The Political Business Cycle Refers To The Possibility That

In the lead-up to elections, promises of tax cuts, increased spending on social programs, and infrastructure projects often fill the air. Are these genuine attempts to improve the economy, or are they calculated moves to sway voters? The question hangs heavy in the air, highlighting the contentious concept of the Political Business Cycle.

The Political Business Cycle (PBC) suggests that incumbent politicians manipulate the economy to improve their re-election chances. This article delves into the intricacies of this theory, examining its theoretical underpinnings, empirical evidence, criticisms, and potential implications for economic stability and voter welfare.

Understanding the Political Business Cycle

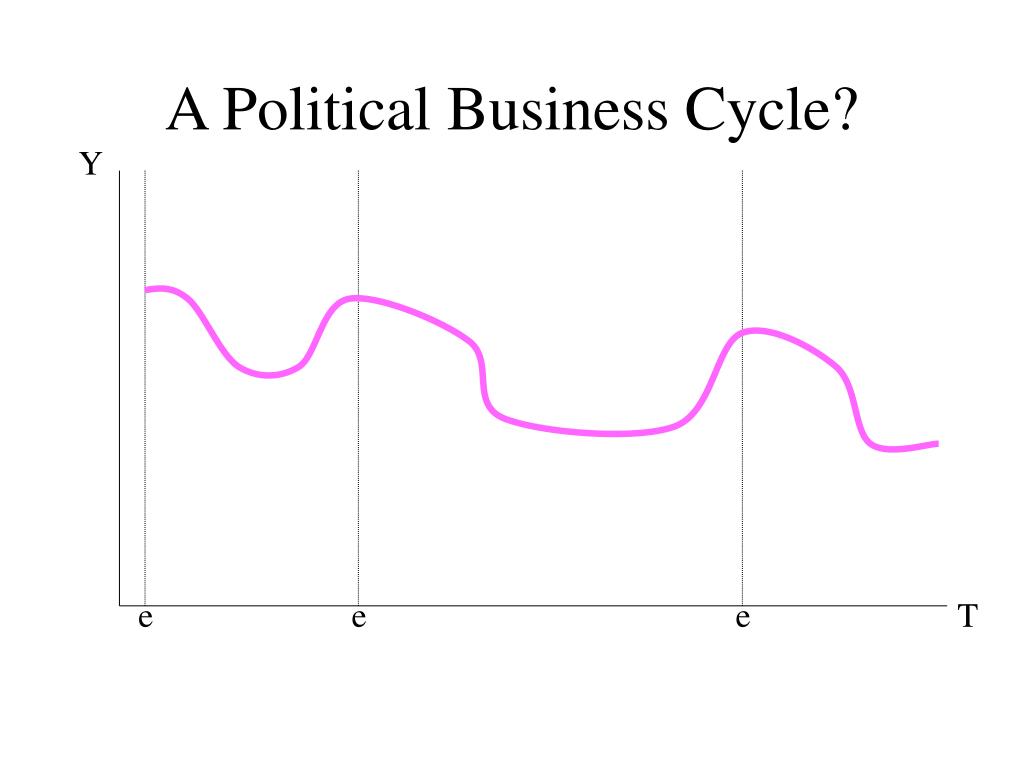

At its core, the PBC theory posits that policymakers prioritize short-term electoral gains over long-term economic health. They may implement expansionary policies – like increasing government spending or lowering interest rates – to stimulate economic growth and reduce unemployment before an election. This boosts their popularity and makes them more likely to be re-elected.

The theory's foundations lie in the assumption of rational voters with imperfect information. Voters are rational in that they respond to improvements in the economy, but they may lack the time or resources to fully understand the long-term consequences of policy decisions.

