The Opportunity Cost Of An Action

The aroma of freshly baked bread hung heavy in the air, mingling with the cheerful chatter of the Saturday market. Sunlight dappled through the canvas awnings, illuminating stalls overflowing with colorful produce and handcrafted goods. Sarah paused, her gaze drawn to two tempting options: a delicate watercolor painting of a local wildflower meadow and a steaming cup of fair-trade coffee with a flaky croissant. The artist smiled invitingly, while the barista energetically called out orders. In that simple moment, a silent calculation began, a weighing of values that lies at the heart of every decision we make – the concept of opportunity cost.

This seemingly small, everyday scenario perfectly illustrates the opportunity cost – the value of the next best alternative forgone when making a decision. It's a fundamental principle in economics that permeates every aspect of our lives, from personal spending habits to large-scale government policies. Understanding opportunity cost can empower us to make more informed choices, leading to greater satisfaction and success, both individually and collectively.

The Roots of Opportunity Cost

The idea of opportunity cost isn't new, though its formal recognition as a core economic concept came later. Thinkers throughout history have recognized the inherent trade-offs in decision-making. As resources are scarce, any action or choice means foregoing other potential uses of those resources.

Economist Friedrich von Wieser, an Austrian economist, is often credited with formalizing the concept of opportunity cost in the late 19th century. He emphasized that the true cost of something wasn't just the money spent, but also the value of what you had to give up to get it.

This idea challenged the traditional view of cost, which focused primarily on direct financial outlays. Instead, Wieser highlighted the subjective nature of value and the importance of considering alternative possibilities.

Opportunity Cost in Everyday Life

The beauty of opportunity cost lies in its universal applicability. It's not just about money; it's about time, energy, and any other limited resource. Every time we choose to do one thing, we're implicitly choosing not to do something else.

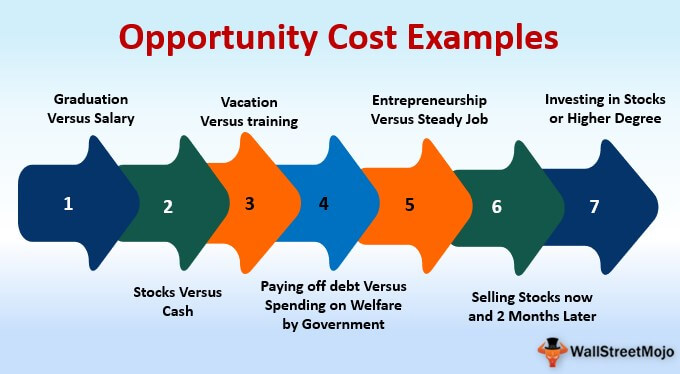

Consider a student deciding how to spend their Saturday afternoon. They could study for an upcoming exam, work a part-time job, or spend time with friends. Each option offers different benefits, but choosing one means foregoing the others.

The opportunity cost of studying might be the income earned from working or the enjoyment of socializing with friends. Similarly, the opportunity cost of socializing could be a better grade on the exam or increased financial security. The optimal decision depends on the student's individual priorities and values.

