Upon Policy Delivery The Producer May Be Required

The insurance industry is facing a potential paradigm shift. At issue are proposed regulations that could significantly alter the way life insurance policies are delivered and explained to consumers. States are considering mandates that would require insurance producers to be present at the time of policy delivery, raising questions about cost, accessibility, and the very definition of suitable advice.

This article delves into the core of this debate. It will uncover the potential ramifications of mandating producer involvement during policy delivery, and investigate the motivations behind these proposed changes. We'll also examine the arguments both for and against these measures. The impact on consumers, insurance companies, and producers themselves will be explored in detail.

The Proposed Mandate: A Closer Look

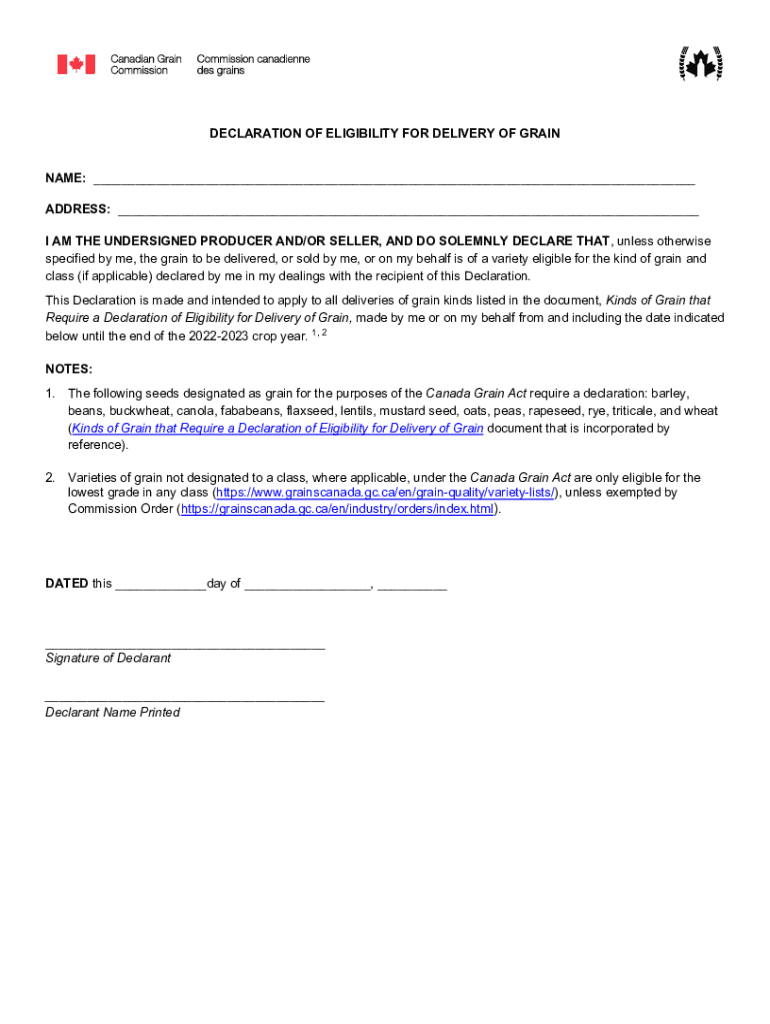

The premise behind these proposed mandates is consumer protection. Proponents argue that having a producer present at policy delivery ensures the consumer fully understands the policy's terms and conditions.

This face-to-face interaction is intended to address any lingering questions and prevent future misunderstandings. It's a direct response to concerns about the complexity of life insurance products and the potential for consumers to purchase policies that don't meet their needs.

The *National Association of Insurance Commissioners* (NAIC) has been actively involved in discussions surrounding suitability and consumer protection. Several states are taking cues from NAIC model regulations as they consider these new mandates.

