Type 1 Vs Type 2 Subsequent Event

The recent bankruptcy filing of GlobalTech Industries has brought renewed attention to the critical, yet often misunderstood, accounting concepts of Type 1 and Type 2 subsequent events.

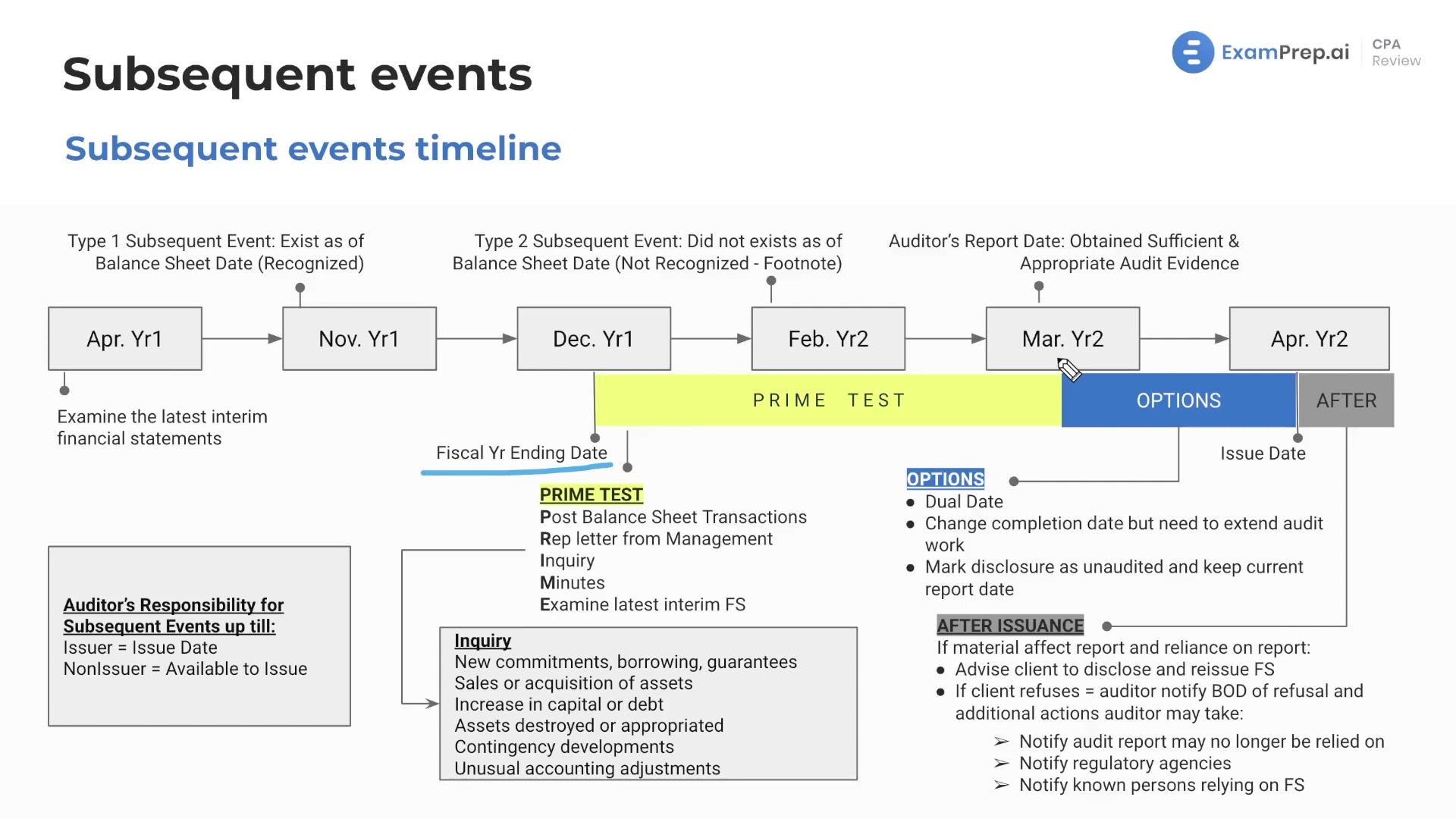

These classifications dictate how events occurring after the balance sheet date, but before the financial statements are issued, are treated, impacting everything from investor confidence to legal liabilities. The distinction, rooted in Generally Accepted Accounting Principles (GAAP), hinges on whether the event provides new information about conditions that existed at the balance sheet date or relates to conditions that arose after that date.

