48 Crypto Exchanges Approved In The Philippines

The Philippines has quietly emerged as a significant hub for cryptocurrency adoption and trading, a reality underscored by the sheer number of registered and operating virtual asset service providers (VASPs) in the country. While global regulatory landscapes surrounding digital assets remain murky, the Southeast Asian nation has taken a more proactive, if cautious, approach to integrating cryptocurrencies into its financial system. The surprising revelation: nearly 50 crypto exchanges are now officially sanctioned to operate within Philippine borders, a figure that signals both opportunity and potential challenges for the burgeoning digital asset market.

This burgeoning ecosystem is not without its complexities. The central question remains: How will the Philippines balance the innovative potential of cryptocurrencies with the need to protect investors and maintain financial stability in a rapidly evolving digital landscape? This article delves into the specifics of this regulatory approval surge, explores its implications for the Philippine economy and the broader crypto industry, and examines the potential hurdles that lie ahead as the country navigates the intricacies of digital finance.

Bangko Sentral ng Pilipinas (BSP) and VASP Licensing

The Bangko Sentral ng Pilipinas (BSP), the country's central bank, is the primary regulatory body overseeing virtual asset service providers (VASPs). The BSP’s approach, rooted in a risk-based and activity-based framework, aims to foster innovation while mitigating potential threats associated with cryptocurrency transactions. This framework is crucial to understanding the high number of approved exchanges.

Under Circular No. 1108, the BSP requires VASPs to obtain a Certificate of Authority to operate. This rigorous process involves demonstrating compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as meeting specific capital requirements and cybersecurity standards. The approval of 48 exchanges reflects a deliberate, albeit potentially gradual, integration of cryptocurrencies within established financial structures.

The BSP's licensing framework is designed to protect consumers and maintain the integrity of the financial system. The high number of approved VASPs suggests a degree of comfort from the BSP that these entities can operate responsibly within the existing regulatory environment. This number, however, could fluctuate as the central bank monitors and updates its requirements over time.

The Appeal of the Philippine Crypto Market

Several factors contribute to the Philippines' attractiveness as a crypto hub. The country boasts a large, tech-savvy population, with high mobile phone penetration and increasing internet access. This demographic landscape creates a fertile ground for crypto adoption, particularly among younger generations seeking alternative investment opportunities.

Remittances from overseas Filipino workers (OFWs) also play a significant role. Cryptocurrencies offer a potentially faster and cheaper way to send money home compared to traditional remittance services. The relatively high cost of traditional remittance services incentivizes many OFWs to explore digital alternatives.

Furthermore, the Philippines' relatively open regulatory environment, compared to some other countries in the region, encourages both local and international crypto businesses to establish operations. The perceived clarity provided by the BSP's regulations, even with their stringency, creates a more predictable operational landscape.

Breakdown of Approved Exchanges and Services

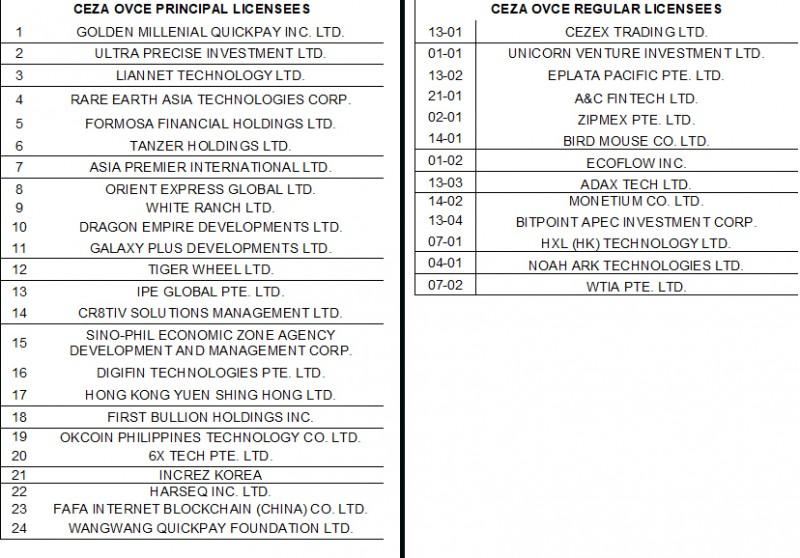

While the exact names and market shares of all 48 approved exchanges are not publicly available in a single, consolidated list, it's understood that they encompass a range of services. These include spot trading, cryptocurrency wallets, and even over-the-counter (OTC) trading desks. The specific offerings of each VASP vary significantly.

Some of the more well-known and established players include Binance, Coinbase (which has limited operational aspects in the Philippines), and several locally founded exchanges. These major exchanges often handle a significant portion of the trading volume and offer a wider range of cryptocurrency pairs and services.

The presence of both international and local exchanges highlights the maturity of the Philippine crypto market. The diverse range of services available caters to both experienced traders and newcomers to the crypto space.

Challenges and Risks

Despite the positive growth, the Philippine crypto market faces significant challenges. The risk of fraud and scams remains a major concern. Many individuals are vulnerable to schemes promising unrealistic returns, highlighting the need for increased investor education and awareness campaigns.

The fluctuating nature of cryptocurrency prices also poses a risk to investors. The lack of a comprehensive regulatory framework for stablecoins and other emerging crypto assets adds further complexity. The volatile nature of the crypto market warrants extra caution for risk-averse investors.

Furthermore, the potential use of cryptocurrencies for money laundering and other illicit activities is a constant concern for regulators. The BSP must remain vigilant in enforcing AML/CTF regulations to prevent the misuse of digital assets. Continued regulatory updates and enforcement are crucial for maintaining market integrity.

Investor Protection and Education

The BSP, along with other government agencies, has emphasized the importance of investor protection. Public awareness campaigns are crucial to educating Filipinos about the risks associated with cryptocurrencies. These campaigns should provide clear and accessible information about digital asset investments.

VASPs also have a responsibility to educate their users about the risks involved in trading cryptocurrencies. This includes providing clear disclaimers and offering resources for users to learn more about digital assets. Transparent and responsible communication is key to building trust in the market.

Beyond awareness campaigns, collaboration between regulators, exchanges, and industry stakeholders can foster a more secure and informed crypto ecosystem. Collective efforts are needed to mitigate risk and promote responsible investing. This includes developing educational resources tailored to different levels of experience and risk tolerance.

Future Outlook

The Philippine crypto market is poised for further growth, but its trajectory will depend on several factors. Continued regulatory clarity and innovation-friendly policies will be crucial to attracting investment and fostering sustainable growth. Striking the right balance is essential for long-term success.

The adoption of new technologies, such as blockchain-based solutions for payments and remittances, could further accelerate the growth of the crypto market. Exploring and implementing these technologies will unlock new opportunities. The potential for innovation remains significant.

Ultimately, the success of the Philippine crypto market will depend on its ability to address the challenges and risks associated with digital assets while harnessing their innovative potential. The future success hinges on robust regulation, investor protection, and technological advancement. The 48 approved exchanges represent a significant step forward, but the journey is far from over.

.webp)

![48 Crypto Exchanges Approved In The Philippines 8 Best Crypto Exchanges In The Philippines 2023 [Compared] | HWC](https://cdn.sanity.io/images/hmujj720/production/765f50db985fdd73b5fb00411b4ebcff549c5d7a-1200x600.jpg)