This Account Is Currently Restricted Capital One

The sudden freezing of accounts at Capital One, indicated by messages like "This Account Is Currently Restricted," has triggered widespread anxiety and confusion among customers. Individuals and businesses alike are reporting unexpected lockouts, leaving them unable to access their funds or conduct essential financial transactions. This disruption has sparked a wave of inquiries and complaints directed at the financial institution, demanding clarity and swift resolution.

At the heart of this issue is a surge in account restrictions imposed by Capital One, impacting an unknown number of users who report receiving the aforementioned restrictive message. The reasons behind these restrictions remain largely opaque, fostering frustration and fueling speculation about potential security breaches, system errors, or compliance measures. This article aims to dissect the situation, exploring the potential causes, examining customer experiences, and analyzing the implications for both Capital One and its clientele.

Customer Experiences and Immediate Impact

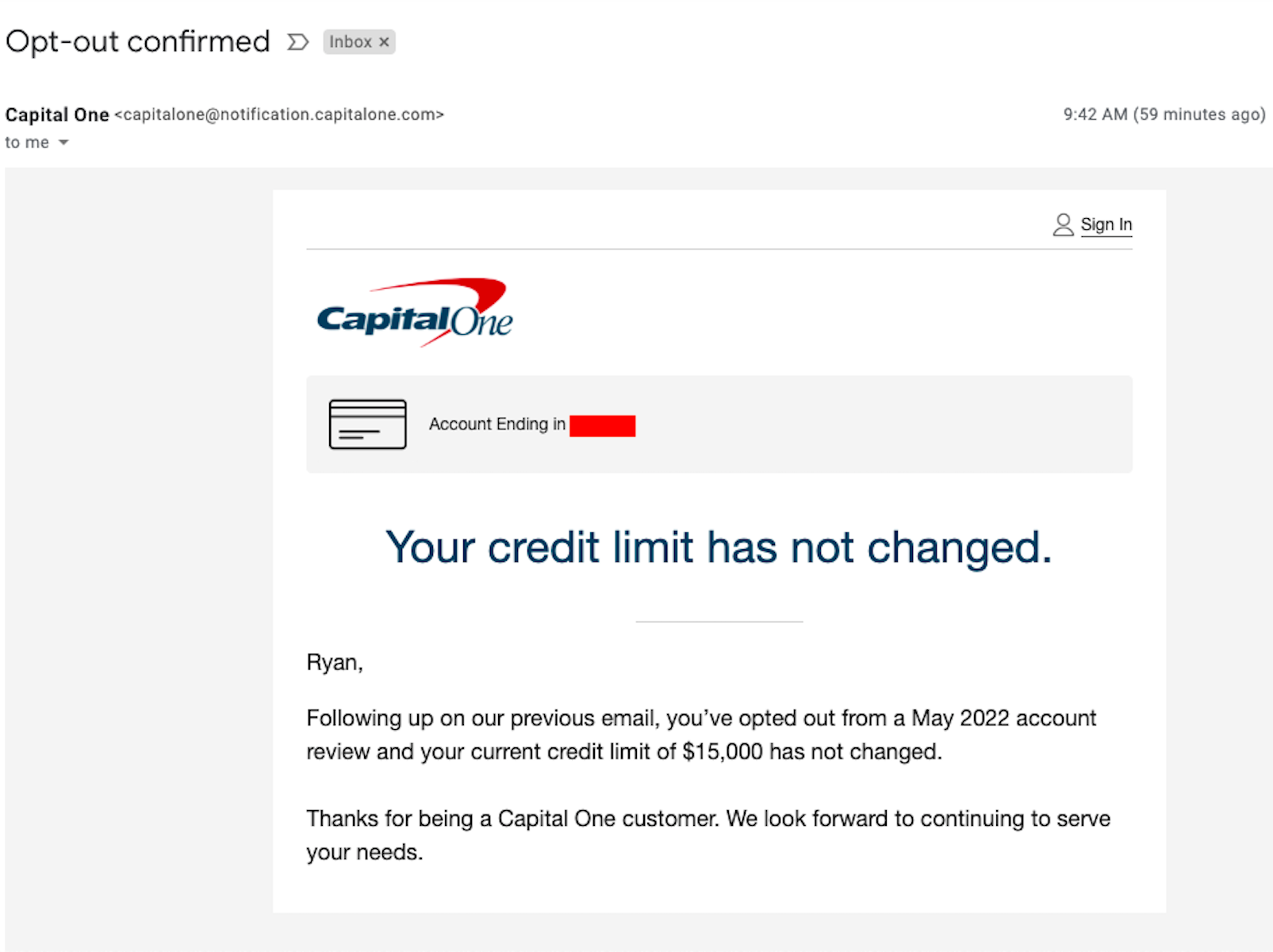

Reports of locked accounts have flooded social media platforms and online forums, painting a picture of widespread disruption. Many customers recount attempting to log into their accounts, only to be met with the stark message: "This Account Is Currently Restricted."

The immediate impact is often severe. Individuals are left unable to pay bills, make purchases, or transfer funds, leading to potential late fees, damaged credit scores, and significant personal inconvenience.

Businesses, particularly small enterprises, face even greater challenges. Inability to access funds can disrupt payroll, hamper supplier payments, and ultimately threaten operational continuity.

Potential Causes and Capital One's Response

While Capital One has not issued a comprehensive statement detailing the specific reasons behind the widespread account restrictions, several potential factors are being considered.

Security Concerns

One possibility is heightened security measures in response to potential fraud or cyberattacks. Financial institutions often implement temporary account freezes when suspicious activity is detected to protect customer assets.

Increased vigilance might be triggered by unusual transaction patterns, multiple failed login attempts, or data breaches at third-party vendors. However, this explanation doesn't necessarily justify the apparent scale of the restrictions.

Compliance and Regulatory Requirements

Another potential cause lies in Capital One's adherence to anti-money laundering (AML) regulations and "Know Your Customer" (KYC) requirements. These regulations mandate financial institutions to scrutinize customer transactions and identify potentially illicit activities.

