Using Personal Funds To Start A Business

The aroma of freshly baked bread wafted through the air, mingling with the excited chatter of locals gathered outside a small, newly opened bakery. Sunlight streamed through the large front window, illuminating rows of golden croissants, crusty baguettes, and intricately decorated cakes. Inside, Sarah Miller, the bakery's owner, beamed as she served a customer, her hands dusted with flour and her heart filled with a sense of accomplishment.

Sarah's story is a testament to the enduring power of personal savings and unwavering determination in the pursuit of entrepreneurial dreams. Choosing to bootstrap her business with her own funds, instead of seeking external investment, allowed her to maintain complete control and build her bakery, "Sweet Surrender," according to her vision.

The Seed of an Idea

For years, baking had been Sarah's passion, a creative outlet that brought joy to her and those around her. What began as a hobby, crafting elaborate cakes for family birthdays and perfecting her grandmother's sourdough recipe, gradually transformed into a burning desire to share her talent with a wider audience.

"I always dreamed of having my own little bakery," Sarah confessed, her eyes sparkling with enthusiasm. "A place where people could come to enjoy delicious, handcrafted treats in a warm and welcoming atmosphere."

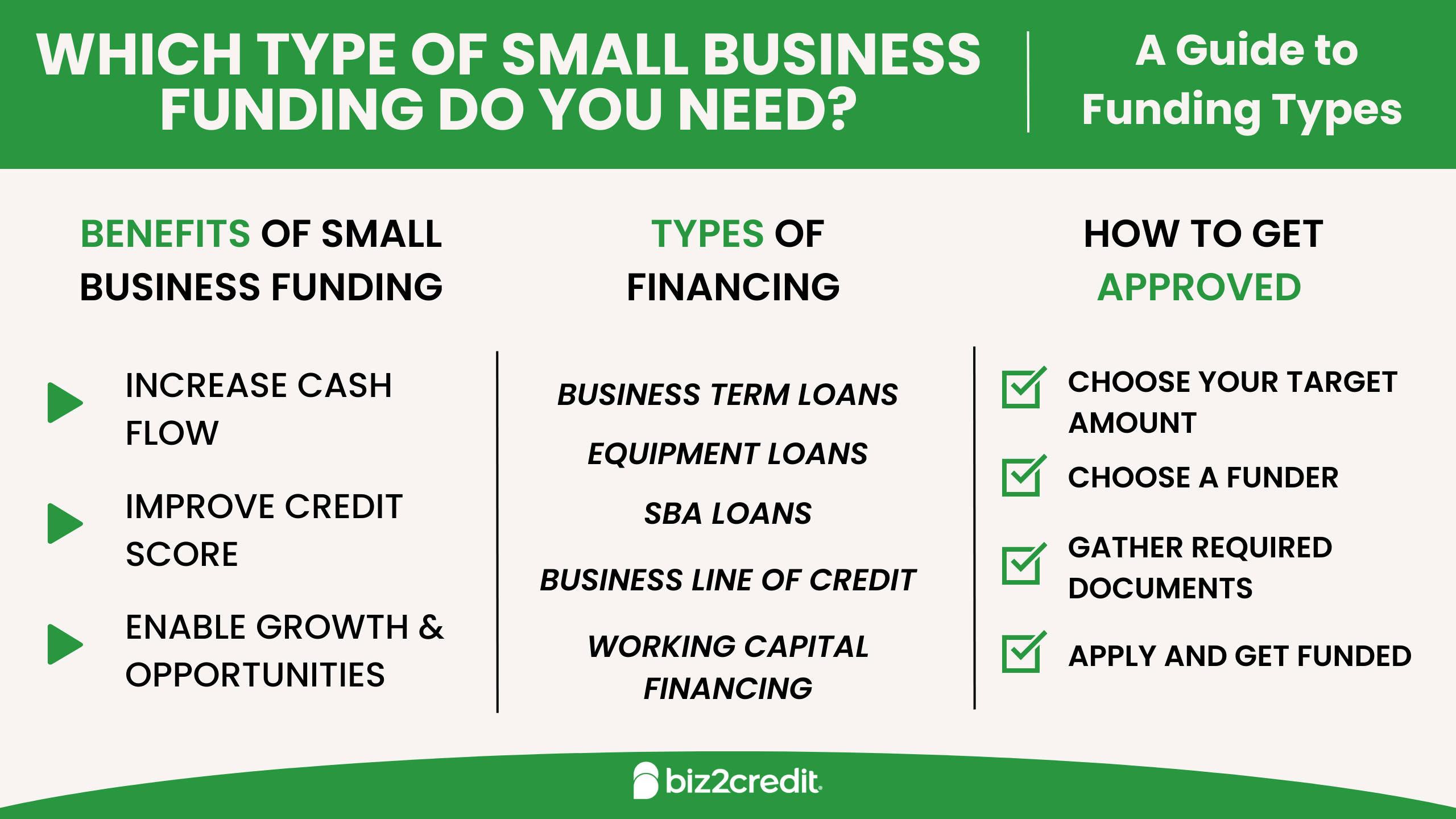

But dreams require funding. Initially daunted by the prospect of seeking loans or investors, Sarah considered an alternative approach: using her own savings.

