Transfer Money From Nro Account To Local Account

The process of repatriating funds from Non-Resident Ordinary (NRO) accounts to resident accounts in India has long been a subject of interest and, at times, confusion for non-resident Indians (NRIs). Navigating the regulations surrounding these transfers is crucial for NRIs seeking to manage their finances effectively and compliantly.

Understanding the permissible limits, applicable taxes, and required documentation is key to ensuring a smooth and hassle-free transfer. Recent updates and clarifications from the Reserve Bank of India (RBI) have further refined the guidelines, demanding a closer look at the current landscape.

Understanding NRO Account Transfers

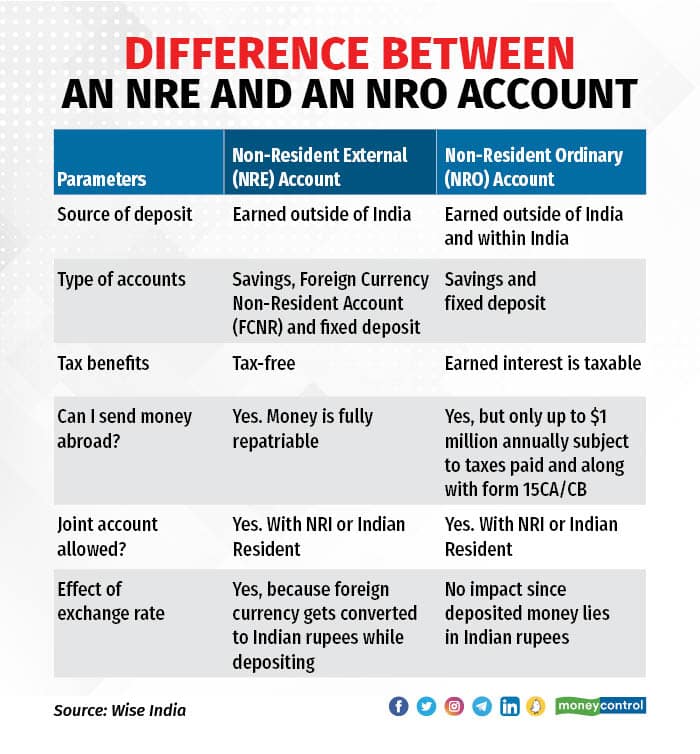

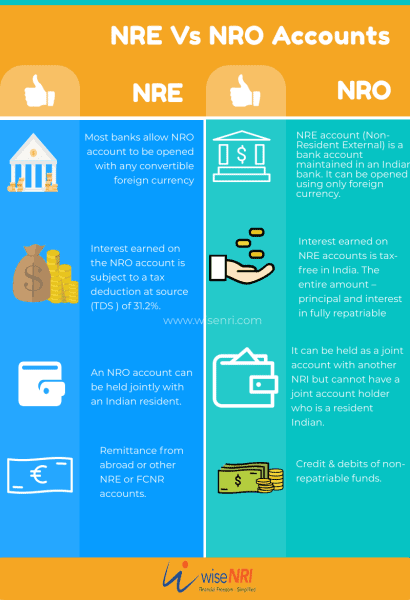

At its core, an NRO account is designed to manage income earned in India by NRIs. This income can include rent, dividends, pension, and other earnings. The ability to transfer funds from an NRO account to a resident account allows NRIs to utilize their Indian income for expenses or investments in their country of residence or elsewhere.

However, this transfer is subject to certain regulations set forth by the RBI. It's crucial to understand these regulations before initiating any transfer.

Permissible Limits and Regulations

The RBI permits NRIs to remit up to USD 1 million per financial year from their NRO accounts, subject to applicable taxes. This limit encompasses the repatriation of funds from the sale of assets, gifts, and other sources of income held in the NRO account. It is important to note that the USD 1 million limit is a consolidated one, applying to all remittances made by an individual during the financial year.

Specific transactions might require additional documentation or approvals, particularly if they involve significant amounts or the sale of immovable property. Consulting with a financial advisor or chartered accountant familiar with NRI taxation is highly recommended in such cases.

Tax Implications

Transfers from NRO accounts are generally subject to tax deducted at source (TDS). The applicable TDS rate varies depending on the nature of the income and the country of residence of the NRI. It's essential to understand these tax implications to avoid any unexpected liabilities.

For instance, income from rent is subject to TDS under Section 194I of the Income Tax Act. Similarly, interest earned on NRO account deposits is also subject to TDS.

