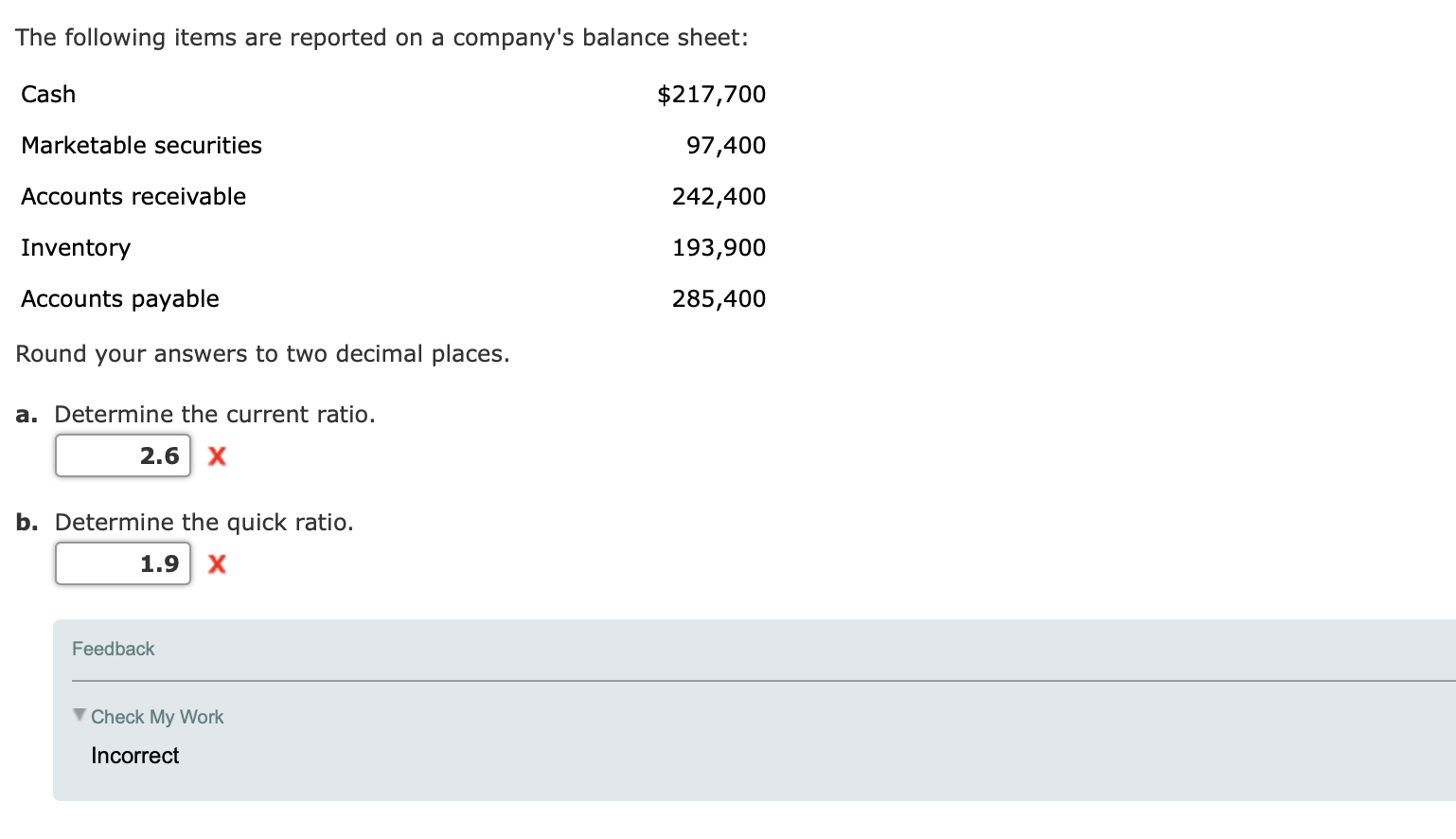

The Following Items Are Reported On A Company's Balance Sheet

Imagine a bustling marketplace, vendors displaying their wares, customers bartering, and money changing hands. At the end of the day, each merchant tallies up what they own – their goods, the cash in their till – and what they owe – to suppliers, maybe a loan from the bank. This simple accounting mirrors, in essence, what a balance sheet does for a company, only on a much larger, more complex, and meticulously documented scale.

