The President Of A Company Is Starting An Annuity

In a move that has sparked conversation within the financial sector, Alex Thompson, the President of GlobalTech Solutions, has announced his decision to begin contributing to a fixed annuity. The announcement, made earlier this week, highlights a personal financial strategy that contrasts with the high-risk, high-reward investments often associated with corporate leadership. The move prompts questions about retirement planning trends and the role of guaranteed income streams in a volatile economic landscape.

Thompson's decision to invest in an annuity serves as an interesting case study in financial risk management, raising awareness about retirement income strategies and the importance of diversification. It underscores the growing appeal of guaranteed income solutions amidst economic uncertainties. This strategic decision might influence public perception and inspire further discussions on financial planning.

The Details of Thompson's Annuity

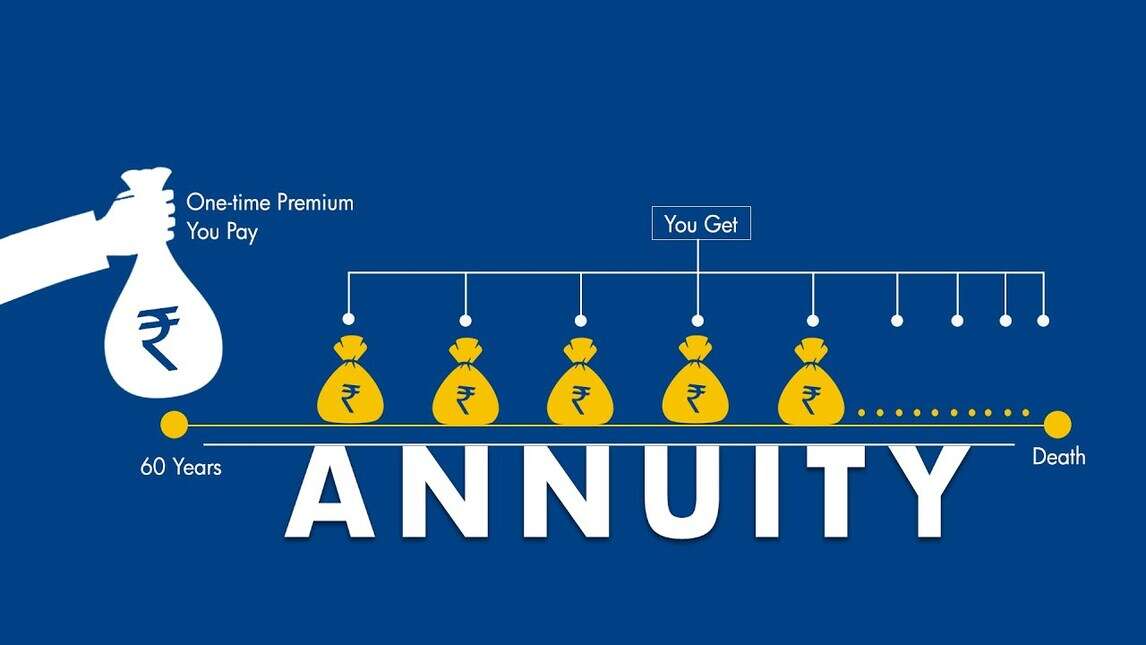

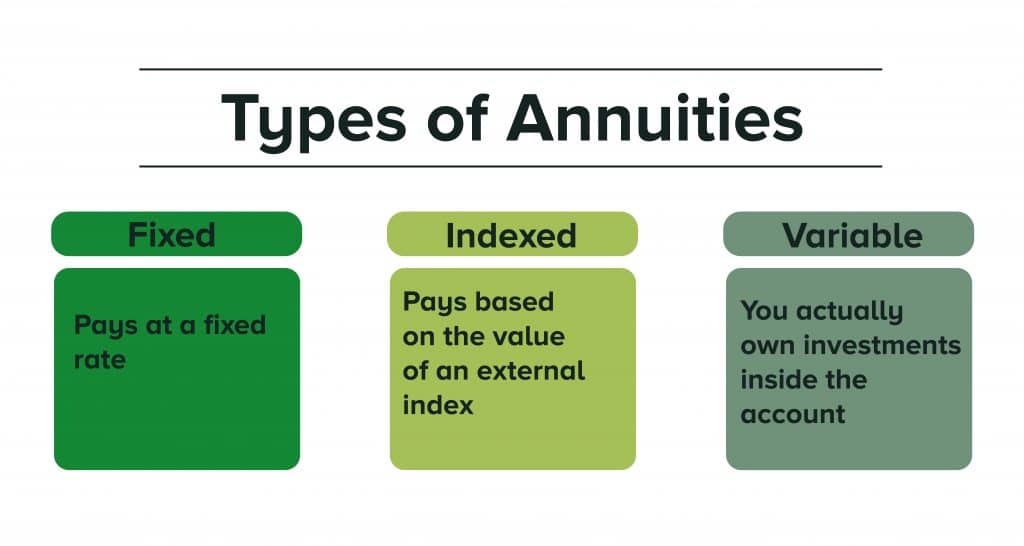

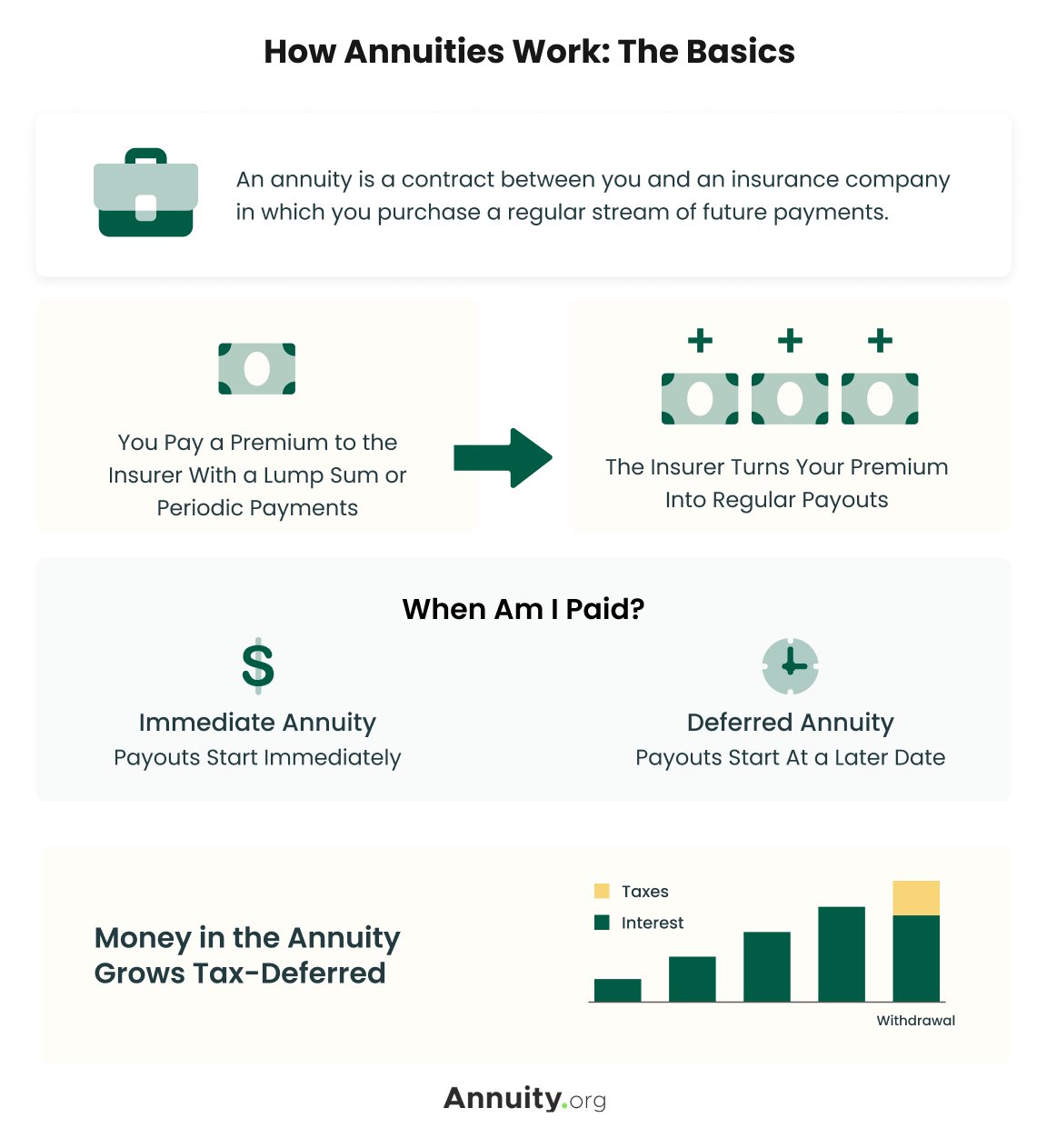

