Warrior Trading Trade Ideas Scanner Settings

Imagine sitting at your desk, the glow of multiple monitors illuminating your face. The market's symphony—ticks, charts, and news flashes—fills the air. You're searching for that golden setup, that perfect entry point, amidst the chaotic dance of stocks. A well-configured scanner, like those used within Warrior Trading, can be your compass, guiding you to profitable opportunities.

This article delves into the trade ideas scanner settings used by Warrior Trading, examining how these configurations can help traders identify potential setups. Understanding these settings, while not a guaranteed path to profits, can empower traders to navigate the market with greater precision and confidence. By exploring the key criteria and parameters involved, we'll shed light on how to effectively use these tools to filter through the noise and find promising trading candidates.

Background and Significance

Warrior Trading, founded by Ross Cameron, is known for its educational resources and real-time trading insights. Their community emphasizes disciplined trading strategies and risk management. A core component of their approach is the use of stock scanners to quickly identify stocks meeting specific criteria.

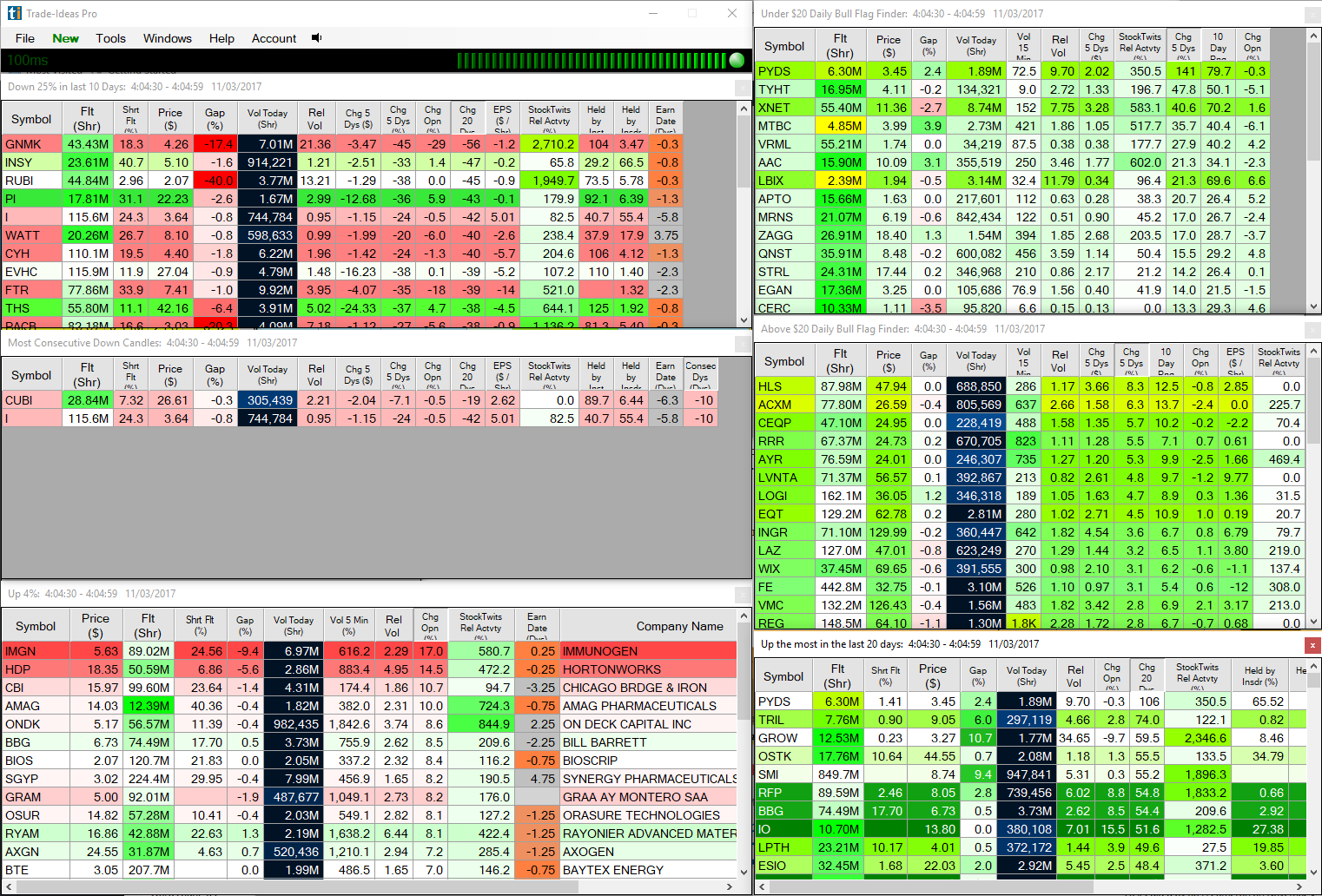

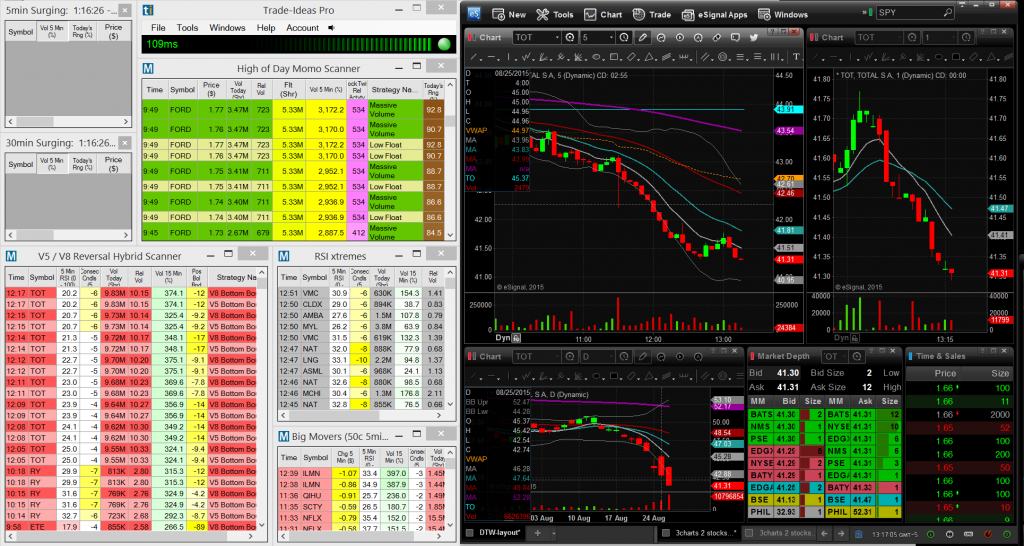

Scanners act as powerful filters, sifting through thousands of stocks to surface those matching pre-defined parameters. These parameters typically include price, volume, volatility, and technical indicators. By leveraging a well-configured scanner, traders can significantly reduce the time and effort required to find suitable trading opportunities.

Key Scanner Settings

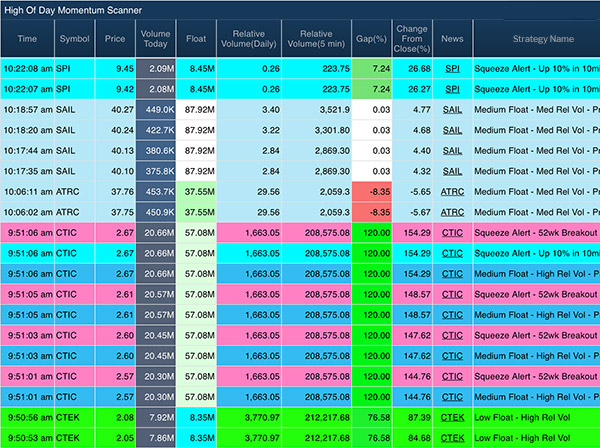

While specific settings can vary depending on individual trading styles and market conditions, certain parameters are commonly used in Warrior Trading's scanner setups. One of the most fundamental settings is premarket volume. This helps to identify stocks with significant early activity, indicating potential for intraday momentum.

Price range is another crucial filter. Traders often focus on stocks within a certain price range, typically between a few dollars and around $50 or $100, depending on their risk tolerance and capital. Focusing on this allows for a balance between potential percentage gains and manageability.

Relative volume, which compares current volume to average historical volume, is also key. A high relative volume signals increased interest and potential for price movement. Stocks exhibiting high relative volume are often considered prime candidates for day trading.

Additional Filters

