Tsly Next Dividend Date 2024 Announcement

The cryptocurrency markets are buzzing with anticipation as investors eagerly await the next dividend distribution date for TSLY, a popular exchange-traded fund (ETF) that tracks the performance of Tesla. Fluctuations in Tesla's stock price directly impact TSLY's profitability, making the announcement a crucial event for shareholders seeking consistent income. This announcement will determine the yield they can expect and influence investment decisions across the board.

At the heart of this investor interest is TSLY's unique approach: it generates income by selling covered call options on Tesla (TSLA) shares. This strategy can provide substantial yields, but it also introduces complexity and risk. The upcoming dividend announcement, expected in July 2024, will provide critical information about the fund's recent performance and future payouts, directly impacting shareholder confidence and investment strategies.

TSLY's Dividend Mechanism: A Detailed Look

TSLY, managed by REX Shares, aims to provide investors with a high current income by employing a strategy centered around covered calls. These calls are written on Tesla (TSLA) stock. The premiums received from selling these options are then distributed to shareholders as dividends.

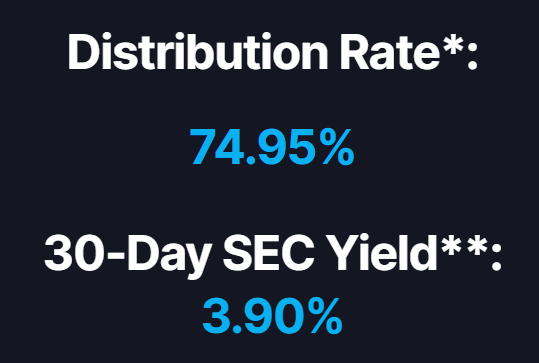

The fund's yield is significantly influenced by several factors. These include Tesla's stock volatility, prevailing interest rates, and the overall market sentiment towards technology stocks. Option premiums tend to be higher when volatility is high, potentially leading to larger dividend payouts.

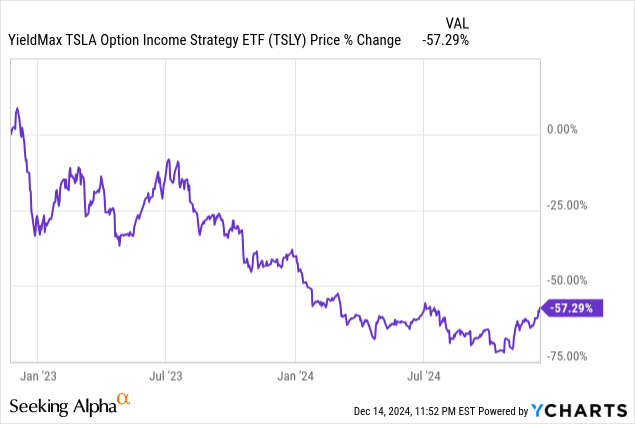

However, there's a tradeoff. If Tesla experiences a significant price surge, TSLY might miss out on some of the upside because the call options cap the potential gains. Conversely, if Tesla's price declines, TSLY's returns will be negatively impacted, though the option premiums can partially offset the losses.

Anticipated Announcement: What to Expect

While the exact date and amount of the next TSLY dividend haven't been officially announced, historical trends offer some clues. Typically, REX Shares announces the dividend details towards the end of each month. The payout usually follows a few days later.

Investors should closely monitor the official REX Shares website and reputable financial news outlets for the announcement. Expect detailed information regarding the record date, payable date, and the dividend amount per share. The amount is usually reported in dollars per share ($/share).

The market's reaction to the announcement will largely depend on whether the dividend meets, exceeds, or falls short of expectations. Higher-than-expected dividends typically lead to a short-term increase in TSLY's price, while lower-than-expected dividends can cause a sell-off.

