What All U Need To Open A Bank Account

Imagine standing on the precipice of a new financial chapter. The aroma of freshly brewed coffee wafts from a nearby café, and sunlight streams through the bank's large windows, illuminating the brochures promising financial security. You're finally ready to open a bank account, a crucial step toward managing your money and achieving your dreams.

But where do you begin? What exactly do you need to unlock this gateway to financial empowerment? This article breaks down everything you need to open a bank account, ensuring the process is smooth and stress-free.

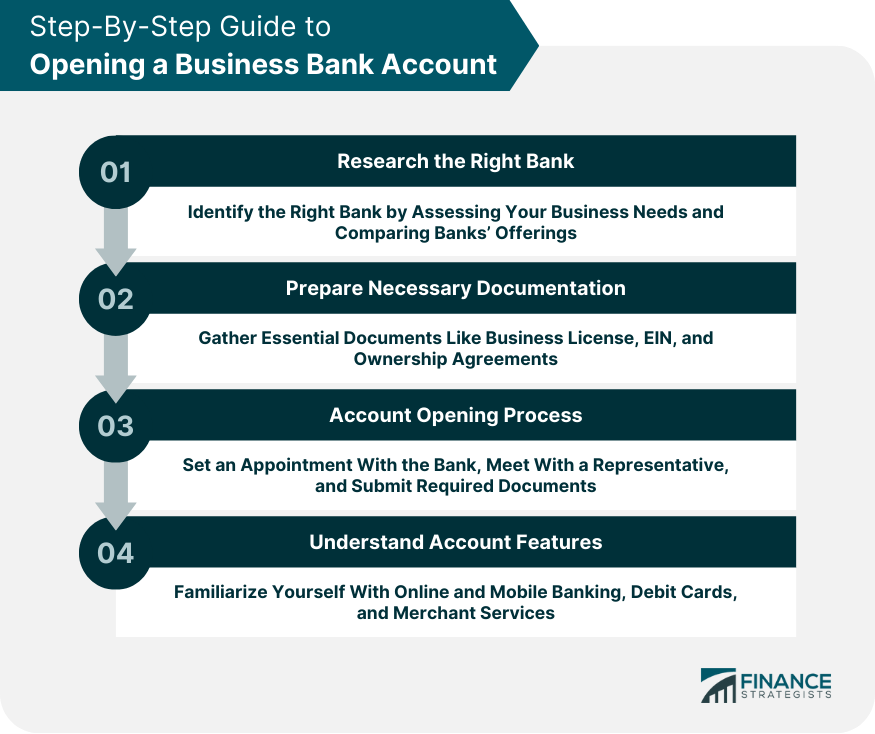

The Essentials: Identification is Key

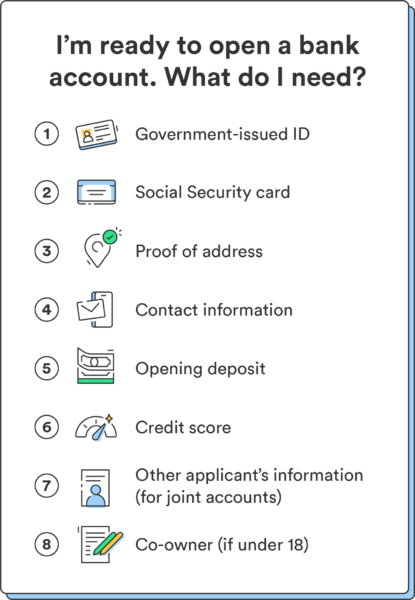

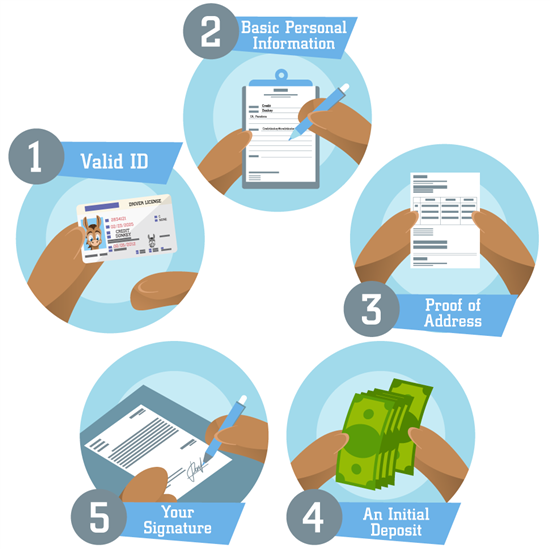

First and foremost, you'll need to prove your identity. Banks are legally required to verify who you are to prevent fraud and comply with anti-money laundering regulations.

