Utility Credit Check Hard Or Soft

The question of whether utility companies perform hard or soft credit checks when customers apply for service has become a focal point for consumer advocates and financial experts. This distinction carries significant implications for individuals' credit scores and their ability to access essential services.

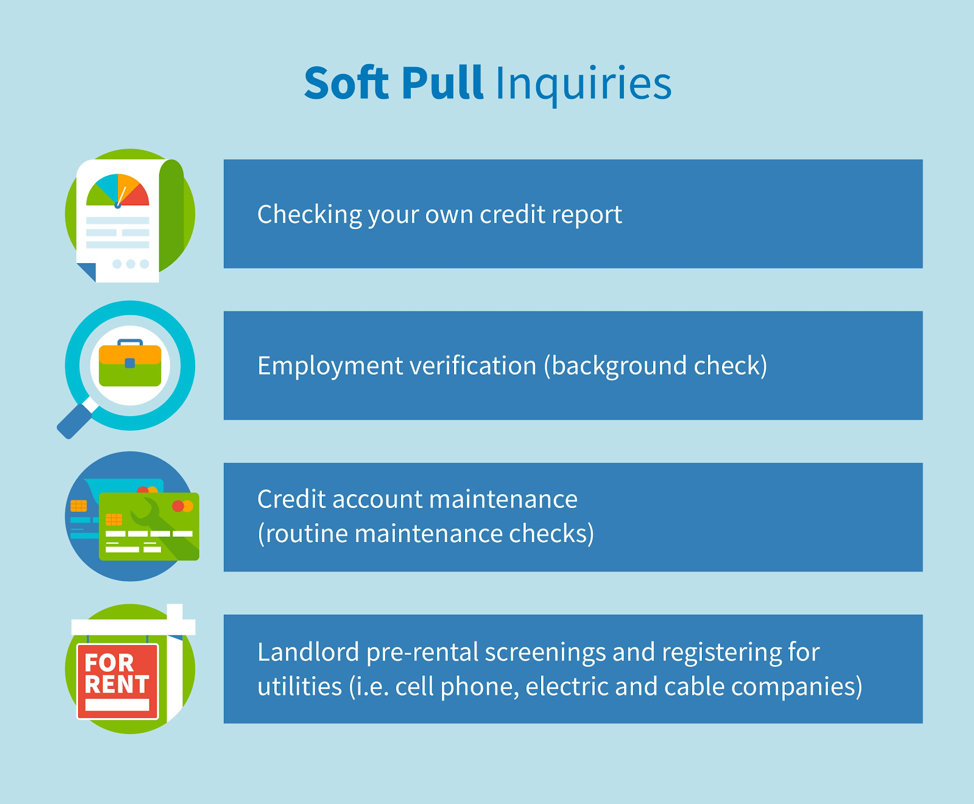

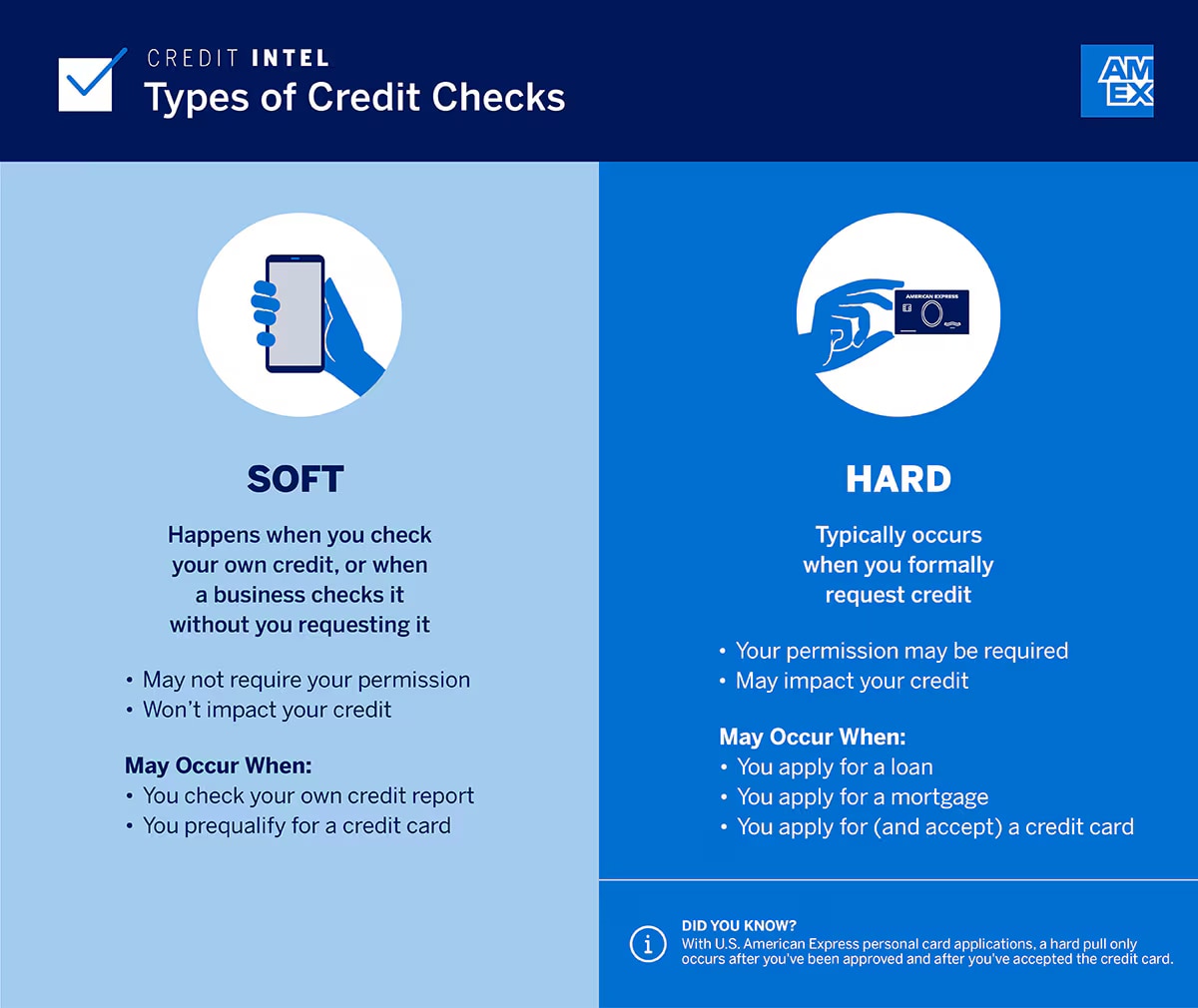

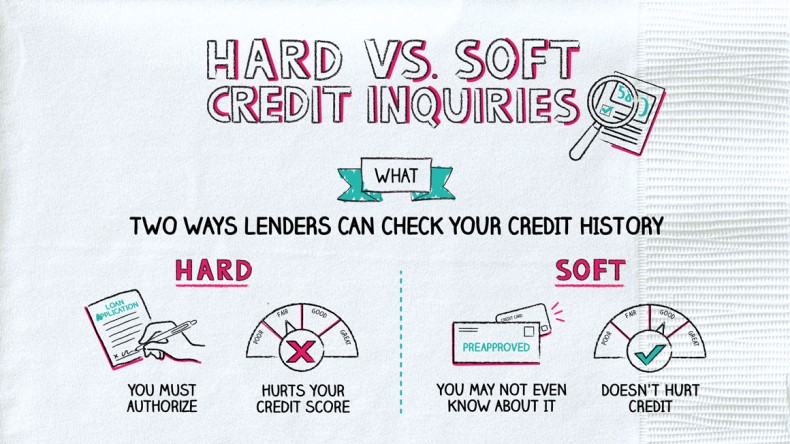

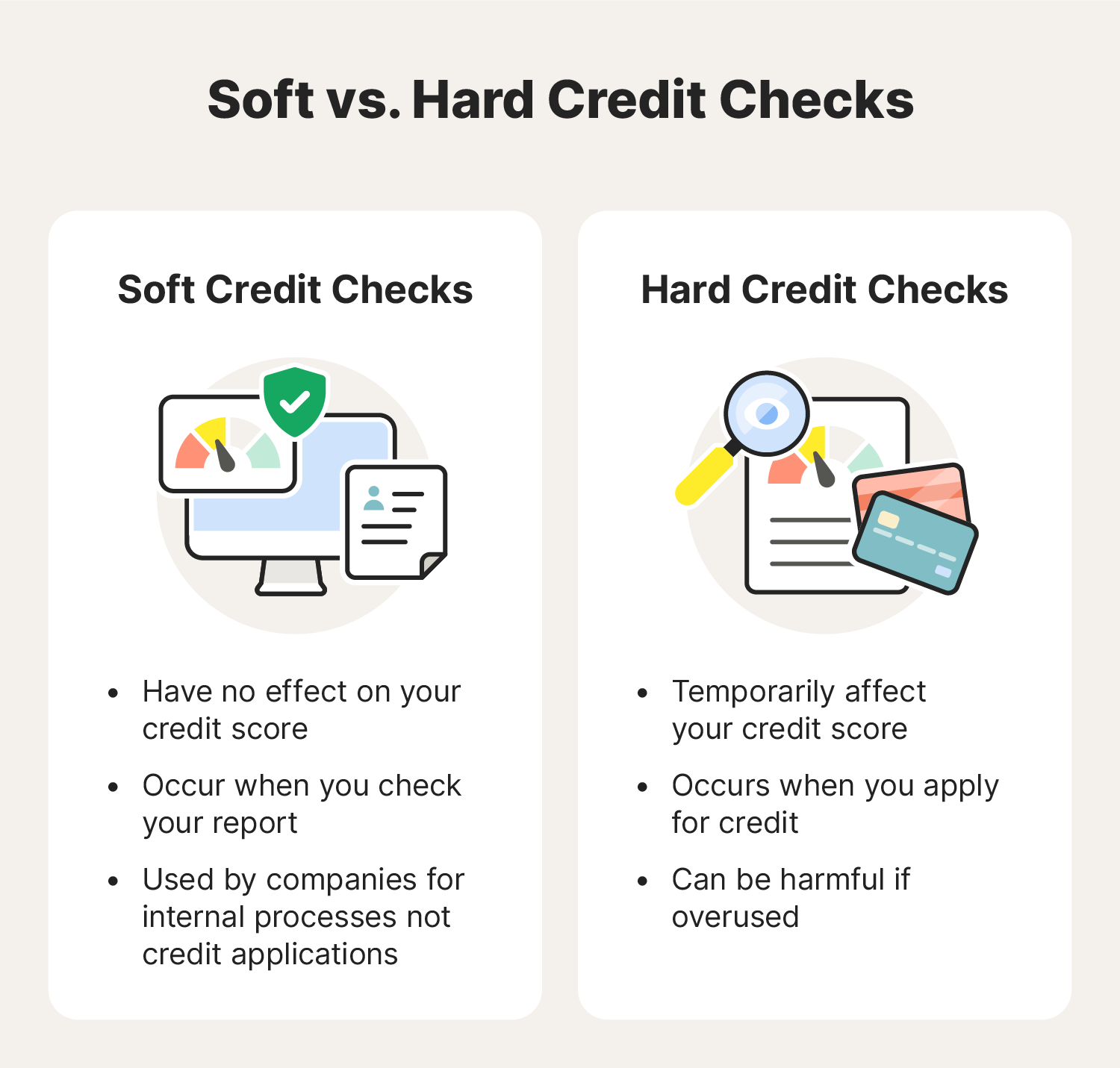

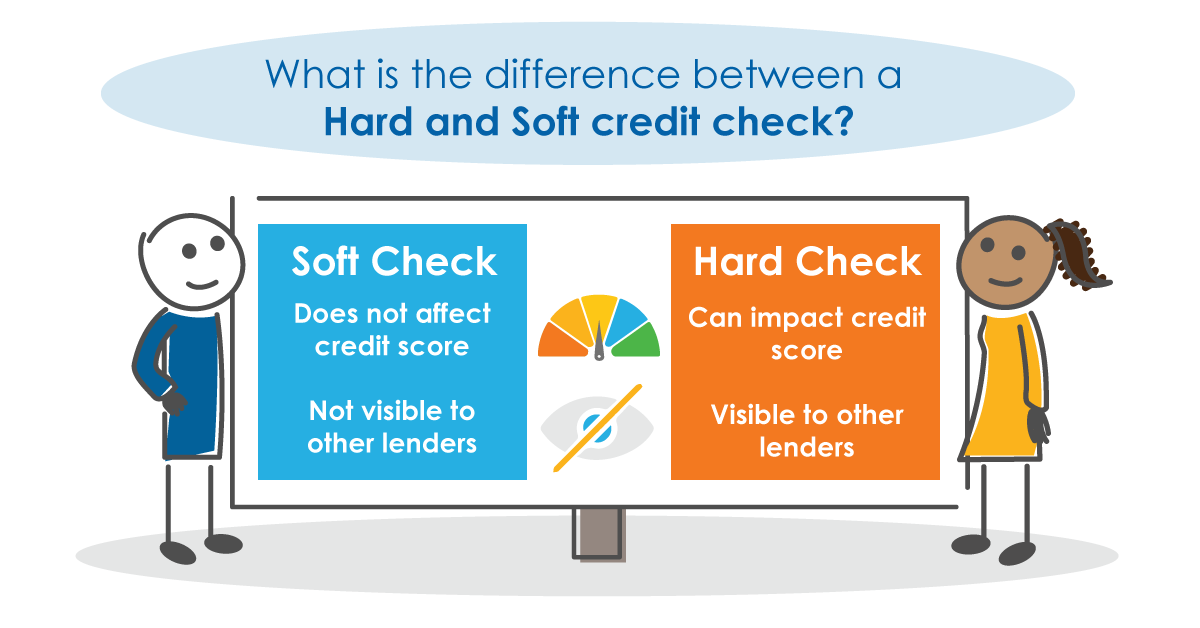

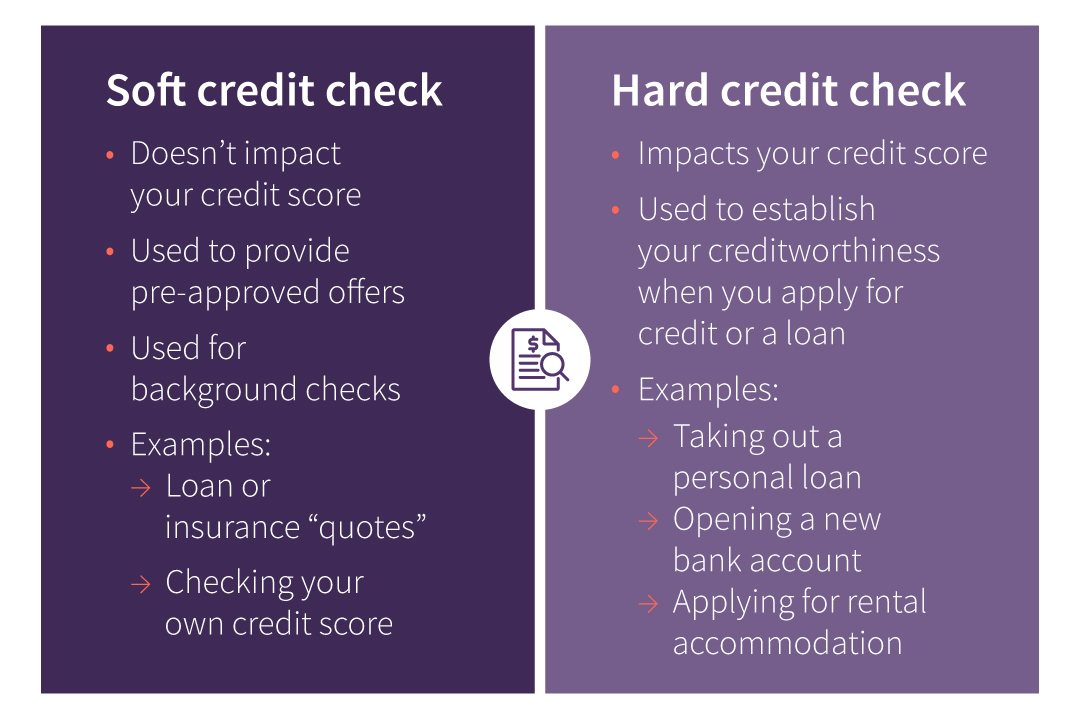

Understanding the nuances between hard and soft credit inquiries is crucial for consumers managing their credit health. A hard credit check, typically associated with loan applications, can slightly lower a credit score, while a soft credit check, often used for background checks, has no impact.

The Core of the Issue

The practice of utility companies checking credit is aimed at assessing a customer's risk of non-payment. This assessment often dictates whether a deposit is required to initiate service.

