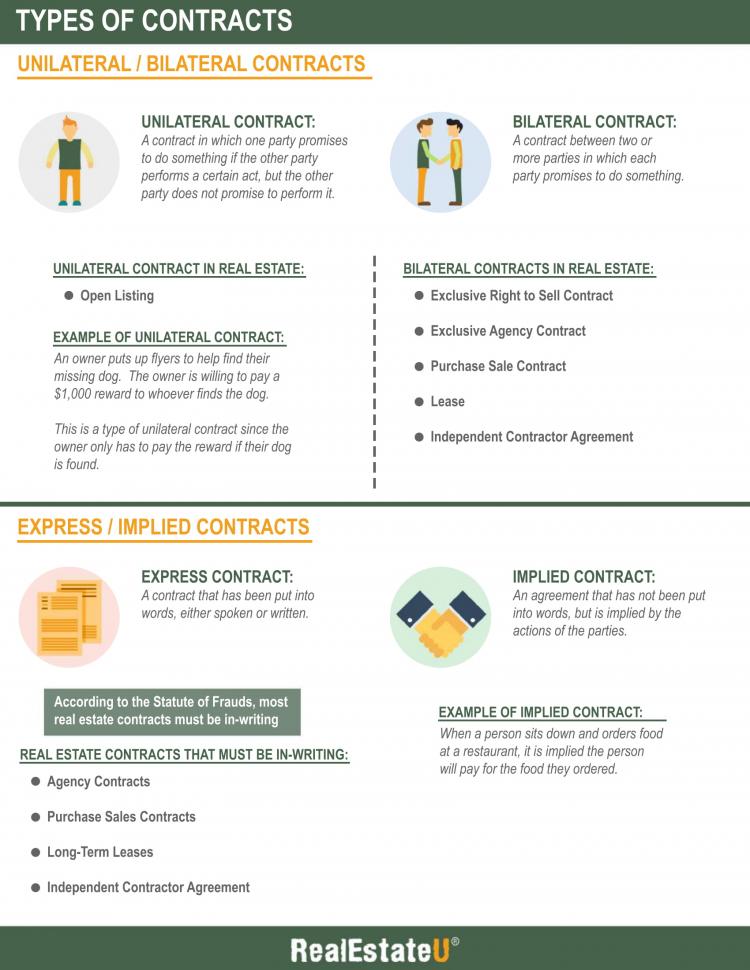

The core issue lies in the interpretation of "entire contract" clauses commonly found in insurance policies. Traditionally, some insurers have argued that only the main policy document is binding.

This new interpretation demands that all documents explicitly incorporated by reference within the policy are legally binding and form part of the contract.

This includes riders, endorsements, schedules, and even external documents referenced within those riders, effectively broadening the scope of the contractual agreement and the insurer's potential liability.

Legal Precedent and Court Rulings

Several recent court cases have solidified this interpretation, challenging long-held industry practices. The Smith v. Acme Insurance Co. case in California stands out, where the court ruled that Acme Insurance was liable for damages based on a clause found in a referenced document not explicitly detailed in the main policy.

Similarly, in Jones v. Global Coverage Inc. in New York, the judge stated that policyholders have a right to expect that all documents influencing their coverage are considered part of the "entire contract."

These rulings, along with others across multiple jurisdictions, are establishing a clear legal precedent.

Consumer Protection and Industry Response

Consumer advocacy groups are hailing this development as a significant victory. They argue it increases transparency and protects policyholders from being denied claims based on obscure or hidden clauses.

"For too long, insurers have relied on complex and convoluted policy language to deny legitimate claims," said Maria Hernandez, Executive Director of the National Consumer Insurance Association.

"This interpretation ensures that policyholders are fully aware of their rights and obligations under the entire contract."

The insurance industry, however, is expressing concerns about the potential for increased litigation and the need to revise policy language. The American Insurance Association has released a statement acknowledging the court rulings and advising its members to review their policy documentation.

Some industry analysts predict this change could lead to higher premiums as insurers adjust to the increased liability and administrative burden of ensuring all referenced documents are readily accessible and understood by policyholders.

