The Four Stages Of The Business Cycle

The global economy, a complex and ever-shifting landscape, is rarely static. Recent volatility in interest rates, coupled with fluctuating inflation figures, has put the cyclical nature of economic activity firmly in the spotlight. Understanding these cycles is crucial for businesses, investors, and policymakers alike to navigate the turbulent waters of economic change and prepare for what lies ahead.

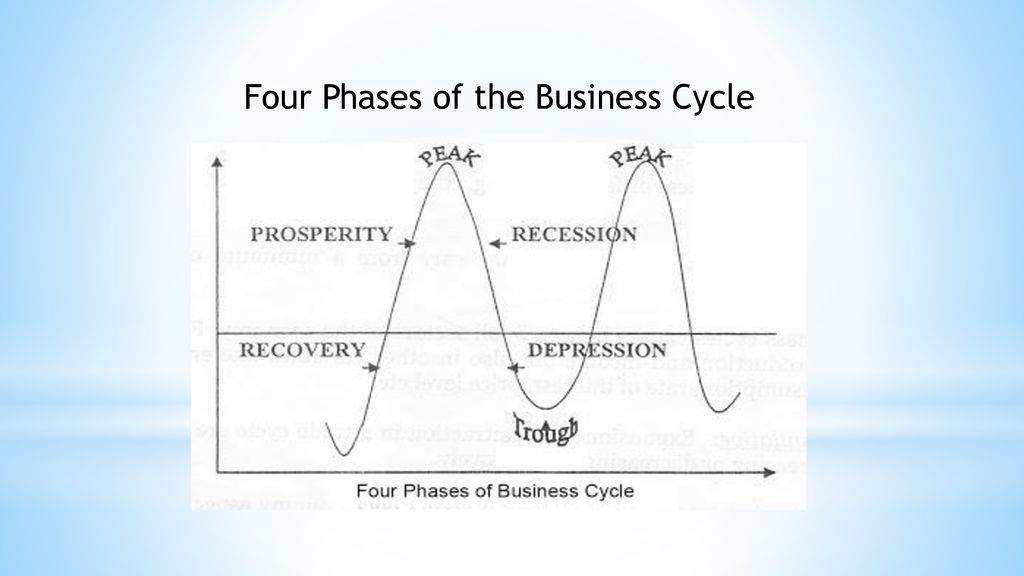

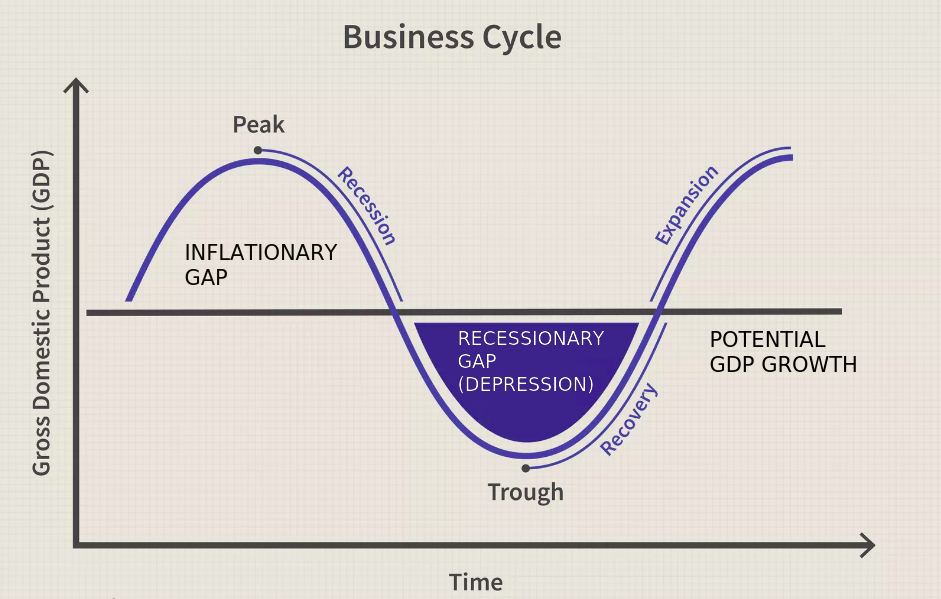