The Nordhaus Model

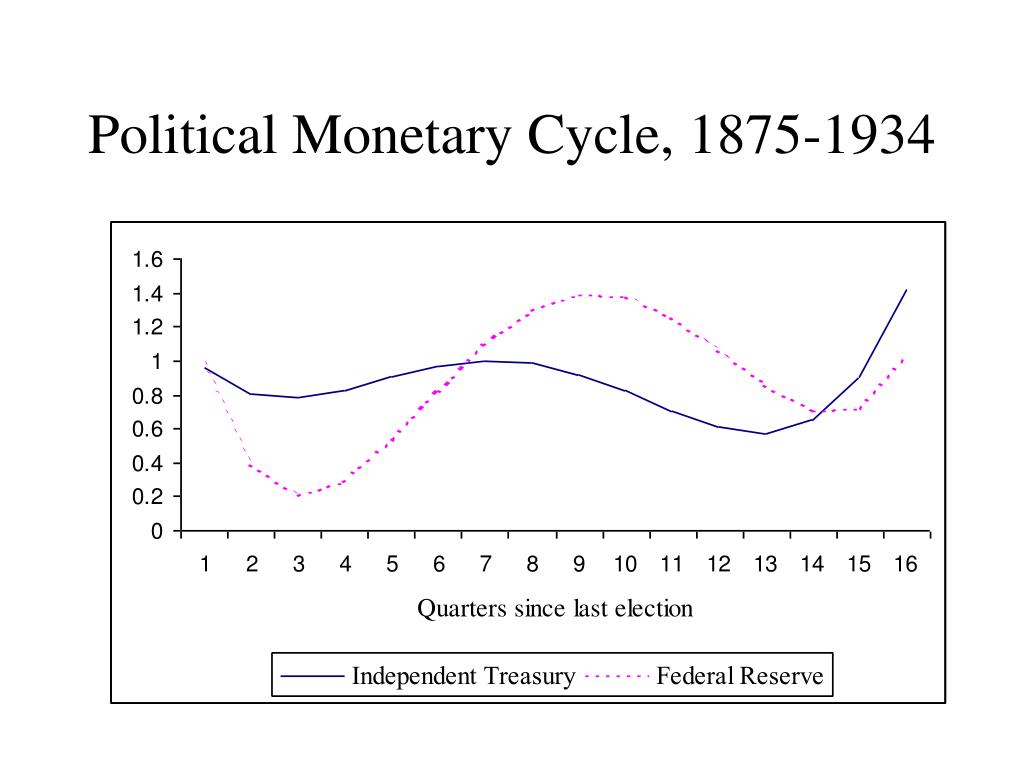

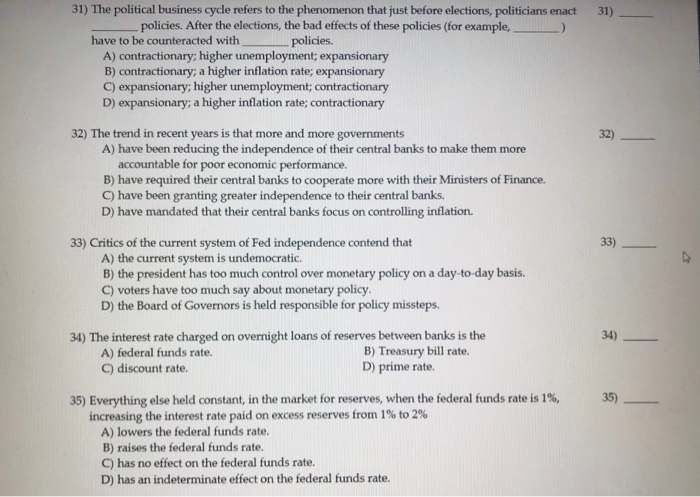

One of the earliest and most influential models of the Political Business Cycle was developed by economist William Nordhaus. This model suggested that incumbent politicians might strategically manipulate macroeconomic policy tools, such as inflation and unemployment, to maximize their chances of winning elections. Nordhaus's model posited a trade-off between inflation and unemployment, allowing politicians to temporarily reduce unemployment at the cost of higher inflation before an election.

After winning, politicians may then implement contractionary policies to curb inflation, even if it means slower economic growth. This cycle repeats itself, with the economy fluctuating in response to the electoral calendar rather than underlying economic fundamentals.