Documentation and Procedures

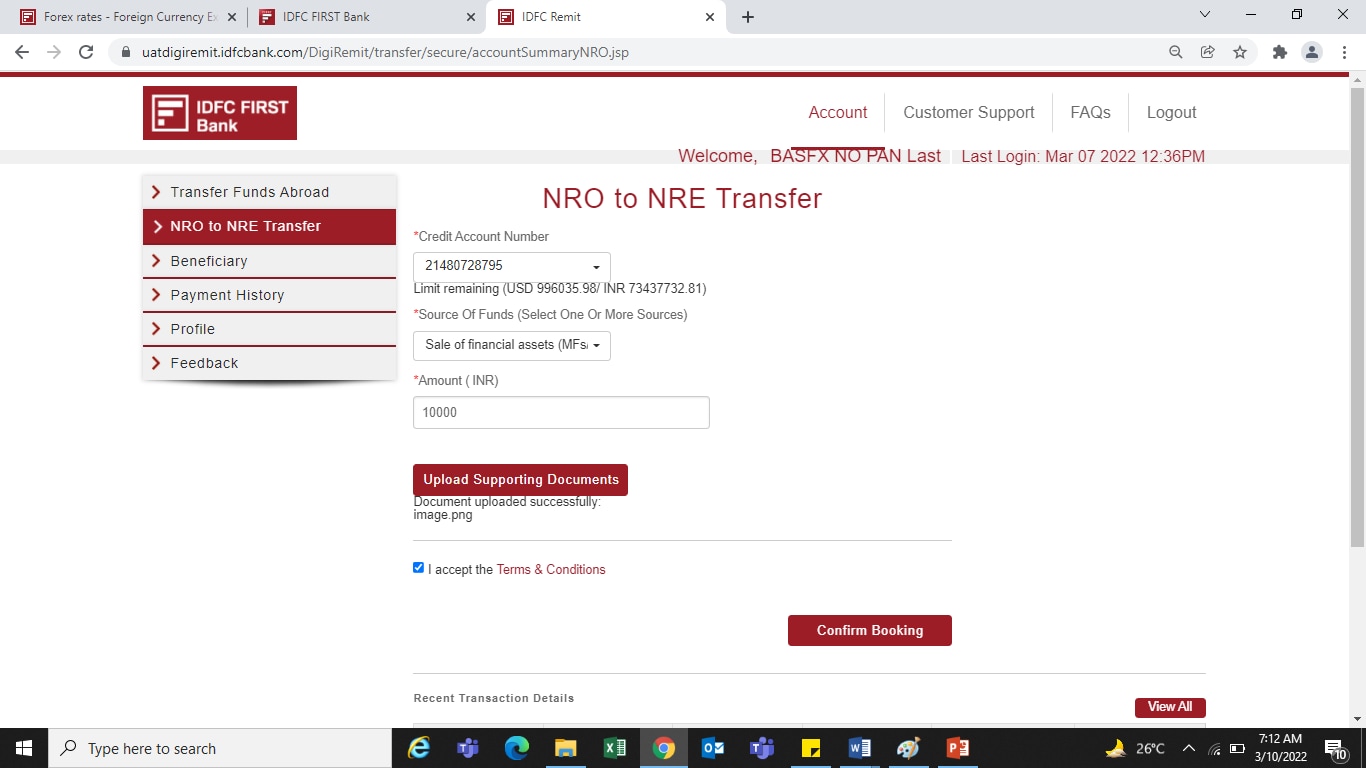

To initiate a transfer from an NRO account, NRIs typically need to submit a declaration form to their bank. This form includes details of the remitter, the beneficiary, the purpose of the remittance, and the amount being transferred. Supporting documents, such as a copy of the PAN card and address proof, may also be required.

Banks often have their own specific procedures and documentation requirements, so it's prudent to check with the bank beforehand. Some banks may also require a certificate from a chartered accountant confirming that all applicable taxes have been paid.

Challenges and Considerations

While the process of transferring funds from NRO accounts is generally straightforward, some challenges may arise. Currency fluctuations can impact the actual amount received in the recipient account. Banks may also charge transaction fees for processing the transfer. Moreover, procedural delays can sometimes occur, particularly if the documentation is incomplete or if the bank requires further clarification.

Another potential challenge is staying updated with the latest regulatory changes. The RBI frequently issues circulars and notifications that may impact the rules governing NRO account transfers. NRIs should therefore proactively monitor these changes or seek professional advice to ensure compliance.

"It's crucial for NRIs to stay informed about the evolving regulations and consult with financial professionals to navigate the complexities of NRO account transfers effectively," says Mr. Sharma, a leading Chartered Accountant specializing in NRI taxation.

Future Outlook

The regulatory landscape surrounding NRO accounts is likely to continue to evolve as the Indian economy becomes increasingly integrated with the global financial system. The government may introduce further measures to streamline the transfer process and enhance transparency. Advances in technology, such as online remittance platforms, are also likely to play a significant role in facilitating easier and more efficient transfers.

However, it's important for NRIs to remain vigilant and adapt to these changes. By staying informed and seeking expert advice, they can ensure that they are managing their finances effectively and compliantly. The key takeaway is that understanding the nuances of NRO account transfers is essential for sound financial planning.