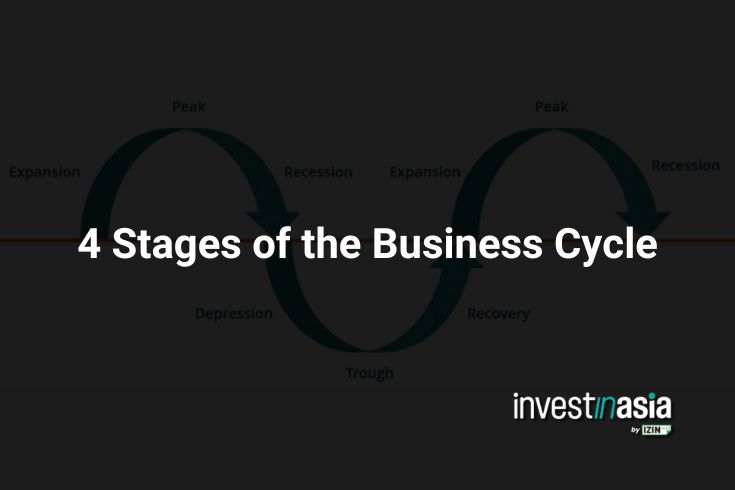

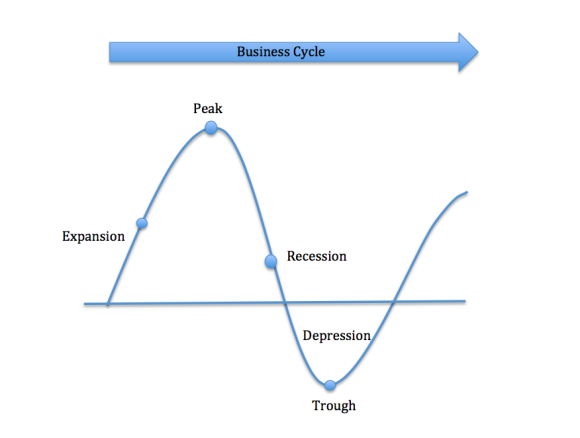

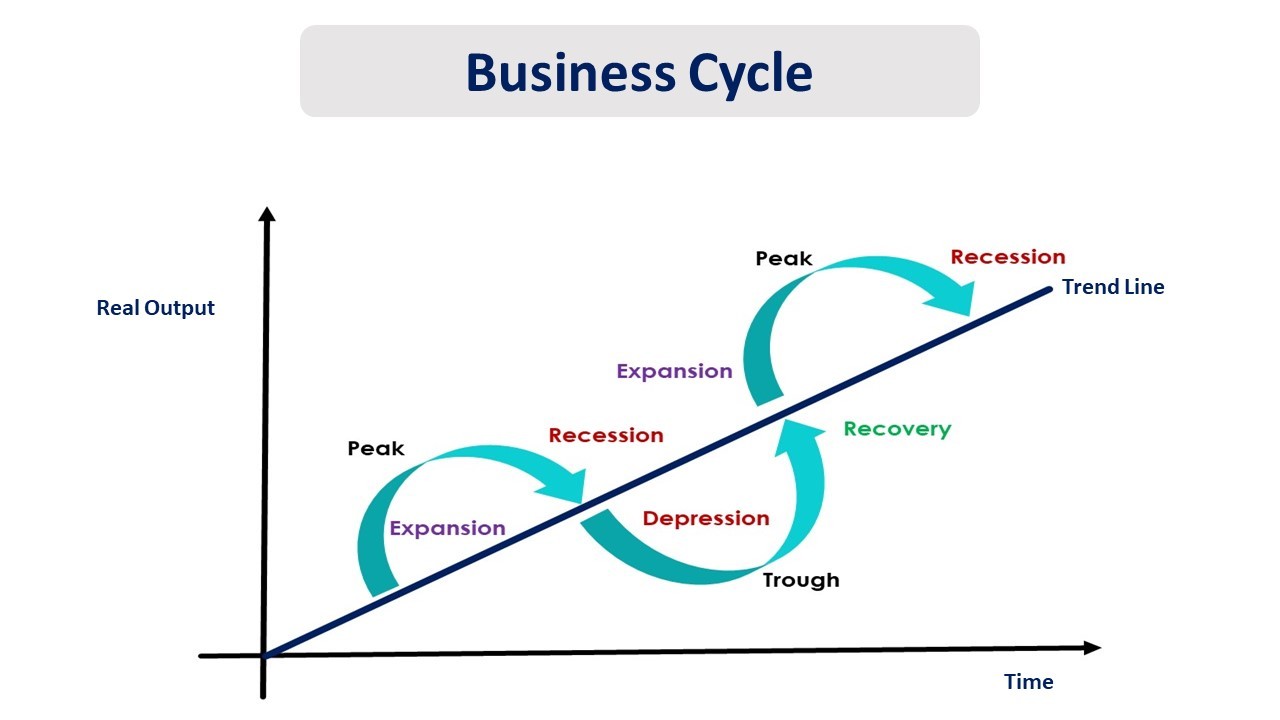

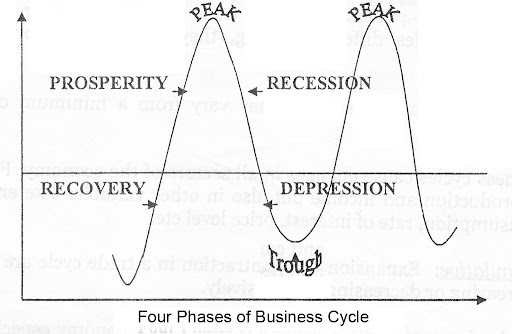

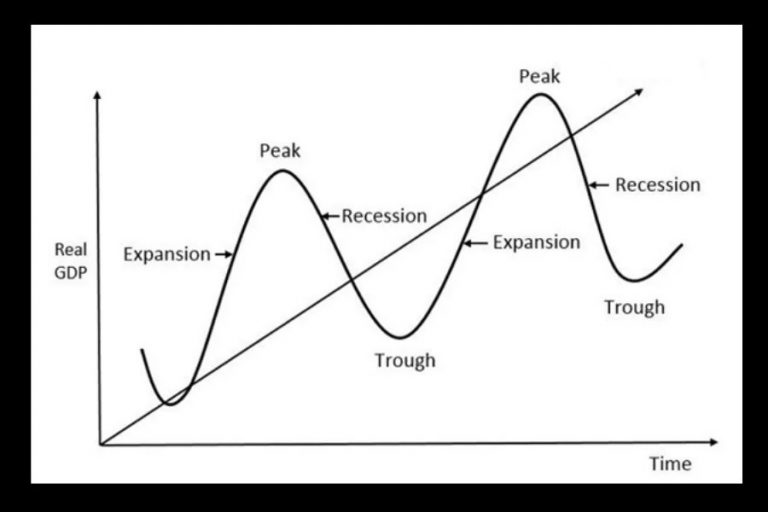

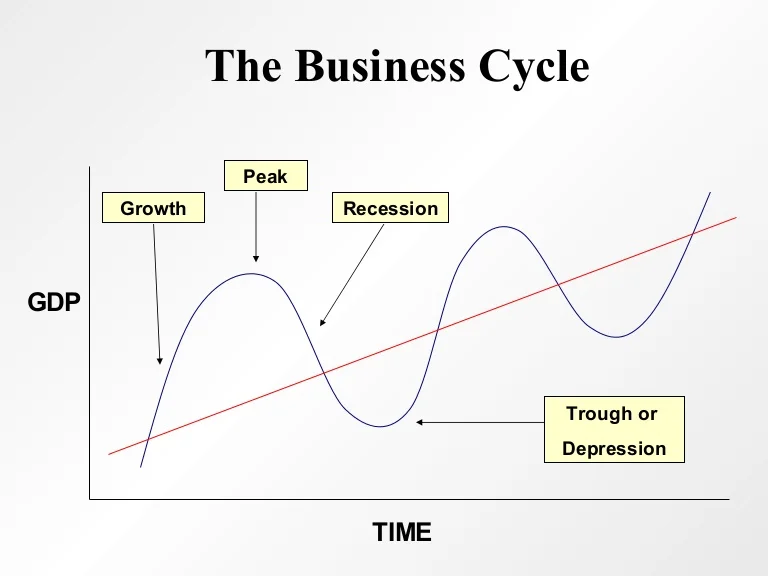

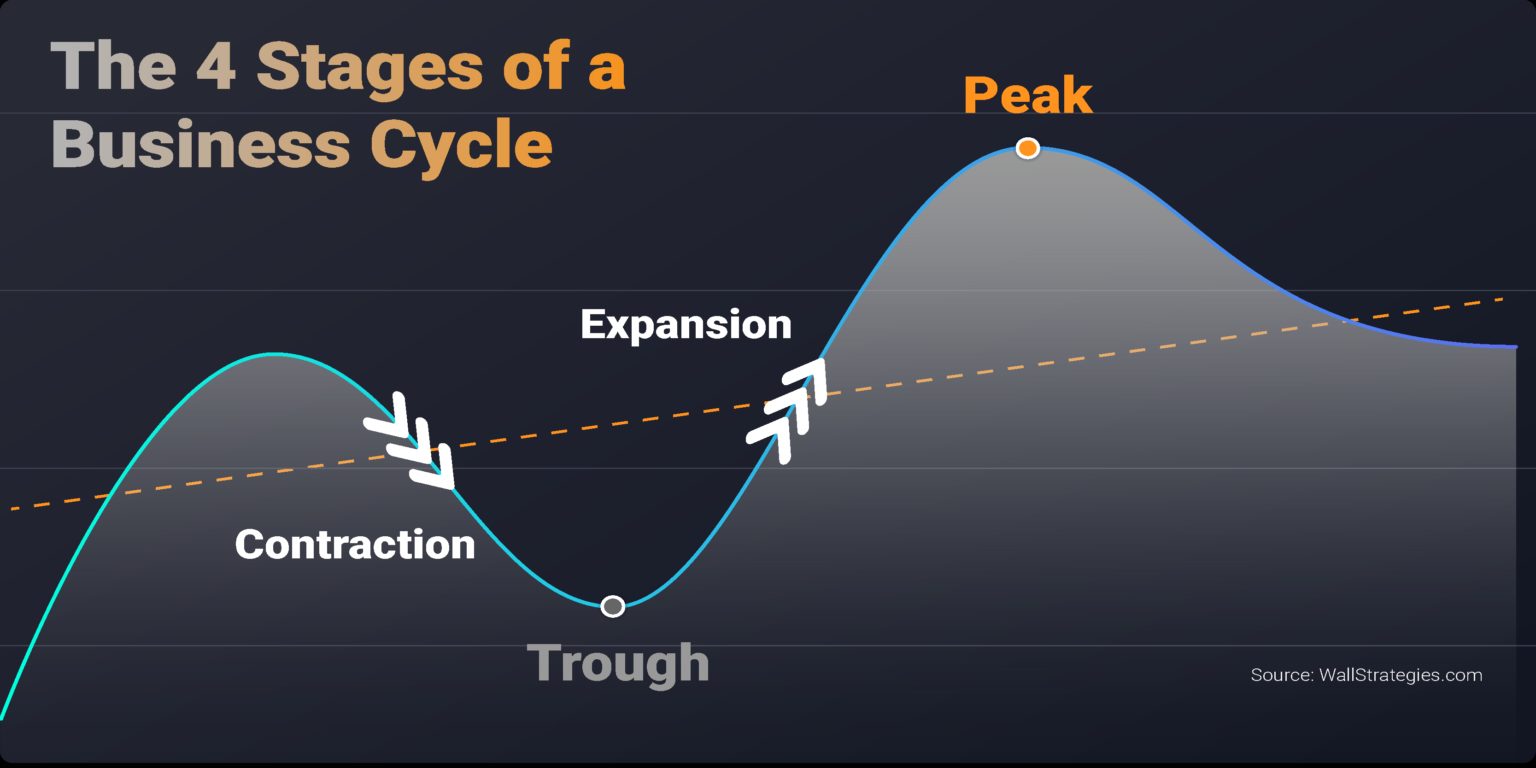