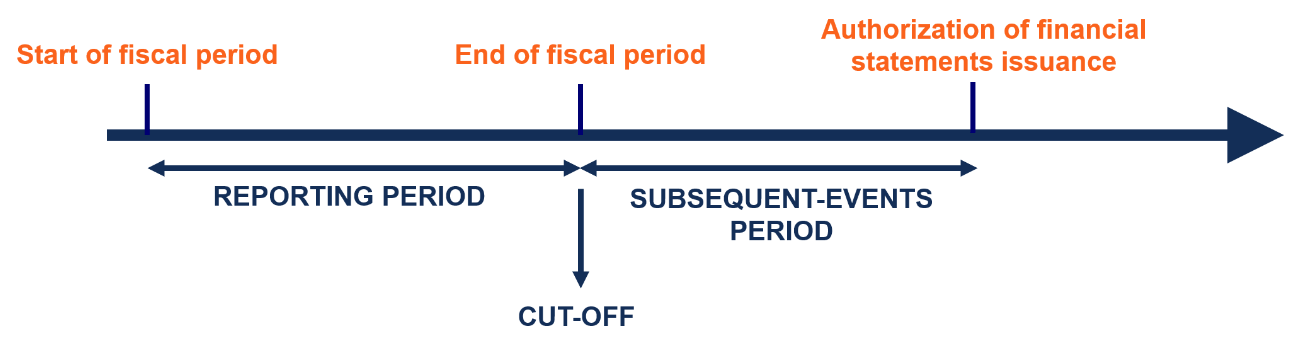

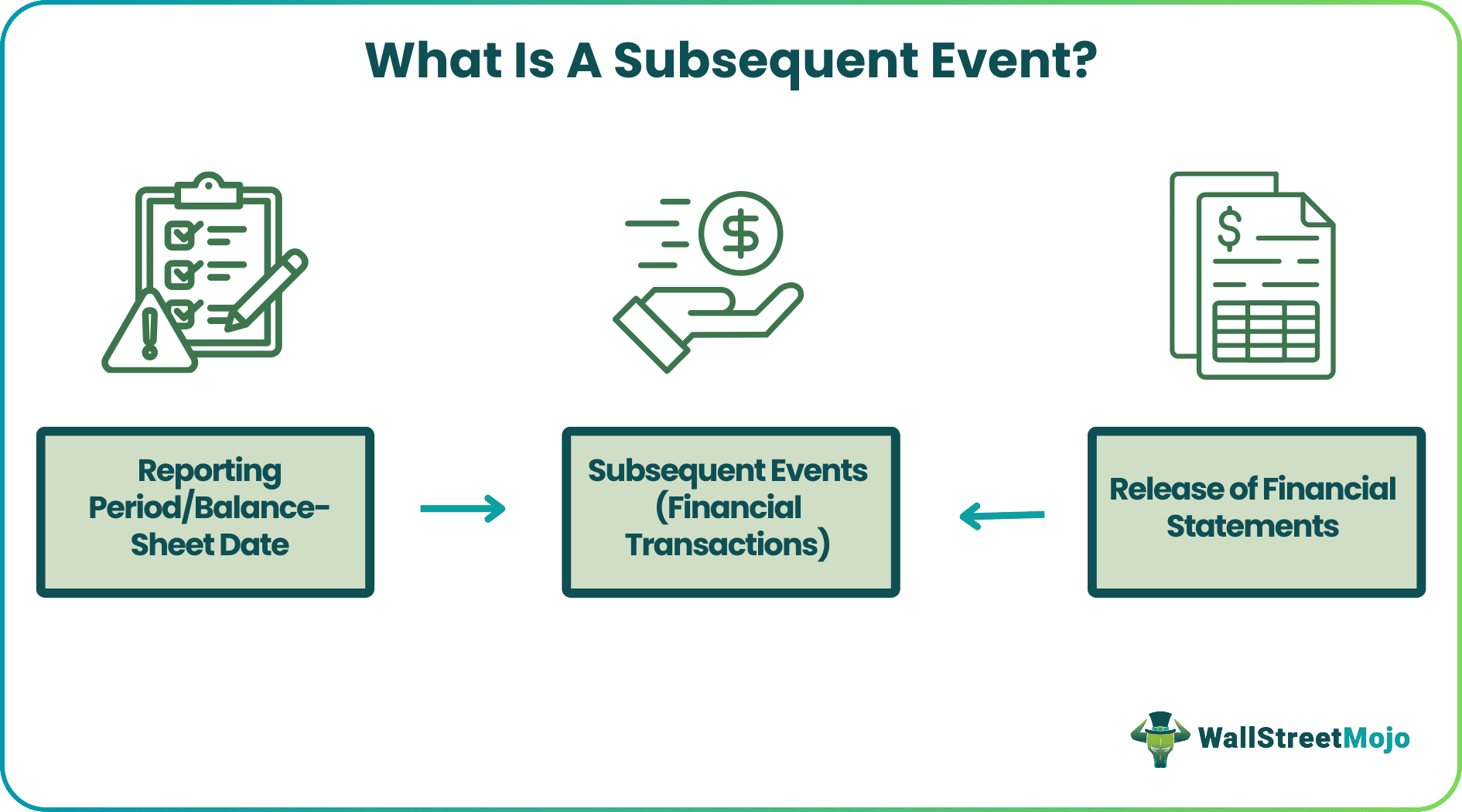

Understanding Subsequent Events

Subsequent events, also known as events after the reporting period, represent significant occurrences that transpire between a company’s balance sheet date and the date its financial statements are issued or are available to be issued. These events can dramatically alter a company's financial standing, making their proper accounting crucial for accurate representation. The Financial Accounting Standards Board (FASB) provides guidance on how to handle these situations within GAAP.