Empirical Evidence and Debate

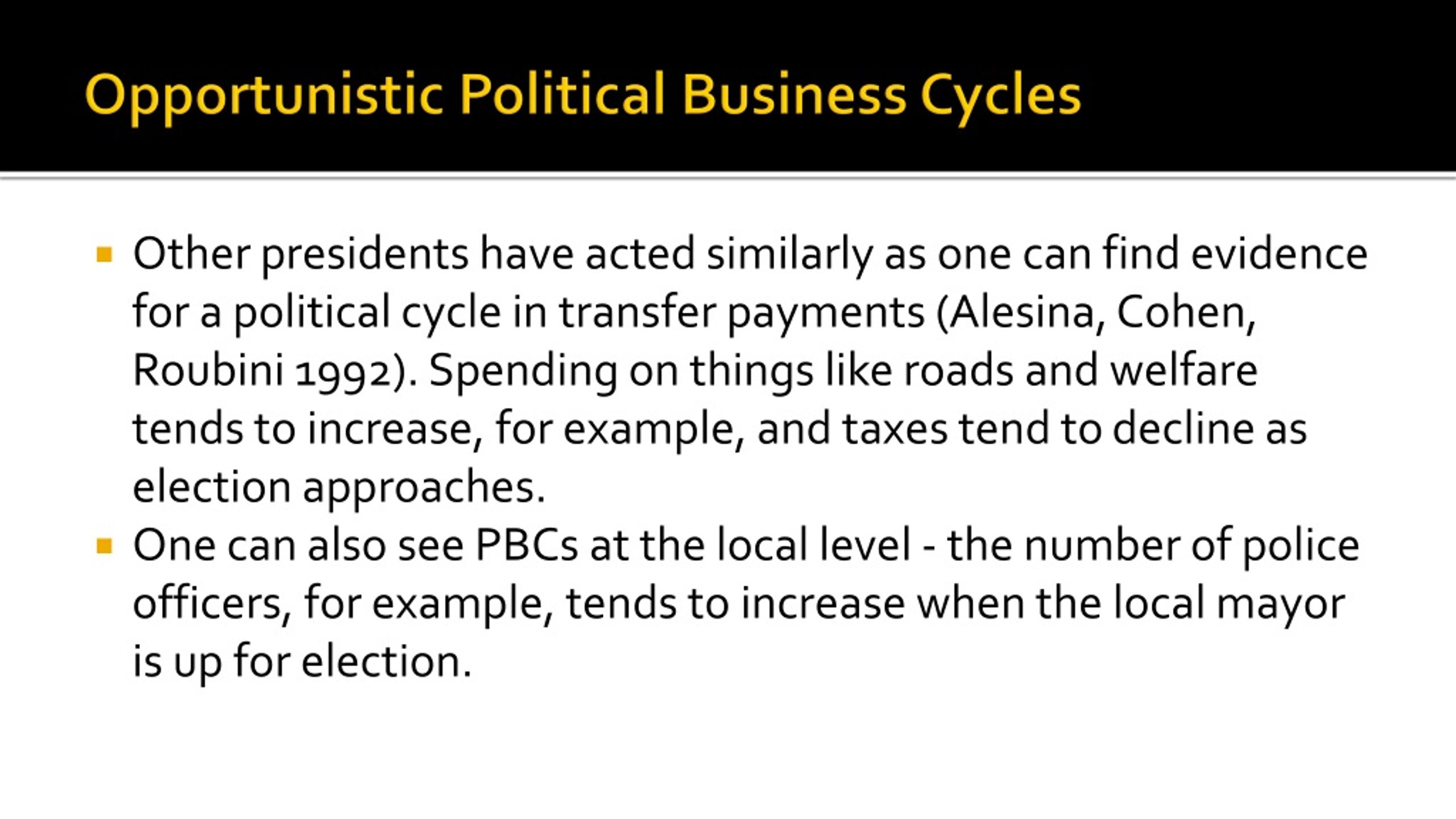

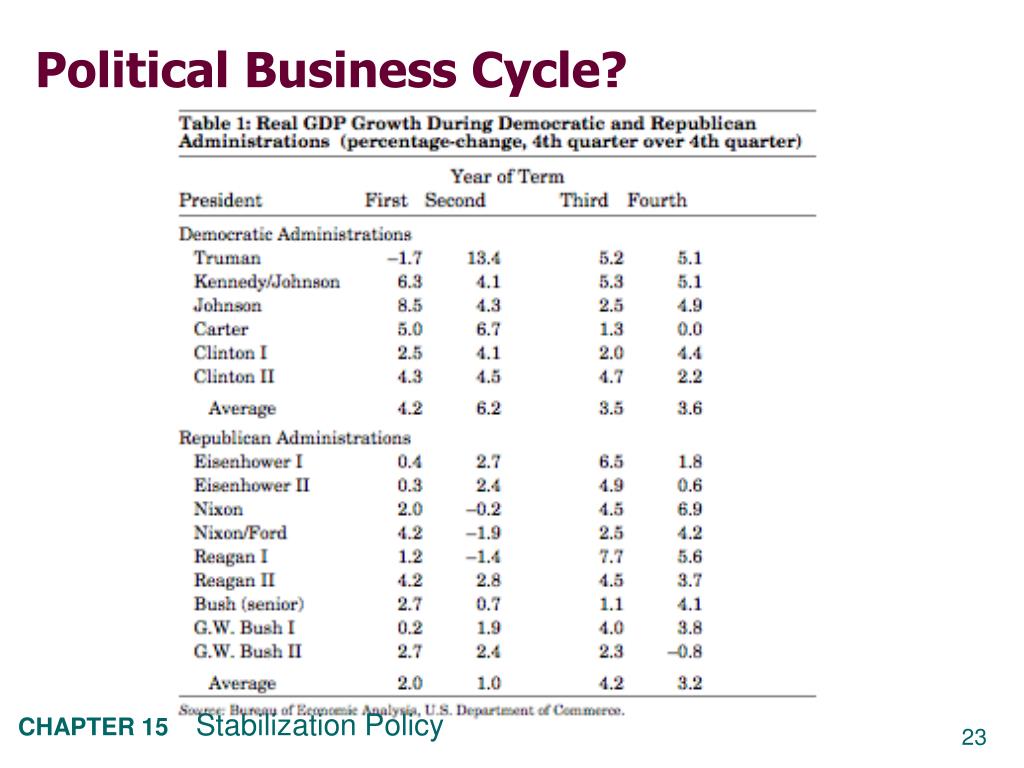

The existence and strength of the Political Business Cycle have been a subject of ongoing debate among economists. Some studies have found evidence consistent with the theory, identifying patterns of increased government spending or looser monetary policy in the period leading up to elections.

For example, research examining fiscal policy in OECD countries has found that government spending tends to increase in election years. A 2019 study published in the Journal of Public Economics suggested that certain types of government spending, particularly those easily attributed to incumbent politicians, are more likely to be manipulated for electoral purposes. However, other studies have yielded mixed or contradictory results.