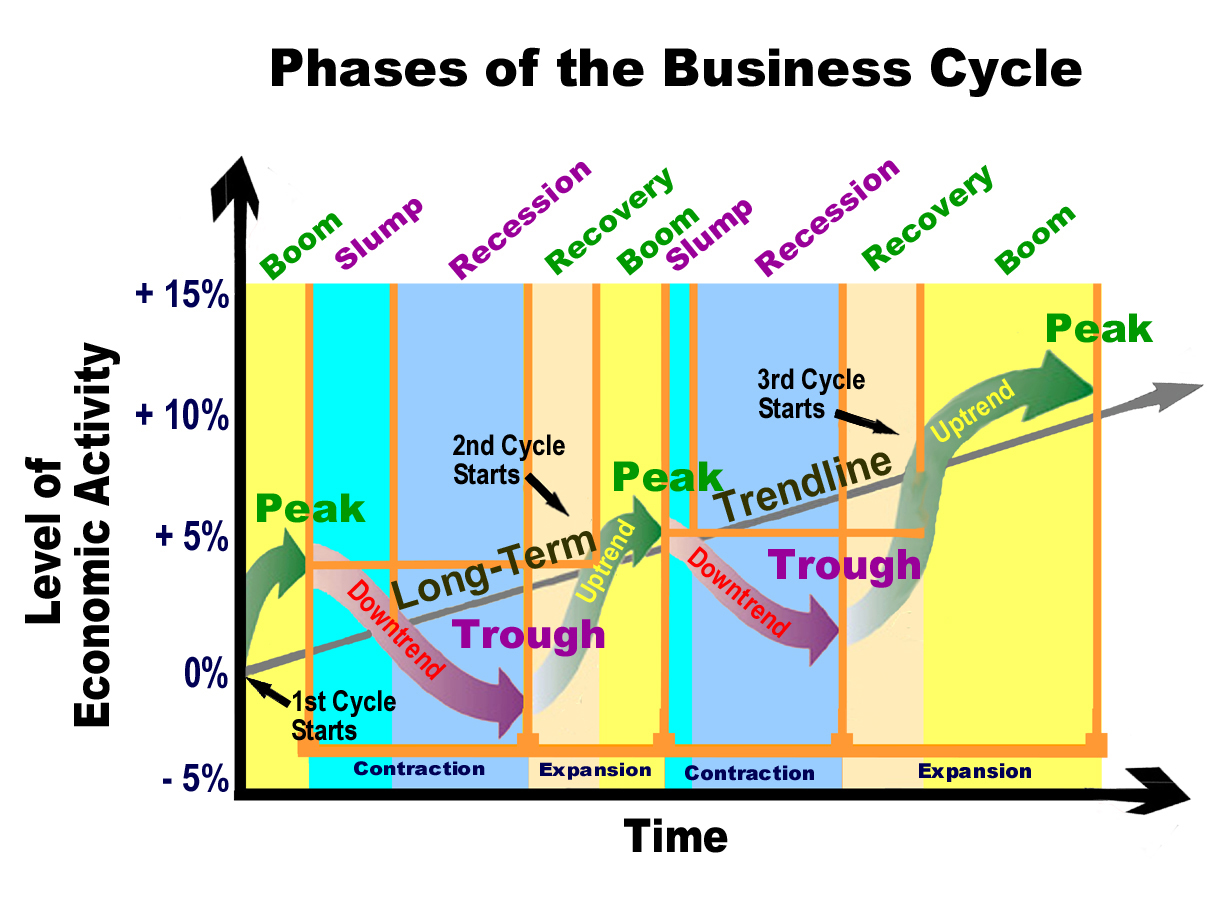

At the heart of economic understanding lies the business cycle, a recurring but not periodic pattern of expansion and contraction. This article delves into the four distinct stages of the business cycle – expansion, peak, contraction (or recession) and trough – exploring their characteristics, key indicators, and potential implications for the future. We will also examine different perspectives on the drivers of these cycles and how various actors can respond effectively.

