The Statement Of Stockholders' Equity Includes These Amounts

Understanding the financial health of a company often requires delving into the intricacies of its financial statements. Among these crucial reports, the Statement of Stockholders' Equity provides a detailed look at the changes in the ownership interest of a company over a specific period. This statement, sometimes referred to as the Statement of Changes in Equity, is vital for investors, analysts, and stakeholders seeking to understand the factors influencing a company’s net worth.

This article aims to dissect the Statement of Stockholders' Equity, identifying the specific components and amounts that comprise it. By understanding these elements, readers can gain a clearer perspective on how a company is managing its equity and creating value for its owners. We will explore the key details, the significance of the statement, and the potential impact of the information it reveals.

What's Included? A Deep Dive into the Components

The Statement of Stockholders' Equity tracks all changes in the equity accounts of a company. This encompasses a comprehensive record of transactions affecting the company's capital structure. Key components routinely included are detailed below.

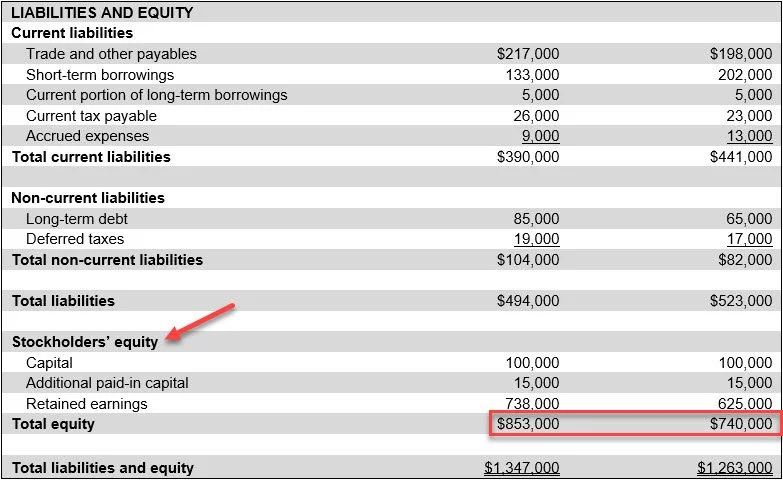

Beginning Balance

The starting point of the statement is the beginning balance of each equity account. This represents the ending balance from the previous accounting period. It serves as the foundation upon which all subsequent changes are built.

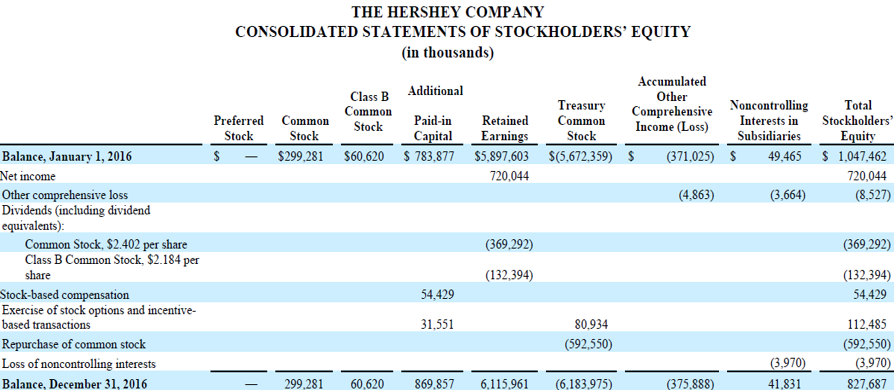

Net Income (or Net Loss)

Perhaps the most significant contributor to retained earnings, net income reflects the company's profitability over the period. Conversely, a net loss will decrease retained earnings. This figure is directly derived from the company's income statement.

Dividends

Dividends represent distributions of a company's earnings to its shareholders. These payments reduce the retained earnings balance. Dividends can be in the form of cash, stock, or property.

