The Statement Of Changes In Stockholders Equity Presents

Breaking: Key insights into company performance now available with the release of the Statement of Changes in Stockholders' Equity. This document offers a crucial snapshot of ownership fluctuations and the overall financial health of a publicly traded entity.

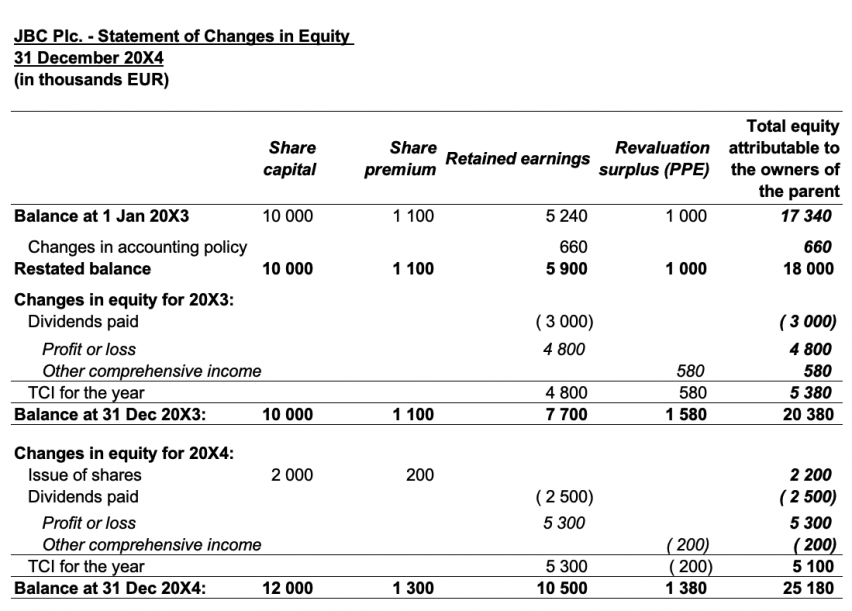

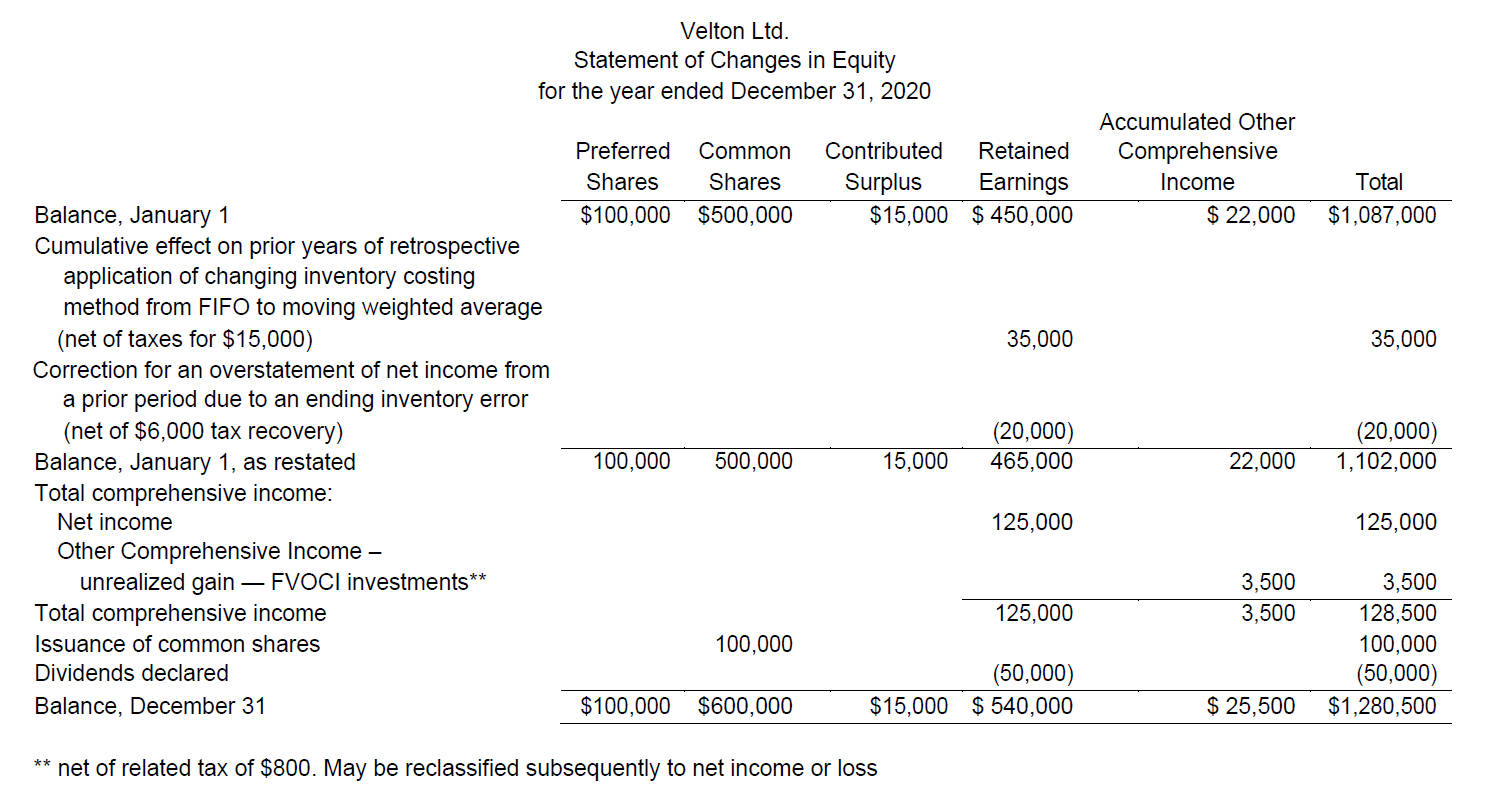

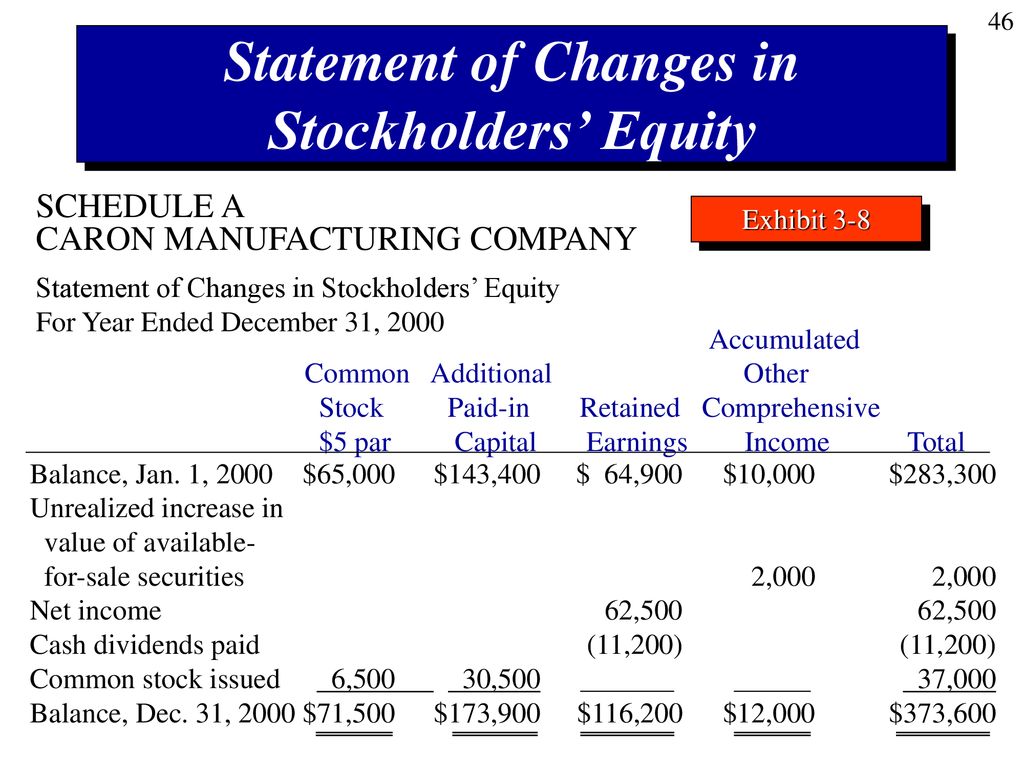

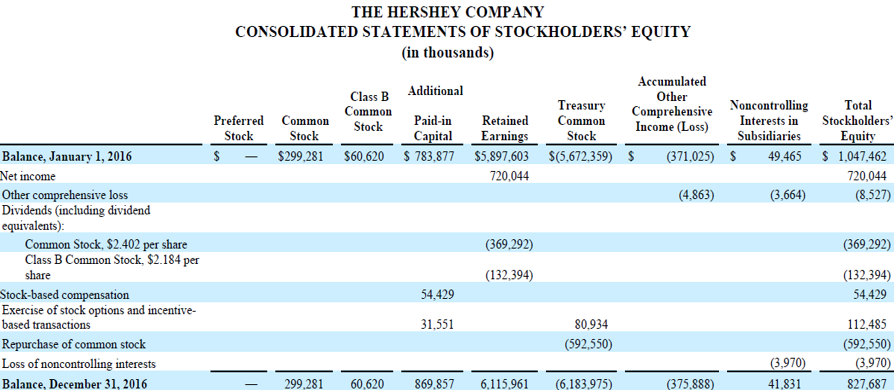

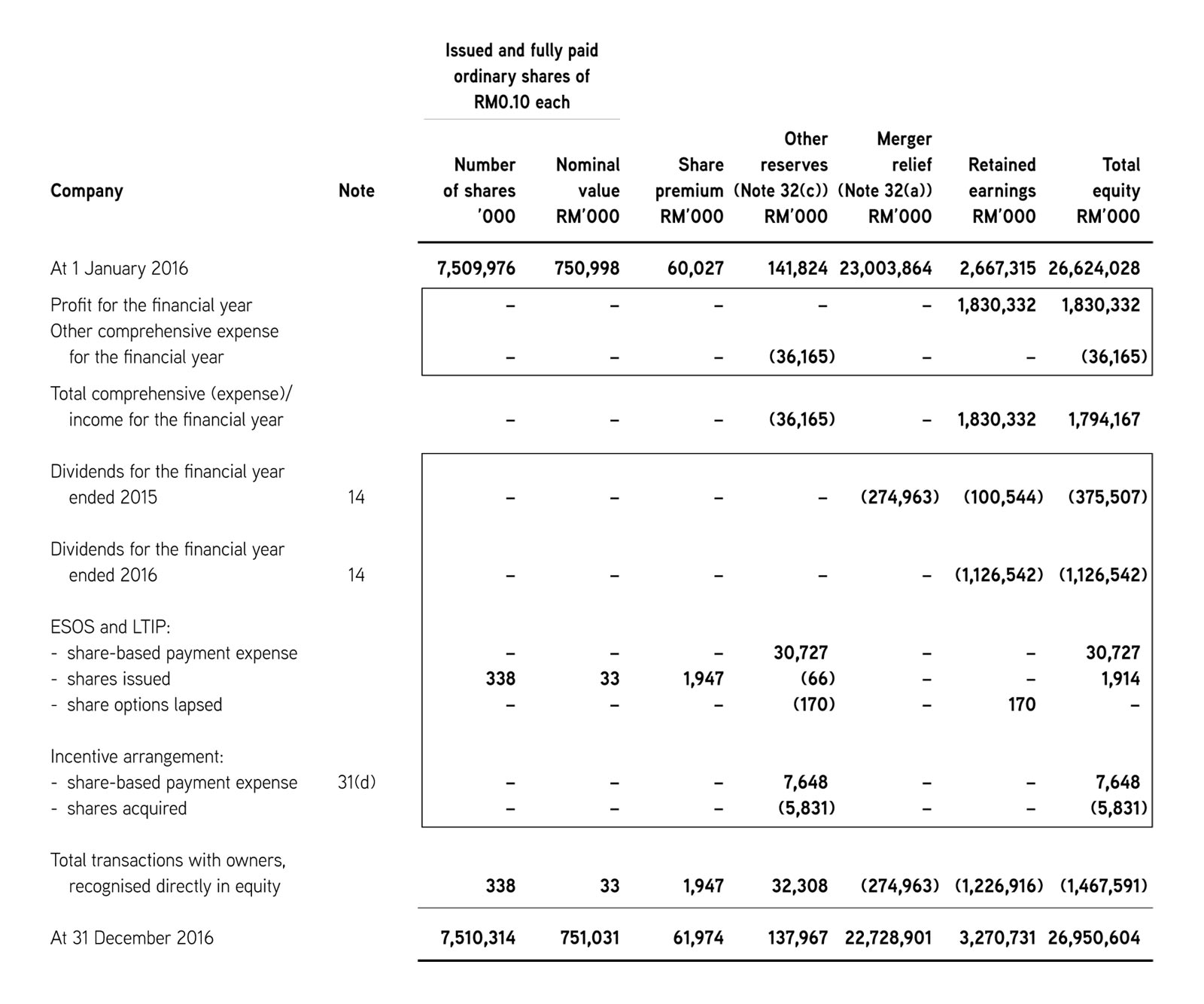

The Statement of Changes in Stockholders' Equity, often overlooked, provides a comprehensive record of how a company's equity evolved over a specific period. It details critical activities like stock issuance, repurchase, dividend payouts, and the impact of net income or loss on retained earnings, offering stakeholders a deeper understanding of ownership dynamics.

Decoding the Equity Statement: Key Components

The statement meticulously tracks changes in each component of stockholders' equity. This includes Common Stock, Preferred Stock, Retained Earnings, and Additional Paid-in Capital.

Each line item reveals a strategic decision or the financial consequence of operational performance. Examining these movements is essential for evaluating a company's financial trajectory.

Understanding Common Stock Fluctuations

