The Factor Used Most Often When Underwriting

Breaking: Credit scores remain the undisputed king in underwriting decisions across most financial sectors, influencing loan approvals, interest rates, and insurance premiums. A new report highlights the continued dominance of credit history despite evolving data analytics.

This article cuts through the noise to deliver the essential facts about the most critical factor in underwriting: the enduring power of the credit score, its impact on consumers, and what this means for the future of financial access.

Credit Score Still Reigns Supreme

Data released this week confirms that credit scores are the primary determinant in underwriting decisions. This holds true for mortgages, auto loans, personal loans, and insurance policies according to a comprehensive study by Fair Lending Analytics.

The 2024 Underwriting Landscape Report analyzed over 10 million loan applications across various lending institutions. It definitively shows a strong correlation between creditworthiness (as measured by a FICO or VantageScore) and approval rates.

Applicants with scores below 620 faced significantly higher rejection rates. They also received less favorable terms, including higher interest rates and stricter repayment schedules.

Impact Across Sectors

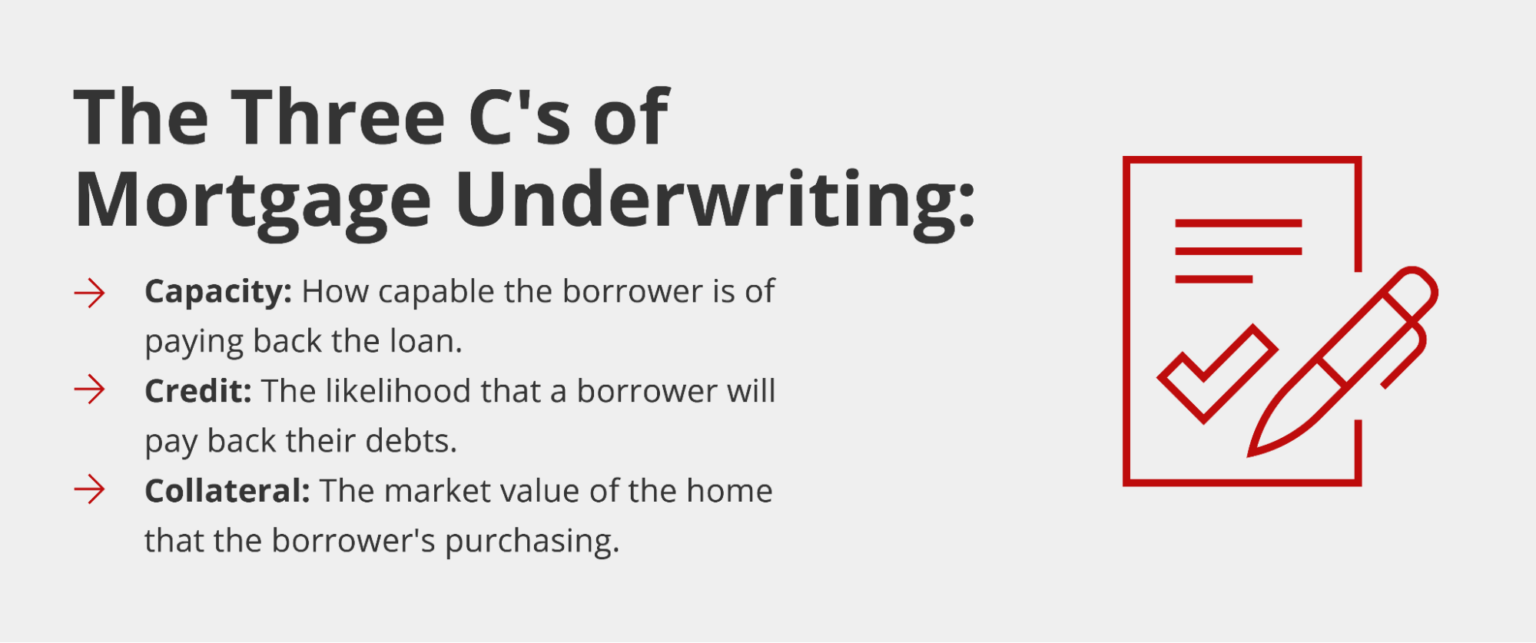

Mortgage Lending

In the mortgage sector, a borrower's credit score heavily impacts their ability to secure a loan. A score below 680 can disqualify applicants from prime lending rates, potentially costing them thousands over the life of the loan.