The concern arises when these credit checks are conducted as hard inquiries, potentially impacting a consumer's credit score for simply establishing essential services like electricity, gas, or water.

Who is Involved?

The main actors in this debate are utility companies, credit bureaus (Experian, Equifax, TransUnion), consumer advocacy groups, and the consumers themselves.

Utility companies aim to minimize financial risk, while consumer groups advocate for fair and transparent practices that don't penalize individuals seeking basic necessities.

What's Happening?

Reports indicate that practices vary significantly across different utility companies and even within the same company depending on location. Some utilities perform soft credit checks, while others conduct hard inquiries.

There's a growing push for standardization and greater transparency regarding these practices.

Where and When?

This issue is relevant nationwide in the United States and also in other countries where utilities perform credit checks. The debate has gained momentum in recent years due to increased awareness of credit score impacts and growing financial vulnerability among certain populations.

Legislation and regulatory action are being considered in some states to address the issue. It has increased following the Covid-19 pandemic.

Why is This Important?

The type of credit check performed by utility companies has a direct impact on consumers' financial well-being. Multiple hard inquiries within a short period can negatively affect a credit score, potentially hindering access to loans, mortgages, and even employment opportunities.

For low-income individuals and those with already vulnerable credit histories, this impact can be particularly detrimental.

How Does it Work?

When a customer applies for utility service, the company typically requests authorization to access their credit report. This request is then processed through a credit bureau.

If the utility company initiates a hard inquiry, it's recorded on the customer's credit report and can be seen by other lenders. If it is a soft inquiry, it is only visible to the consumer.

The Impact on Consumers