According to an official statement released by GlobalTech Solutions, Thompson's annuity is a fixed annuity. It is structured to provide a guaranteed rate of return over a specified period.

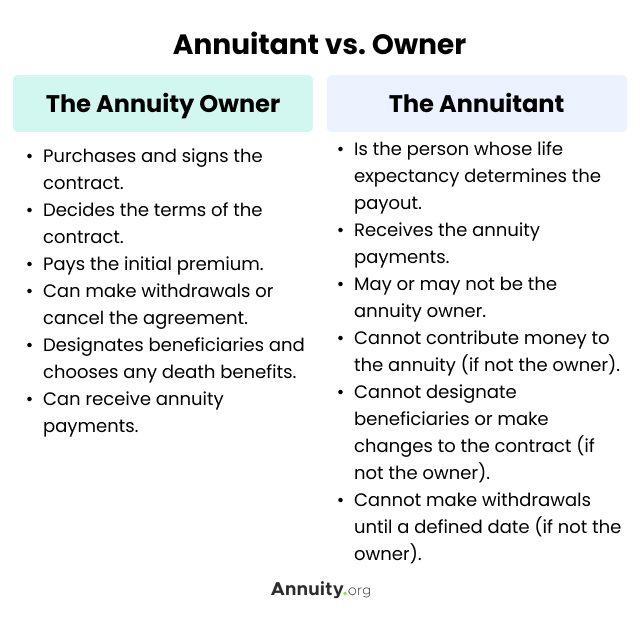

While the exact amount of Thompson's initial investment and the duration of the annuity contract remain undisclosed, sources close to the company suggest it is a substantial investment representing a notable portion of his retirement savings.

This decision was reportedly made after consulting with financial advisors and considering his long-term financial goals.

Why an Annuity?