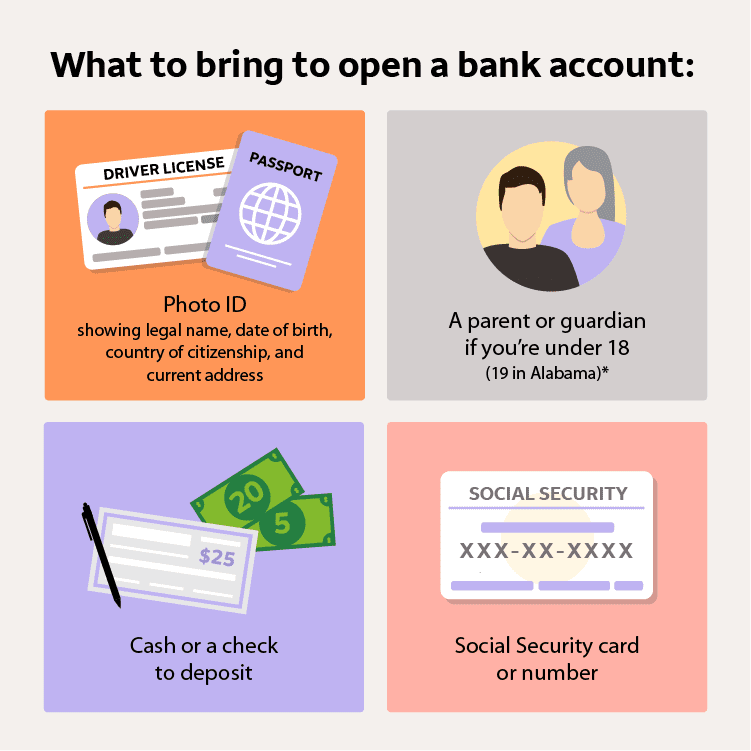

Acceptable forms of identification typically include a government-issued photo ID, such as a driver's license, passport, or state-issued identification card. Make sure your ID is current and hasn't expired.

Some banks may also accept other forms of identification, like a military ID or a permanent resident card. It's always a good idea to check with the specific bank you're interested in to confirm their requirements.

Proof of Address: Where Do You Hang Your Hat?

In addition to verifying your identity, banks also need to confirm your address. This is to ensure they can send you important account information and statements.

Commonly accepted documents for proof of address include a utility bill (such as electricity, water, or gas), a lease agreement, or a recent bank statement from another financial institution. Be aware that the document usually needs to be recent, typically within the last 30 to 90 days.

If you're living with family or friends and don't have a utility bill in your name, you might be able to use a letter from the homeowner or renter, along with a copy of their ID and proof of address.