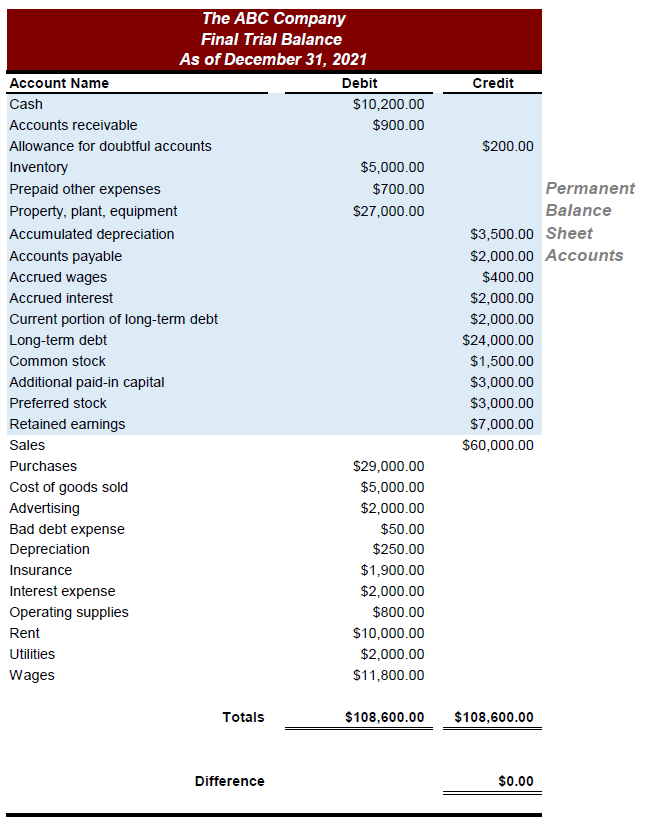

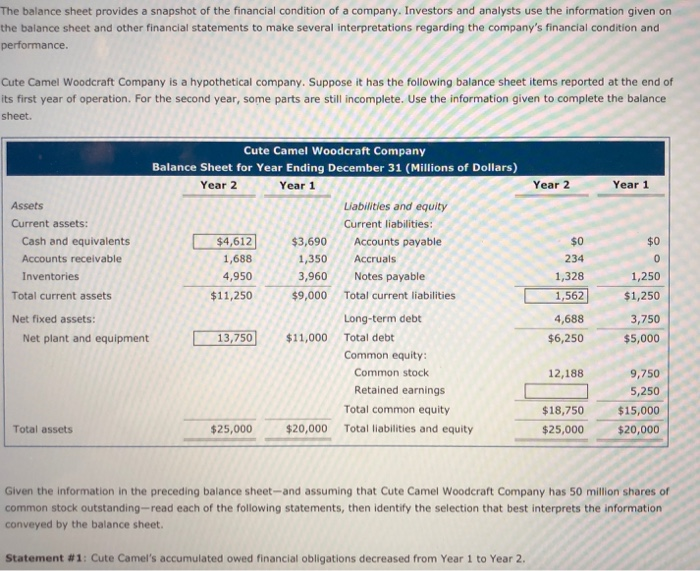

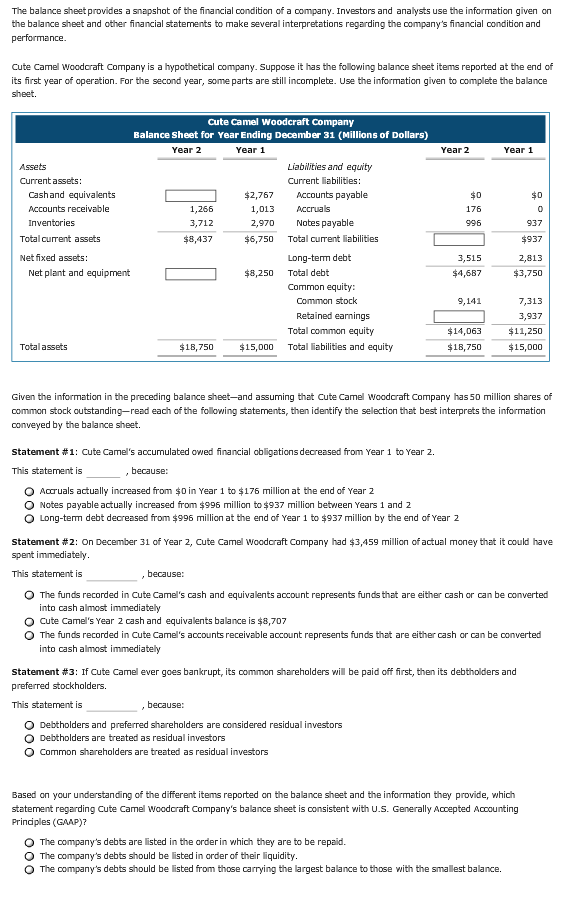

The balance sheet, a snapshot in time, reveals a company's financial position by showcasing its assets, liabilities, and equity. Understanding the information presented on this financial statement is crucial for investors, creditors, and company management alike, providing insights into a company's solvency, efficiency, and overall financial health.

