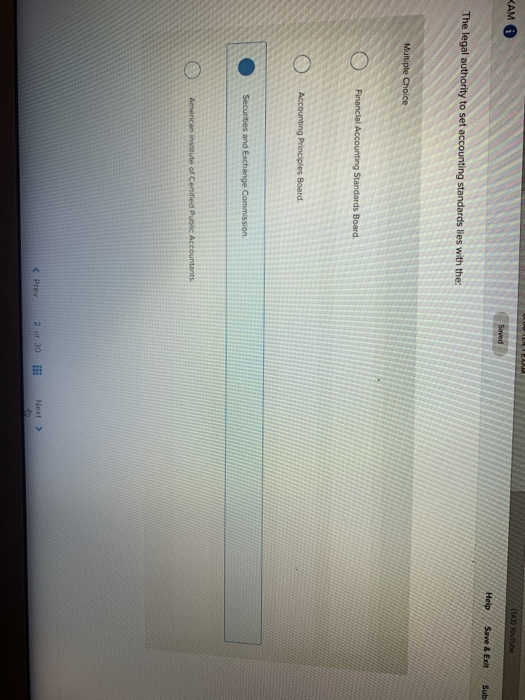

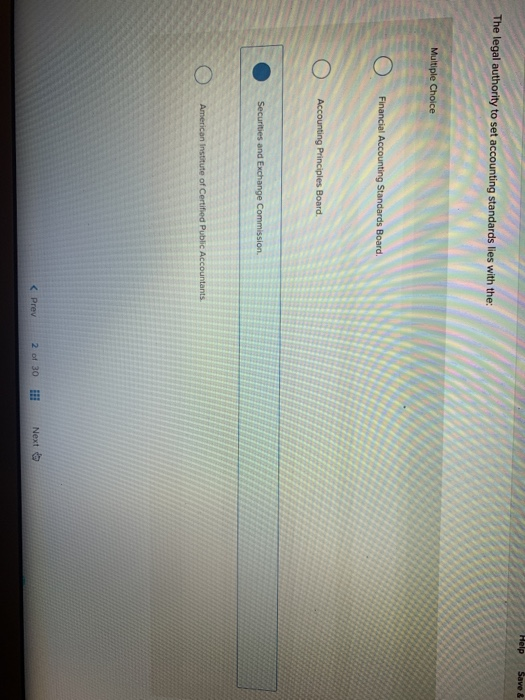

The Legal Authority To Set Accounting Standards Lies With The

The debate over who holds the ultimate legal authority to set accounting standards has reignited, prompting urgent discussions among regulators, industry professionals, and investors. Recent challenges question the established roles of key organizations, potentially reshaping the future of financial reporting.

At stake is the integrity and reliability of financial information, critical for market stability and investor confidence. This article dissects the complex legal framework governing accounting standards, clarifying the powers and responsibilities of the involved entities.

The Core Issue: Authority and Accountability

The fundamental question revolves around which entity possesses the legal authority to dictate the rules businesses must follow when preparing their financial statements. This determination directly impacts how companies report their earnings, assets, and liabilities.

Different countries have different answers to this fundamental question. For example, the United States depends on the work of the Financial Accounting Standards Board, or FASB.

However, FASB's authority is not unlimited.