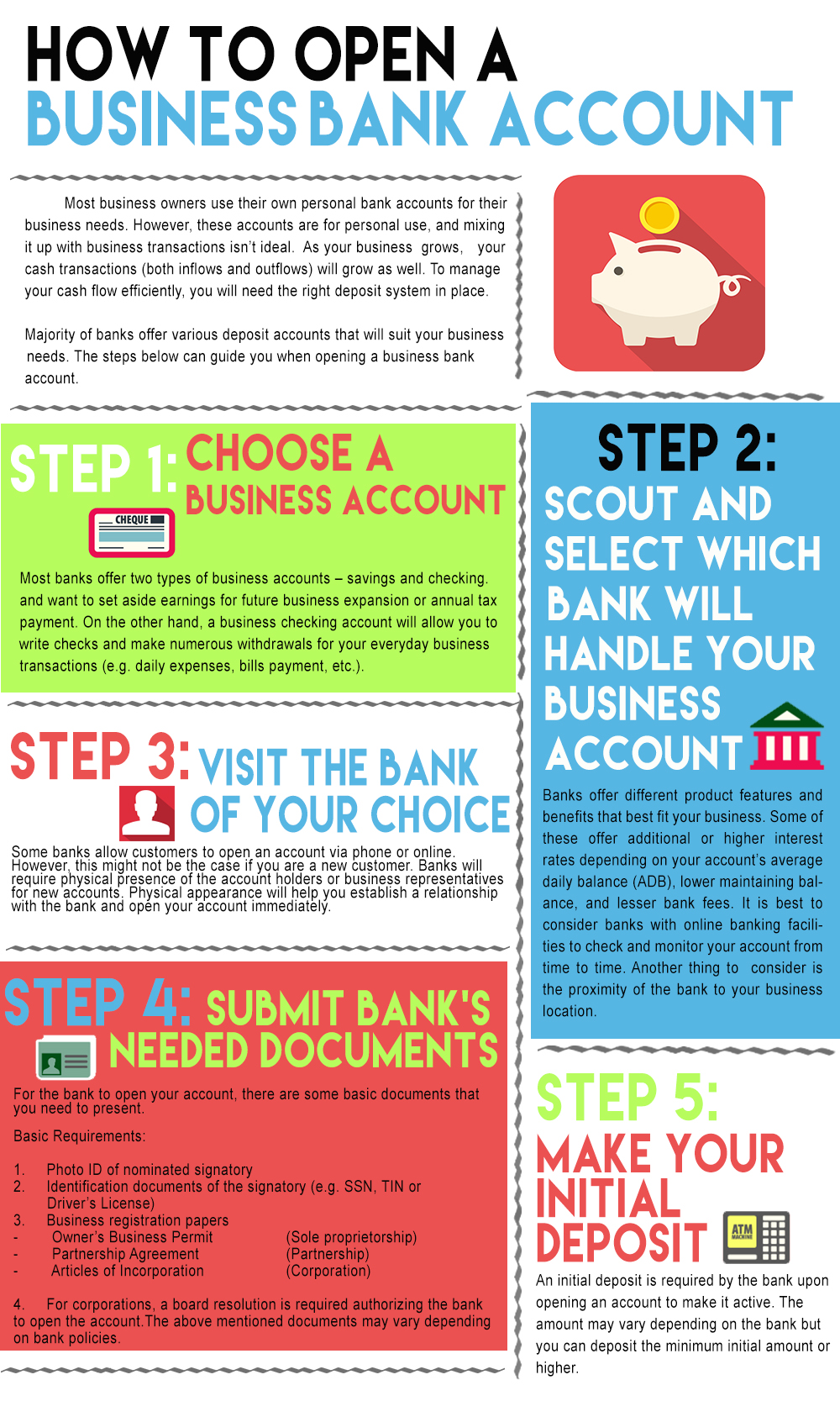

Initial Deposit: Getting Started on the Right Foot

Most banks require an initial deposit to open an account. The amount varies depending on the bank and the type of account you're opening.

Some accounts might have a minimum deposit requirement to avoid monthly fees. This information will usually be clear when you’re signing up.

You can typically make your initial deposit with cash, a check, or an electronic transfer from another bank account. Check with the bank about acceptable methods.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Banks are required to collect your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for tax reporting purposes. This information helps the bank report any interest earned on your account to the IRS.

If you're not a U.S. citizen, you'll likely need to provide your ITIN instead of your SSN. Providing this information is mandatory for opening an account.

The bank is responsible for protecting your personal information and uses secure systems to store it.