The potential for a negative impact on credit scores raises concerns about equitable access to essential services. Requiring deposits or denying service based on a credit score influenced by hard utility credit checks can disproportionately affect low-income households.

Advocates argue that alternative methods for assessing risk, such as payment history or income verification, should be considered to minimize the burden on consumers.

One consumer, Sarah Miller, shared her experience: "I was shocked to see my credit score drop after simply signing up for electricity. I didn't realize a utility company could even do that."

Potential Solutions and Regulatory Responses

Several solutions are being explored to address this issue. One option is to mandate that all utility companies perform only soft credit checks.

Another approach involves creating alternative risk assessment models that don't rely heavily on credit scores.

In some states, consumer protection agencies are investigating utility company credit check practices and considering regulatory action to protect consumers.

Expert Opinions

Ted Rossman, a senior industry analyst at CreditCards.com, stated, "Consumers should be aware of their rights and inquire about the type of credit check a utility company will perform."

He added, "If possible, explore options that don't involve hard inquiries, or negotiate alternative payment arrangements."

Moving Forward

The debate over utility credit check practices highlights the need for greater transparency and consumer protection. As awareness of this issue grows, pressure is mounting on utility companies and regulators to adopt fairer and more equitable policies.

Consumers are encouraged to actively monitor their credit reports and to advocate for policies that ensure access to essential services without jeopardizing their financial well-being.

The future may see a shift towards more consumer-friendly practices, ensuring that accessing basic utilities doesn't come at the cost of a damaged credit score.

![Utility Credit Check Hard Or Soft Hard vs Soft Credit Check: What's the Difference [2024 ]](https://review42.com/wp-content/uploads/2021/05/hard-vs-soft-credit-check-featured-image.jpg)