The Two Sources Of Stockholders Equity Are Amounts

Imagine peering into a bustling marketplace, not of tangible goods, but of financial dreams. Investors gather, exchanging not coins but shares, representing ownership in companies poised for growth. The heart of this marketplace pulses with activity, fueled by the collective belief in future prosperity. Behind every share traded lies a story, a history reflected in the fundamental accounting equation: Assets = Liabilities + Equity.

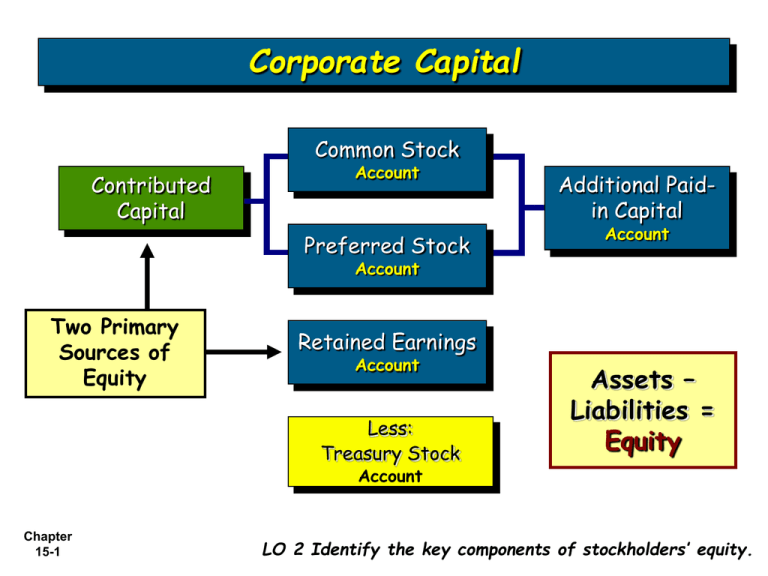

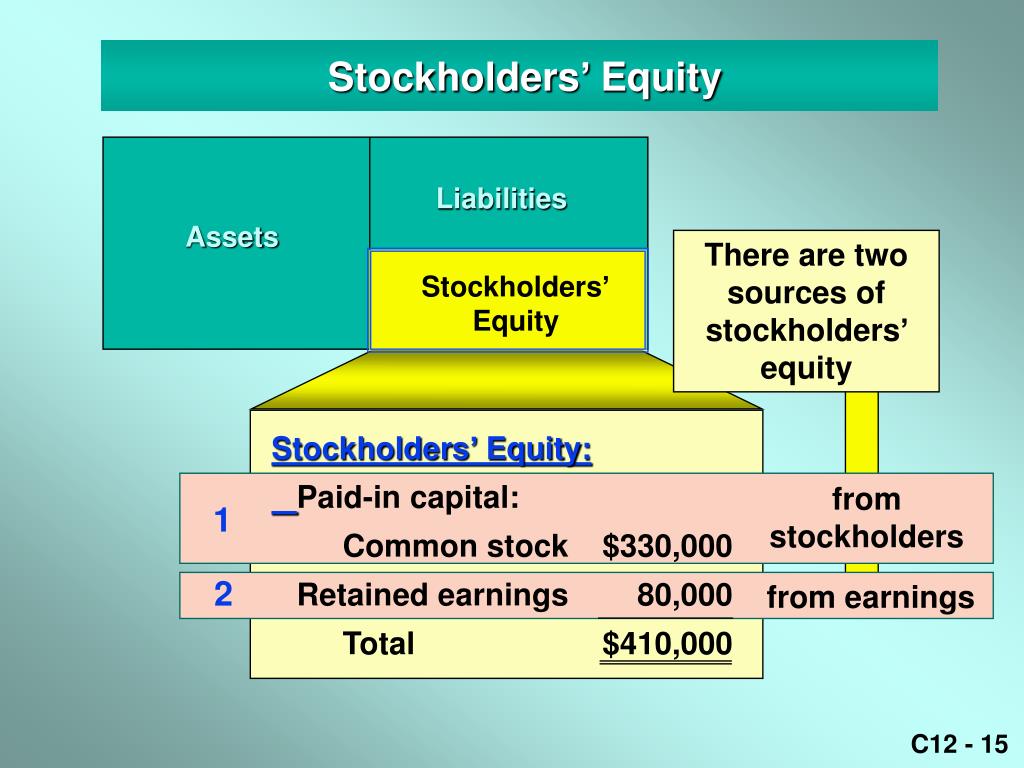

The tale we're about to unfold explores the bedrock of stockholder's equity, the lifeblood of corporate finance. It reveals the two primary sources that build this crucial element of the balance sheet: contributed capital and retained earnings. Understanding these sources unlocks the secrets to a company's financial health and its ability to create value for its owners. This knowledge is essential for investors, business owners, and anyone seeking to navigate the complexities of the financial world.

Contributed Capital: The Initial Investment

Contributed capital represents the total amount of money stockholders have invested directly into the company in exchange for shares of stock. This is the initial infusion of funds that sets the stage for a company's operations. It's the seed money that allows a business to take root and grow.

This source primarily comprises two key components: common stock and preferred stock. Common stock represents the basic ownership of the company. Holders typically have voting rights, allowing them to participate in corporate governance.

Preferred stock, on the other hand, often carries preferential rights. These may include a fixed dividend payment and priority over common stockholders in the event of liquidation. Different classes of stock might exist within each category, each with varying rights and privileges.

Understanding Par Value and Additional Paid-in Capital

When a company issues stock, it may assign a par value, a nominal value per share stated in the corporate charter. The par value is often a small amount (e.g., $0.01 per share). However, the actual price investors pay for the stock (the issue price) is usually much higher than the par value.