Stock Issuances

When a company issues new shares of stock, it increases its equity. This is typically presented as an increase in common stock or preferred stock, depending on the type of shares issued. The proceeds from these issuances enhance the company's capital base.

Stock Repurchases (Treasury Stock)

Companies may repurchase their own shares from the open market, leading to a decrease in outstanding shares. These repurchased shares are often held as treasury stock. This transaction reduces stockholders' equity.

Other Comprehensive Income (OCI)

This includes items that bypass the income statement but still impact equity. Examples include unrealized gains or losses on certain investments and foreign currency translation adjustments. These items are presented separately to distinguish them from net income.

Changes in Accumulated Other Comprehensive Income (AOCI)

This section details the specific changes within each category of OCI. It provides a more granular view of the factors affecting this component of equity. Examples include adjustments to pension obligations or changes in the fair value of derivatives.

Stock Options and Other Equity-Based Compensation

If a company grants stock options or other equity-based compensation to employees, this will impact equity. The expense associated with these plans is recognized over the vesting period. The exercise of stock options will also increase equity as employees purchase shares.

Effects of Accounting Changes

Occasionally, a company may need to adjust its financial statements due to changes in accounting principles. These adjustments are reported in the Statement of Stockholders' Equity. Such changes are often implemented retrospectively, affecting prior periods.

Ending Balance

The ending balance represents the final amount of each equity account after all changes have been accounted for. This becomes the beginning balance for the next accounting period. It reflects the cumulative effect of all transactions affecting equity during the period.

Why is This Important? Significance and Impact

The Statement of Stockholders' Equity provides critical insights into a company's financial management. It allows stakeholders to assess how equity is being managed and utilized. This information is invaluable for making informed investment decisions.

For investors, the statement clarifies how a company is building value. It shows whether profits are being reinvested or distributed as dividends. A healthy Statement of Stockholders' Equity signals financial stability and growth potential.

Analysts use the statement to assess a company's capital structure and evaluate its ability to meet its financial obligations. Changes in equity can indicate shifts in a company's strategy or its overall financial health. Understanding these shifts is crucial for accurate financial forecasting.

Beyond the Numbers: A Human Perspective

While the Statement of Stockholders' Equity is primarily a financial document, its impact extends beyond the balance sheet. Changes in equity can reflect strategic decisions regarding employee compensation or shareholder returns. These decisions ultimately affect the lives and livelihoods of individuals associated with the company.

For example, the issuance of stock options can incentivize employees and align their interests with those of the shareholders. Conversely, a significant decrease in retained earnings due to a net loss might signal impending layoffs or restructuring. The statement tells a story about the company's direction and its commitment to its stakeholders.

Conclusion

The Statement of Stockholders' Equity is more than just a collection of numbers. It is a comprehensive record of the transactions affecting a company's ownership structure. By understanding the components of this statement, stakeholders can gain valuable insights into a company's financial health, management strategies, and long-term prospects.

Ultimately, this understanding empowers informed decision-making and promotes greater transparency in the financial markets. As such, the Statement of Stockholders' Equity remains a crucial tool for navigating the complexities of corporate finance.

.+There+are+separate+columns+for+each+account+in+stockholders’+equity:+Common+Stock+(both+dollar+amounts+and+number+of+shares)%3B+Paid-in+Capital%3B+Retained+Earnings%3B+and+Treasury+Stock+(both+dollar+amounts+and+number+of+shares).+The+statement+also+contains+another+column+called+Accumulated+Other+Comprehensive+Income+(Loss)%2C+which+summarizes+changes+in+the+few+elements+of+income+that+are+permitted+to+bypass+the+income+statement.+These+elements+include+unrealized+gains+or+losses+on+available-for-sale+debt+securities%2C+and+foreign-currency+translation+adjustments+resulting+from+consolidating+the+accounting+of+a+company’s+foreign+subsidiaries.+Accounting+for+available-for-sale+debt+securities+is+covered+briefly+in+Appendix+E..jpg)

.jpg)