Fortress Transportation And Infrastructure Investor Relations

Shares of Fortress Transportation and Infrastructure Investors LLC (FTAI) have experienced notable volatility in recent months, prompting increased scrutiny of the company's investor relations strategies and overall financial health.

Investors are seeking greater clarity regarding FTAI's long-term strategy, particularly in light of evolving market conditions and recent infrastructure developments.

This article examines FTAI's investor relations efforts, recent financial performance, and the potential impact on stakeholders.

FTAI: A Focus on Infrastructure

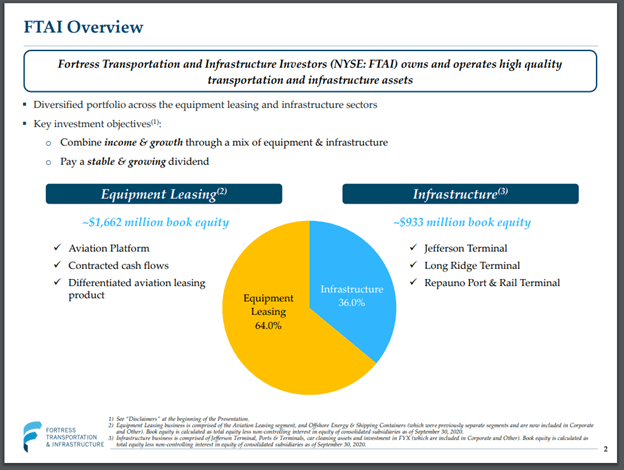

FTAI, headquartered in New York, invests in and manages infrastructure and equipment across various sectors, including aviation, energy, and rail.

The company's portfolio includes assets like jet engines, ports, and rail lines, generating revenue through leasing, management fees, and direct ownership.

FTAI's investment strategy centers on acquiring assets at attractive valuations and enhancing their performance through operational improvements and strategic repositioning.

Investor Relations Under the Microscope

Effective investor relations are crucial for companies like FTAI, ensuring transparency and fostering confidence among shareholders and potential investors.

FTAI's investor relations team is responsible for communicating the company's strategy, financial results, and outlook to the investment community.

Key activities include quarterly earnings calls, investor conferences, and the dissemination of press releases and regulatory filings.

In recent years, some investors have expressed concerns about the complexity of FTAI's business model and the opacity of certain financial transactions.

These concerns have led to calls for improved communication and greater transparency regarding the company's investment decisions and risk management practices.

Recent Financial Performance

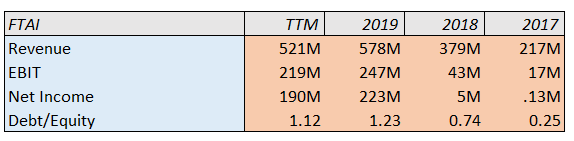

FTAI's financial performance has been influenced by factors such as global economic conditions, industry-specific trends, and the success of its investment projects.

Recent earnings reports have revealed both successes and challenges, with some segments of the business performing well while others face headwinds.

Notably, the aviation sector, a significant component of FTAI's portfolio, has been impacted by fluctuations in air travel demand and jet fuel prices.

The company's energy infrastructure investments have also been subject to volatility due to changing energy prices and regulatory developments.

FTAI's management has emphasized its commitment to maximizing shareholder value through disciplined capital allocation and strategic asset management.

