United States Antimony Corporation Quarterly Report

The United States Antimony Corporation (USAC), a key player in the domestic antimony market, recently released its quarterly report, painting a picture of challenges and strategic maneuvering amidst fluctuating market conditions and persistent operational hurdles. The report highlights a complex interplay of increased production costs, supply chain disruptions, and shifting demand dynamics, demanding a closer examination of the company's current state and future prospects.

This article dives deep into USAC's latest quarterly performance, analyzing the key financial metrics, operational updates, and strategic initiatives outlined in the report. It will provide an objective assessment of the company's current situation, considering both the headwinds it faces and the opportunities it seeks to capitalize on. Furthermore, it will explore the broader implications of USAC's performance on the US antimony market and the industries that rely on this critical mineral.

Financial Performance Overview

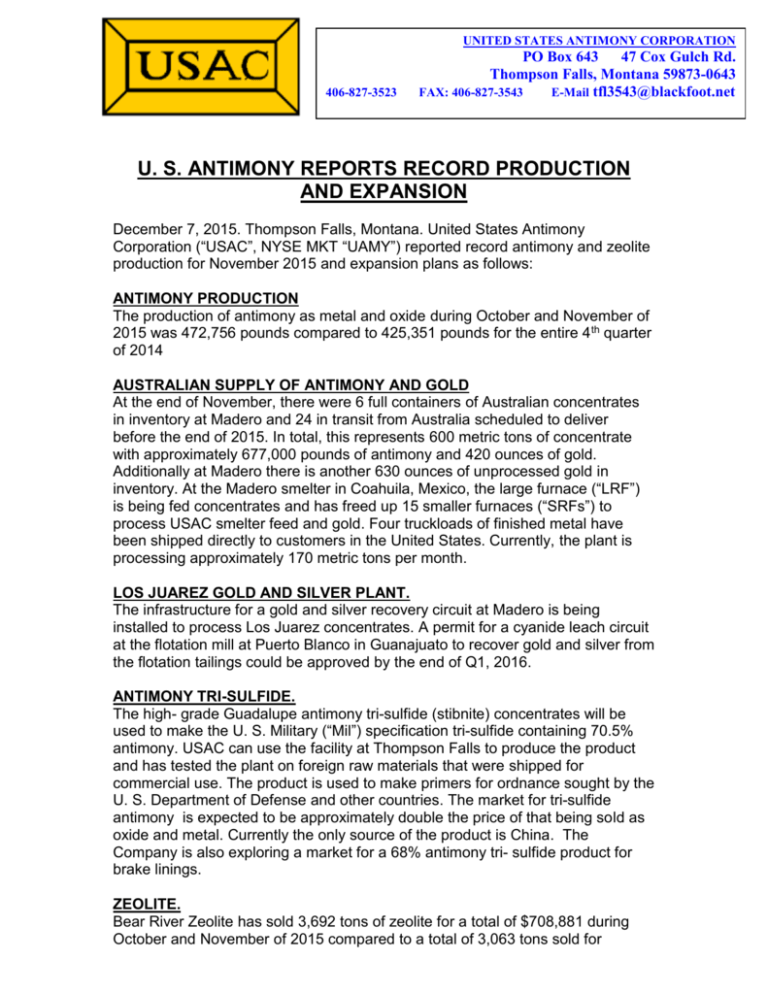

USAC's quarterly report reveals a mixed bag of results. While specific figures require careful analysis of the official filings, preliminary assessments suggest a challenging quarter characterized by increased production costs and potentially lower sales volume compared to previous periods.

Analysts point to several factors contributing to this performance, including the rising cost of raw materials, ongoing supply chain bottlenecks affecting the procurement of essential supplies, and increased energy expenses related to mining and processing operations. These factors collectively put pressure on USAC's profit margins.

Cost of Goods Sold

The Cost of Goods Sold (COGS) appears to be a significant area of concern for USAC. The report likely details a rise in COGS due to higher raw material prices, increased labor costs, and escalating energy expenses.

This increase directly impacts the company's profitability, requiring USAC to either raise prices, which could affect demand, or absorb the costs, further reducing profit margins. Effectively managing COGS is crucial for USAC to maintain a competitive edge.