The Four Stages Unveiled

1. Expansion: Growth and Optimism

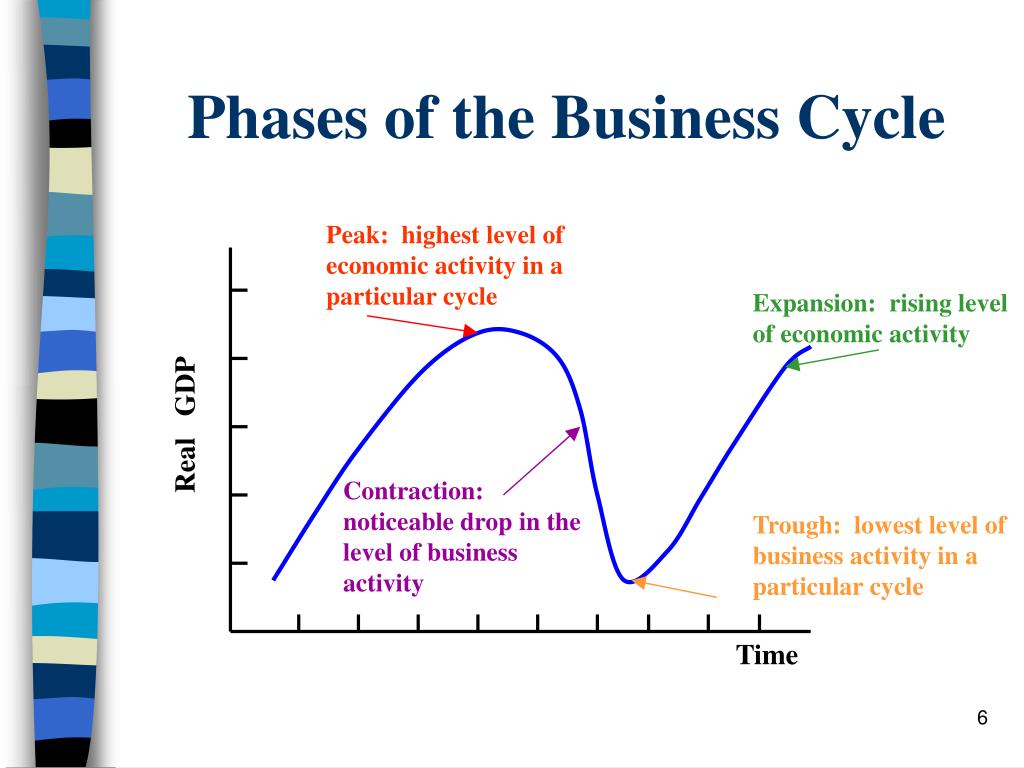

The expansion phase is characterized by sustained economic growth. Gross Domestic Product (GDP) increases, unemployment falls, and consumer confidence rises.

Businesses invest, and production expands to meet rising demand, fueling further job creation and wage growth. This phase is generally marked by optimism and a sense of prosperity, although inflationary pressures can begin to build.

2. Peak: The Apex of Prosperity

The peak represents the highest point of economic activity in the cycle. Economic growth slows, and the labor market tightens.

Inflation often rises, as demand outstrips supply, potentially leading to higher interest rates implemented by central banks to cool down the economy. This phase is inherently unstable as the conditions that fueled growth begin to reverse.

3. Contraction (Recession): A Downturn in Fortune

The contraction, often referred to as a recession when prolonged, is a period of economic decline. GDP falls, unemployment rises, and consumer spending decreases.

Businesses reduce investment and production, sometimes leading to layoffs. Pessimism prevails, and bankruptcies may increase as businesses struggle to cope with declining demand. The National Bureau of Economic Research (NBER) in the US is a key organization that officially declares recessions, based on a variety of economic indicators.

4. Trough: The Nadir and the Beginning of Recovery

The trough represents the lowest point of economic activity in the cycle. Economic decline bottoms out, and there are signs that the economy is about to turn around.

Unemployment remains high, but new orders may start to increase, and consumer confidence may slowly improve. This phase sets the stage for the next expansion, driven by pent-up demand, lower interest rates, and government stimulus measures.

Understanding the Drivers and Indicators

The business cycle is driven by a complex interplay of factors. These factors include monetary policy, fiscal policy, technological innovation, global events, and consumer and business sentiment.

Monetary policy, controlled by central banks like the Federal Reserve in the US or the European Central Bank, influences interest rates and the money supply, impacting borrowing costs and investment decisions. Fiscal policy, enacted by governments, involves spending and taxation decisions that can stimulate or dampen economic activity.

Key indicators of the business cycle include GDP growth, unemployment rate, inflation rate, consumer confidence index, and purchasing managers' index (PMI). These indicators provide valuable insights into the current stage of the cycle and potential future direction of the economy.

"Monitoring these indicators closely allows businesses and policymakers to make informed decisions and mitigate potential risks,"according to a recent report by the International Monetary Fund (IMF).

Navigating the Cycle: Strategies for Success

Businesses can employ various strategies to navigate the business cycle effectively. During expansions, they should focus on growth and innovation, but also manage risks and build up reserves for potential downturns.

During contractions, businesses should focus on cost control, efficiency improvements, and exploring new markets or product lines to maintain competitiveness. Investors can adjust their portfolios by shifting assets between stocks, bonds, and other asset classes to mitigate risk and maximize returns based on the cycle's stage. Policy makers can implement countercyclical policies like lowering interest rates or increasing government spending to stimulate the economy during recessions and cool it down during expansions.

Looking Ahead: The Future of the Business Cycle

Predicting the future of the business cycle is notoriously difficult, but some trends suggest the cycle is evolving. Factors such as increasing globalization, rapid technological advancements, and demographic shifts are influencing the length and intensity of cycles.

Some economists argue that the traditional business cycle is becoming less pronounced, while others believe that future cycles will be more volatile due to increased uncertainty and interconnectedness. Regardless of the specific path, understanding the principles of the business cycle remains essential for informed decision-making and navigating the ever-changing economic landscape. The ongoing interplay of economic forces ensures that the cycle, in some form, will persist.

.png)

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)