The Foundation: The Accounting Equation

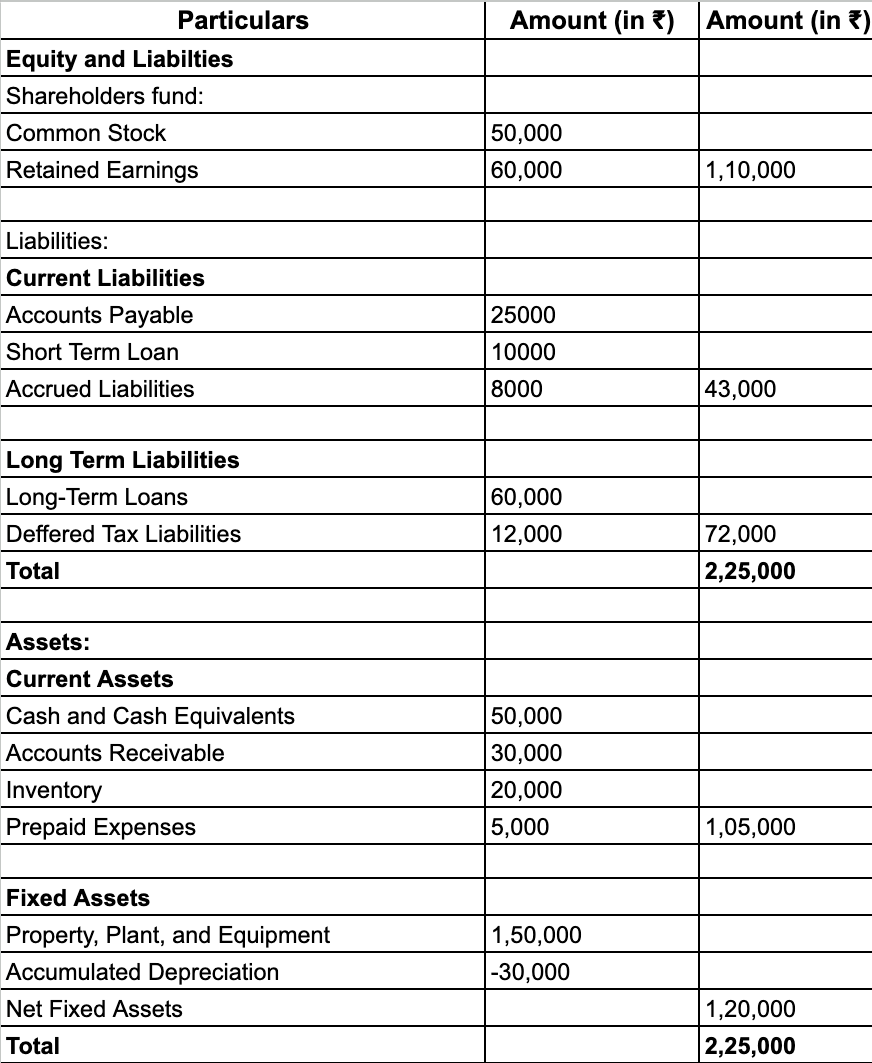

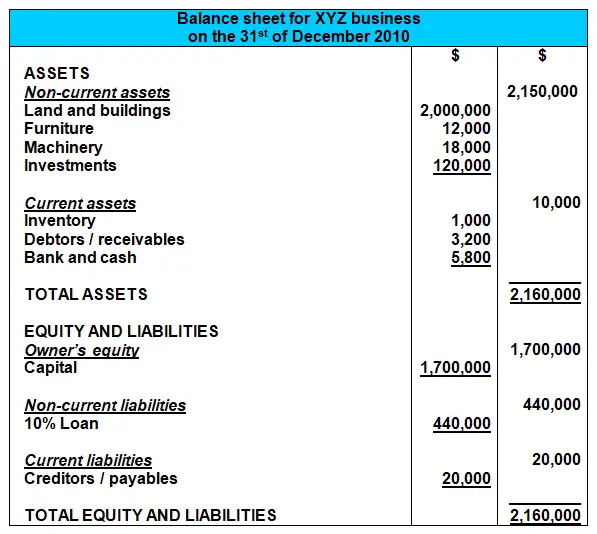

The balance sheet operates on a fundamental principle: the accounting equation. This equation states that Assets = Liabilities + Equity. It's a simple yet powerful concept, highlighting that everything a company owns (assets) is financed by either what it owes to others (liabilities) or by the owners' investment (equity).

Assets: What the Company Owns

Assets represent a company’s resources, things it owns that have future economic value. These can be tangible, like buildings and equipment, or intangible, like patents and trademarks.

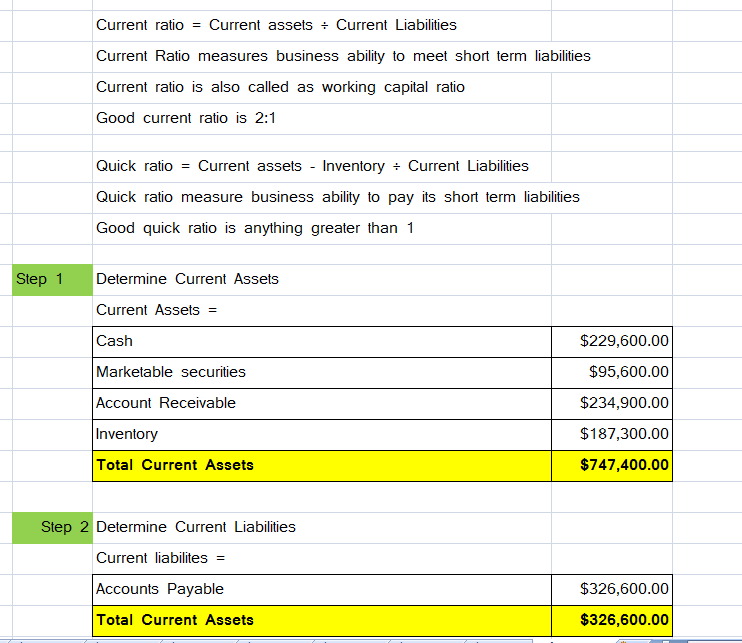

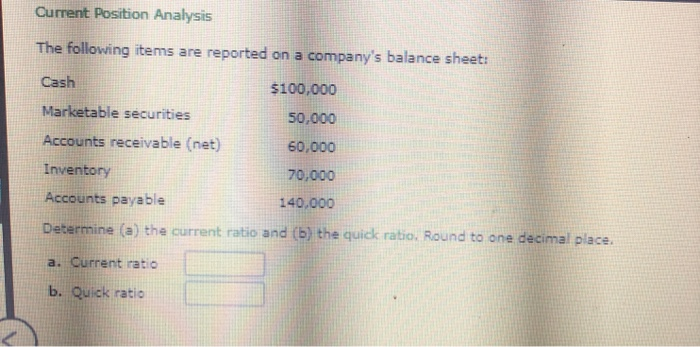

Assets are typically categorized as current or non-current. Current assets are those expected to be converted to cash or used up within one year. This includes cash, accounts receivable (money owed by customers), inventory (goods for sale), and prepaid expenses (payments made in advance for services).

Non-current assets, conversely, are those with a life of more than one year. Examples include property, plant, and equipment (PP&E), long-term investments, and intangible assets such as goodwill (the value of a company beyond its tangible assets) and brand recognition.

Liabilities: What the Company Owes

Liabilities represent a company’s obligations to others. These are amounts owed to creditors, suppliers, and other parties.

Like assets, liabilities are also categorized as current or non-current. Current liabilities are obligations due within one year, such as accounts payable (money owed to suppliers), salaries payable, and short-term loans.

Non-current liabilities are obligations due in more than one year. This category includes long-term debt (like bonds payable), deferred tax liabilities (taxes owed in the future), and lease obligations.

Equity: The Owners' Stake

Equity represents the owners’ stake in the company. It’s the residual interest in the assets of the company after deducting all its liabilities.

