Which Of The Following Financial Measures Are Used To Determine

Imagine sitting at your kitchen table, bills spread out before you, a mix of confusion and anxiety swirling in your mind. You're trying to understand the health of your personal finances, but where do you even begin? It's a common feeling, shared by individuals and businesses alike, as they navigate the sometimes-opaque world of financial evaluation.

This article will demystify the key financial measures used to determine the financial health of individuals and organizations. We'll explore essential tools like net worth, cash flow, profit margins, and debt-to-equity ratios, providing insights into how they work and why they matter. Understanding these metrics empowers you to make informed decisions, whether you're managing your household budget or strategizing for a multi-million dollar corporation.

Understanding Individual Financial Health

Assessing personal finances involves more than just looking at your bank balance. It requires a holistic view of your assets, liabilities, income, and expenses. Several key measures help paint a complete picture of your financial well-being.

Net Worth: Your Financial Foundation

Net worth is often considered the cornerstone of personal financial health. It's calculated by subtracting your total liabilities (debts) from your total assets (what you own). A positive net worth indicates you own more than you owe, while a negative net worth suggests the opposite.

Assets can include things like your home, investments, savings accounts, and personal property. Liabilities encompass mortgages, student loans, credit card debt, and other outstanding obligations. Tracking your net worth over time provides a valuable indicator of your overall financial progress.

Cash Flow: The Lifeblood of Your Finances

Cash flow refers to the movement of money into and out of your accounts. Positive cash flow means you're bringing in more money than you're spending. Negative cash flow means you're spending more than you earn.

Analyzing your cash flow involves tracking your income, expenses, and identifying areas where you can optimize your spending. Creating a budget and monitoring your spending habits are crucial steps in managing your cash flow effectively. Maintaining a healthy cash flow is essential for meeting your financial obligations and achieving your financial goals.

Debt-to-Income Ratio (DTI): Managing Your Debt Burden

The debt-to-income ratio (DTI) measures the percentage of your gross monthly income that goes towards debt payments. Lenders use DTI to assess your ability to repay loans. A lower DTI generally indicates a healthier financial situation.

To calculate your DTI, divide your total monthly debt payments (including rent/mortgage, credit cards, and loans) by your gross monthly income. Aiming for a DTI below 43% is generally considered favorable by lenders. Managing your debt and increasing your income can help improve your DTI.

Evaluating Organizational Financial Performance

For businesses, financial measures provide critical insights into profitability, efficiency, and solvency. These metrics help stakeholders assess the company's performance and make informed investment decisions.

Revenue and Cost of Goods Sold (COGS): Measuring Core Performance

Revenue represents the total income generated from sales of goods or services. Cost of Goods Sold (COGS) includes the direct costs associated with producing those goods or services. Understanding these figures provides a fundamental view of the company's operating efficiency.

Subtracting COGS from revenue yields gross profit, which represents the profit earned before considering operating expenses. Analyzing trends in revenue and COGS can highlight areas for improvement in production processes and pricing strategies. Increased revenue combined with controlled COGS is a positive sign of business health.

Profit Margins: Gauging Profitability

Profit margins measure the percentage of revenue that remains after deducting various costs. Gross profit margin, operating profit margin, and net profit margin are key indicators. These are calculated by dividing profit by revenue.

Higher profit margins indicate greater profitability and efficiency in managing costs. Monitoring these margins over time can reveal potential problems, such as rising expenses or declining sales. Comparing these margins to industry benchmarks provides valuable context for evaluating the company's performance.

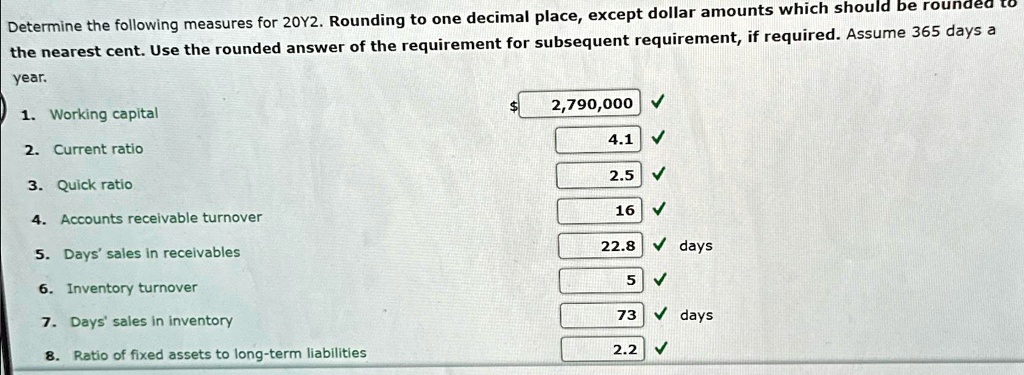

Liquidity Ratios: Assessing Short-Term Obligations

Liquidity ratios measure a company's ability to meet its short-term obligations. The current ratio and quick ratio are two commonly used liquidity ratios. These provide insights into whether a company has enough liquid assets.