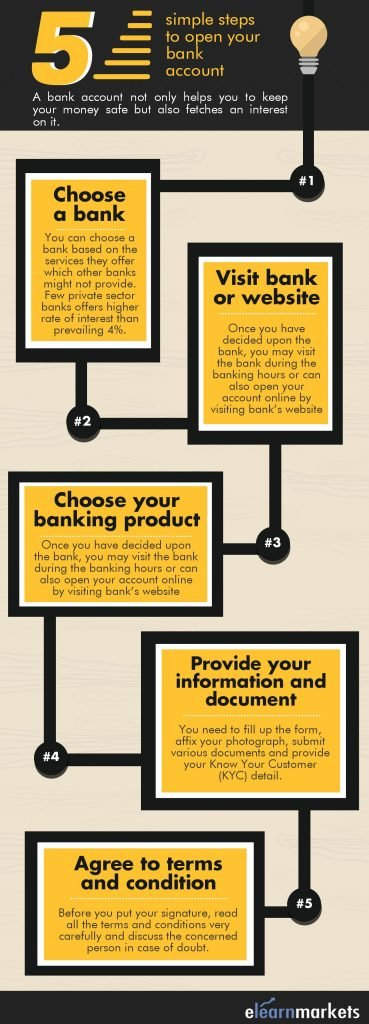

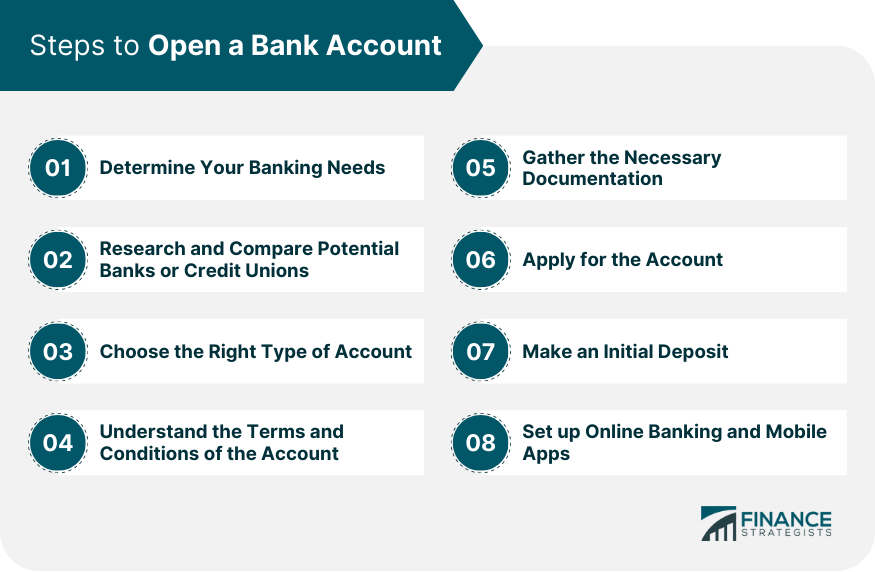

Choosing the Right Account: It’s All About You

Before you head to the bank, think about what you want from your account. Are you looking for a simple checking account for everyday transactions? Or do you need a savings account to grow your money?

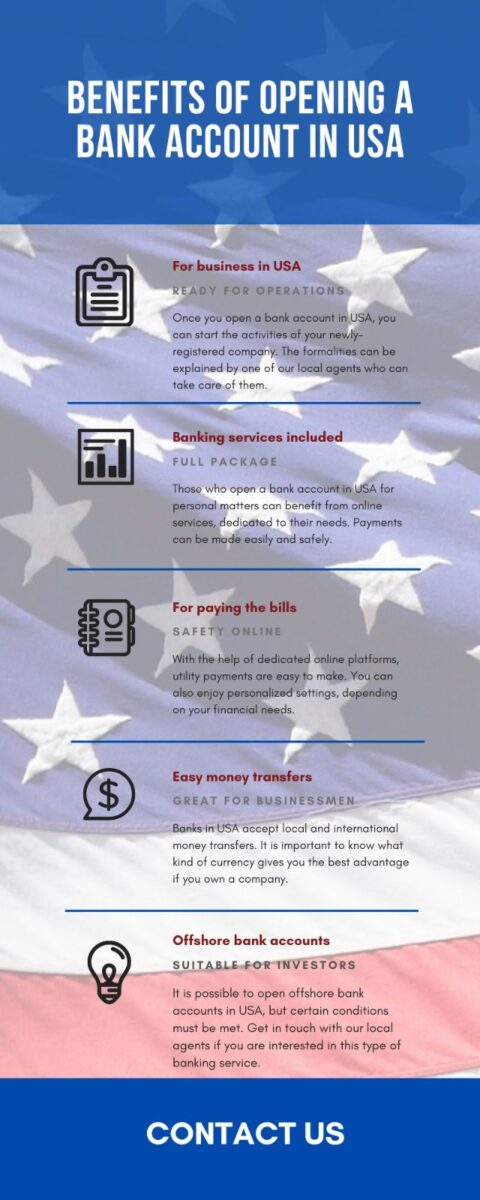

Consider factors like fees, interest rates, and online banking options. Research different banks and compare their offerings to find the best fit for your needs. Look for banks with FDIC insurance.

Many banks now offer online account opening, allowing you to complete the process from the comfort of your own home. This can save you time and make the process even more convenient.

A Word of Caution About Fees

Be mindful of the fees associated with the account. Overdraft fees, monthly maintenance fees, and ATM fees can quickly add up.

Read the fine print carefully and ask the bank representative to explain any fees you're unsure about. Many banks offer accounts with no monthly fees if you meet certain requirements, such as maintaining a minimum balance or setting up direct deposit.

Understanding these fees is important to being able to manage your money properly.

Opening a bank account is a significant step towards financial security and independence. By gathering the necessary documents and doing your research, you can navigate the process with confidence.

Take a deep breath, gather your documents, and walk through those doors. You're on your way to a brighter financial future. The tools are there and the first step can always be the most empowering.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)

:max_bytes(150000):strip_icc()/what-should-you-bring-bank-open-checking-account.asp-final-f16d5ca14ba14c588edca55037bd2ce4.jpg)