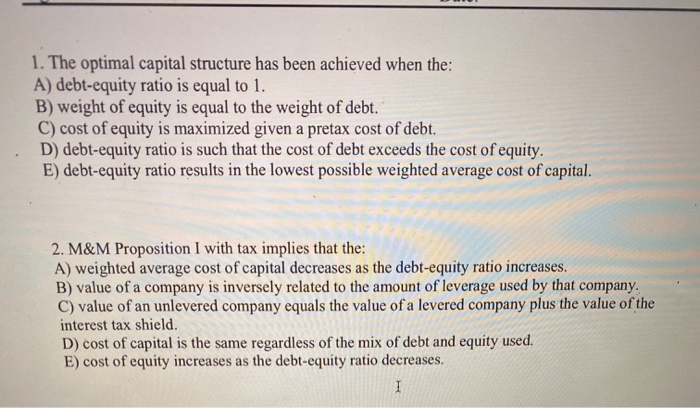

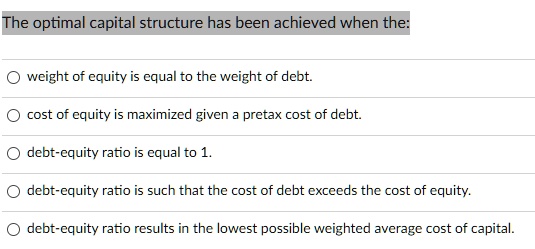

The Optimal Capital Structure Has Been Achieved When The

Imagine a seasoned captain navigating a ship through a vast ocean. The sails must be perfectly trimmed to catch the wind, the ballast carefully balanced to keep the vessel steady. Too much reliance on one and the ship risks capsizing; too little, and it drifts aimlessly. Similarly, in the world of finance, a company's capital structure—the way it funds its operations—requires delicate calibration to achieve optimal performance.

