The Par Value Per Share Of Common Stock Represents

Urgent clarification needed: The concept of par value per share of common stock is consistently misunderstood, leading to potential misinterpretations of a company's financial health and legal standing.

This article cuts through the complexity to deliver a straightforward explanation of what par value truly represents and, more importantly, what it doesn't.

What is Par Value?

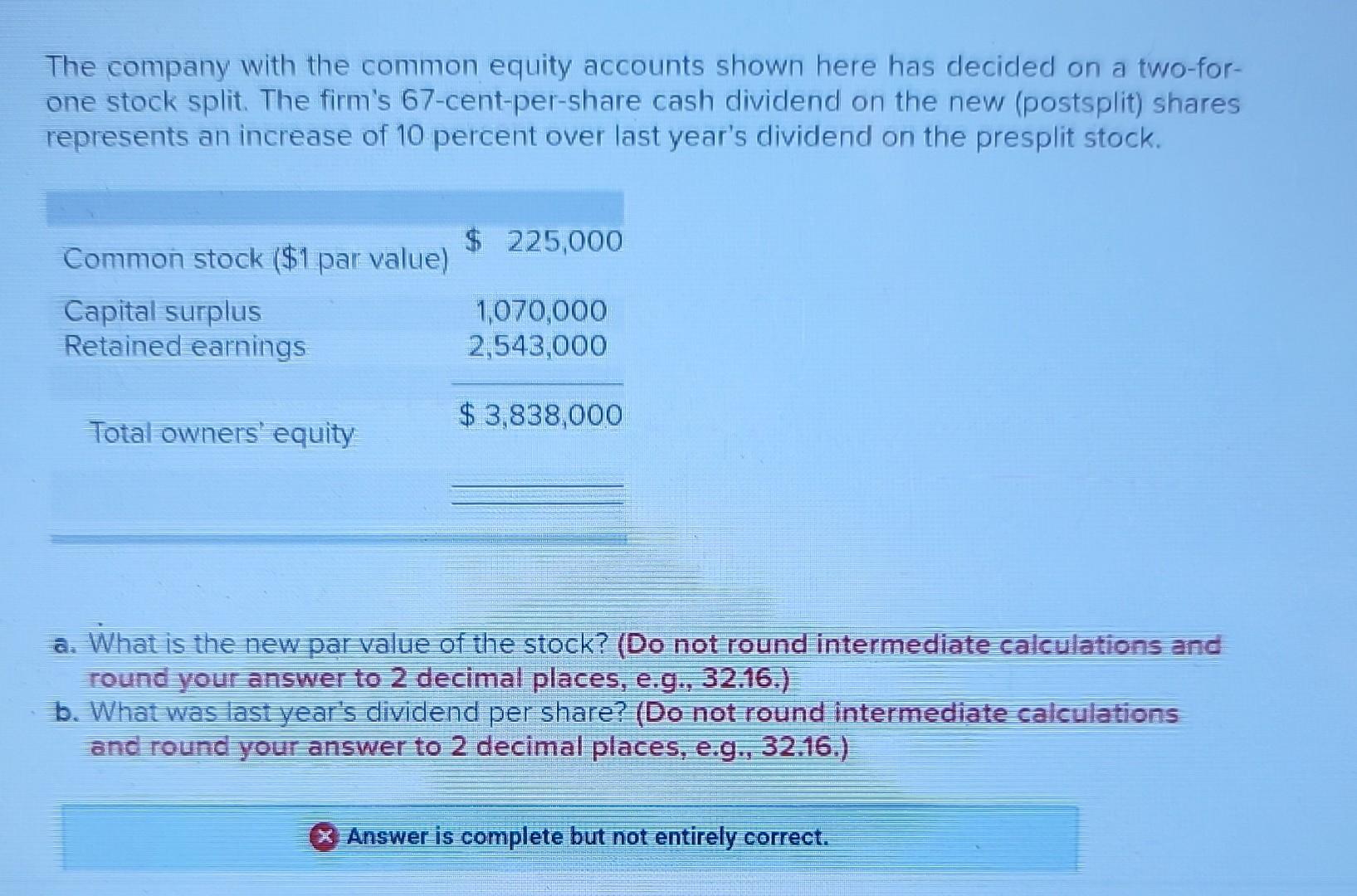

Par value is the nominal or face value of a share as specified in the company's corporate charter.

It's essentially a minimum amount that a share could initially be sold for, although modern practice often sees it set at a very low amount, such as $0.01 or even $0.0001 per share.

Who determines the par value? The company's founders or board of directors establish this value during the incorporation process.

Why Does Par Value Exist?

Historically, par value served as a protection for creditors, preventing companies from issuing shares at prices below this value, thus ensuring a certain level of capital was maintained.

However, modern accounting practices and legal interpretations have largely diminished this protective function.

Where does this concept originate? Corporate law, particularly state corporate statutes in the United States, dictates the requirements regarding par value.

What Par Value Is NOT:

Crucially, par value is not an indicator of the market value of a share.

The market value is determined by supply and demand in the open market and can be significantly higher or lower than the par value.