According to the Mortgage Bankers Association (MBA), the average interest rate for borrowers with credit scores between 620-679 is 1-2% higher than those with scores above 740.

Auto Loans

The trend continues in auto lending. Individuals with poor credit are often relegated to subprime lenders, who charge exorbitant interest rates that can quickly lead to debt traps.

Experian's State of the Automotive Finance Market Q1 2024 report indicated that the average interest rate for a new car loan for borrowers with a credit score below 500 was 14.27%. This contrasts sharply with the 6.71% average for those with scores above 781.

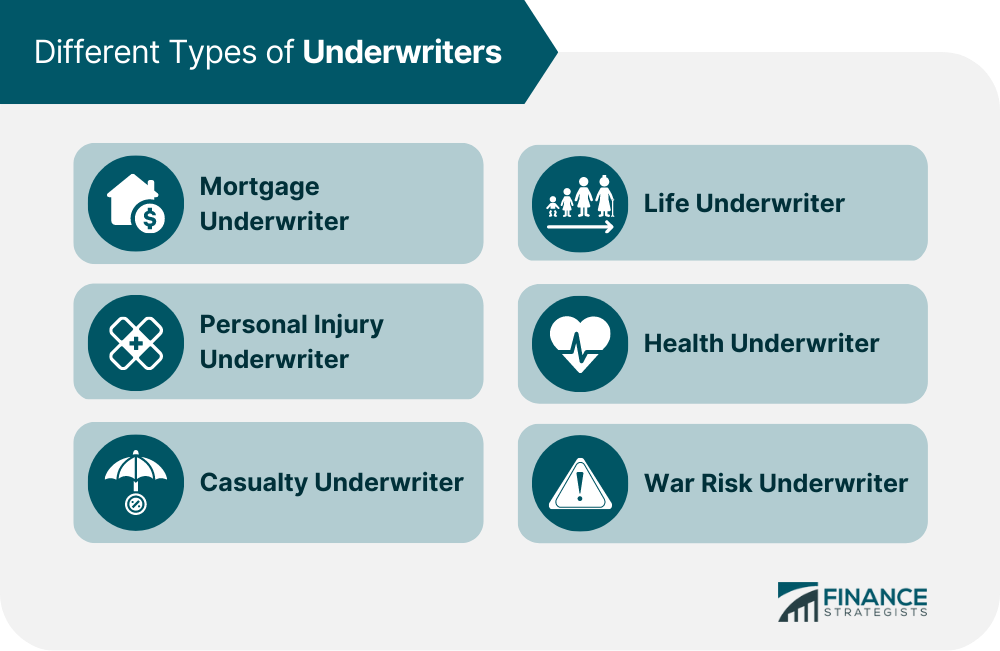

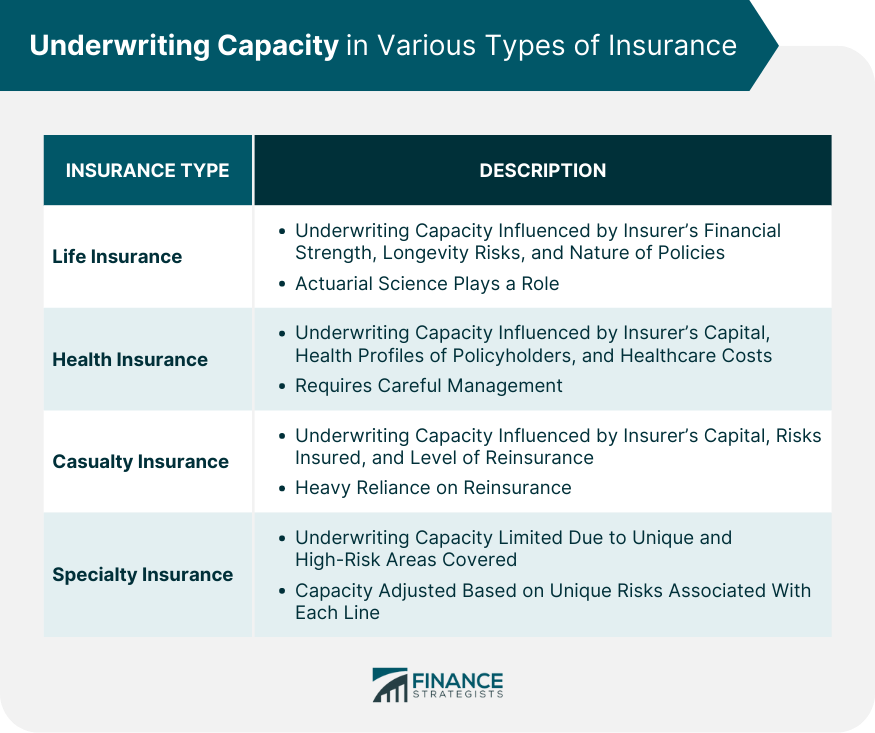

Insurance Policies

Insurance companies also rely heavily on credit scores to assess risk. Lower scores often translate to higher premiums, particularly for auto and homeowner's insurance.

The Consumer Federation of America has long criticized this practice. They argue that it unfairly penalizes low-income individuals and minorities, creating a cycle of financial disadvantage.

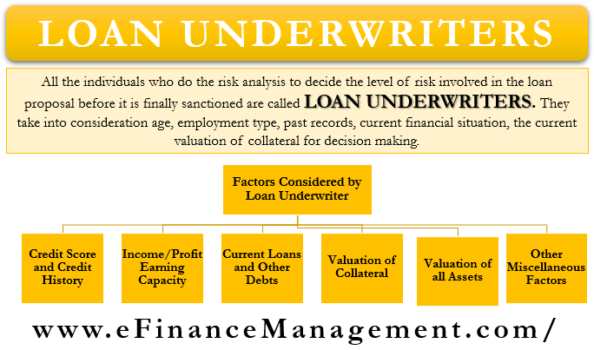

Why Credit Scores Hold Such Power

Lenders and insurers argue that credit scores provide a standardized and objective measure of risk. They believe that a person's past credit behavior is a strong indicator of their future payment patterns.

However, critics point out that credit scores are not a perfect measure. They do not account for factors like employment history, rent payments, or utility bills, potentially disadvantaging individuals with limited credit histories or those who rely on alternative financial services.

Furthermore, errors on credit reports are common and can significantly impact a person's score, even if they are otherwise financially responsible. Consumers should regularly check reports from Equifax, Experian and TransUnion.

The Push for Alternative Data

Growing calls are underway to incorporate alternative data into underwriting models. This includes information like bank account transaction history, on-time rent payments, and employment records.

Advocates argue that using a wider range of data points can provide a more comprehensive and accurate assessment of creditworthiness. This can help to expand access to credit for underserved populations.

Some fintech companies are already experimenting with alternative data underwriting models. The models aim to give loans to people previously denied, potentially disrupting the traditional lending landscape.

The Future of Underwriting

While the debate continues, credit scores remain firmly entrenched in the underwriting process. Change will likely be gradual, with alternative data slowly supplementing, rather than replacing, traditional credit scores.

The Consumer Financial Protection Bureau (CFPB) is actively studying the use of alternative data in lending and its potential impact on consumers. The CFPB is looking for potential for discriminatory lending practices.

Individuals seeking to improve their financial prospects should focus on building and maintaining a strong credit history. Checking credit reports regularly for errors is the first key step.