U.s. Bancorp Declares Quarterly Dividends For Common And Preferred Stocks

U.S. Bancorp, one of the nation's largest financial institutions, announced its declaration of quarterly dividends for both its common and preferred stocks. This move signals the bank's continued financial stability and commitment to returning value to its shareholders.

The declaration, made public on [Insert Date - Search Official U.S. Bancorp News Releases for the actual date], reaffirms U.S. Bancorp's consistent dividend policy. It provides a predictable income stream for investors holding the company's stock.

Quarterly Dividends Declared

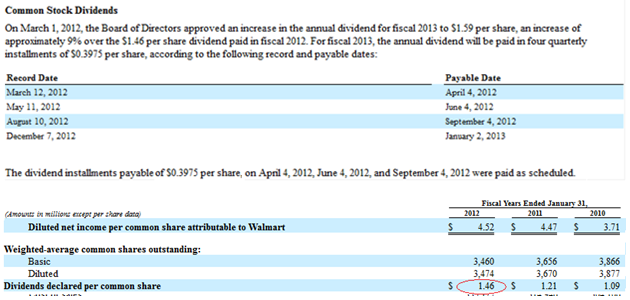

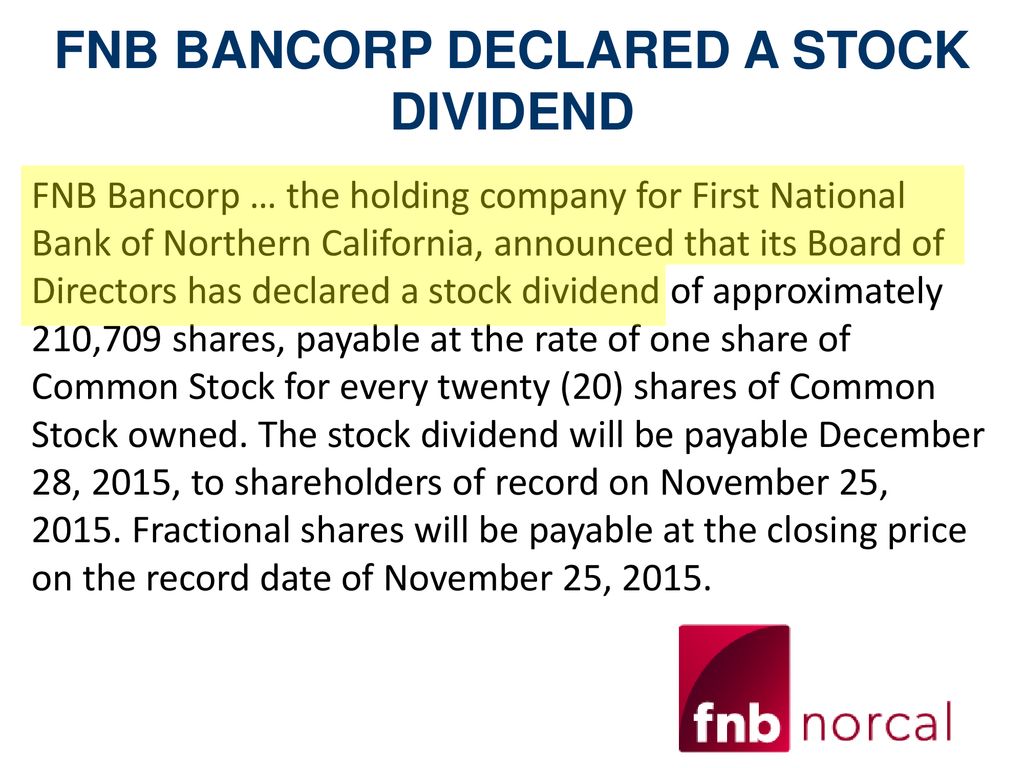

The U.S. Bancorp board of directors has declared a quarterly dividend of $0.48 per share on its common stock. This dividend is payable on [Insert Payment Date - Search Official U.S. Bancorp News Releases for the actual date] to stockholders of record as of [Insert Record Date - Search Official U.S. Bancorp News Releases for the actual date].

