The Primary Goal Of Financial Management Is To Maximize

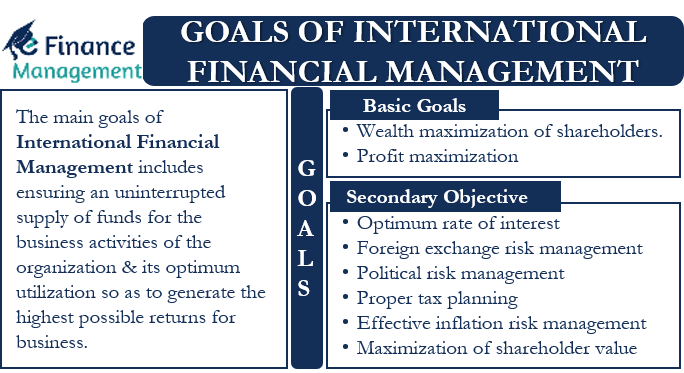

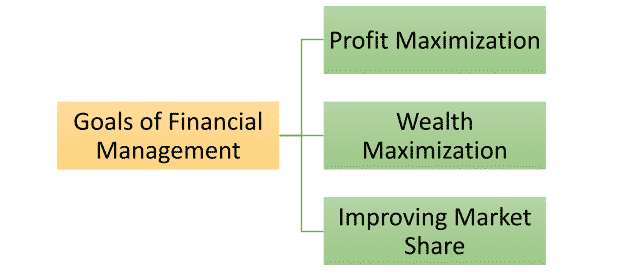

Financial management's core directive remains unwavering: maximize shareholder wealth. This principle, though foundational, is under renewed scrutiny amid evolving economic and social priorities.

This article dissects the practical implications of this maximization objective. We address its impact on corporate decisions, regulatory oversight, and the broader economy.