The current ratio divides current assets by current liabilities, while the quick ratio (also known as the acid-test ratio) excludes inventory from current assets. A higher ratio generally indicates greater liquidity. A current ratio of 1.5 to 2 and a quick ratio of 1 or more are often considered healthy, but this can vary by industry.

Solvency Ratios: Evaluating Long-Term Obligations

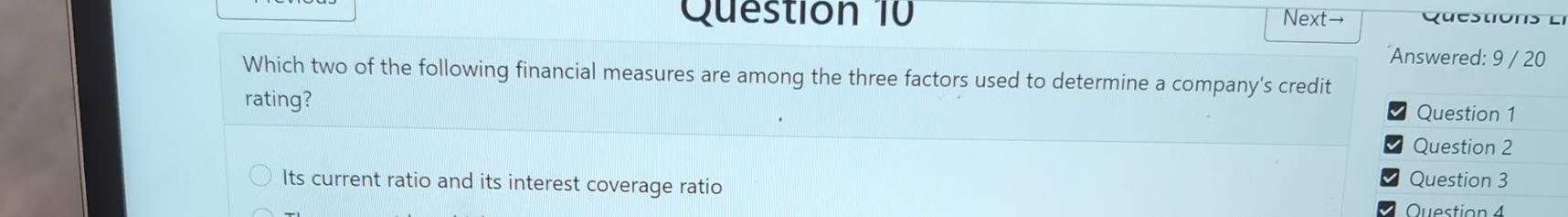

Solvency ratios assess a company's ability to meet its long-term obligations. The debt-to-equity ratio and times interest earned ratio are essential solvency indicators. These indicate the relationship between debt and equity.

The debt-to-equity ratio compares a company's total debt to its total equity. A lower ratio indicates less reliance on debt financing. The times interest earned ratio measures a company's ability to cover its interest expenses with its earnings before interest and taxes (EBIT). A higher ratio indicates a stronger ability to service its debt.

Return on Equity (ROE): Measuring Investor Returns

Return on Equity (ROE) measures how effectively a company is using shareholders' equity to generate profits. It is calculated by dividing net income by shareholders’ equity. A higher ROE suggests that the company is generating more profit for each dollar of equity invested.

ROE is a key metric for investors as it indicates how well their investment is being utilized. Benchmarking ROE against industry averages can provide valuable context for evaluating the company's performance. Consistently improving ROE is a positive sign for potential investors.

The Interconnectedness of Financial Measures

It's important to remember that no single financial measure tells the whole story. Rather, these metrics are interconnected and should be analyzed collectively. For instance, a high revenue might be offset by low profit margins, indicating inefficiencies in cost management. Examining several measures together provides a more comprehensive understanding of financial health.

Furthermore, understanding the context surrounding these measures is crucial. Industry-specific benchmarks, economic conditions, and company-specific factors all influence the interpretation of financial data. Consider the environment when evaluating these numbers.

Beyond the Numbers: Qualitative Factors

While financial measures provide quantitative insights, qualitative factors also play a crucial role in assessing financial health. These include the quality of management, brand reputation, and the competitive landscape.

A strong management team can navigate challenges and capitalize on opportunities, while a positive brand reputation can attract customers and enhance revenue. Understanding these qualitative aspects, in addition to the numbers, provides a more holistic view of financial stability.

Conclusion: Empowering Financial Decision-Making

Understanding and utilizing financial measures is essential for making informed decisions, whether in your personal life or in the business world. By grasping the significance of metrics like net worth, cash flow, profit margins, and debt-to-equity ratios, you can gain a clearer picture of your financial standing and take steps to improve it.

Remember that financial health is a journey, not a destination. Continuously monitoring your financial measures, seeking professional advice when needed, and adapting your strategies over time can lead to long-term financial success and peace of mind. Start by taking that first step: identify one area where you can improve your financial knowledge and take action. The future you will thank you for it.