The difference between the issue price and the par value is called additional paid-in capital (APIC). APIC represents the amount investors paid above the par value. It is an essential part of contributed capital, reflecting investor confidence and the perceived value of the company's stock.

For instance, if a company issues 1,000 shares of common stock with a par value of $0.01 per share at an issue price of $10 per share, the common stock account would increase by $10 (1,000 shares x $0.01 par value). The APIC account would increase by $9,990 (1,000 shares x ($10 - $0.01)).

Retained Earnings: The Fruits of Labor

Retained earnings represent the accumulated profits of a company that have not been distributed to stockholders as dividends. Instead, these profits are reinvested back into the business to fuel growth, fund new projects, or reduce debt. It is the cumulative sum of net income, less any dividends declared, over the life of the company.

In essence, retained earnings are the company's savings account. It is the result of successful operations and prudent financial management. A healthy balance of retained earnings is often a sign of financial strength and stability.

Retained earnings demonstrate a company's capacity to generate profit. It also shows its commitment to long-term growth and value creation. This reinvestment cycle is crucial for sustainable success.

The Impact of Net Income and Dividends

Net income, the bottom line on the income statement, directly increases retained earnings. A profitable year adds to the accumulated profits, boosting the company's equity. Conversely, a net loss decreases retained earnings, reducing the amount available for reinvestment or distribution.

Dividends, payments made to stockholders from the company's profits, reduce retained earnings. These payments represent a distribution of accumulated profits to the owners of the company. While dividends can be attractive to investors, they also decrease the amount available for reinvestment.

The decision to pay dividends or reinvest profits is a strategic one for management. It requires balancing the desire to reward shareholders with the need to fund future growth opportunities.