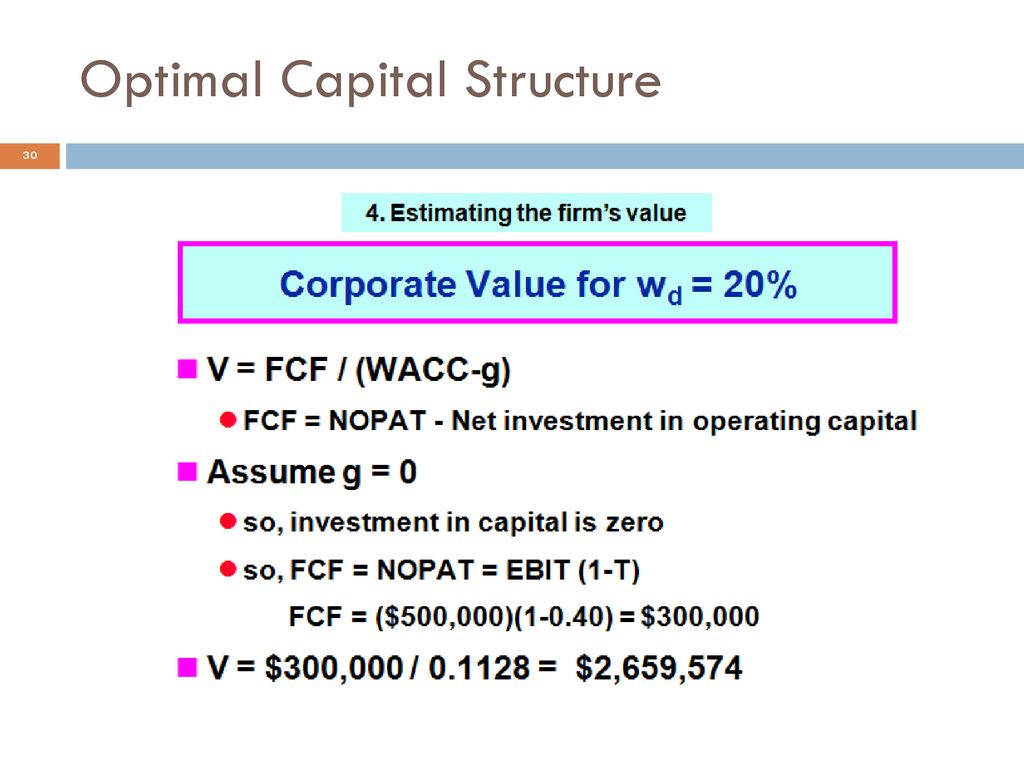

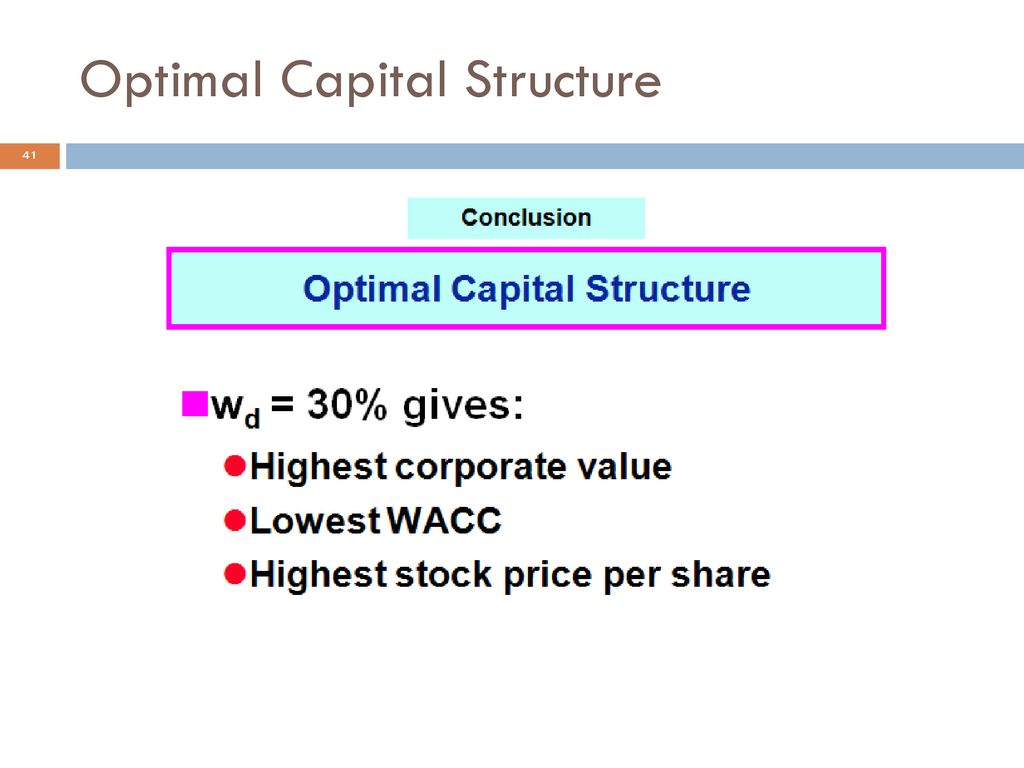

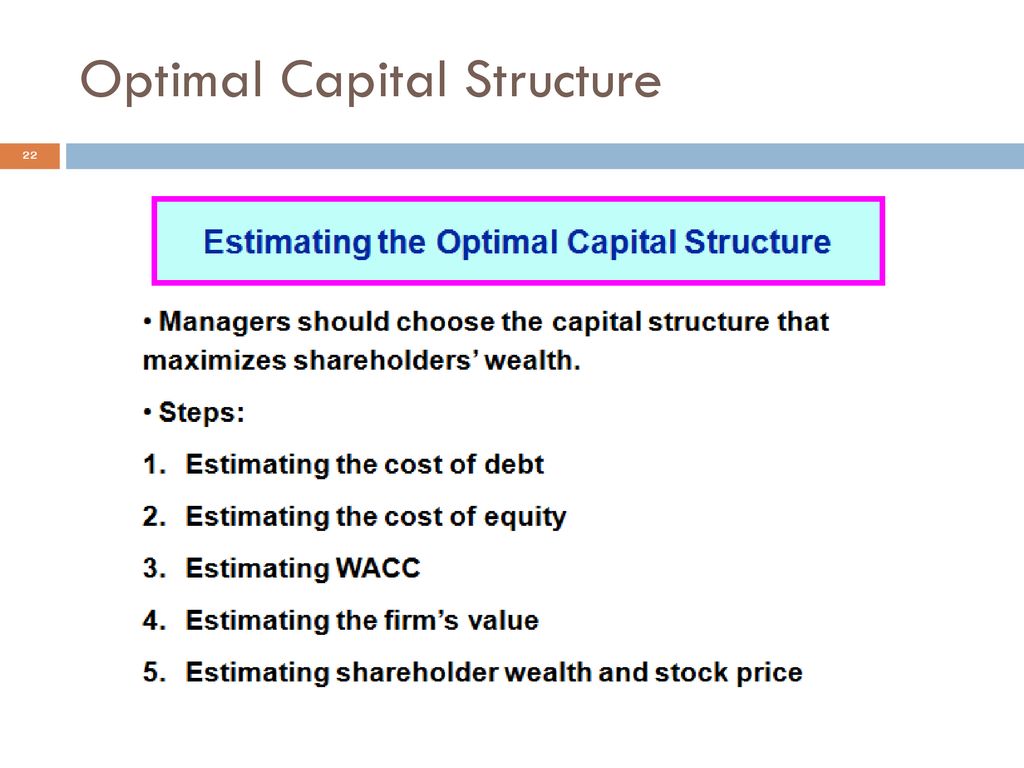

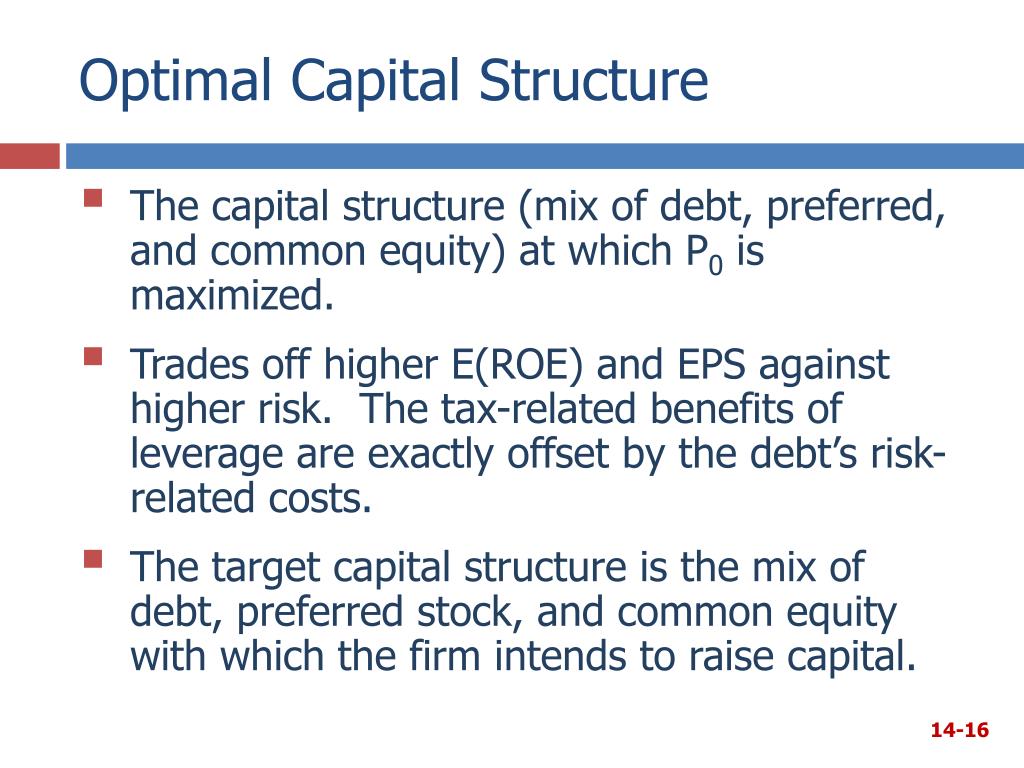

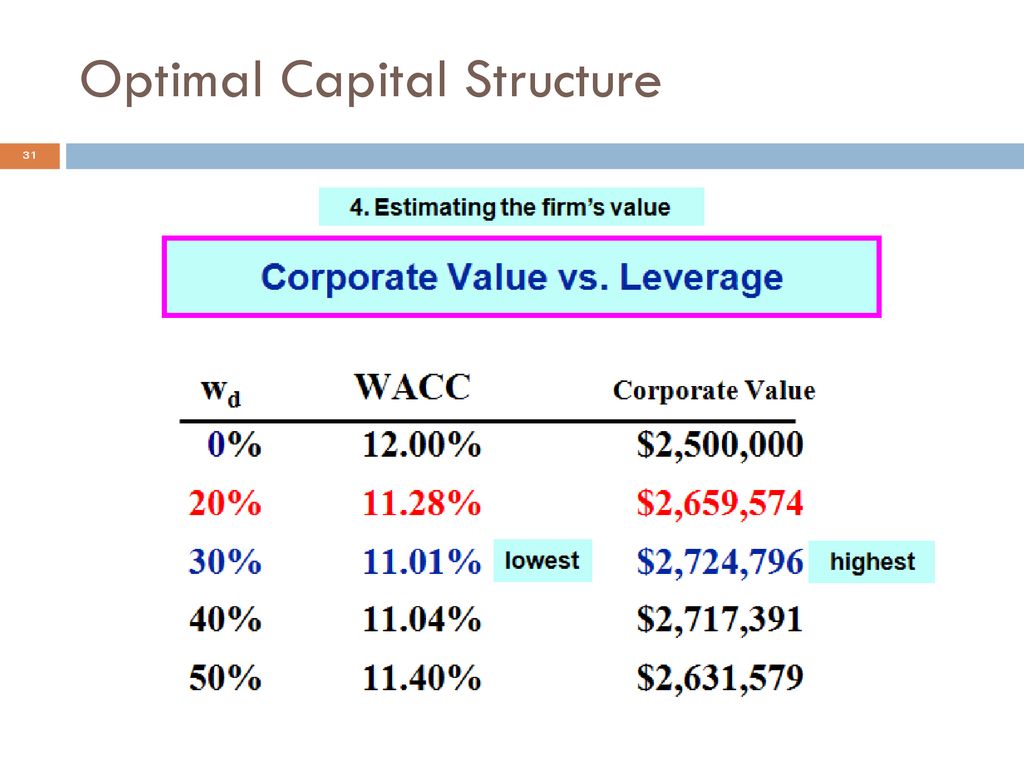

The optimal capital structure, a concept often debated in boardrooms and business schools, is achieved when a company minimizes its cost of capital while simultaneously maximizing its value. This sweet spot, where debt and equity are harmoniously balanced, empowers the company to pursue growth opportunities, weather economic storms, and deliver consistent returns to its stakeholders.

The Foundation: Understanding Capital Structure

A company's capital structure is essentially its financial architecture, outlining the proportion of debt and equity used to finance its assets and operations. Debt includes loans, bonds, and other forms of borrowing, while equity represents ownership in the company, typically in the form of stock.

Decisions about capital structure are not made in a vacuum. They are influenced by a complex interplay of factors, including the company's industry, its growth stage, prevailing economic conditions, and its appetite for risk.