Key Financial Metrics

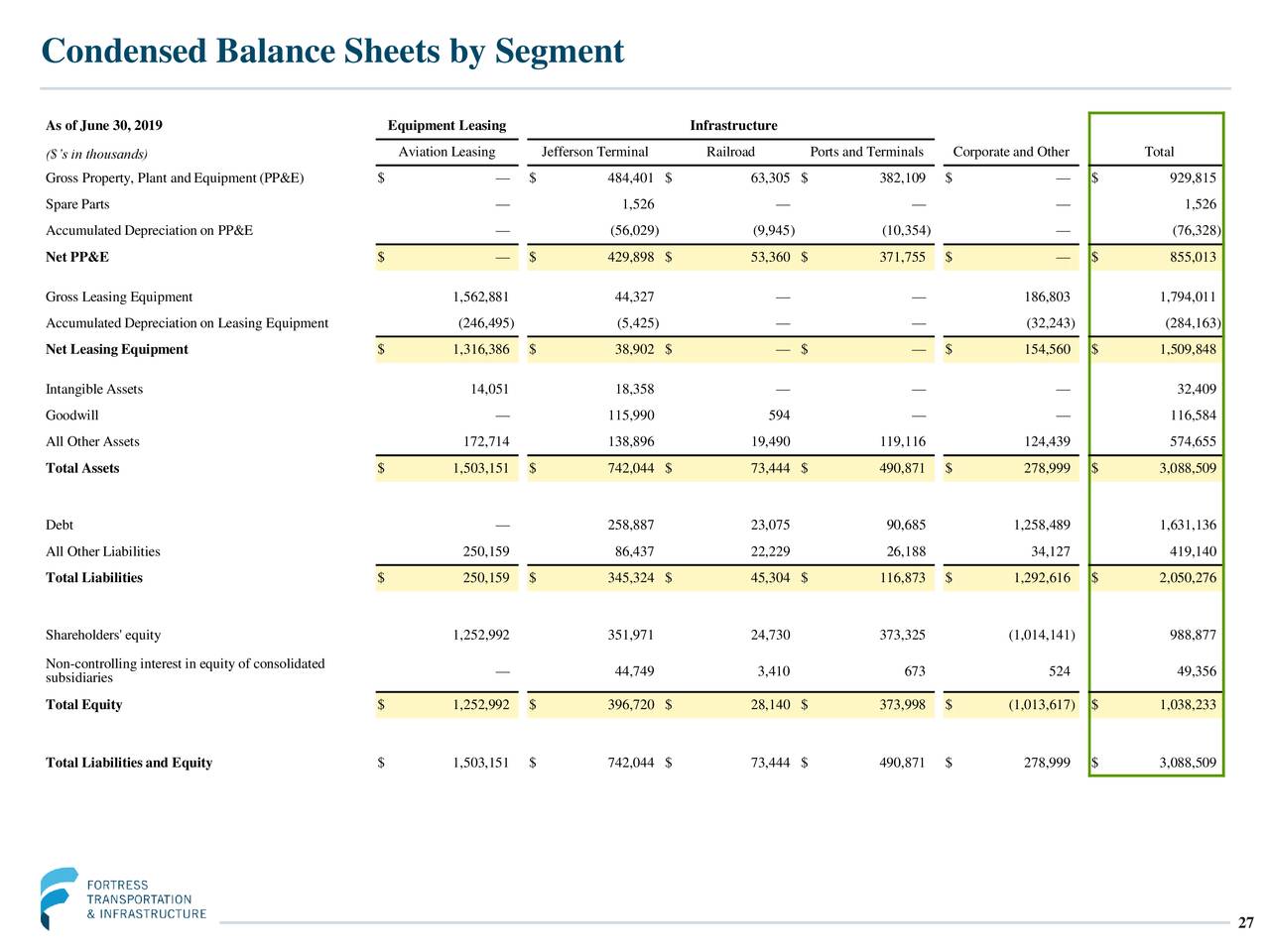

Investors closely monitor metrics such as revenue growth, earnings per share (EPS), and cash flow generation to assess FTAI's financial health.

The company's debt levels and capital expenditure plans are also key areas of focus for investors.

FTAI's ability to generate consistent cash flow and maintain a healthy balance sheet is crucial for sustaining investor confidence.

Impact on Stakeholders

FTAI's performance directly impacts its shareholders, employees, customers, and the communities where it operates.

Shareholders benefit from capital appreciation and dividend payments, while employees rely on the company for job security and career opportunities.

Customers depend on FTAI's infrastructure and equipment to support their own business operations.

Furthermore, FTAI's investments can contribute to economic growth and infrastructure development in the regions where it operates.

The Future of FTAI

The future of FTAI hinges on its ability to navigate evolving market conditions, execute its investment strategy effectively, and maintain strong relationships with its stakeholders.

The company's success will depend on its ability to identify and capitalize on emerging opportunities in the infrastructure sector.

Furthermore, maintaining transparent and effective investor relations will be critical for fostering trust and attracting capital.

FTAI's management team faces the challenge of balancing growth ambitions with the need to manage risk and maintain financial discipline.

The company's long-term success will ultimately depend on its ability to deliver sustainable value to its shareholders while also contributing to the broader economy.

Ultimately, Fortress Transportation and Infrastructure Investors' commitment to transparency and proactive communication will determine its ability to navigate the challenges and capitalize on the opportunities ahead.

Improved investor relations will build confidence and secure long-term value.