Sudden account restrictions could be triggered by inconsistencies in customer information, large or unusual transactions, or suspected links to illegal activities. Increased regulatory scrutiny could also be a contributing factor.

System Errors and Technical Glitches

While less likely, the possibility of system errors or technical glitches cannot be entirely dismissed. Complex banking systems are susceptible to occasional malfunctions, which can inadvertently lead to account restrictions.

If this is the case, Capital One would need to address the underlying technical issues promptly and provide clear communication to affected customers.

Capital One's Official Statements

Capital One has generally responded to individual customer inquiries with generic statements citing security concerns or compliance requirements. These responses, however, lack specific details and fail to address the broader scope of the issue.

The lack of transparency has further fueled customer frustration and prompted calls for greater clarity from the financial institution.

The Broader Implications

The widespread account restrictions at Capital One raise broader concerns about the security and stability of the financial system. Any disruption that prevents customers from accessing their funds erodes trust in financial institutions.

Moreover, the situation highlights the importance of clear communication and proactive customer service in times of crisis. Financial institutions have a responsibility to keep customers informed and address their concerns promptly and transparently.

Seeking Resolution and Moving Forward

Affected customers are advised to contact Capital One directly through their official channels, including phone, email, or in-person branches.

Documenting all communication and keeping records of any financial losses incurred as a result of the account restrictions is also recommended. Furthermore, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) if Capital One fails to provide a satisfactory resolution.

The incident serves as a stark reminder of the importance of diversifying financial holdings and maintaining emergency funds outside of a single account. While Capital One works towards resolving the current situation, proactive financial planning can mitigate the impact of future disruptions.

Looking ahead, Capital One must prioritize transparency and improve its communication strategies to rebuild customer trust. A thorough investigation into the root causes of the account restrictions is essential, followed by the implementation of robust safeguards to prevent similar incidents from occurring in the future. Only through such measures can Capital One restore confidence in its services and maintain its position as a leading financial institution.