Beyond volume and price, Warrior Trading scanners often incorporate technical indicators. Moving averages, for instance, can help identify stocks trending in a specific direction. Watching for certain moving average relationships can also signify potential breakouts.

Ross Cameron often discusses using the gap and go strategy, which involves identifying stocks that gap up significantly at the market open. Scanner settings can be configured to highlight stocks meeting gap-up criteria, coupled with sufficient volume and relative strength. This provides insight for traders looking to trade stocks that open outside of the previous day's range.

Float, which refers to the number of shares available for public trading, is also an important consideration. Stocks with a smaller float can be more volatile and prone to rapid price swings. This makes them attractive to some day traders, but riskier for others.

Importance of Customization and Adaptation

It's crucial to understand that scanner settings are not static. Successful traders constantly refine their settings based on market conditions and personal trading preferences. What works in a bull market may not work in a bear market, and vice-versa.

Backtesting and paper trading are essential steps in validating any scanner configuration. These allow traders to test their strategies and settings in a simulated environment before risking real capital. By consistently analyzing their results and adjusting their approach, traders can improve their scanner's effectiveness.

Conclusion

The Warrior Trading trade ideas scanner settings offer a framework for identifying potential trading opportunities. While understanding and implementing these settings can be beneficial, remember that a scanner is only a tool. Ultimately, success in trading hinges on a solid understanding of market dynamics, disciplined risk management, and continuous learning.

By combining a well-configured scanner with a sound trading strategy, traders can increase their chances of finding consistent profits in the dynamic world of the stock market. This journey of discovery and refinement is what makes trading both challenging and rewarding.

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/Trade-Ideas.png)

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/Trade-Ideas-5-1024x559.png)

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/Trade-Ideas-2-1536x1020.png)

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/Trade-Ideas-3-1024x722.png)

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/Trade-Ideas-1-1024x479.jpg)

![Warrior Trading Trade Ideas Scanner Settings Trade Ideas Stock Scanner Review [2021] - Warrior Trading](https://media.warriortrading.com/2016/05/wt_review_trade_ideas_3-9.png)