Upon Policy Delivery The Producer May Be Required To Obtain

Insurance producers nationwide face potential new requirements regarding client interaction post-policy delivery. Mandatory documentation of delivered policies and client acknowledgment are potentially on the horizon, impacting producer workflows significantly.

The proposed changes aim to increase transparency and accountability in the insurance sales process. They are driven by growing concerns about policy understanding and client satisfaction after the point of sale.

Proposed Requirements: A Closer Look

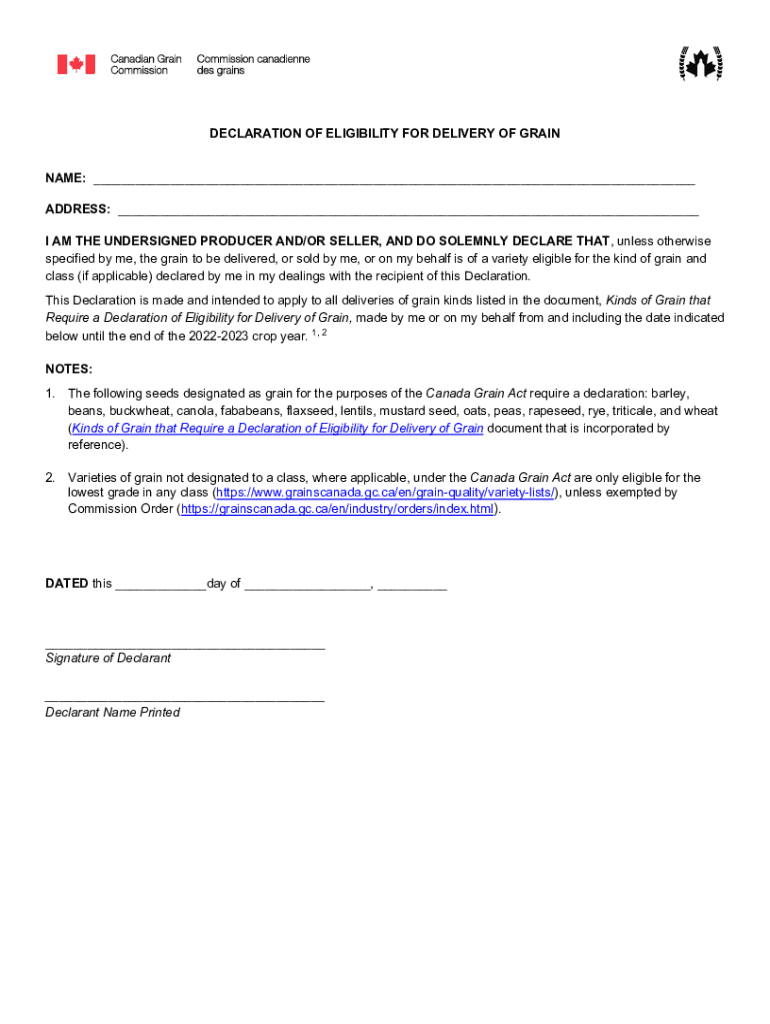

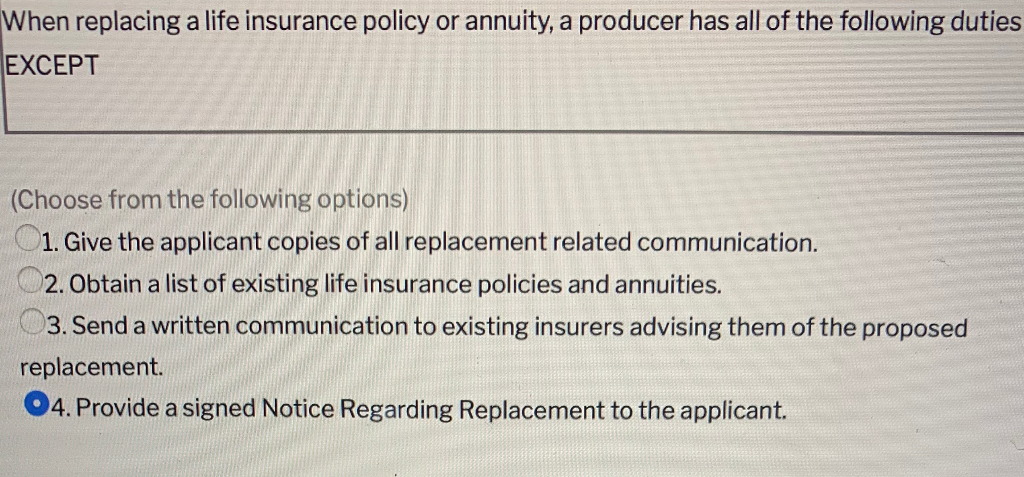

At the heart of the discussion is the introduction of a standardized Policy Delivery Acknowledgment Form. This form, currently under review by the National Association of Insurance Commissioners (NAIC), would require producers to confirm that the policy was delivered and discussed with the client.

Key data fields would include the date of delivery, the method of delivery (e.g., in-person, mail, electronic), and a summary of the key policy features explained to the client. Crucially, the client's signature, verifying their understanding of the policy, is being considered as a mandatory element.

Where would this apply? The rules would potentially impact all insurance lines, from life and health to property and casualty. It would be required nationally, not just in certain states.

Who Is Affected?

The most direct impact will be on insurance producers and agencies of all sizes. They will need to adapt their operational procedures to incorporate the new documentation requirements.

Insurance carriers will also be affected, potentially needing to provide standardized policy summaries. These summaries should be easily understandable by clients.

The Importance of Signed Acknowledgements

The potential requirement for a client signature is a critical point of contention. Advocates argue it provides concrete proof of policy delivery and understanding, protecting both the client and the producer.

Critics, however, worry about the administrative burden and potential for slowing down the sales process. They also raise concerns about clients’ willingness to sign such a form.

Implementation Timeline and Considerations

While a definitive implementation date has not been set, the NAIC is expected to issue a final recommendation by the end of the year. Many states will likely adopt the NAIC's model regulation relatively quickly.

The timing will likely be influence by pending legal challenges and further consultations with industry groups. There may be phased in introduction in certain states.

Navigating the Changes: What Producers Can Do Now

Producers should familiarize themselves with the proposed requirements and start evaluating their current delivery processes. This includes their documentation and communication protocols.

Investing in training for staff on effectively communicating policy details is crucial. It's important to document these trainings as well.

Exploring digital solutions for policy delivery and acknowledgment can streamline the process. These solution should also be compliant.

Expert Commentary

"This is a significant shift in the insurance landscape," says Jane Doe, a compliance expert at Insurance Regulations, Inc. "Producers need to be proactive in adapting to these changes to avoid potential penalties."

According to a recent survey by the Independent Insurance Agents & Brokers of America (IIABA), 65% of independent agencies are concerned about the potential administrative burden. They worry that the new rules would take time away from sales.

"We understand the concerns and are working to ensure a smooth transition," stated John Smith, a spokesperson for the NAIC. "Our goal is to protect consumers while minimizing the impact on producers."

Conclusion: Staying Informed and Prepared

The proposed policy delivery requirements are poised to reshape how insurance is sold and managed. Producers must remain informed about the developments and proactively adapt their business practices.

The NAIC will continue to provide updates and resources on its website. Producers are encouraged to monitor the site for the latest information and guidance.

Industry associations, such as the IIABA and the National Association of Professional Insurance Agents (PIA), are also valuable resources. They will be crucial in supporting their members through this transition.