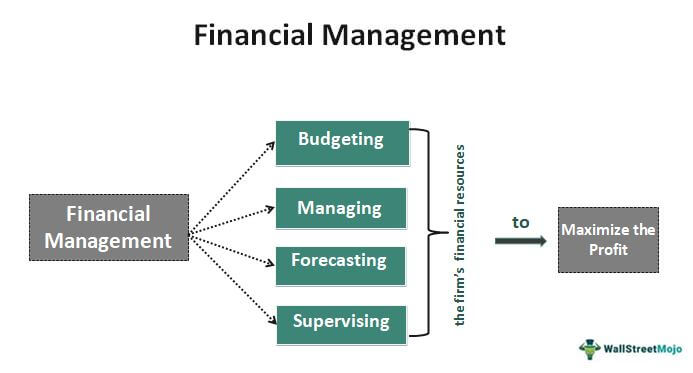

The Maximization Mandate: A Deep Dive

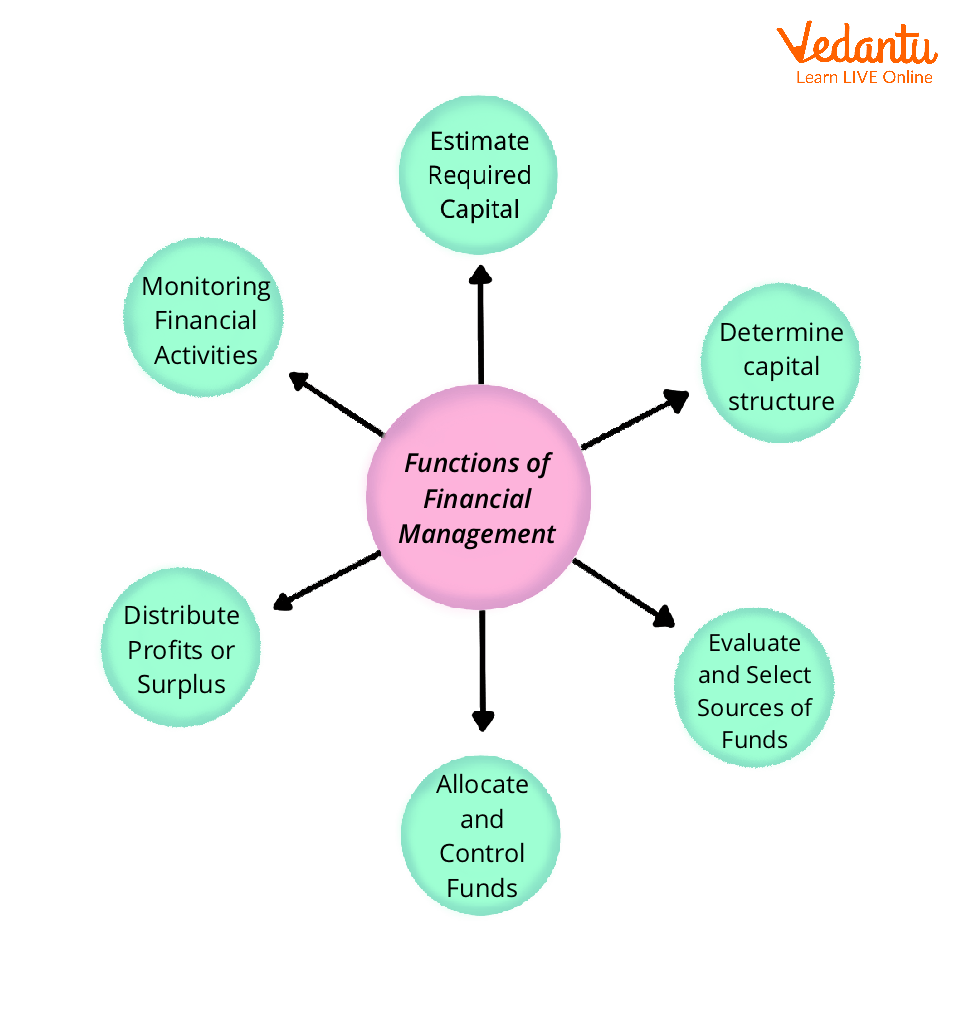

At its heart, maximizing shareholder wealth means increasing the value of the company's stock. This is achieved through strategic investments, efficient operations, and prudent risk management.

Essentially, every financial decision, from capital budgeting to dividend payouts, should contribute to this ultimate goal. Companies like Apple and Microsoft are often cited as examples of firms that successfully pursue this strategy.

Profitability and Growth: The Twin Pillars

Achieving this maximization requires a dual focus on profitability and growth. Higher profits translate directly into higher earnings per share, boosting stock prices.

Simultaneously, expanding into new markets and developing innovative products can increase the company's future earning potential. Data suggests that companies focusing on both see sustained long-term growth (Source: Harvard Business Review).

Efficiency and Risk Management

Efficient use of resources is key. Minimizing costs and maximizing output directly contributes to enhanced profitability.

Prudent risk management is equally critical. Avoiding excessive debt and diversifying investments protects shareholder value from potential losses.

The Critics' Corner: Beyond Shareholder Value

Critics argue that a singular focus on shareholder wealth can lead to unethical behavior and short-term thinking. This is according to a 2022 report by the World Economic Forum.

Concerns include neglecting environmental sustainability, exploiting workers, and prioritizing short-term gains over long-term stability. Many now advocate for a stakeholder approach that considers the interests of employees, customers, and the community.

Regulation and Oversight: Balancing Act

Regulatory bodies like the Securities and Exchange Commission (SEC) play a crucial role in ensuring fair and transparent financial practices. These are practices that protect investors and prevent corporate malfeasance.

However, some argue that regulations can stifle innovation and hinder economic growth. Finding the right balance between regulation and free markets remains a constant challenge.

The Impact on the Economy

The pursuit of shareholder wealth maximization has profound implications for the overall economy. It can drive investment, innovation, and job creation.

However, it can also exacerbate income inequality and contribute to financial instability. The 2008 financial crisis served as a stark reminder of the risks associated with unchecked financial incentives.

Case Studies: Successes and Failures

Enron's collapse provides a cautionary tale of how a relentless pursuit of shareholder value can lead to disastrous consequences. The company engaged in fraudulent accounting practices to inflate its stock price.

In contrast, companies like Patagonia demonstrate that a commitment to social responsibility can coexist with financial success. Patagonia’s purpose led business drives profit, which further supports their purpose.

"A company's long-term sustainability depends on its ability to create value for all stakeholders, not just shareholders." - Paul Polman, former CEO of Unilever

The Future of Financial Management

The debate over the primary goal of financial management is ongoing. There is a growing movement toward a more inclusive and sustainable approach.

This shift is driven by increasing awareness of social and environmental issues. It is further driven by evolving investor preferences that prioritize long-term value creation.

Ultimately, the future of financial management will likely involve a more nuanced approach. This is one that balances the interests of shareholders with the needs of a broader range of stakeholders.

Next Steps and Ongoing Developments

Regulatory bodies are actively exploring ways to promote corporate social responsibility. Investors are increasingly demanding greater transparency and accountability from companies.

The shift toward ESG (Environmental, Social, and Governance) investing signals a growing recognition of the importance of non-financial factors in investment decisions. Monitoring these trends and adapting to these changes will be crucial for companies seeking long-term success. The SEC is expected to release updated guidance on ESG disclosures in the coming months.