The Path to Self-Funding

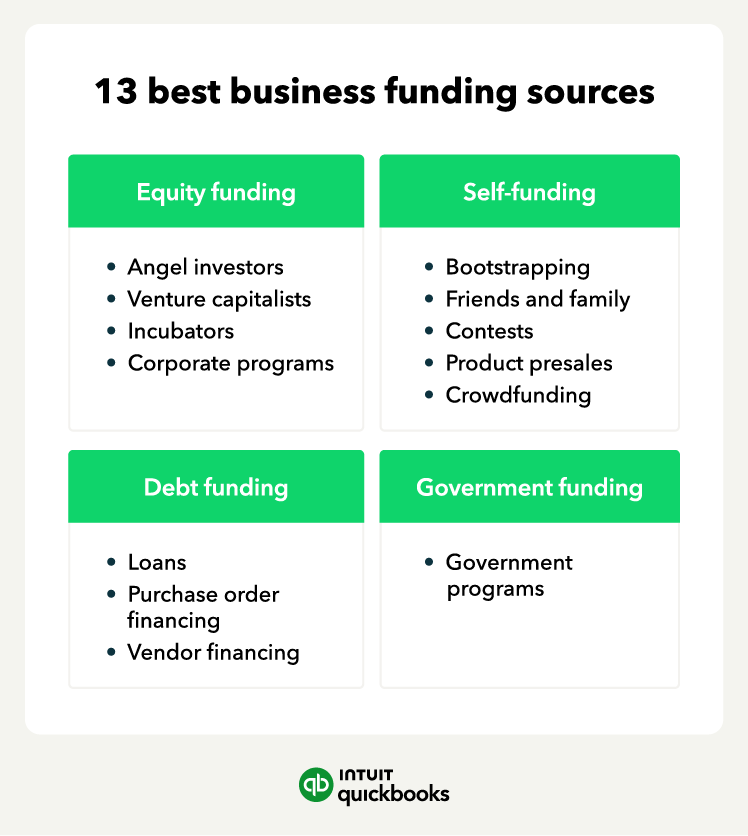

According to a 2023 report by the Small Business Administration (SBA), approximately 77% of startups rely on personal savings and income from other sources to get off the ground. This strategy, often referred to as "bootstrapping," offers several advantages, including complete ownership and freedom from external pressures.

For Sarah, bootstrapping meant meticulous planning and disciplined saving. Over several years, she diligently set aside a portion of her income, making sacrifices along the way to accumulate the necessary capital. She also took advantage of free online resources and workshops offered by organizations like SCORE, a nonprofit that provides mentorship and guidance to small businesses.

"It wasn't easy," Sarah admitted, "but I was so determined to make my dream a reality. Every dollar saved felt like a step closer to opening the doors of Sweet Surrender."

Challenges and Rewards

The journey of self-funding a business is not without its challenges. Limited capital requires careful budgeting and resourcefulness. Sarah had to prioritize essential expenses, such as equipment and ingredients, while minimizing non-essential costs.

She also relied heavily on her own labor, handling everything from baking and customer service to marketing and accounting. According to a 2022 study by the Kauffman Foundation, entrepreneurs who bootstrap their businesses often work longer hours and face greater financial risks.

However, the rewards of self-funding can be immense. Sarah enjoys the autonomy of making all the decisions for her business, from the menu offerings to the store's decor. She also takes pride in knowing that Sweet Surrender is a true reflection of her vision and values.

A Recipe for Success

Sweet Surrender has quickly become a beloved fixture in the community. Customers rave about the quality of the baked goods, the friendly service, and the cozy atmosphere.

Sarah's success is a testament to the power of perseverance, passion, and a well-thought-out plan. It also highlights the viability of bootstrapping as a path to entrepreneurship.

As Sarah reflects on her journey, she hopes her story will inspire others to pursue their own entrepreneurial dreams, even if they don't have access to traditional funding sources. "If you have a passion and a strong work ethic," she advises, "anything is possible. Don't be afraid to bet on yourself."

%2C+you+may+find+that+using+personal+funds+is+the+best+option..jpg)