When is par value relevant? Primarily during the initial stock issuance and when accounting for the company's capital structure.

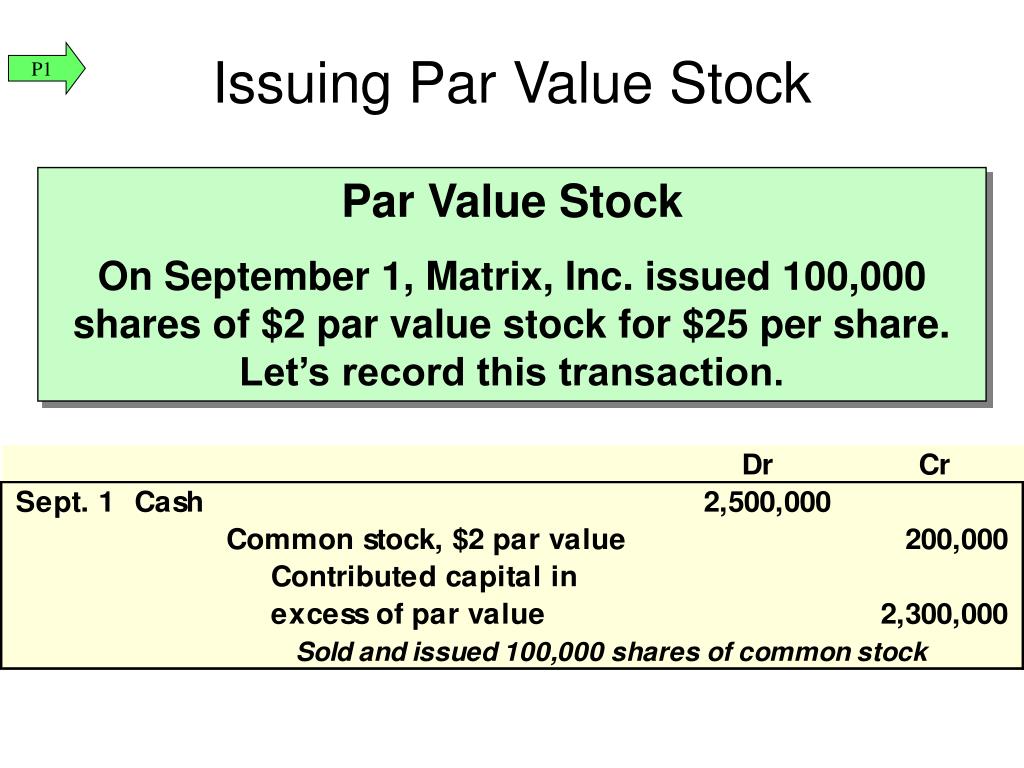

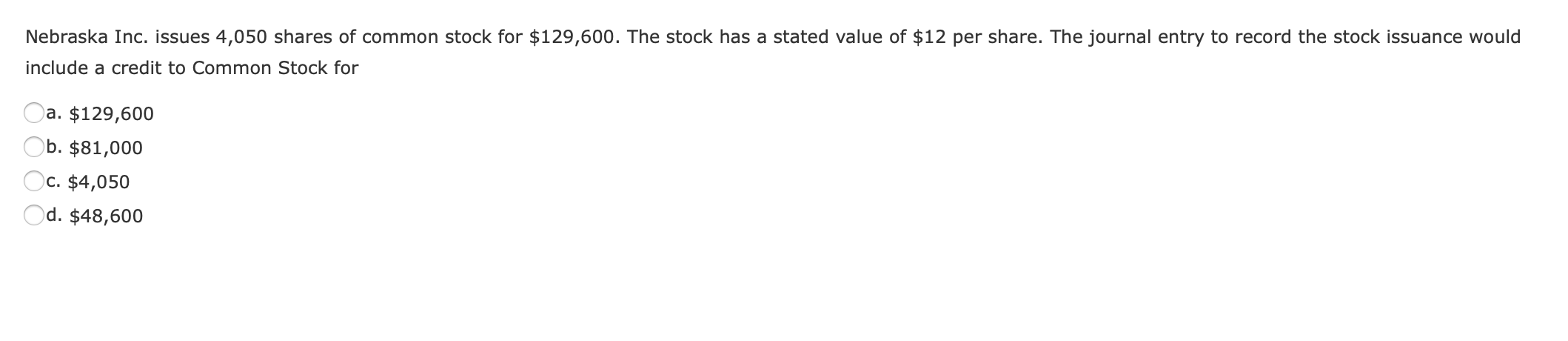

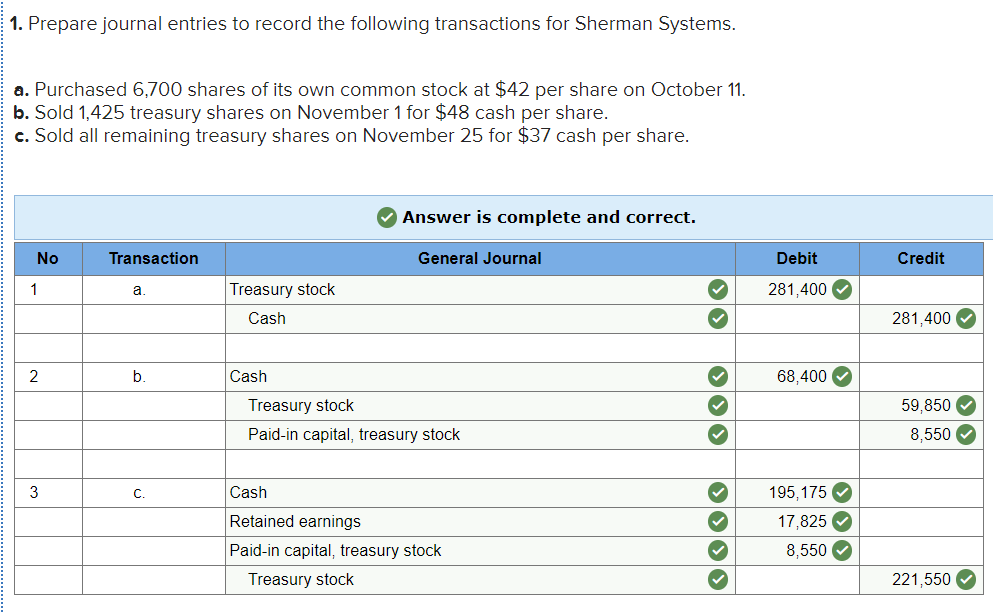

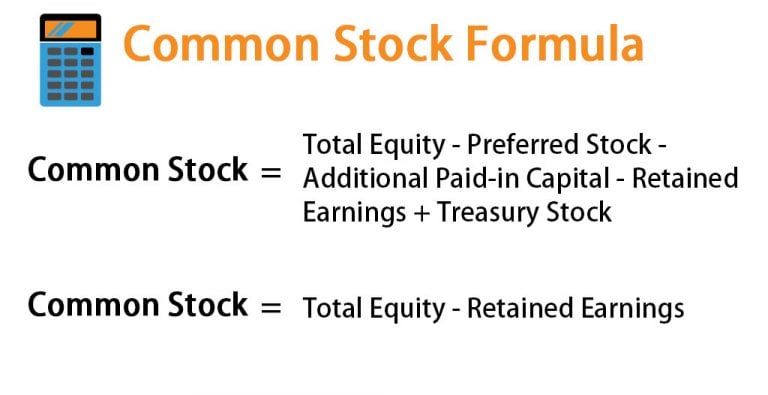

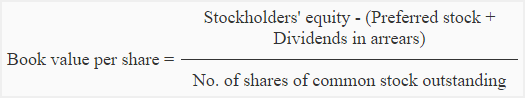

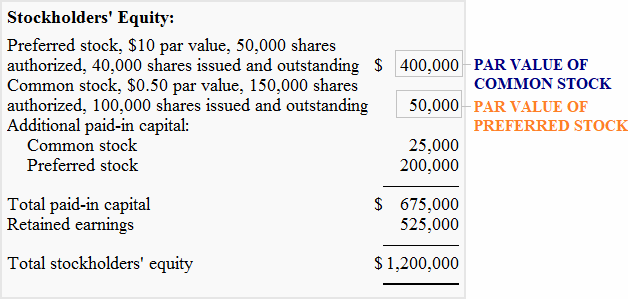

The Accounting Implications

When a company issues shares at a price above par value, the excess amount is recorded as additional paid-in capital.

For example, if a company issues a share with a par value of $0.01 for $20, $0.01 is allocated to stated capital, and $19.99 goes to additional paid-in capital.

How is it recorded? It's documented within the equity section of the balance sheet, showing the breakdown between par value and the excess paid by investors.

The Risk of "Discounted Stock"

Issuing shares below par value, known as issuing "discounted stock," can expose shareholders to liability.

Shareholders might be required to pay the difference between the par value and the price they paid if the company becomes insolvent.

This is less common today because of the practice of setting low par values.

Modern Relevance and No-Par Stock

Many states now allow companies to issue no-par stock, which eliminates the concept of par value altogether.

This simplifies the accounting process and avoids potential legal complications associated with issuing stock at a discount.

What are the alternatives? Choosing between par value stock and no-par value stock is a crucial decision made during the company's formation.

Debunking Common Misconceptions

One major misconception is that par value reflects a company's intrinsic worth or the stock's potential for growth.

This is simply not true; market factors, financial performance, and industry trends are far more influential.

Another misconception is that a higher par value indicates a stronger company. This is usually not the case in modern practice.

The Bottom Line

Par value per share is primarily a legal and accounting construct with limited practical significance in determining a stock's market value or a company's overall financial health.

Focus on fundamental analysis, market conditions, and industry trends for a more accurate assessment of investment potential.

Ignoring this can lead to flawed investment decisions.

Next Steps

Investors should consult financial professionals for personalized advice and to avoid relying solely on outdated or misleading metrics.

Companies should regularly review their capital structure and ensure compliance with relevant corporate laws.

Stay tuned for further analysis on related financial topics.