Debt: The Double-Edged Sword

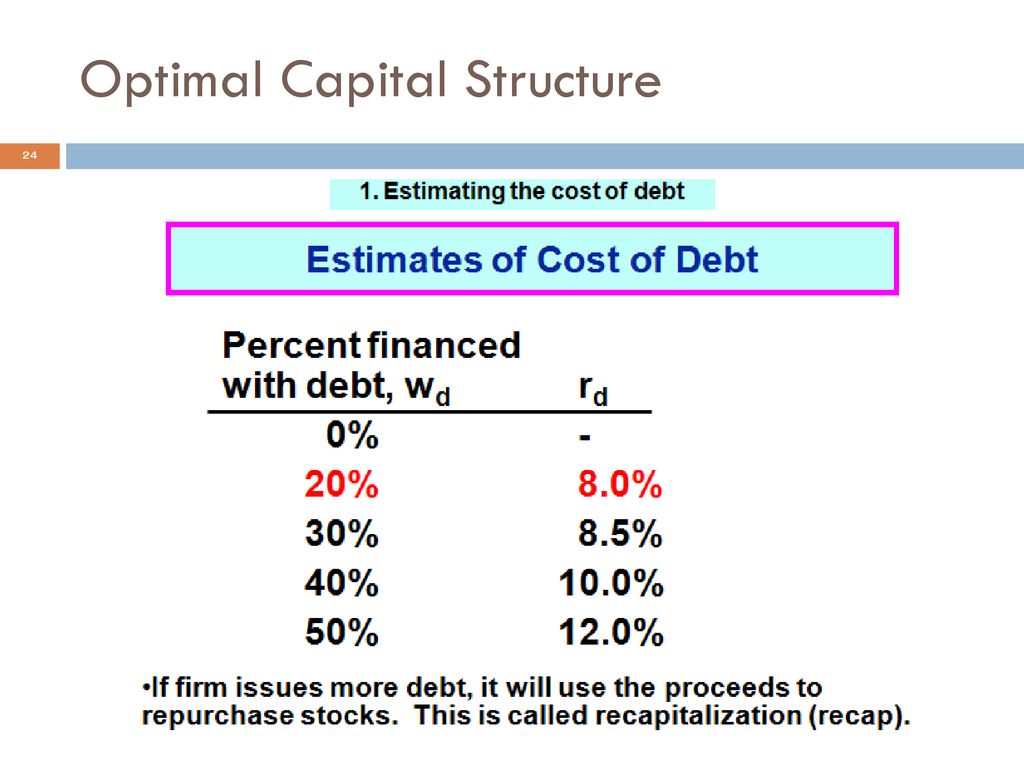

Debt can be a powerful tool. It offers the advantage of tax deductibility on interest payments, effectively lowering the cost of capital. Moreover, debt can amplify returns to shareholders during periods of growth, as the company leverages borrowed funds to generate profits.

However, excessive debt can be a dangerous game. High debt levels increase financial risk, making the company vulnerable to economic downturns and potentially leading to bankruptcy. The interest burden can also strain cash flow, limiting the company's ability to invest in future growth.

Equity: Sharing the Pie

Equity, on the other hand, represents a more stable source of funding. It doesn't require mandatory repayments like debt, providing the company with greater financial flexibility.

However, issuing equity dilutes ownership, reducing the percentage of profits accruing to existing shareholders. Equity also tends to be a more expensive source of capital than debt, as investors demand a higher rate of return to compensate for the greater risk they assume.