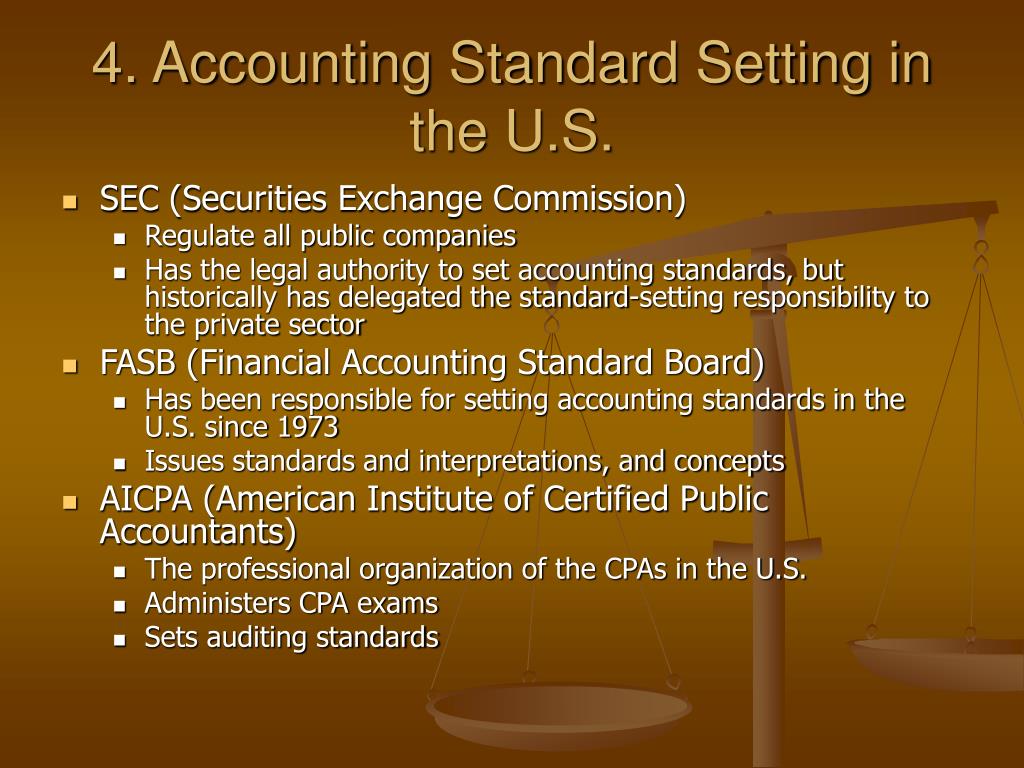

United States: The SEC and FASB's Collaborative Role

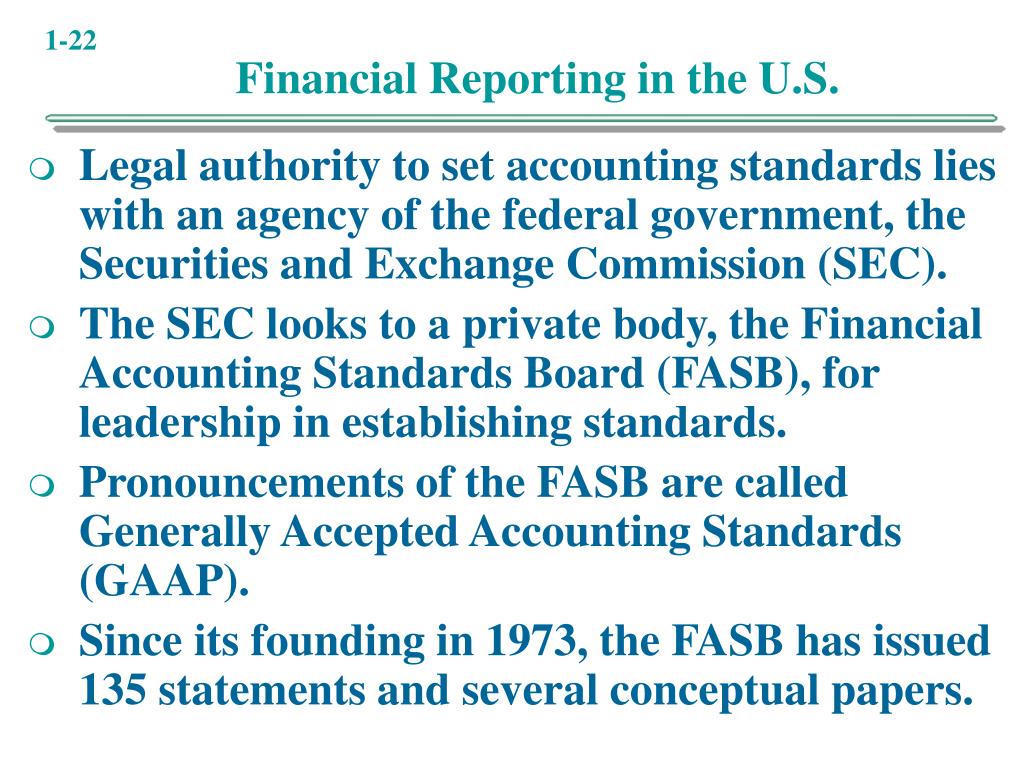

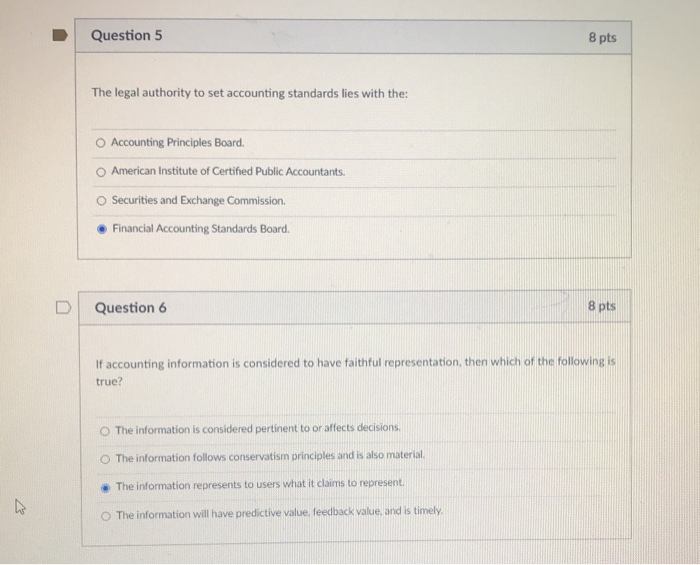

In the United States, the Securities and Exchange Commission (SEC) holds the ultimate legal authority to establish accounting principles for publicly traded companies. This power is granted by federal securities laws.

The SEC, however, has historically delegated much of this responsibility to the Financial Accounting Standards Board (FASB). FASB is a private, non-profit organization.

The FASB develops and issues accounting standards known as Generally Accepted Accounting Principles (GAAP). GAAP represents the common set of accounting rules, standards, and procedures.

The SEC oversees FASB's activities and retains the authority to reject, modify, or supplement FASB standards. This oversight ensures that accounting standards serve the public interest and protect investors.

The Commission has a statutory obligation to ensure that financial reporting requirements result in transparent and reliable financial information.

- Statement from the SEC regarding oversight of accounting standards.

International Landscape: IFRS Foundation and National Regulators

Globally, the IFRS Foundation, through its International Accounting Standards Board (IASB), develops International Financial Reporting Standards (IFRS). IFRS are used by companies in more than 140 jurisdictions.

However, the legal authority to mandate the use of IFRS rests with individual countries or jurisdictions. Each jurisdiction decides whether to adopt, adapt, or reject IFRS for companies within its borders.