Revenue and Sales Volume

Information regarding USAC's revenue and sales volume requires careful scrutiny of the official report. It is likely that revenue may have been impacted by both pricing fluctuations and sales volume, possibly impacted by slower activity due to a challenging economy.

Understanding the specific drivers behind any revenue changes is crucial. Did lower sales volume contribute more significantly, or were price fluctuations the primary factor?

Operational Challenges and Strategic Responses

Beyond the financial figures, USAC's quarterly report sheds light on the operational challenges the company faces and the strategic responses it is undertaking to address them. These challenges include supply chain disruptions, regulatory compliance hurdles, and the need to optimize production processes.

USAC's management has outlined specific initiatives to mitigate these challenges, including exploring alternative sourcing options, investing in process improvements to enhance efficiency, and engaging with regulatory bodies to ensure compliance. These strategic moves aim to strengthen the company's long-term sustainability.

Supply Chain Disruptions

The global supply chain continues to be a source of disruption for many industries, and USAC is no exception. Delays in the delivery of essential supplies, coupled with rising transportation costs, impact the company's ability to maintain consistent production levels.

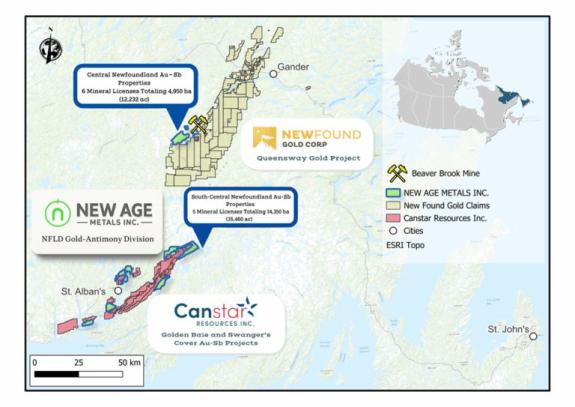

USAC is actively seeking to diversify its supplier base and explore domestic sourcing options to mitigate these risks. These moves may help the company reduce its reliance on volatile international markets and strengthen its supply chain resilience.

Environmental and Regulatory Compliance

Mining and processing operations are subject to stringent environmental regulations. USAC is committed to adhering to these regulations and continuously improving its environmental performance.

The company invests in technologies and practices that minimize its environmental impact and ensure responsible resource management. Meeting and exceeding regulatory standards is not only a legal requirement but also a key aspect of USAC's commitment to sustainable operations.