The Quest for Optimization: Finding the Perfect Balance

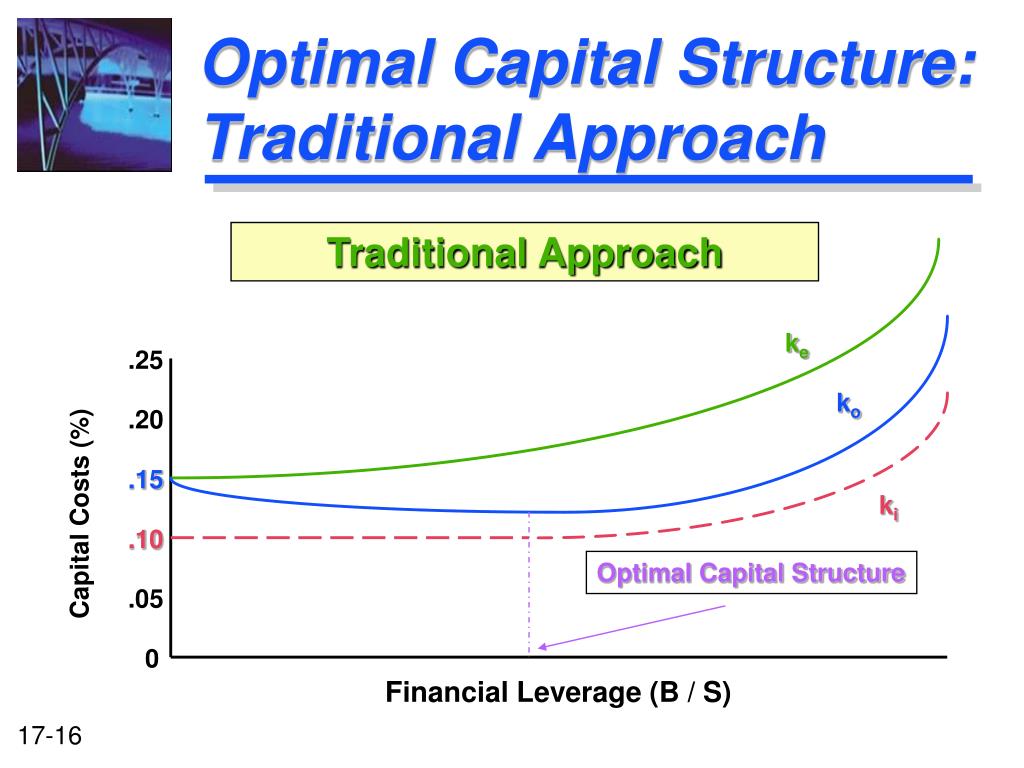

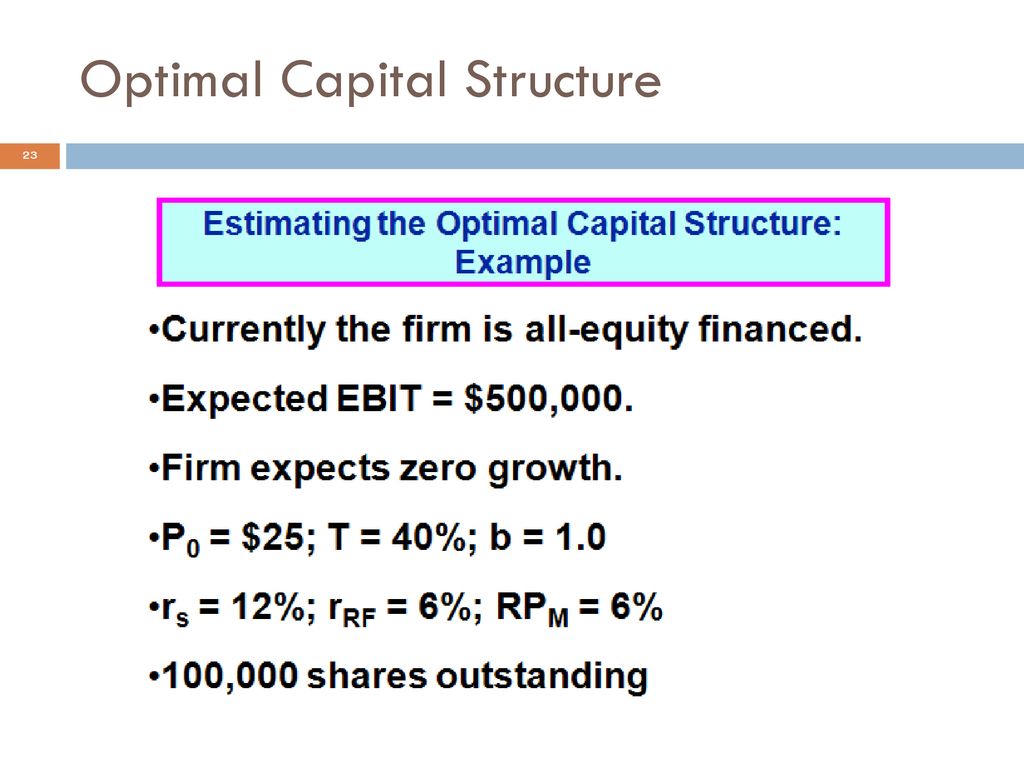

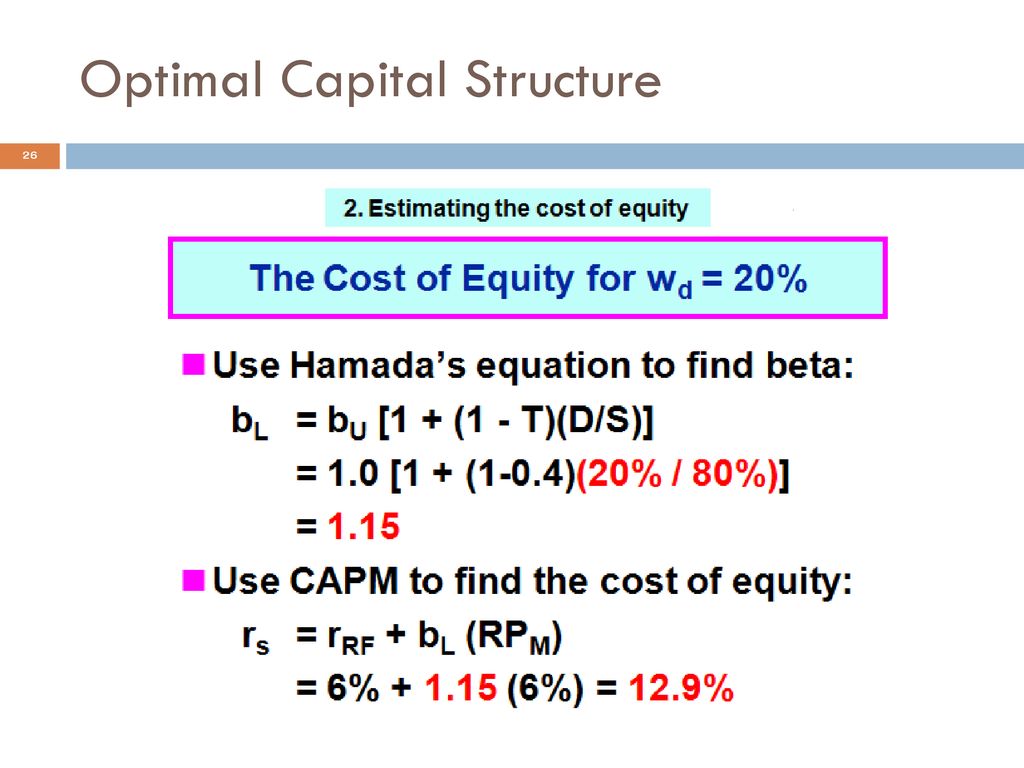

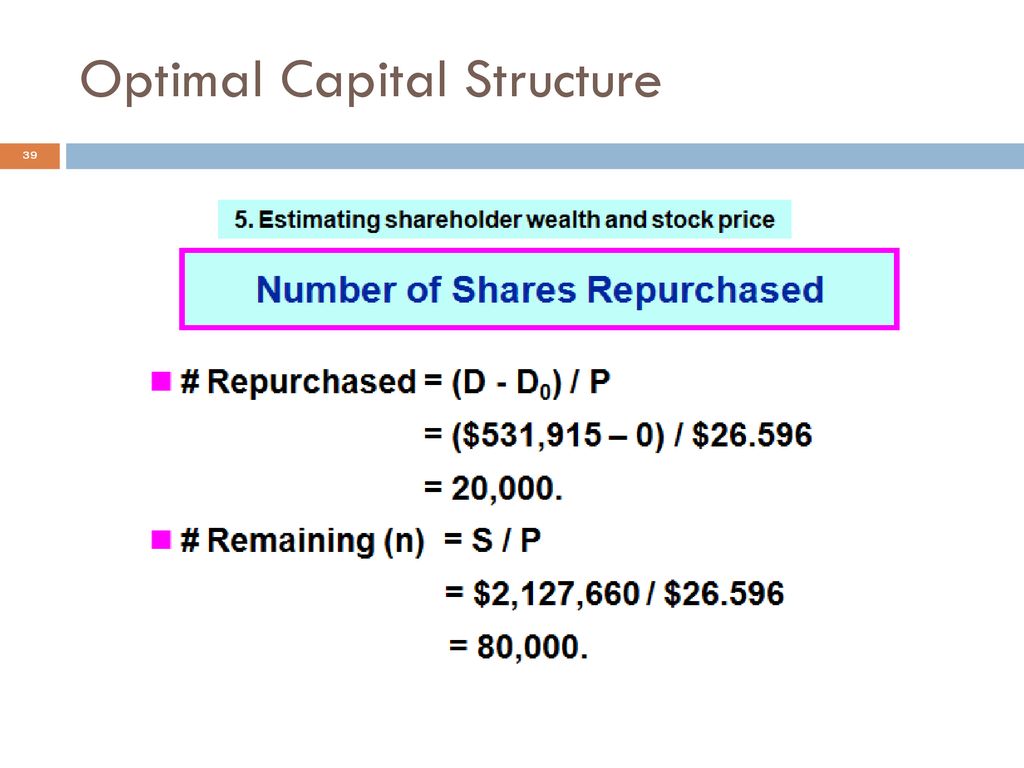

The quest for the optimal capital structure is a constant balancing act. Companies strive to find the mix of debt and equity that minimizes the weighted average cost of capital (WACC), the average rate of return a company must earn to satisfy its investors.