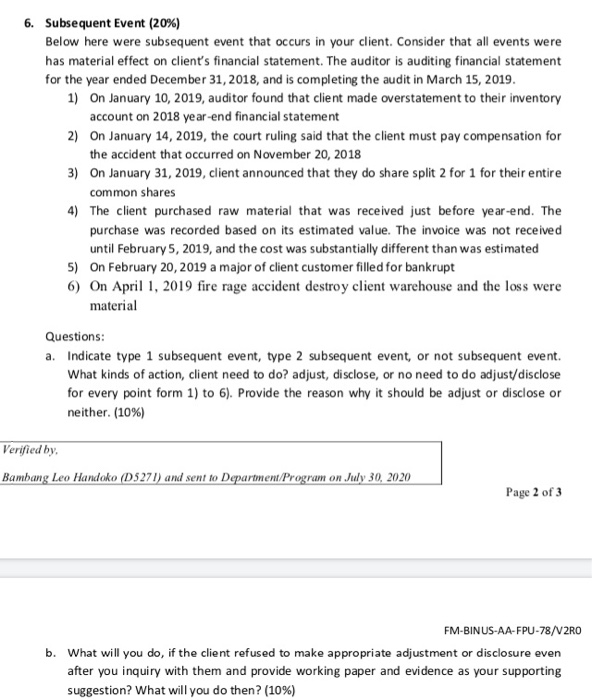

Type 1 Subsequent Events: Providing New Information

Type 1 subsequent events, often called "recognized subsequent events," offer further evidence about conditions that already existed at the balance sheet date. This means that the event sheds light on a situation that was uncertain or unresolved at the year-end. These events require adjustments to the financial statements to reflect the new information.

Consider a legal dispute pending at year-end, where an unfavorable court ruling is received after the balance sheet date but before the financials are issued. This resolution provides concrete information about a liability that existed at year-end, requiring an adjustment to reflect the loss. Another example might be the discovery of significant inventory obsolescence that existed at the balance sheet date.

The company would need to adjust its financial statements to reflect the newly discovered loss in inventory value. Failing to properly account for Type 1 events can lead to misstated financial statements and potential legal ramifications.

Type 2 Subsequent Events: Indicating New Circumstances

Type 2 subsequent events, sometimes termed "non-recognized subsequent events," relate to conditions that arose after the balance sheet date. These events do not require adjustments to the financial statements themselves. Instead, they necessitate disclosure in the notes to the financial statements if they are considered material.

Materiality, in this context, means that the event is significant enough to influence the decisions of financial statement users. An example would be a major fire at a company's factory after year-end, or a significant acquisition or disposal of a business segment.

These events did not impact the company's financial position at the balance sheet date but could substantially affect its future operations and profitability. Disclosing Type 2 events allows stakeholders to understand the evolving landscape and make informed investment decisions.

The GlobalTech Industries Bankruptcy: A Case Study

The GlobalTech Industries bankruptcy, filed two months after its fiscal year-end, highlights the practical importance of understanding these accounting principles. The question is whether the conditions leading to the bankruptcy existed at the balance sheet date (Type 1) or arose subsequently (Type 2). The answer dictates how the event impacts the company's financial reporting.

If the company was already facing severe financial distress, unsustainable debt levels, and declining sales at the balance sheet date, the bankruptcy could be considered a Type 1 event. In this case, the financials would need to be adjusted to reflect the impaired value of assets and increased liabilities. On the other hand, if the bankruptcy was triggered by a sudden, unforeseen event, like the loss of a major contract or a catastrophic market downturn after the year-end, it would likely be classified as a Type 2 event.

In this scenario, the bankruptcy would be disclosed in the notes to the financial statements, providing users with context about the company's future prospects.

Impact and Implications

The correct classification of subsequent events has far-reaching consequences. Misclassification can lead to inaccurate financial reporting, misleading investors, and potential legal issues. Auditors play a crucial role in evaluating management's assessment of subsequent events and ensuring that the financial statements fairly present the company's financial position.

Investors rely on accurate financial information to make investment decisions. Lenders use financial statements to assess creditworthiness. Regulators, like the Securities and Exchange Commission (SEC), enforce accounting standards to protect investors and maintain market integrity.

Properly accounting for subsequent events is not merely a technical exercise; it is essential for maintaining transparency and fostering trust in the financial markets.

Conclusion

The distinction between Type 1 and Type 2 subsequent events is a cornerstone of sound financial reporting. While seemingly nuanced, this distinction can have a profound impact on a company's financial statements and its stakeholders.

As the GlobalTech Industries case demonstrates, understanding these principles is critical for ensuring that financial statements provide a true and fair view of a company's financial position and performance. By adhering to GAAP and exercising professional judgment, companies and their auditors can navigate the complexities of subsequent events and maintain the integrity of the financial reporting process.