Market Dynamics and Future Outlook

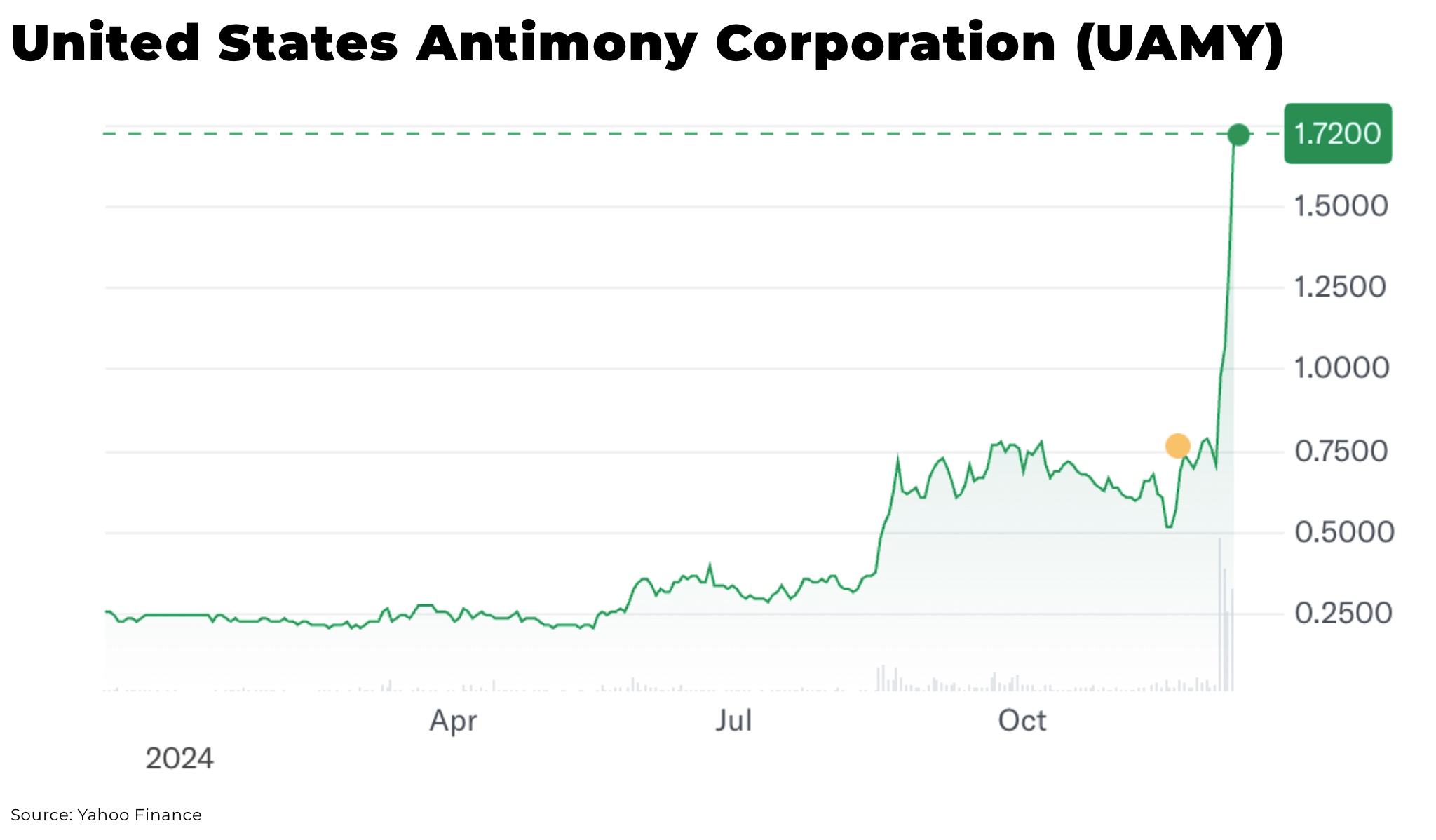

The antimony market is influenced by a variety of factors, including global economic conditions, geopolitical developments, and technological advancements. USAC's quarterly report provides insights into how these factors are shaping the demand and supply dynamics of antimony.

Looking ahead, USAC aims to capitalize on the growing demand for antimony in various applications, including flame retardants, batteries, and alloys. The company is also exploring opportunities to expand its product offerings and diversify its customer base.

Antimony Demand and Applications

The demand for antimony is closely tied to the growth of industries that rely on its unique properties. The increasing use of antimony in flame retardants for textiles and plastics, as well as its role in battery technologies, is expected to drive future demand.

USAC is positioning itself to capitalize on these trends by investing in research and development to create innovative antimony-based products that meet the evolving needs of the market.

Strategic Partnerships and Growth Opportunities

USAC is actively seeking strategic partnerships and growth opportunities to expand its market reach and enhance its competitive position. Collaborations with other companies in the mining and materials industries can provide access to new technologies, resources, and markets.

These partnerships can also enable USAC to diversify its product portfolio and reduce its reliance on specific applications. A well-defined growth strategy is essential for USAC to achieve its long-term objectives.

Conclusion

The latest quarterly report from the United States Antimony Corporation reveals a company navigating a complex and challenging market environment. While facing headwinds related to increased production costs, supply chain disruptions, and regulatory compliance, USAC is implementing strategic initiatives to mitigate these challenges and capitalize on future growth opportunities.

The company's performance in the coming quarters will depend on its ability to effectively manage costs, optimize production processes, and leverage strategic partnerships. The market will be watching closely to see how USAC executes its plans and adapts to the evolving dynamics of the antimony market.

Ultimately, USAC's success hinges on its ability to innovate, adapt, and maintain a strong focus on operational efficiency and sustainable practices. The company's commitment to these principles will be key to unlocking its long-term potential and solidifying its position in the US antimony market.