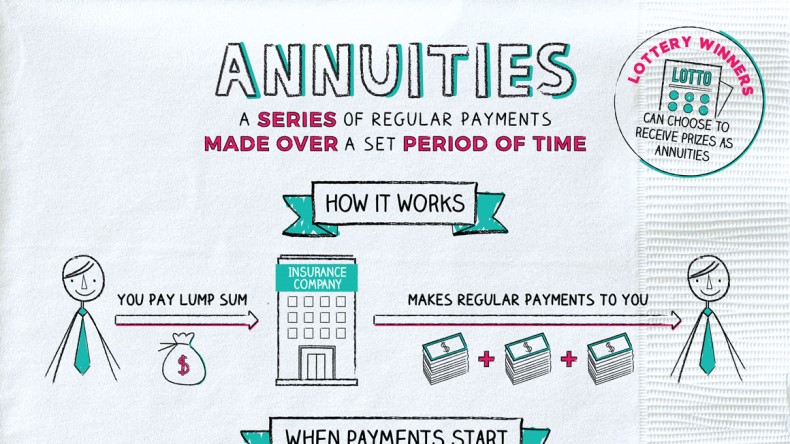

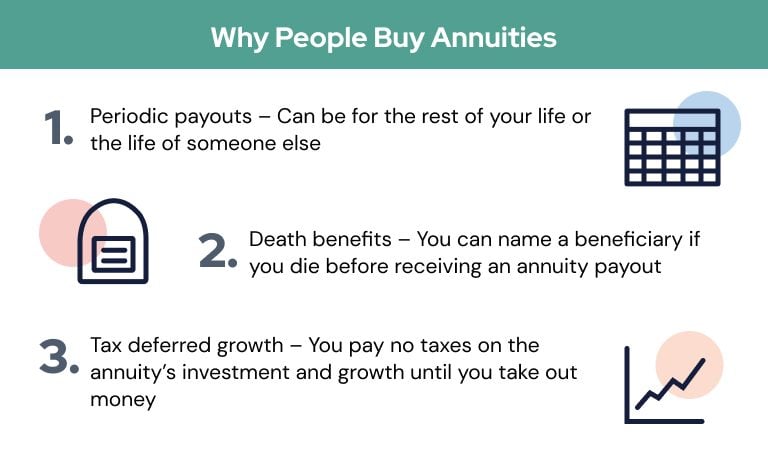

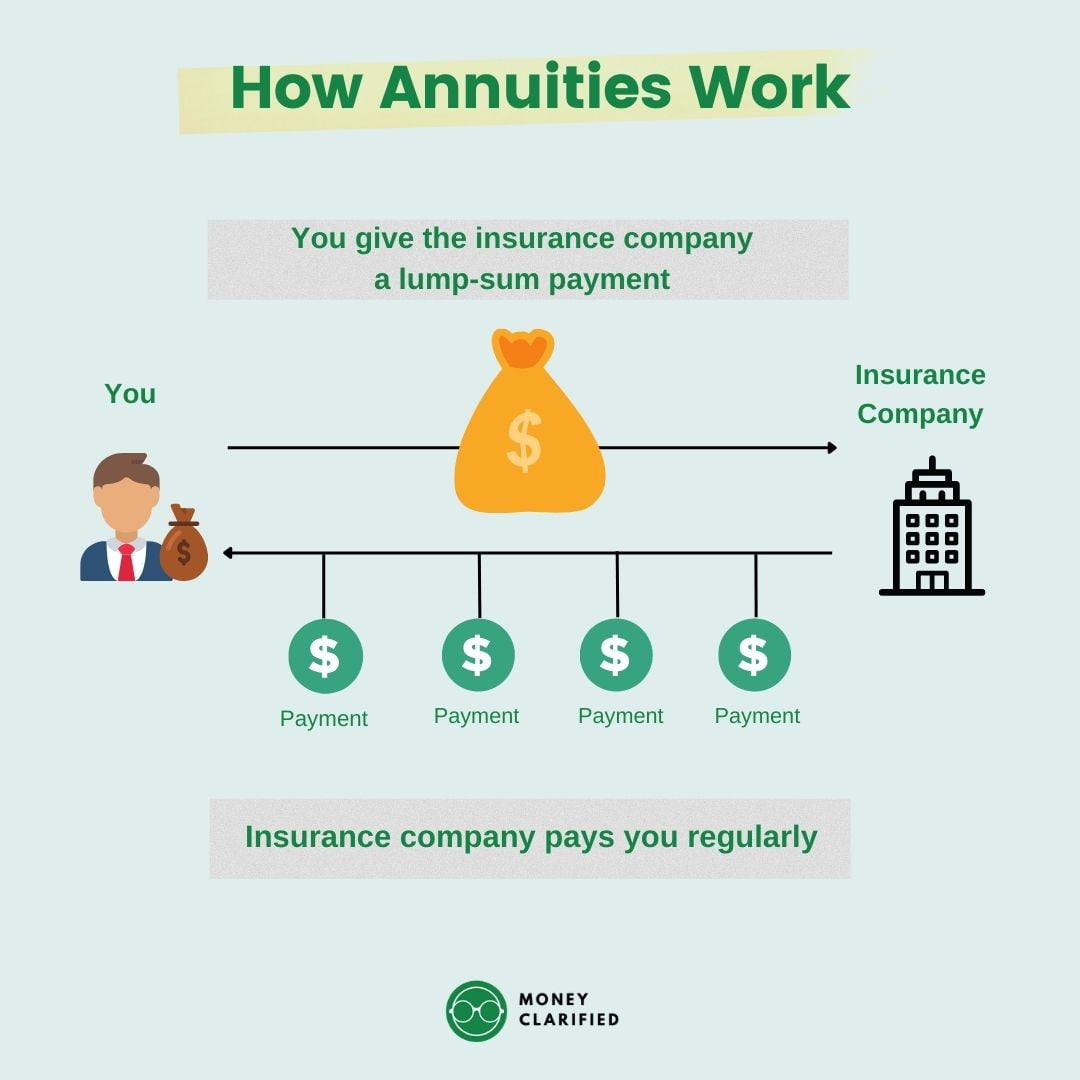

Thompson's decision to begin an annuity may be attributed to several factors. These factors include a desire for a secure and predictable income stream in retirement, and concerns about market volatility. The appeal of an annuity lies in its ability to provide a guaranteed payout.