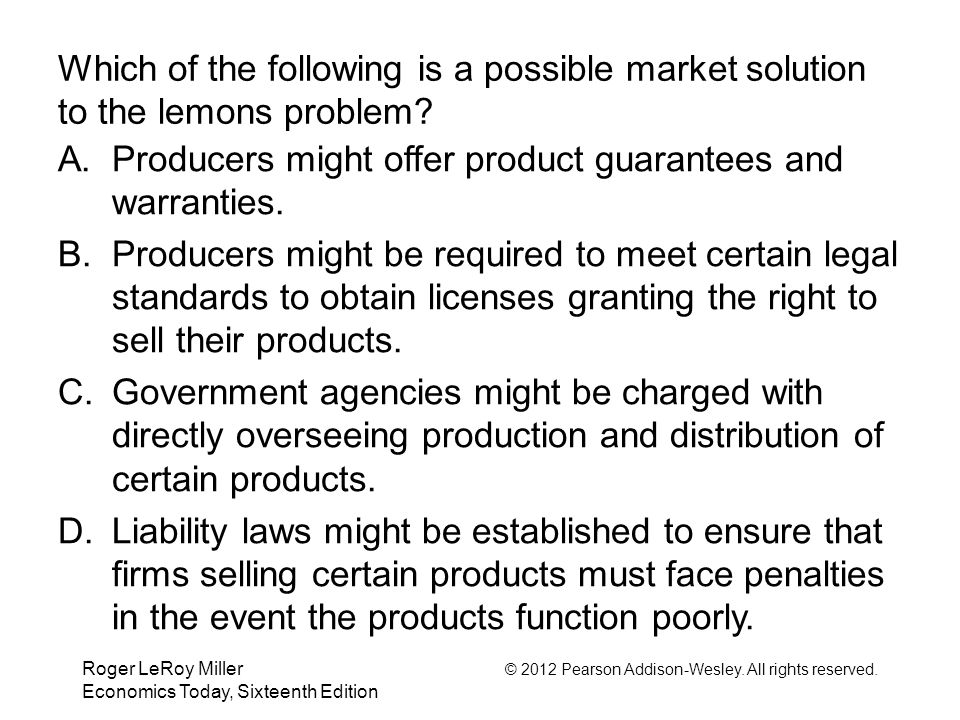

Arguments in Favor: Enhanced Consumer Understanding

Advocates of mandatory producer involvement during policy delivery stress the importance of personalized explanations. They contend that reading a policy document alone is often insufficient for consumers to grasp the intricacies of coverage, exclusions, and riders.

“Consumers need to understand what they are buying," says *Susan Miller*, a consumer advocate with the *Consumer Federation of America*. "A producer present at delivery can answer questions and clarify any confusion.”

The face-to-face interaction allows for a more interactive and tailored approach to explaining the policy's benefits. This may be especially crucial for individuals with limited financial literacy or those purchasing complex insurance products like variable life insurance.

Arguments Against: Increased Costs and Limited Access

Opponents of the mandate express concerns about increased costs and reduced accessibility. They argue that requiring a producer to be physically present for every policy delivery will add significant overhead for insurance companies and ultimately drive up premiums for consumers.

“This mandate adds an unnecessary layer of bureaucracy," claims *David Thompson*, CEO of the *American Council of Life Insurers* (ACLI). "It will disproportionately affect consumers in rural areas where producers may not be readily available."

Critics also point out that many consumers are comfortable with online or telephone-based policy explanations. Forcing an in-person meeting may be inconvenient and ultimately unnecessary for those who prefer alternative methods.

The Impact on Insurance Producers

Insurance producers are at the heart of this debate. The proposed mandates would undoubtedly alter their roles and responsibilities.

While some producers see this as an opportunity to strengthen client relationships and demonstrate their value, others worry about the logistical challenges and potential strain on their resources. The need to be physically present for every policy delivery could significantly impact their schedules and ability to serve a wide range of clients.

Furthermore, there are concerns about the potential for increased liability. If a producer is required to provide an explanation and the consumer later claims they didn't fully understand the policy, the producer could face legal repercussions.

"We need to ensure that any new regulations are practical and don't create undue burdens on producers," says Mark Johnson, President of the National Association of Insurance and Financial Advisors (NAIFA). "Our focus should be on providing consumers with the best possible advice and service, not simply complying with a mandated procedure."

Technology and the Future of Policy Delivery

The rise of technology has transformed many aspects of the insurance industry, including policy delivery. Online portals, video conferencing, and interactive digital tools offer alternative ways to explain policies and answer consumer questions.

Some argue that these technologies can provide a more efficient and cost-effective way to deliver policy information. However, others maintain that the human touch is essential, particularly when dealing with complex financial products.

The *Insurance Information Institute* (III) highlights the need for a balanced approach. They believe technology can supplement, but not necessarily replace, the role of the insurance producer.

Navigating the Regulatory Landscape

The future of mandatory producer involvement in policy delivery remains uncertain. State legislatures are actively considering the issue, and the regulatory landscape is constantly evolving.

It's crucial for insurance companies and producers to stay informed about these developments and adapt their practices accordingly. They must also work collaboratively with policymakers to ensure that any new regulations are in the best interests of both consumers and the industry.

The key will be finding a solution that balances consumer protection with affordability and accessibility. Open dialogue and collaboration among all stakeholders are essential to achieving this goal.

Conclusion: A Balancing Act

The debate surrounding mandatory producer involvement during policy delivery highlights the ongoing tension between consumer protection and the need for an efficient and affordable insurance market. While the intention to ensure consumers understand their policies is laudable, the practical implications of such a mandate require careful consideration.

Ultimately, the best approach may involve a combination of personalized advice from producers, enhanced digital tools, and robust consumer education initiatives. As the regulatory landscape continues to evolve, the insurance industry must remain committed to finding innovative ways to serve the needs of its customers while upholding the highest standards of ethical conduct.

The outcome of this debate will shape the future of life insurance distribution for years to come. It will also impact the way consumers interact with insurance products and the role of the producer in providing financial guidance.

.jpg)

.jpg)