Total Outstanding Authorization Amount Hdfc Credit Card

Imagine a bustling marketplace, vendors calling out their wares, and customers happily bartering. Now, picture this scene translated into the digital realm, where credit cards are the currency. At the heart of this financial hub stands HDFC Bank, a major player with its credit card offerings. The air hums with transactions, each swipe contributing to a grand total – the Total Outstanding Authorization Amount.

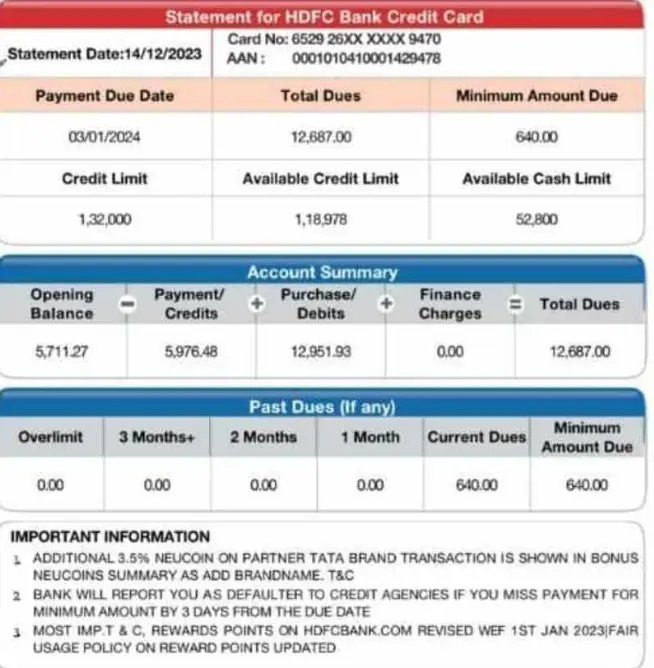

This figure represents the sum of all credit card transactions that have been authorized but not yet settled for HDFC Bank's credit card users. It is a crucial indicator of consumer spending and the bank's financial health, reflecting current economic activity and consumer confidence.

Understanding the Total Outstanding Authorization Amount

The Total Outstanding Authorization Amount (TOAA) is not simply a number. It is a dynamic snapshot of the financial interplay between HDFC Bank, its cardholders, and merchants. It tells a story of daily purchases, planned expenses, and the overall reliance on credit within the bank's customer base.

A Closer Look at the Components

Several factors contribute to this amount. Every time an HDFC credit card is used, the transaction goes through an authorization process. This process verifies that the card is valid and that sufficient credit is available.

The authorized amount is then held by the bank until the merchant settles the transaction, typically within a few business days. Until settlement, this amount contributes to the TOAA.

Significance for HDFC Bank

The TOAA is a key metric for HDFC Bank. A consistently high TOAA can indicate strong customer engagement and usage of credit cards. However, it also necessitates careful risk management.

The bank needs to ensure adequate liquidity to cover these outstanding authorizations. Further, they have to actively monitor for fraudulent activity and potential credit risks.

Impact on Cardholders

For HDFC credit cardholders, understanding the concept of authorized amounts is essential. An authorized amount reduces the available credit limit temporarily. This can be particularly important for users with lower credit limits or those planning significant purchases.

It is crucial to keep track of recent transactions to avoid exceeding the credit limit. Monitoring spending habits is also important, to prevent unwanted charges that eat up available credit.

Economic Implications

On a broader scale, the TOAA of major banks like HDFC reflects the overall health of the Indian economy. An increasing TOAA generally suggests increased consumer spending, which is a key driver of economic growth. Conversely, a decreasing TOAA might indicate a slowdown in spending and potential economic concerns.

It’s important to note that this metric is not always a straightforward indicator. Seasonal trends, festive periods, and changes in interest rates can also influence spending habits.

Factors Influencing the TOAA

Several factors influence the Total Outstanding Authorization Amount. Consumer confidence plays a vital role. When consumers are confident about the future, they are more likely to spend, resulting in higher credit card usage and a larger TOAA.

Interest rates also have an impact. Higher interest rates may discourage spending, while lower rates can encourage borrowing and spending. Promotions and reward programs offered by HDFC can also incentivize card usage.

Economic policies and global events can indirectly influence consumer behavior. This ultimately affects the TOAA, therefore economic stability is important.

Future Trends

Looking ahead, the Total Outstanding Authorization Amount is likely to continue evolving. The rise of digital payments, e-commerce, and innovative financial technologies will continue to shape credit card usage. HDFC Bank will need to adapt its strategies to effectively manage and leverage this metric in a dynamic financial landscape.

This may involve investing in advanced analytics to better understand consumer behavior. Another strategy might be offering personalized credit solutions and strengthening fraud detection mechanisms.

Ultimately, the Total Outstanding Authorization Amount for HDFC credit cards paints a rich portrait of consumer activity and financial dynamics. It serves as a valuable data point for the bank, its cardholders, and the broader economy. As the digital marketplace continues to evolve, the story this number tells will become even more insightful.