The Relationship Between Price Expectations And Current Demand Is

Consumer behavior is a complex dance, constantly shifting in response to a multitude of factors. Among the most influential of these factors is the intricate relationship between what consumers expect prices to be in the future and how they choose to spend their money today. Understanding this dynamic is crucial for businesses, policymakers, and anyone trying to navigate the ever-changing economic landscape.

At its core, this relationship hinges on a fundamental principle: people make purchasing decisions based not only on current prices but also on their predictions about future price movements. This anticipatory behavior, while seemingly straightforward, can have far-reaching consequences for overall demand and economic stability. The intricacies of this connection deserve careful consideration.

Understanding the Price Expectation-Demand Link

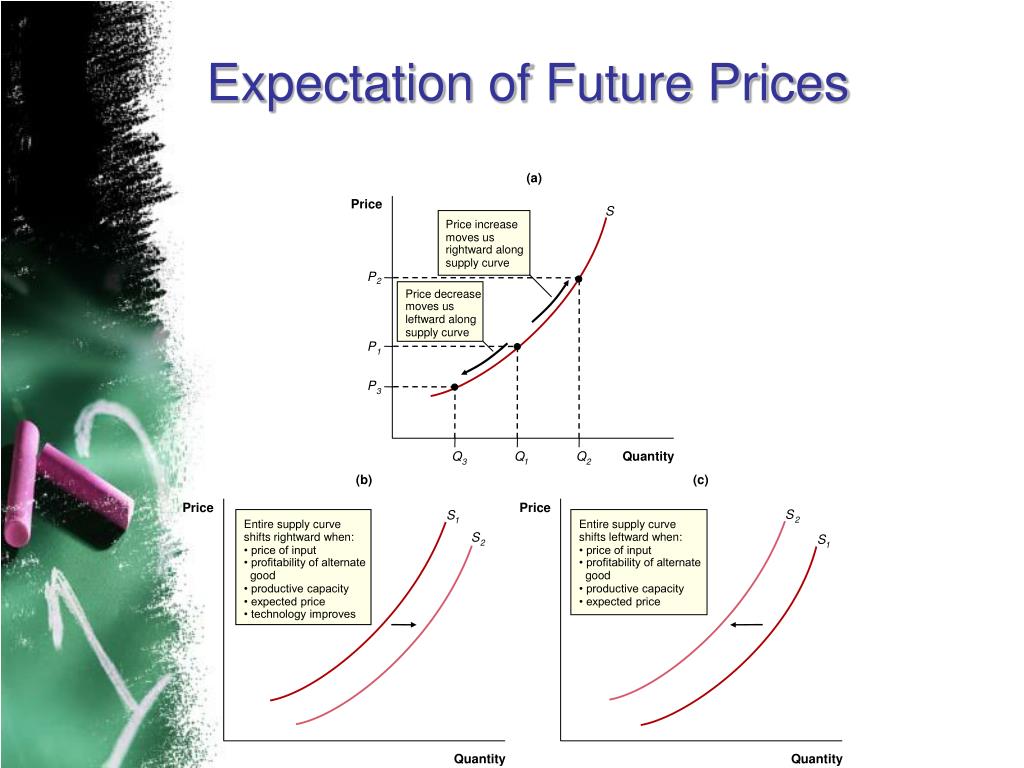

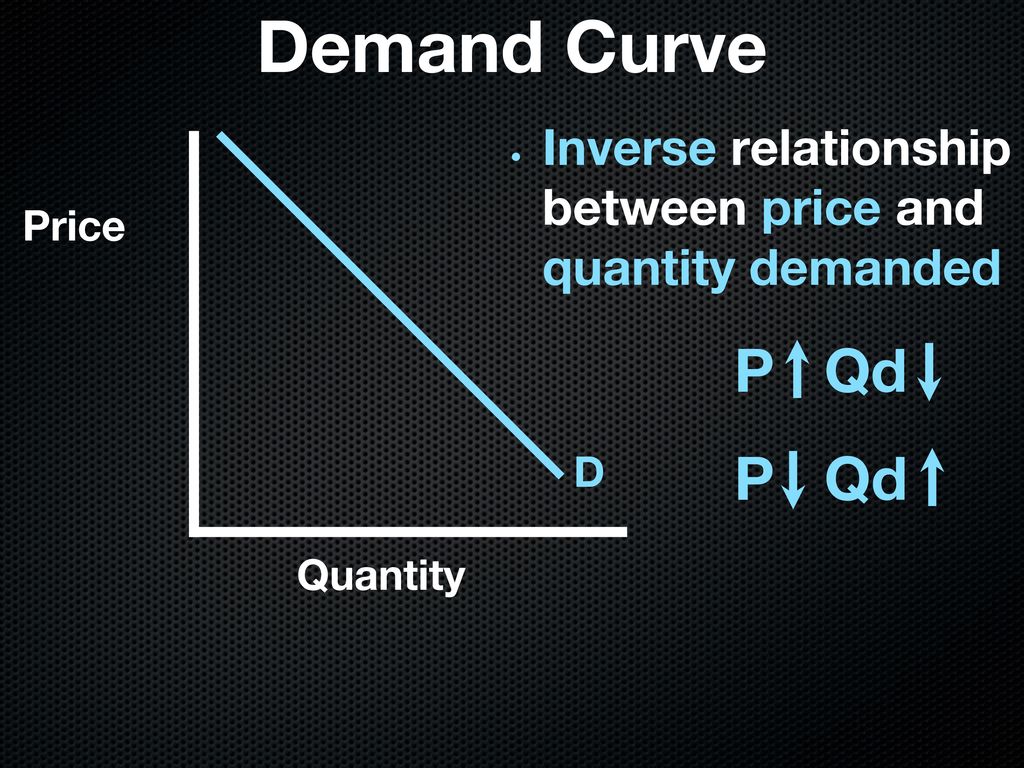

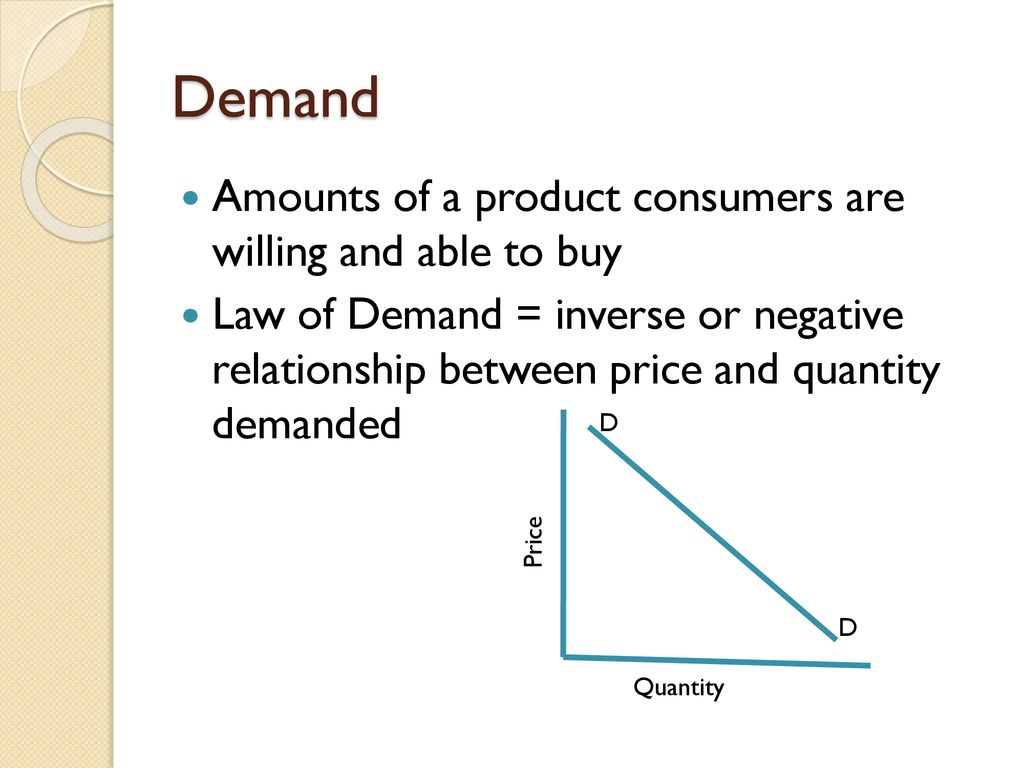

The relationship between price expectations and current demand operates primarily through two key channels: intertemporal substitution and the wealth effect. Intertemporal substitution refers to the willingness of consumers to shift their purchases across time periods depending on expected price changes.