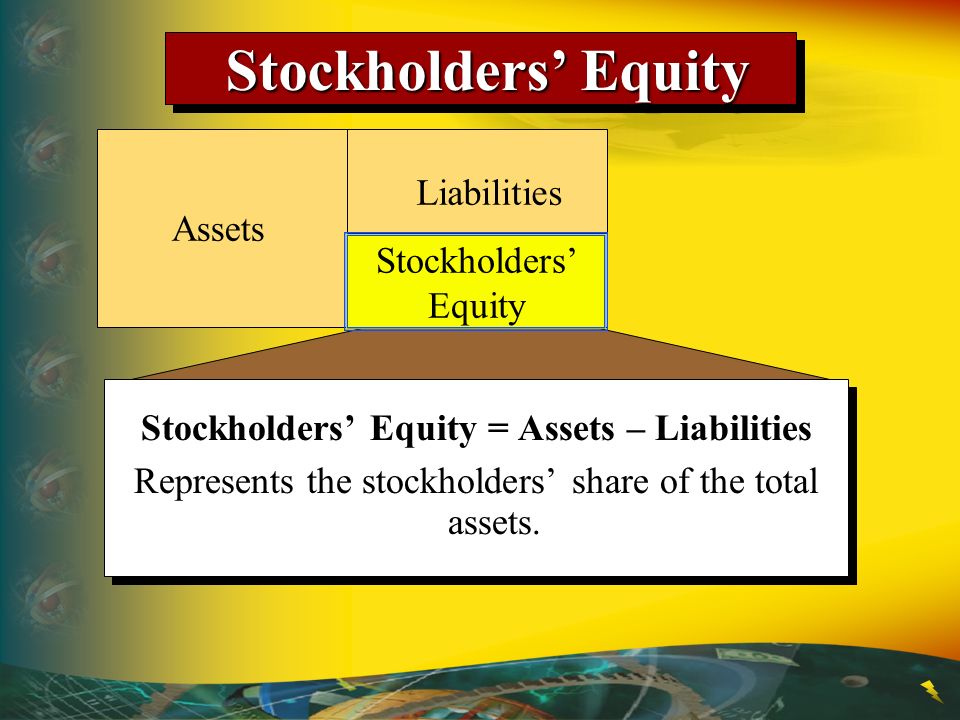

The Significance of Stockholders' Equity

Stockholders' equity is a vital indicator of a company's financial health. It provides a snapshot of the ownership stake in the company, reflecting the net assets belonging to the stockholders after all liabilities are paid. A strong equity position signals financial stability and resilience.

It also serves as a crucial metric for investors. It helps them evaluate the value of their investment and assess the company's ability to generate future returns. Understanding the components of stockholders' equity allows investors to make informed decisions.

Furthermore, stakeholders (creditors, suppliers, and employees) use it to evaluate a company's creditworthiness and operational stability. A robust equity base provides a buffer against financial distress and increases confidence in the company's ability to meet its obligations.

"A company's stockholder equity is a reflection of its financial foundation, built upon the pillars of contributed capital and retained earnings." -Financial Analyst, Jane Doe

A Dynamic and Evolving Landscape

Stockholders' equity is not static; it changes constantly with each transaction and reporting period. New stock issuances increase contributed capital, while profitable operations increase retained earnings. Dividend payments reduce retained earnings, and stock buybacks reduce both contributed capital and retained earnings (depending on how treasury stock is accounted for).

Understanding these dynamics is essential for analyzing a company's financial performance over time. Tracking the changes in stockholders' equity provides insights into the company's growth strategy and its ability to create value for its owners.

Companies must manage their equity position carefully, balancing the needs of investors, creditors, and the long-term growth of the business. Maintaining a healthy equity base is crucial for sustainable success and continued access to capital markets.

The Interplay of the Two Sources

Contributed capital provides the initial resources, while retained earnings represent the fruits of the company's operations. Both are essential for a company's long-term success. A company with substantial contributed capital can use those funds to build infrastructure or invest in research and development.

A company with strong retained earnings can reinvest profits to expand operations. It also has the financial flexibility to weather economic downturns or pursue new opportunities. The ideal scenario is a company that effectively utilizes its contributed capital to generate strong earnings, leading to a healthy accumulation of retained earnings.

Analyzing the relationship between contributed capital and retained earnings can reveal valuable insights into a company's strategy and performance. For example, a company with high contributed capital but low retained earnings may be struggling to generate profits from its investments.

Conclusion: A Foundation for Growth

The story of stockholders' equity is a story of investment, growth, and value creation. Contributed capital and retained earnings are the two fundamental sources that build this critical element of the balance sheet. They offer a glimpse into the financial health and long-term potential of any enterprise.

As we navigate the complexities of the financial world, understanding these sources empowers us to make informed decisions as investors, business owners, and stakeholders. It allows us to see beyond the numbers. It helps us to appreciate the underlying story of growth and sustainability.

By grasping the essence of stockholders' equity, we gain a deeper understanding of the marketplace, not just as a place of exchange, but as a landscape of opportunity built on a solid financial foundation. And that understanding is a powerful tool for navigating the future.

.jpg)