Numerous theories attempt to explain how companies can achieve this optimal balance. The Modigliani-Miller theorem, a cornerstone of modern finance, initially posited that in a perfect market with no taxes or bankruptcy costs, a company's value is independent of its capital structure.

However, real-world markets are far from perfect. Taxes, bankruptcy costs, and information asymmetry all play a role in shaping capital structure decisions. Subsequent modifications to the Modigliani-Miller theorem incorporated these factors, suggesting that an optimal capital structure does indeed exist.

"A well-designed capital structure should reflect a company's risk profile, growth prospects, and access to capital markets." – Dr. Anya Sharma, Finance Professor at the University of Metropolitan

One key consideration is the trade-off theory. This theory suggests that companies should increase debt until the tax benefits of debt are offset by the costs of financial distress. In other words, the optimal capital structure occurs where the marginal benefit of an additional dollar of debt equals the marginal cost.

The pecking order theory, another influential framework, argues that companies prefer internal financing (retained earnings) over external financing, and debt over equity when external financing is required. This preference stems from information asymmetry – the idea that managers possess more information about the company's prospects than outside investors, leading to a higher cost of raising capital through equity.

Factors Influencing the Optimal Structure

The ideal mix of debt and equity is not a one-size-fits-all solution. Several factors influence a company's optimal capital structure, including industry characteristics, company size, growth opportunities, and management's risk tolerance.

Industry Dynamics

Companies in stable, mature industries with predictable cash flows, such as utilities, can typically support higher levels of debt. These businesses are less likely to face financial distress, making debt a relatively safe and attractive option.

On the other hand, companies in volatile, high-growth industries, such as technology, often rely more heavily on equity financing. The uncertainty surrounding their future cash flows makes debt a riskier proposition.

Company Size and Growth

Larger, more established companies generally have better access to debt markets and can secure more favorable terms. These firms often maintain higher debt levels than smaller companies.

Companies with significant growth opportunities may choose to issue equity to finance these investments, even if it dilutes ownership. The potential for future profits can outweigh the cost of equity financing.

Management's Risk Tolerance

Ultimately, capital structure decisions are influenced by management's risk tolerance. Some managers are comfortable taking on higher levels of debt to boost returns, while others prefer a more conservative approach with a greater reliance on equity.

The Metrics of Success: Measuring Optimality

While finding the "perfect" capital structure is an ongoing process, companies can use several metrics to assess their progress. These metrics help gauge whether the company is approaching its optimal balance between debt and equity.

The debt-to-equity ratio, a widely used measure, compares a company's total debt to its total equity. A lower ratio indicates a more conservative capital structure, while a higher ratio suggests greater reliance on debt.

The times interest earned ratio (TIE) measures a company's ability to cover its interest expenses. A higher TIE ratio indicates that the company has ample earnings to meet its debt obligations.

Changes in the company's credit rating can also provide insights into the effectiveness of its capital structure. An improved credit rating typically reflects a stronger financial position and a lower risk of default.

Beyond the Numbers: The Qualitative Factors

While quantitative metrics are essential, qualitative factors also play a crucial role in assessing the optimality of a capital structure. These factors include the company's strategic goals, its competitive landscape, and its overall financial health.

A company's capital structure should support its long-term strategic goals. For example, a company pursuing an aggressive acquisition strategy may need to maintain a lower debt level to preserve its financial flexibility.

The competitive landscape also influences capital structure decisions. Companies operating in highly competitive industries may need to maintain a strong balance sheet to weather economic downturns and maintain a competitive edge.

The Enduring Quest: An Ongoing Process

Achieving the optimal capital structure is not a one-time event but an ongoing process of refinement and adaptation. As market conditions change, and as the company evolves, its capital structure must be adjusted to maintain its optimal balance.

Regular reviews of the capital structure are essential. Management should periodically assess the company's debt levels, its cost of capital, and its financial flexibility to ensure that its capital structure remains aligned with its strategic goals.

Navigating the complexities of capital structure requires careful consideration, rigorous analysis, and a deep understanding of the company's unique circumstances. Ultimately, the optimal capital structure is the one that empowers the company to thrive in its competitive environment, create value for its shareholders, and build a sustainable future.