According to data from the Insured Retirement Institute (IRI), annuity sales have been on the rise in recent years, reflecting a broader trend among individuals seeking financial security in retirement. The IRI reports a significant increase in fixed annuity sales, indicating a growing preference for principal protection and guaranteed returns.

Thompson emphasized the importance of planning for retirement in a recent interview, saying, "I believe in taking a balanced approach to financial planning. While I have other investments, the security of a guaranteed income stream from an annuity provides peace of mind."

Potential Impact and Industry Reaction

The news of Thompson's annuity has generated considerable buzz within the financial industry. Experts suggest it could lead to increased interest in annuities among high-net-worth individuals and corporate executives.

"This is a significant endorsement for annuities," said Jane Doe, a certified financial planner at Doe & Associates. "When a prominent business leader chooses an annuity, it sends a message that these products are a viable and valuable part of a comprehensive retirement plan."

However, some industry observers remain cautious, noting that annuities are not suitable for everyone. They emphasize the importance of carefully considering individual financial circumstances and risk tolerance before investing in an annuity.

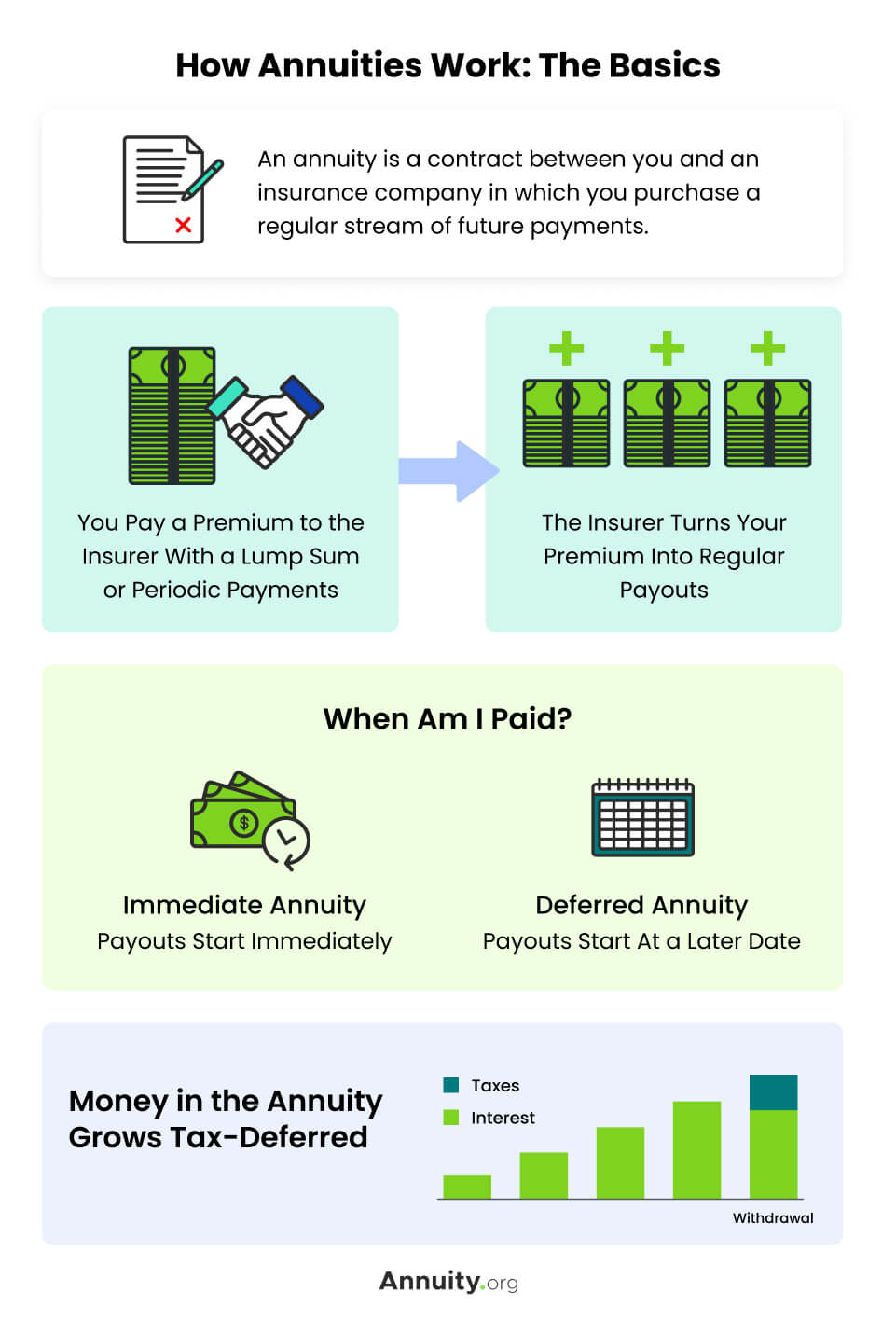

Annuities: Benefits and Considerations

Annuities offer several potential benefits. These benefits include tax-deferred growth, protection from market downturns (in the case of fixed annuities), and a guaranteed income stream for life.