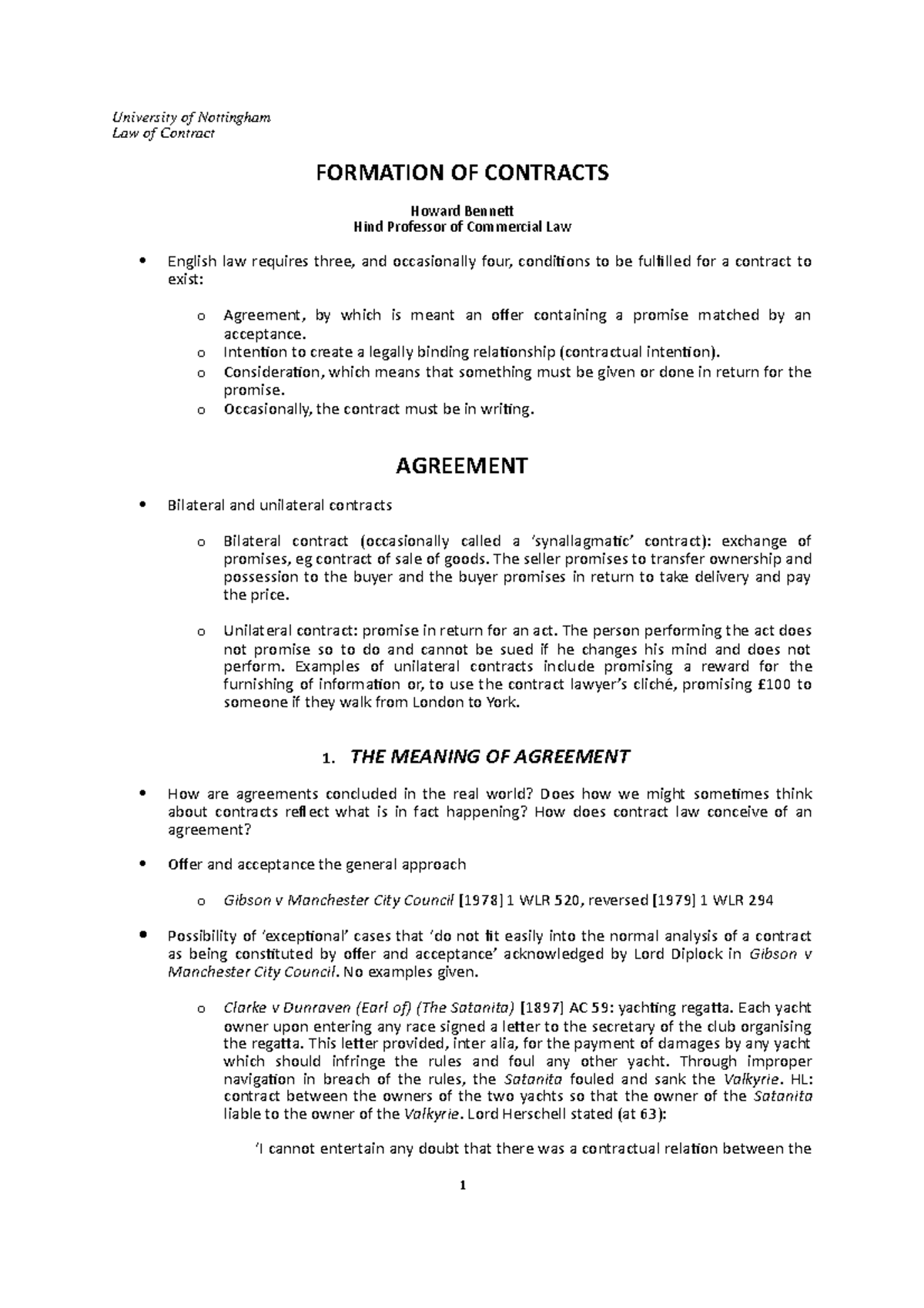

What Policyholders Need to Do

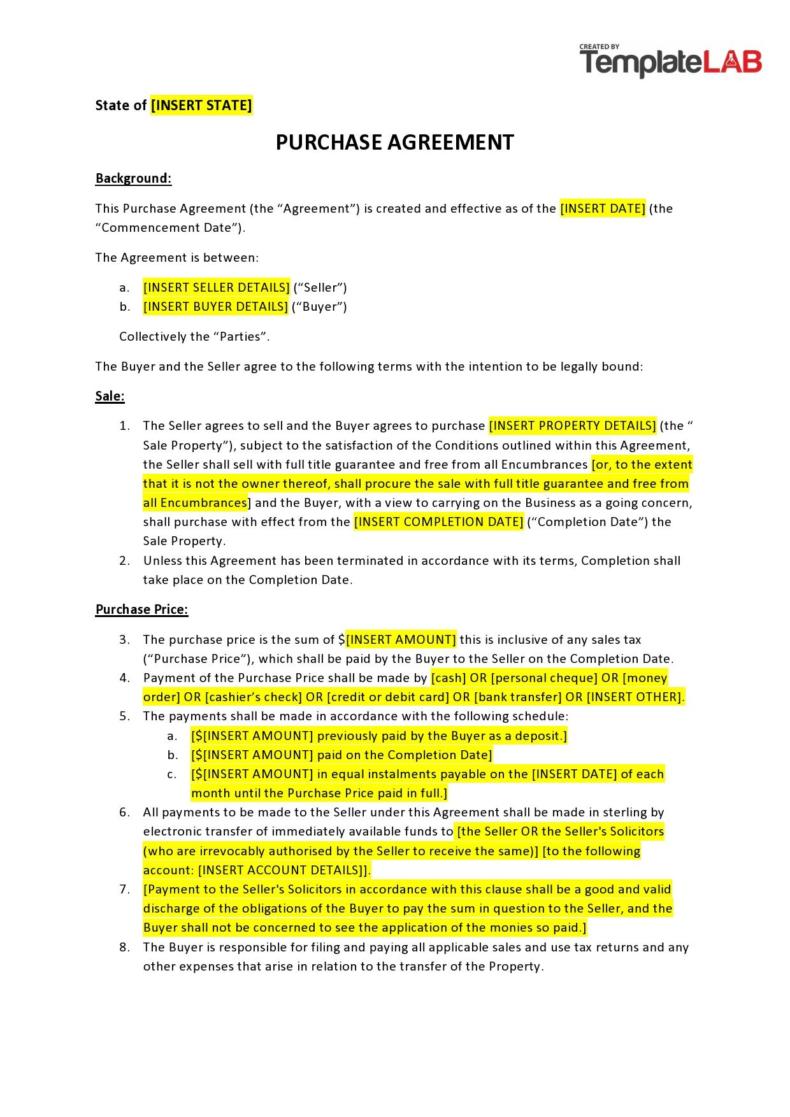

Experts are urging policyholders to carefully review their existing insurance policies, paying close attention to any language referencing external documents or riders.

Specifically, individuals should look for phrases like "incorporated by reference," "subject to the terms of," or "as per schedule."

If such references exist, policyholders should obtain and review those documents to fully understand the scope of their coverage.

Specific Policy Types Affected

While this interpretation impacts all types of insurance policies, some are more vulnerable than others. These include:

- Life Insurance: Beneficiary designations and policy riders often contain crucial details.

- Health Insurance: Network agreements and formulary lists frequently incorporated by reference.

- Business Insurance: Liability policies with complex exclusions and endorsements.

- Homeowners Insurance: Coverage schedules and appraisal documents.

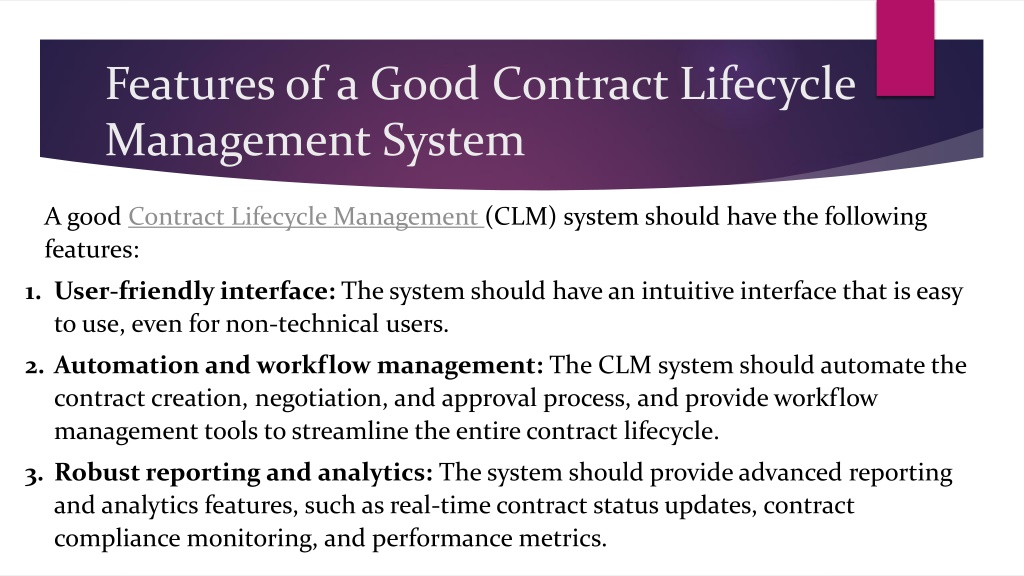

Furthermore, insurance companies are now under increased pressure to provide policyholders with easy access to all relevant documents.

Many are updating their online portals and customer service protocols to ensure policyholders can readily obtain copies of their entire contract.

Looking Ahead

The legal landscape surrounding insurance contracts is rapidly evolving. Further litigation is expected as policyholders challenge denials based on previously overlooked or misinterpreted clauses.

State insurance regulators are also stepping in, with many announcing plans to conduct comprehensive reviews of insurance policies to ensure compliance with the new interpretation.

Policyholders who believe they have been wrongly denied coverage should consult with an attorney to explore their legal options. The days of insurers burying crucial contract terms are, seemingly, coming to an end.

![The Entire Contract Includes The Actual Policy And The Free Printable Wholesale Real Estate Contract Templates [PDF] Example](https://www.typecalendar.com/wp-content/uploads/2023/08/Example-Free-Wholesale-Real-Estate-Contract.jpg)

![The Entire Contract Includes The Actual Policy And The What is an Employment Contract? [Australia Guide]](https://employmenthero.com/wp-content/uploads/2022/06/what-is-an-employment-contract-8-1024x683.png)