Changes in Common Stock reflect the issuance or repurchase of shares. A stock issuance typically signifies fundraising efforts or employee compensation plans.

Conversely, a stock repurchase (buyback) can indicate management's belief that the company's shares are undervalued. This could be a sign of strength, or in some cases, an attempt to artificially inflate earnings per share.

The Significance of Retained Earnings

Retained Earnings represent the accumulated profits that a company has reinvested in the business. This figure is directly impacted by net income or net loss reported on the income statement.

Dividend payments, which are distributions of profits to shareholders, reduce retained earnings. A consistent history of increasing retained earnings, coupled with stable dividend payouts, is generally viewed favorably.

Additional Paid-in Capital: More Than Meets the Eye

Additional Paid-in Capital (APIC) arises when shares are issued at a price above their par value. This represents the premium investors are willing to pay for the stock.

APIC can also be affected by stock-based compensation plans and other equity-related transactions. Monitoring APIC can provide insights into the effectiveness of these strategies.

Real-World Example: Analyzing Tesla's Equity Statement

Let's consider a hypothetical example based on publicly available information. Tesla's Statement of Changes in Stockholders' Equity for the year 2023 revealed a significant increase in common stock due to stock splits and equity offerings, as reflected in their recent report.

Tesla's retained earnings also grew substantially, reflecting the company's profitability and strong financial performance. Changes in equity also reflect the ongoing conversion of convertible notes to equity.

Why This Matters to Investors

For investors, the Statement of Changes in Stockholders' Equity is a critical tool for assessing a company's capital structure and dividend policy. Understanding these elements is crucial for making informed investment decisions.

It helps investors gauge how effectively management is managing shareholder value. It also reveals potential risks associated with excessive debt or unsustainable dividend payouts.

The Statement's Impact on Financial Analysis

Financial analysts use this statement to assess a company's financial health and stability. The statement provides a clearer picture of a company's capital structure and its ability to meet its financial obligations.

For example, a decline in retained earnings coupled with increased debt could signal potential financial distress. Conversely, strong retained earnings growth and a conservative dividend policy often suggest financial strength.

Regulatory Requirements and Compliance

The Statement of Changes in Stockholders' Equity is a required component of a company's audited financial statements. It must adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Accurate and transparent reporting is essential for maintaining investor confidence and ensuring compliance with regulatory requirements. Discrepancies or inconsistencies in the statement can raise red flags.

Concerns Arising from Misinterpretation

Misinterpreting the Statement of Changes in Stockholders' Equity can lead to flawed investment decisions. A superficial analysis may overlook critical details about a company's financial health.

Therefore, it is essential to carefully examine each line item and consider the broader context of the company's financial performance.

Next Steps and Ongoing Developments

Investors and analysts should continuously monitor changes in stockholders' equity to stay informed about a company's financial performance. Upcoming earnings reports will provide further insights into these trends.

Regulatory bodies are constantly refining accounting standards to enhance transparency and comparability. Keeping abreast of these changes is essential for accurate financial analysis.

Stay tuned for further updates as we continue to analyze the implications of these financial statements on the market and individual companies.