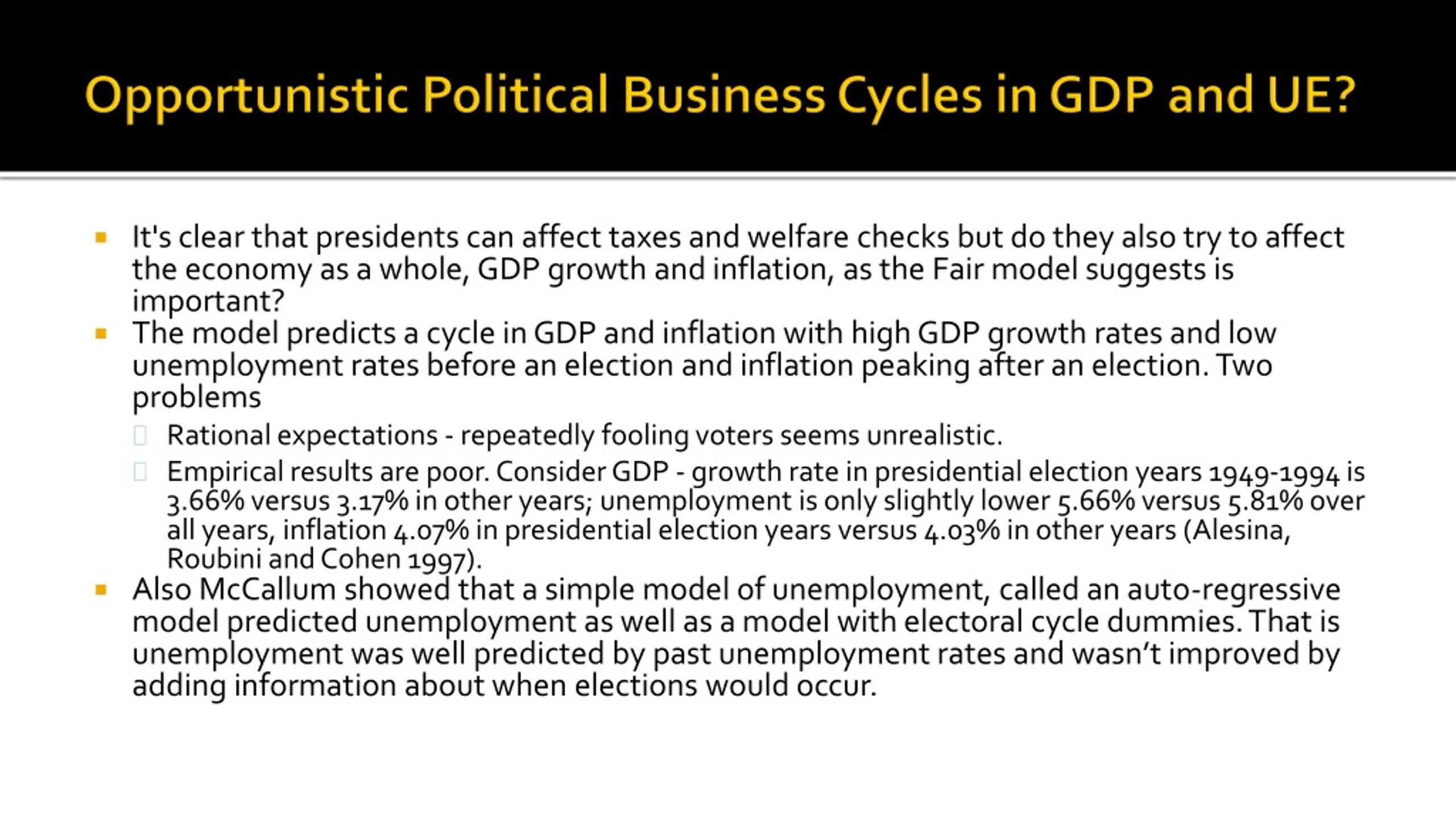

Critics argue that the PBC theory relies on unrealistic assumptions and that it is difficult to isolate the effects of political motivations from other factors influencing economic policy. According to a report by the International Monetary Fund (IMF), economic policies are often influenced by a complex interplay of factors, including global economic conditions, structural reforms, and long-term policy objectives.

Furthermore, voters may be more sophisticated than the theory assumes. Increased access to information through media and the internet might make voters more aware of the potential long-term costs of short-term policy manipulations. This increased awareness could diminish the effectiveness of the PBC.

Rational Expectations and Alternative Explanations

The rational expectations critique poses a significant challenge to the Political Business Cycle theory. If voters and economic actors have rational expectations, they can anticipate the policy manipulations of incumbent politicians and adjust their behavior accordingly. This could neutralize the intended effects of the PBC, making it more difficult for politicians to influence the economy for electoral purposes.

Alternative explanations for observed economic fluctuations include real business cycle theory, which emphasizes the role of technological shocks and other real factors in driving economic cycles. Supply chain disruptions and unexpected shifts in global demand patterns can also cause significant economic fluctuations. Therefore, observing increased spending before an election doesn't automatically imply manipulation; it could be a response to a genuine economic downturn.

Consequences and Implications

If the Political Business Cycle is indeed a real phenomenon, it can have several negative consequences for the economy and society. One potential consequence is increased macroeconomic instability. Manipulating policies for short-term electoral gains may lead to boom-and-bust cycles, creating uncertainty and harming long-term economic growth.

Another concern is that the PBC can lead to inefficient allocation of resources. Politicians may prioritize projects that yield immediate benefits, even if they are not the most economically sound investments. This can result in misallocation of public funds and hinder long-term development.

Moreover, the Political Business Cycle can erode public trust in government and democratic institutions. If voters perceive that politicians are manipulating the economy for their own benefit, it can lead to cynicism and disengagement from the political process.

"The manipulation of economic policy for short-term political gains can undermine long-term economic stability and public trust," stated Dr. Anya Sharma, an economist at the World Bank, in a recent interview.

Looking Ahead

The debate surrounding the Political Business Cycle remains relevant today. As elections approach, policymakers face the temptation to implement policies that boost their short-term popularity. However, a growing awareness of the potential consequences of the PBC may encourage more responsible and sustainable economic policies. Independent central banks, fiscal rules, and increased transparency can help to mitigate the risks associated with the Political Business Cycle.

Ultimately, the best defense against the Political Business Cycle is an informed and engaged electorate. Voters who are aware of the potential for political manipulation are better equipped to hold politicians accountable and demand policies that prioritize long-term economic well-being.