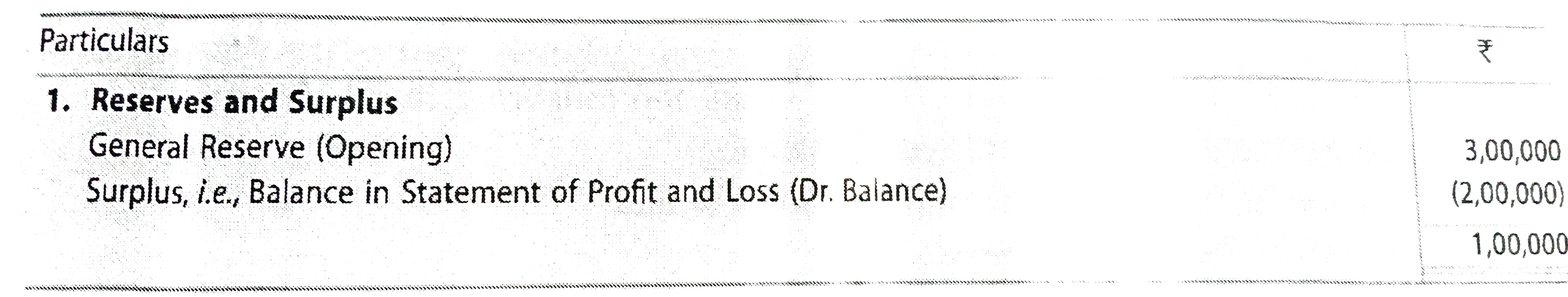

Equity typically includes items like common stock (representing ownership shares), retained earnings (accumulated profits not distributed to shareholders), and additional paid-in capital (the amount investors paid above the par value of the stock).

Diving Deeper: Key Balance Sheet Items Explained

Let’s explore some specific balance sheet items in more detail, providing a clearer picture of their significance.