Factors Influencing the Dividend Payout

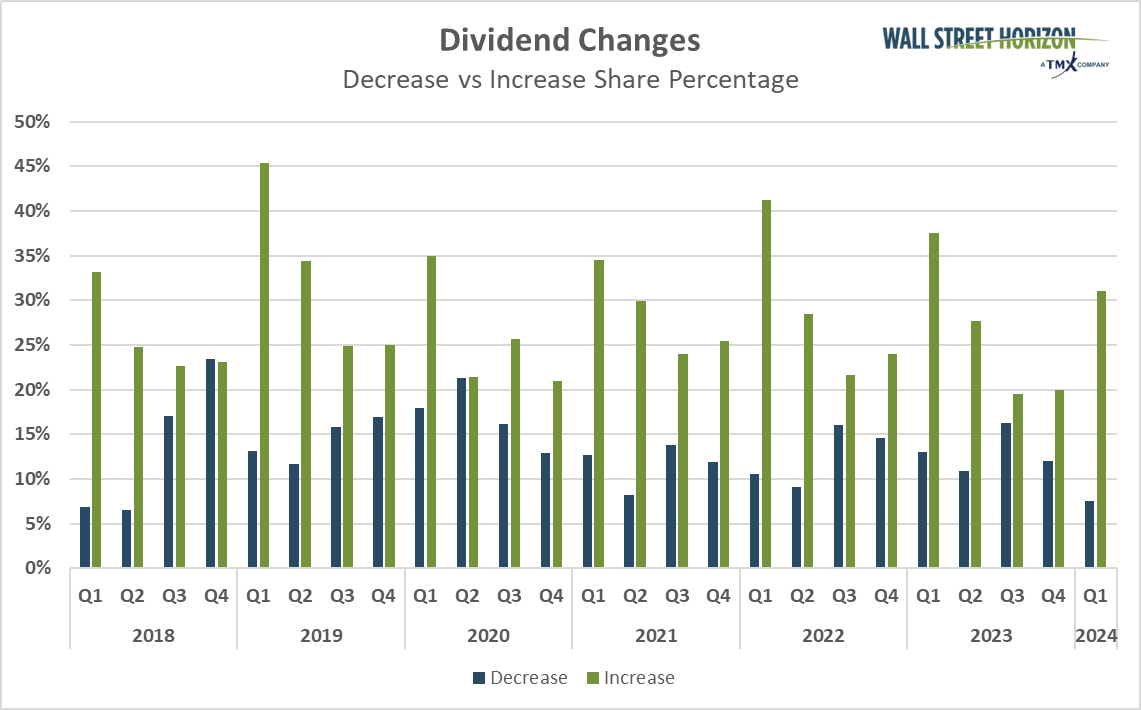

Several key factors will influence the upcoming TSLY dividend. Tesla's stock price fluctuations in the weeks leading up to the announcement are a primary driver. Increased trading volume and volatility will affect the premiums that TSLY receives from selling covered calls.

Changes in implied volatility, as reflected in the VIX index and specific option pricing models for Tesla, play a critical role. Economic data releases and broader market trends will also indirectly impact the sentiment towards TSLA and, subsequently, TSLY’s ability to generate returns.

Regulatory changes, interest rate movements, and broader market conditions must be carefully assessed for a complete picture. REX Shares’ strategy decisions regarding call options (strike price and expiration dates) also determine outcome. These choices have a significant bearing on TSLY's potential income.

Potential Risks and Rewards

Investing in TSLY involves a unique set of risks and rewards that investors should carefully consider. The high dividend yield is attractive, but it's important to remember that this yield is not guaranteed and can fluctuate significantly.

TSLY's reliance on a single stock, Tesla, creates concentration risk. Any negative news or events impacting Tesla will directly affect TSLY's performance.

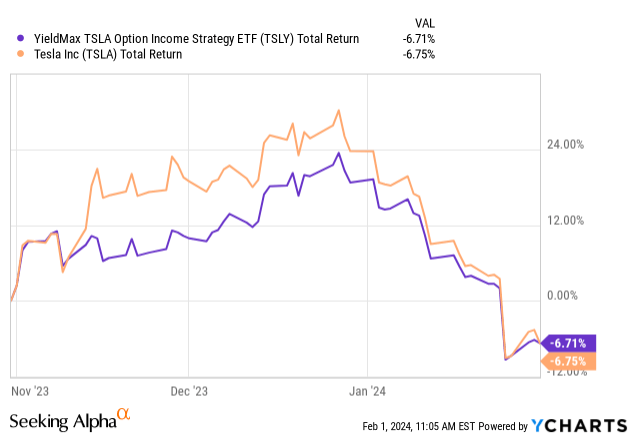

Furthermore, the covered call strategy limits the potential upside. During strong Tesla rallies, TSLY will underperform compared to simply holding Tesla stock. Investors should assess their risk tolerance and investment goals before investing in TSLY.

Expert Opinions and Market Outlook

Financial analysts hold varied opinions on TSLY. Some see it as an attractive income-generating investment, particularly in a low-interest-rate environment. Others express caution due to the inherent risks associated with the covered call strategy and the concentration risk related to Tesla.

Market experts generally advise investors to view TSLY as a component of a well-diversified portfolio. They recommend conducting thorough research and understanding the fund's strategy before investing.

The future performance of TSLY will depend on a combination of factors. These include Tesla's stock performance, market volatility, and the overall economic environment. Investors should continuously monitor these factors to make informed decisions.

Conclusion: Making Informed Investment Decisions

The upcoming TSLY dividend announcement is a pivotal event for investors seeking high-yield income from the technology sector. While the fund offers a compelling income stream, it's crucial to be aware of the risks involved.

By carefully evaluating Tesla's performance, market conditions, and the fund's strategy, investors can make informed decisions aligned with their financial goals. The information contained in this article is intended as an information source and should not be considered financial advice.

It is recommended that investors consult with a qualified financial advisor before making any investment decisions regarding TSLY. Continuous monitoring of official announcements and market trends is essential for managing risk and maximizing potential returns.

.png)