Accounting Profit Is Equal To Total Revenue Minus

In the high-stakes world of business, where fortunes are made and lost on the accuracy of financial reporting, a seemingly simple formula holds the key to understanding a company’s basic profitability: Accounting Profit. Misunderstanding or miscalculating this figure can lead to disastrous decisions, affecting everything from investment strategies to operational efficiency.

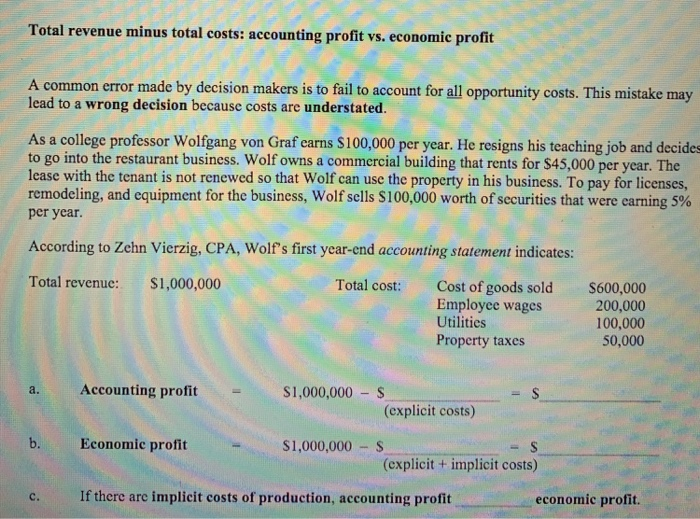

At its core, accounting profit, also known as net profit or book profit, represents the realized revenues less the explicit costs incurred in generating those revenues. This fundamental concept is the cornerstone of financial analysis, but its apparent simplicity belies its significance. It's crucial for businesses to truly understand the components and implications of accounting profit to make sound financial decisions and convey them effectively to stakeholders.

Understanding the Basics

Accounting profit, in its most straightforward form, is calculated as Total Revenue - Explicit Costs. Total Revenue represents all the money a business brings in from its sales of goods or services. Explicit costs, on the other hand, are the direct, out-of-pocket expenses a company incurs.

These explicit costs include wages, salaries, rent, raw materials, utilities, and any other readily identifiable expenses paid for by the business. They are the tangible, easily quantifiable costs that are recorded in a company’s accounting system.

The Importance of Explicit Costs

Properly identifying and tracking explicit costs is paramount. An accurate accounting profit calculation hinges on including all relevant expenses. Overlooking even seemingly small costs can distort the picture and lead to misleading conclusions about profitability.

For example, consider a small bakery. Its total revenue might be $100,000. Its explicit costs include the cost of flour, sugar, labor, rent, and utilities, totaling $60,000.

The bakery's accounting profit would be $100,000 - $60,000 = $40,000.