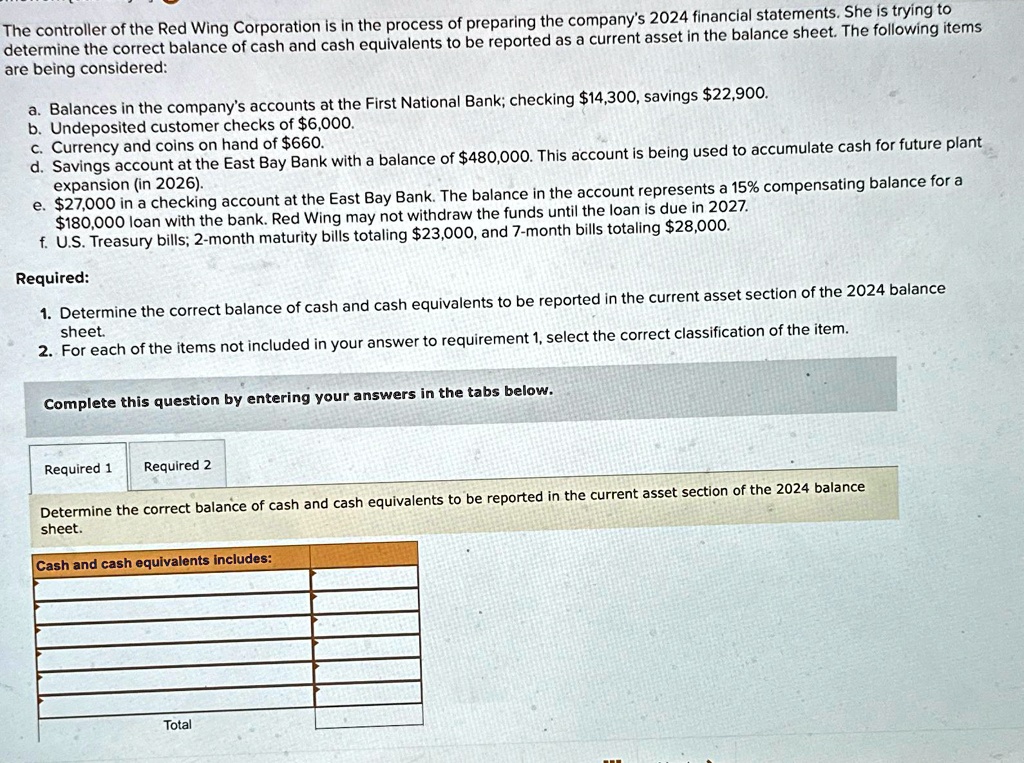

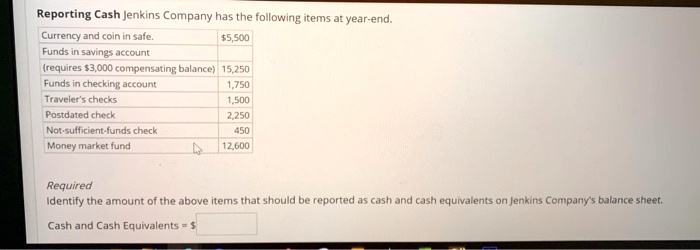

Cash and Cash Equivalents: This is the most liquid asset, representing readily available funds. It includes cash on hand, bank balances, and short-term investments easily convertible to cash.

Accounts Receivable: This represents money owed to the company by its customers for goods or services already delivered. A high level of accounts receivable can indicate potential collection problems.

Inventory: This is the value of goods held for sale. Inventory management is crucial; too much inventory can lead to storage costs and obsolescence, while too little can result in lost sales.

Property, Plant, and Equipment (PP&E): This includes tangible assets like land, buildings, machinery, and equipment used in the company’s operations. These assets are depreciated over their useful lives, reflecting their gradual decline in value.

Goodwill: This arises when a company acquires another company for a price exceeding the fair value of its identifiable net assets. It represents the intangible value of the acquired company, such as its brand reputation and customer relationships.

Accounts Payable: This represents money owed to suppliers for goods or services purchased on credit. Managing accounts payable effectively is crucial for maintaining good supplier relationships.

Long-Term Debt: This includes loans and bonds payable with a maturity of more than one year. High levels of long-term debt can increase a company’s financial risk.

Retained Earnings: This represents the accumulated profits of the company that have not been distributed to shareholders as dividends. Retained earnings are a key source of funding for future growth.

Why the Balance Sheet Matters

The balance sheet is a vital tool for assessing a company’s financial health and performance. It provides insights into:

Solvency: A company's ability to meet its long-term obligations. By comparing assets to liabilities, analysts can assess whether a company has sufficient resources to pay its debts.

Liquidity: A company's ability to meet its short-term obligations. Comparing current assets to current liabilities reveals the company's immediate financial strength.

Financial Structure: The proportion of debt and equity used to finance the company’s assets. A high debt-to-equity ratio can indicate higher financial risk.

Investors use the balance sheet to make informed decisions about whether to invest in a company. Creditors use it to assess the creditworthiness of a company before lending money. Company management uses it to monitor financial performance and make strategic decisions.

Beyond the Numbers: Limitations and Considerations

While the balance sheet is a valuable tool, it’s important to recognize its limitations. It presents a snapshot in time, and a company’s financial position can change rapidly. Furthermore, some assets, like intellectual property, can be difficult to value accurately.

The balance sheet relies on historical cost accounting, meaning assets are generally recorded at their original purchase price. This can lead to undervaluation of assets in times of inflation. Finally, the balance sheet doesn't capture all aspects of a company's value, such as employee morale or brand reputation.

To get a complete picture of a company’s financial health, it’s essential to analyze the balance sheet in conjunction with other financial statements, such as the income statement and the cash flow statement. Also, comparing a company's balance sheet to those of its competitors provides a more comprehensive understanding of its financial standing.

The Balance Sheet in a Changing World

In today's dynamic business environment, the balance sheet continues to evolve. The rise of digital assets like cryptocurrencies and the increasing importance of intangible assets like data are presenting new challenges for accounting standards and financial reporting.

Accountants and regulators are working to develop new frameworks and guidelines to address these challenges and ensure that the balance sheet remains a relevant and reliable tool for assessing a company’s financial position. As businesses become increasingly complex, a thorough understanding of the balance sheet will be more critical than ever.

Ultimately, the balance sheet is more than just a list of numbers; it's a window into a company's financial soul. It reveals its strengths, weaknesses, and its overall ability to thrive. By understanding the language of the balance sheet, we can gain valuable insights into the world of business and finance.

![The Following Items Are Reported On A Company's Balance Sheet [ANSWERED] The balance sheet provides a snapshot of the financial - Kunduz](https://media.kunduz.com/media/sug-question-candidate/20230610202914859638-5124228.jpg?h=512)