For example, the European Union (EU) requires publicly traded companies to use IFRS. But each member state has the legal power to enforce this regulation.

This creates a diverse international landscape. Accounting standards vary depending on each country's legal framework and regulatory preferences.

Recent Challenges and Legal Interpretations

The specific details of the legal authority are sometimes challenged in court.

Such challenges can lead to judicial interpretations that redefine the scope and limits of regulatory power. These court rulings have immediate implications for the accounting practices.

These cases highlight the delicate balance between regulatory oversight, industry self-regulation, and the legal rights of companies.

Potential Impacts on Financial Reporting

Clarifying the legal authority helps to maintain stability and trust in financial markets.

Uncertainty about who sets the rules can lead to inconsistent accounting practices, making it difficult for investors to compare companies and assess risk. Ultimately, this will reduce trust in public market.

Establishing clear lines of authority enhances accountability. This also minimizes the potential for manipulation or fraud in financial reporting.

Next Steps and Ongoing Developments

The debate over the legal authority is ongoing, with potential implications for the future of financial reporting.

Regulatory bodies like the SEC are closely monitoring the situation. They may consider issuing further guidance or regulations to clarify their roles and responsibilities.

Industry stakeholders, including accounting firms and professional organizations, are actively participating in the discussions. These discussions will shape the future of accounting standards.