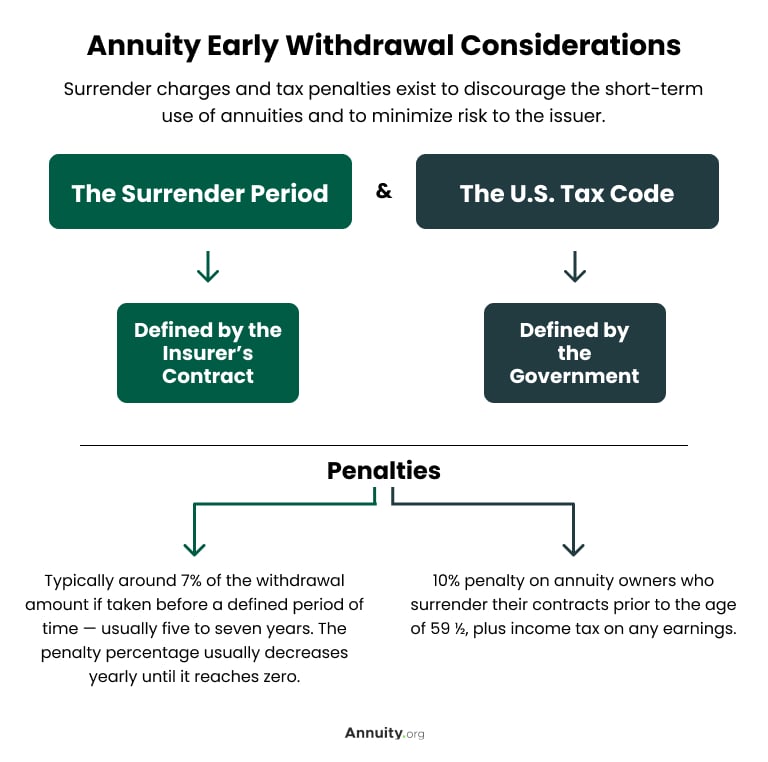

However, annuities also come with potential drawbacks. Drawbacks may include fees, surrender charges, and potential limitations on access to funds.

It's essential for individuals to thoroughly research and understand the terms and conditions of an annuity contract before making a decision. Consult with a qualified financial advisor.

Broader Implications for Retirement Planning

Thompson's move highlights a growing awareness of the need for robust retirement planning strategies. It signals a shift toward prioritizing guaranteed income alongside traditional investment approaches.

As the population ages and concerns about Social Security's long-term solvency persist, annuities may play an increasingly important role in retirement security. This is especially relevant for individuals seeking predictable income.

The impact of Thompson's personal financial decision extends beyond individual circumstances. This underscores the need for comprehensive retirement planning and financial literacy.

Ultimately, Alex Thompson's decision to start an annuity underscores the growing importance of guaranteed income in a rapidly changing financial landscape. The strategic move serves as a thought-provoking example of the diverse and personalized pathways individuals are now charting for their retirement security, prompting ongoing dialogue about the role and relevance of annuities in modern financial planning.

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

![The President Of A Company Is Starting An Annuity How Fixed Index Annuities Work [INFOGRAPHIC] Explained](https://i.pinimg.com/736x/ed/de/08/edde0809c33fe4313d4ba5529e46fbb6.jpg)