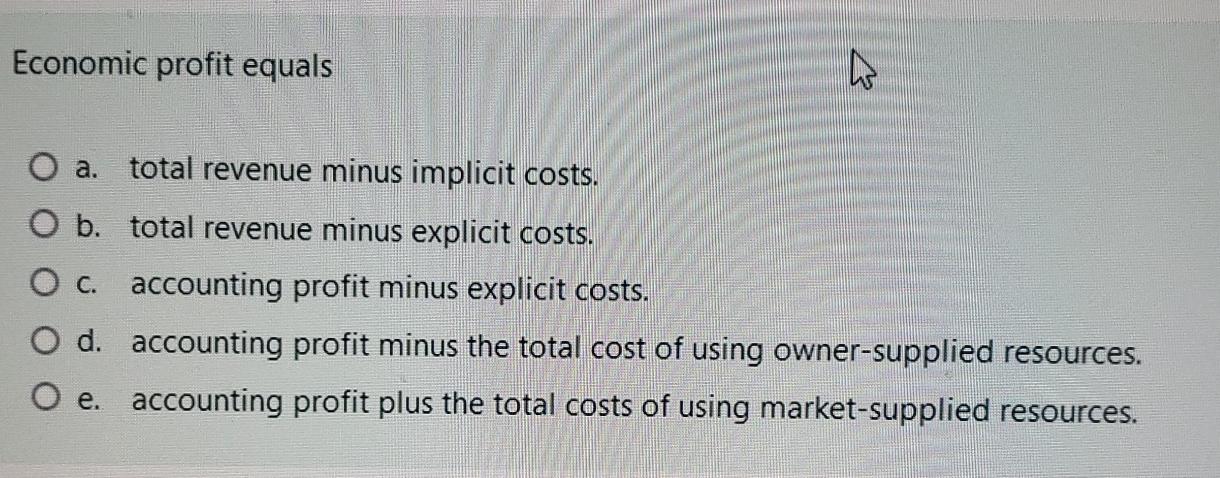

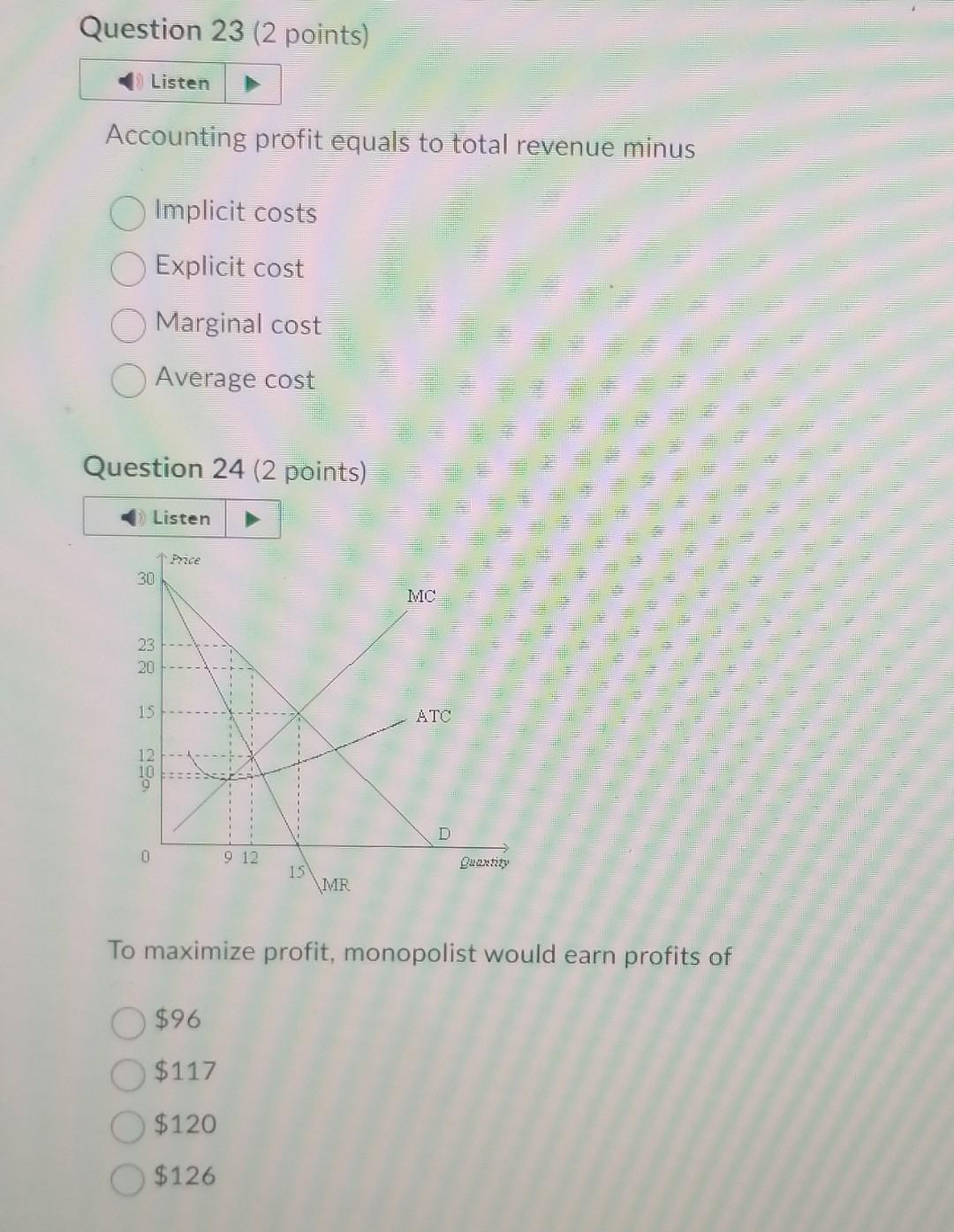

Accounting Profit vs. Economic Profit

While accounting profit provides a valuable snapshot of a company's performance, it's crucial to distinguish it from economic profit. Economic profit takes into account both explicit and implicit costs.

Implicit costs, also known as opportunity costs, represent the potential earnings forgone by choosing one course of action over another. The owner might be sacrificing a higher-paying salary at another firm to run their own business, for instance.

Economic profit is always lower than accounting profit because it accounts for these foregone earnings. Some consider it a more accurate indicator of true profitability, as it provides a more comprehensive view of a business's performance.

Stakeholder Perspectives

Accounting profit is a key figure used by different stakeholders to assess a company's financial health. Investors use it to gauge the profitability and potential return on their investment.

Creditors, such as banks, analyze accounting profit to determine a company's ability to repay loans. Management uses accounting profit to track performance, make strategic decisions, and reward employees.

Even government agencies rely on accounting profit for tax purposes and to monitor regulatory compliance.

Potential Pitfalls and Limitations

Despite its importance, accounting profit has limitations. It can be manipulated through accounting practices, such as delaying expense recognition or accelerating revenue recognition.

Additionally, accounting profit doesn't account for the time value of money or inflation. This can distort comparisons of profitability across different time periods.

Furthermore, reliance solely on accounting profit can lead to short-sighted decisions. This is because it fails to incorporate qualitative factors, such as brand reputation or customer satisfaction.

"Accounting profit is a useful metric, but it should be interpreted with caution and supplemented with other financial metrics and qualitative data," advised Dr. Anya Sharma, Professor of Finance at the University of Metropolitan Business School.

The Future of Accounting Profit

As businesses become more complex and globalized, the role of accounting profit is evolving. There is a growing demand for greater transparency and standardization in financial reporting.

The rise of environmental, social, and governance (ESG) factors is also impacting how profit is assessed. Companies are increasingly being judged not only on their financial performance but also on their social and environmental impact.

This trend is likely to lead to the development of new accounting metrics that better reflect the full spectrum of a business's performance.

In conclusion, while the basic formula for calculating accounting profit – Total Revenue minus Explicit Costs – remains a cornerstone of financial analysis, its interpretation and application are becoming more nuanced. A deep understanding of the metric's strengths, limitations, and the various perspectives of stakeholders is crucial for navigating the complexities of the modern business world. As businesses continue to evolve, so too will the way we measure and interpret profitability, paving the way for a more comprehensive and sustainable approach to value creation.