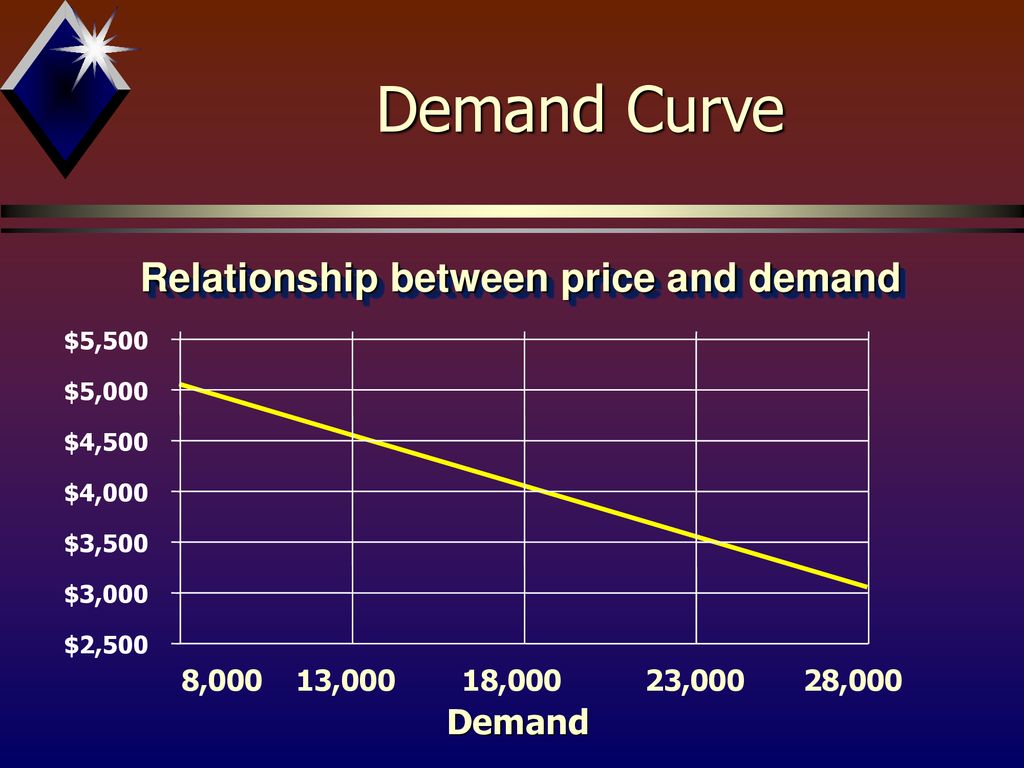

For example, if consumers anticipate that the price of gasoline will rise sharply next month, they may choose to fill their tanks more frequently this week, thereby increasing current demand. Conversely, if they expect prices to fall, they might postpone purchases, leading to a decrease in current demand. This highlights a critical aspect of how consumers strategically manage their spending based on future price predictions.

The wealth effect, on the other hand, is the impact of price expectations on perceived wealth and subsequent spending decisions. If consumers anticipate rising asset prices, such as real estate or stocks, they may feel wealthier and be more inclined to increase their current spending. This effect also operates in reverse, where expectations of falling asset prices can dampen consumer confidence and lead to reduced spending.

These two channels, working in tandem, illustrate the profound impact that price expectations can have on overall demand in the economy. These anticipatory behaviors are not merely theoretical; they have real-world implications.

Key Players and Influences

Several key players and influences shape price expectations and subsequently impact consumer demand. The Federal Reserve, through its monetary policy announcements and forward guidance, plays a significant role in shaping inflation expectations. These announcements can have immediate effects on how consumers and businesses anticipate future price levels.

Economic news and data releases, such as inflation reports and employment figures, also contribute to shaping expectations. Media coverage, both traditional and social, amplifies these signals, further influencing consumer sentiment. The impact of this information environment is not to be underestimated.

Businesses themselves also play a role. Their pricing strategies, investment decisions, and communication about future plans can influence consumer expectations about future price levels. A company announcing a significant price increase in the coming months can immediately influence consumer behavior.

The Impact on Various Sectors

The relationship between price expectations and demand is particularly pronounced in certain sectors. Energy markets are highly sensitive to price expectations due to the volatile nature of oil prices and their impact on transportation and heating costs. Consumers closely monitor these fluctuations.

The housing market is another sector where expectations play a crucial role. Anticipated changes in interest rates, home prices, and rental costs can significantly influence buying and selling decisions. This expectation-driven behavior amplifies the cyclical nature of the housing market.

Even the retail sector is affected. Expectations about future sales, discounts, and promotions can influence when consumers choose to make purchases, creating peaks and valleys in demand. This impacts inventory management and pricing strategies for retailers.

Real-World Examples and Potential Impacts

In early 2022, as inflation surged across the globe, consumers anticipating further price increases rushed to purchase durable goods, such as appliances and furniture, fearing that they would become more expensive later. This surge in demand exacerbated supply chain issues and further fueled inflation. This is a practical example of intertemporal substitution.

Conversely, during periods of economic uncertainty, such as during the onset of the COVID-19 pandemic, consumers anticipating potential job losses and lower incomes drastically cut back on spending, leading to a sharp decline in demand. This exemplifies the impact of wealth effect driven by negative expectations.

These examples underscore the importance of monitoring and understanding price expectations to anticipate and mitigate potential economic disruptions. A well-informed policy response requires a deep understanding of these consumer behaviors.

The influence of price expectations on demand extends beyond individual consumers. Businesses also adjust their investment and production decisions based on their outlook for future price levels. If businesses anticipate rising input costs, they may reduce production, leading to supply constraints and further price increases.

Conclusion

The relationship between price expectations and current demand is a powerful force shaping the economic landscape. Understanding this dynamic is critical for consumers, businesses, and policymakers alike.

By carefully monitoring price expectations and considering their potential impact, we can better navigate the complexities of the economy and make informed decisions that promote stability and growth. It's a complex interaction that requires careful observation and analysis.

+Demand+Quantity+Demanded+(000s).jpg)

.jpg)

+D+Q+Quantity.jpg)