Opportunity Cost in Business

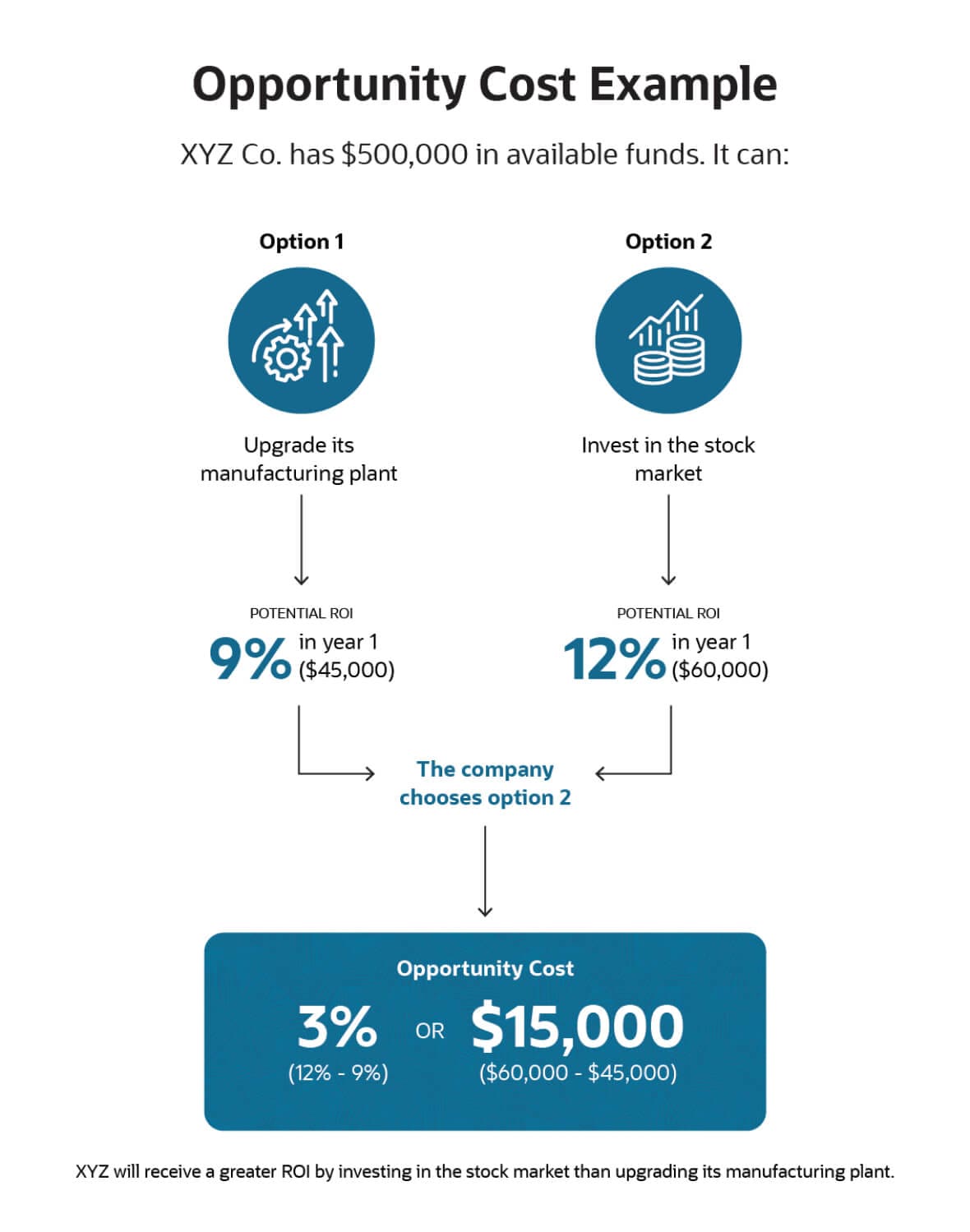

Businesses constantly grapple with opportunity costs. They must decide how to allocate their resources, including capital, labor, and raw materials, to maximize profits.

For example, a company might consider investing in a new piece of equipment or expanding into a new market. Both options require significant capital outlay, and choosing one means foregoing the potential returns from the other.

A study by Harvard Business Review revealed that companies who carefully consider the opportunity cost of potential projects are 20% more likely to succeed with their new ventures. This underscores the importance of strategic thinking and a thorough understanding of trade-offs.

Opportunity Cost in Government Policy

Governments also face complex decisions with significant opportunity costs. Every public policy, from infrastructure projects to social welfare programs, involves allocating scarce resources.

For example, a government might choose to invest in building a new highway or funding education programs. Both investments are valuable, but choosing one means potentially foregoing the benefits of the other.

According to a report by the Congressional Budget Office, understanding the opportunity cost of government spending is crucial for making fiscally responsible decisions. It allows policymakers to weigh the potential benefits of different programs and allocate resources in a way that maximizes societal welfare.

Hidden Opportunity Costs

Sometimes, opportunity costs are not immediately obvious. They can be hidden beneath the surface, obscured by emotions, biases, or short-sighted thinking.

For instance, the decision to hold onto a losing investment might seem sensible in the short term, but the opportunity cost could be the potential gains from investing that capital elsewhere. This is an example of the sunk cost fallacy, where people continue to invest in a losing venture because of the resources they have already committed to it, ignoring the opportunity cost of alternative investments.

Recognizing these hidden costs requires careful analysis, objective evaluation, and a willingness to challenge our own assumptions. Emotional attachment can cloud our judgment, making it difficult to see the true value of alternative opportunities.

Making Better Decisions

While it's impossible to eliminate opportunity costs entirely, understanding the concept can empower us to make better, more informed decisions. Here are some practical tips:

First, identify your alternatives. Clearly define the different options available to you. The more comprehensive your list, the better equipped you'll be to evaluate their respective costs and benefits.

Second, evaluate the value of each alternative. This might involve quantifying the financial returns, assessing the potential benefits, or simply considering the personal satisfaction each option offers. Remember, value is subjective and depends on your individual priorities.

Third, consider both short-term and long-term implications. Don't focus solely on immediate gratification. Think about the potential consequences of your decision over time. A decision that seems beneficial in the short term might have negative repercussions down the road.

Fourth, be open to changing your mind. Circumstances change, and new information emerges. If you realize that your initial decision was not the best one, don't be afraid to adjust your course. Flexibility is key to navigating the complexities of life.

A Reflective Conclusion

Back at the Saturday market, Sarah paused again, her gaze shifting between the watercolor painting and the coffee and croissant. She considered not just the immediate cost of each item, but also the value of the other activities she could be doing with her time and money.

Ultimately, she decided to purchase the painting. While the coffee and croissant would have provided immediate gratification, she knew that the painting would bring her lasting joy and remind her of the beauty of the local landscape.

The choice wasn't simply about money; it was about aligning her spending with her values and making a conscious decision about how to allocate her limited resources. That, in essence, is the power of understanding opportunity cost - the power to make choices that truly reflect what matters most to us.