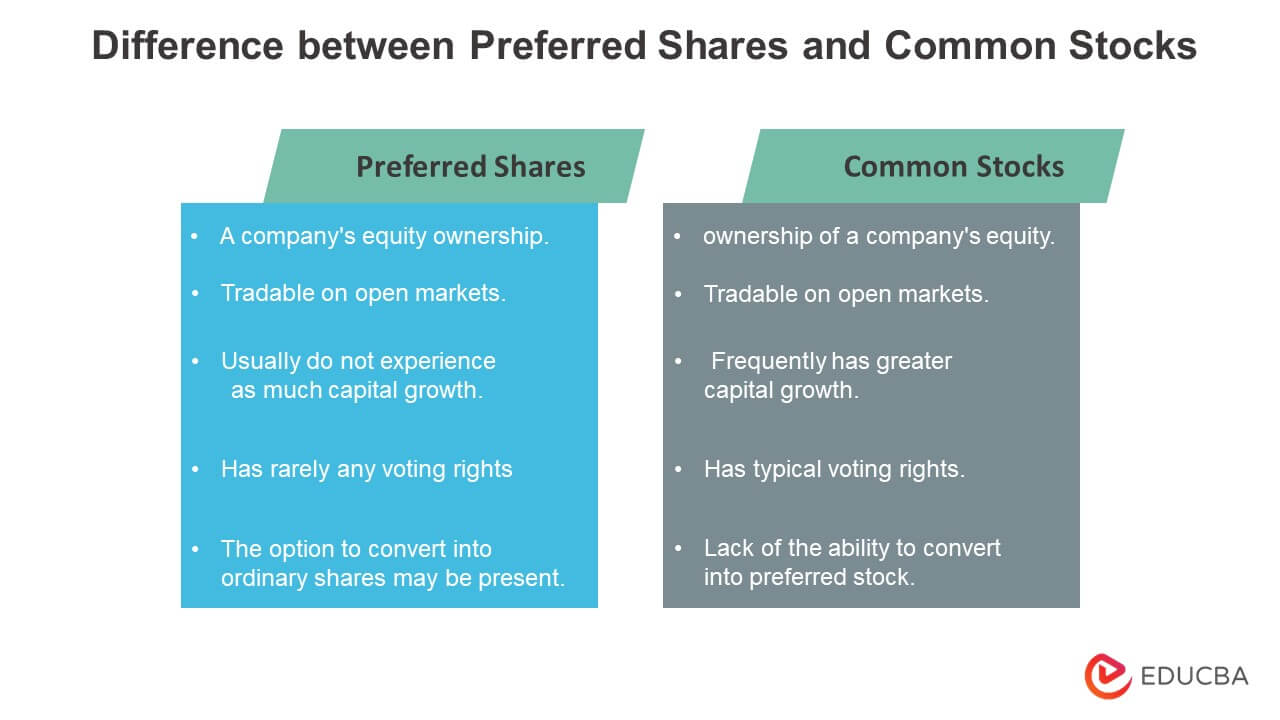

In addition to the common stock dividend, the board also declared dividends on several series of its preferred stock. These dividends will be paid according to the specific terms outlined for each series.

Specifics of Preferred Stock Dividends

The specific details concerning the preferred stock dividends can be found on the U.S. Bancorp investor relations website. This includes the series designations, dividend rates, and payment dates for each preferred stock offering.

Investors are encouraged to consult the official press release or the investor relations section of the U.S. Bancorp website for the comprehensive list of preferred stock dividends. This ensures accuracy and avoids any potential discrepancies.

"The declaration of these dividends reflects our strong capital position and our commitment to delivering value to our shareholders," said [Insert Name and Title of U.S. Bancorp Official - Search Official U.S. Bancorp News Releases for the actual name and title].

Significance and Impact

The declaration of quarterly dividends is often seen as a positive indicator of a company's financial health. It suggests the company is generating sufficient profits to not only cover its operational expenses but also return capital to its shareholders.

For investors, dividends represent a direct return on their investment. This offers a steady stream of income, independent of the stock's price fluctuations in the market.

The dividend yield, calculated by dividing the annual dividend per share by the stock's price, is a key metric for income-seeking investors. It allows them to compare the potential return from dividends across different investments.

Broader Market Context

U.S. Bancorp's dividend announcement comes amidst a period of fluctuating market conditions. Economic uncertainty and interest rate adjustments can impact the performance of financial institutions.

The banking sector, in particular, is closely monitored by investors due to its crucial role in the overall economy. Dividends can influence investor sentiment and confidence in the banking industry.

Analysts will likely scrutinize U.S. Bancorp's dividend declaration in conjunction with its earnings reports and financial outlook. This will provide a comprehensive assessment of the company's performance and future prospects.

Investor Information

U.S. Bancorp encourages investors to review its financial statements and disclosures for a complete understanding of its financial performance. This information is available on the company's investor relations website and through regulatory filings.

Individuals considering investing in U.S. Bancorp stock should consult with a qualified financial advisor. This helps ensure their investment decisions align with their individual financial goals and risk tolerance.

It is important for investors to conduct their own due diligence and research before making any investment decisions.

Conclusion

The declaration of quarterly dividends by U.S. Bancorp underscores its financial stability and commitment to shareholder value. The announcement provides clarity and a reliable income stream for investors holding both common and preferred stocks.

As the financial landscape continues to evolve, U.S. Bancorp's dividend policy reflects its confidence in its ability to navigate market challenges and deliver sustainable returns.

The market will closely observe U.S. Bancorp's performance in the coming quarters to assess the long-term sustainability of its dividend payments and overall financial health.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LI5WYS6QJ5HPBLCPFJXYJJK3RE.jpg)