What Are Four Main Instruments Of Trade Policy

Imagine a bustling marketplace, overflowing with goods from across the globe. Silks from the East shimmer beside rugged woolens from the North, while spices from distant lands perfume the air. But beneath this vibrant tapestry of commerce lies a complex web of rules and regulations, silently shaping the flow of goods and the prosperity of nations. These invisible hands, the instruments of trade policy, determine who can sell what, where, and at what price.

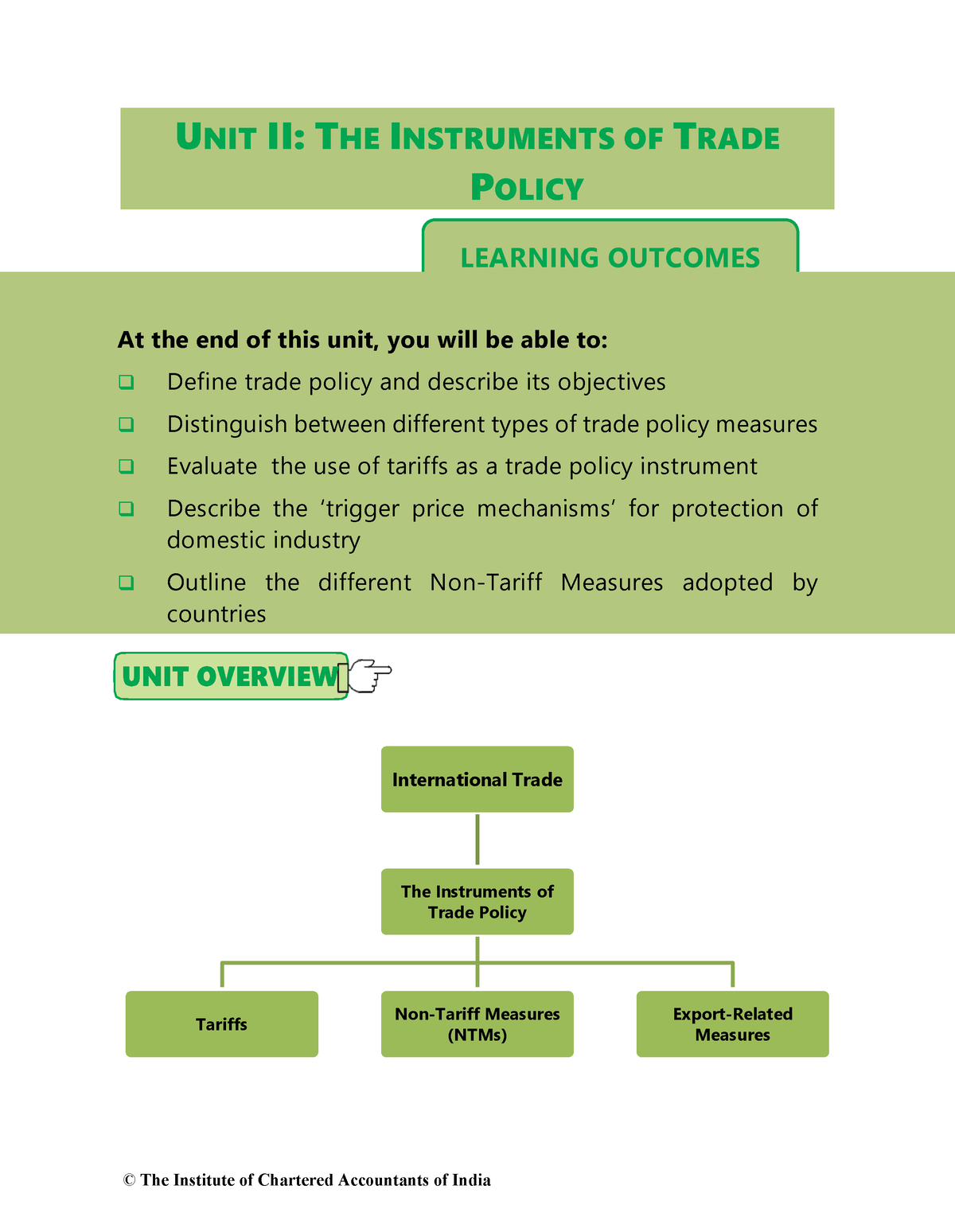

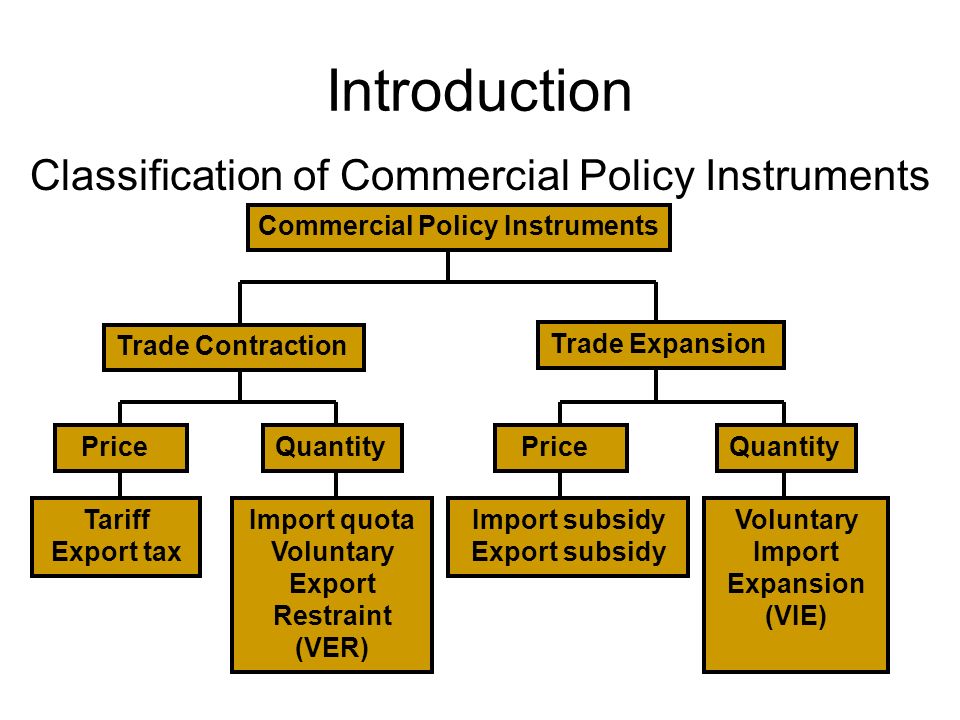

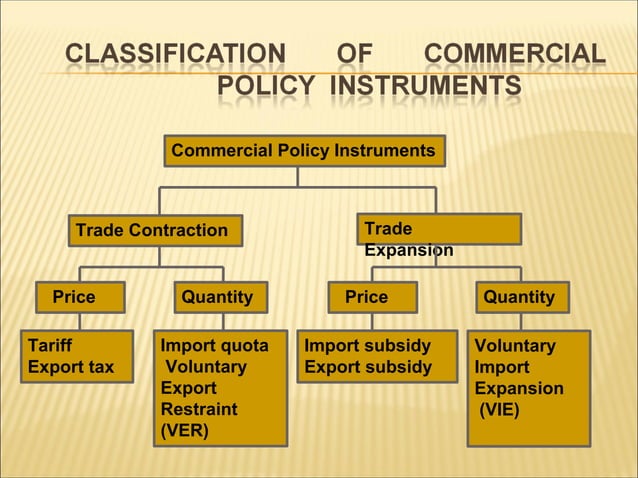

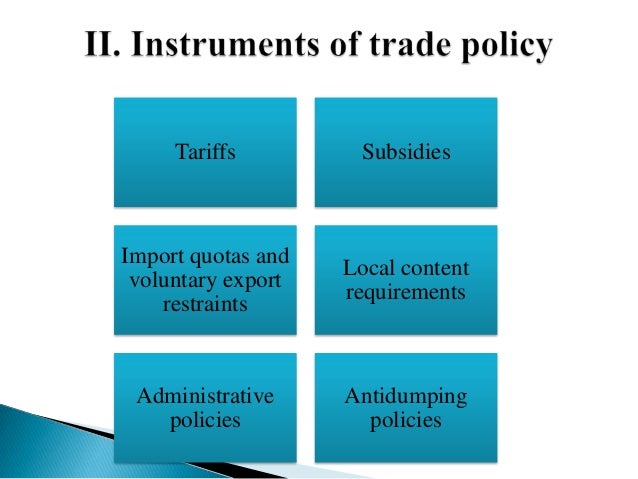

This article delves into the heart of international trade, examining the four main instruments that governments use to influence the exchange of goods and services across borders. Understanding these tools – tariffs, subsidies, quotas, and administrative policies – is crucial for anyone seeking to grasp the dynamics of the global economy and the strategies nations employ to navigate it. Each instrument has its own unique purpose, advantages, and disadvantages, ultimately impacting businesses, consumers, and the overall economic landscape.

The Foundation of International Trade

International trade isn't just about buying and selling; it's about nations interacting, competing, and cooperating. It's a key driver of economic growth, offering access to a wider range of goods, stimulating innovation, and fostering competition. However, it can also pose challenges, such as job displacement and pressure on domestic industries.

Governments step in to manage these complexities, using trade policies to protect their own interests while also promoting mutually beneficial exchange. The history of trade policy is long and varied, marked by periods of protectionism and liberalization, reflecting evolving economic theories and geopolitical realities.

The Four Pillars of Trade Policy

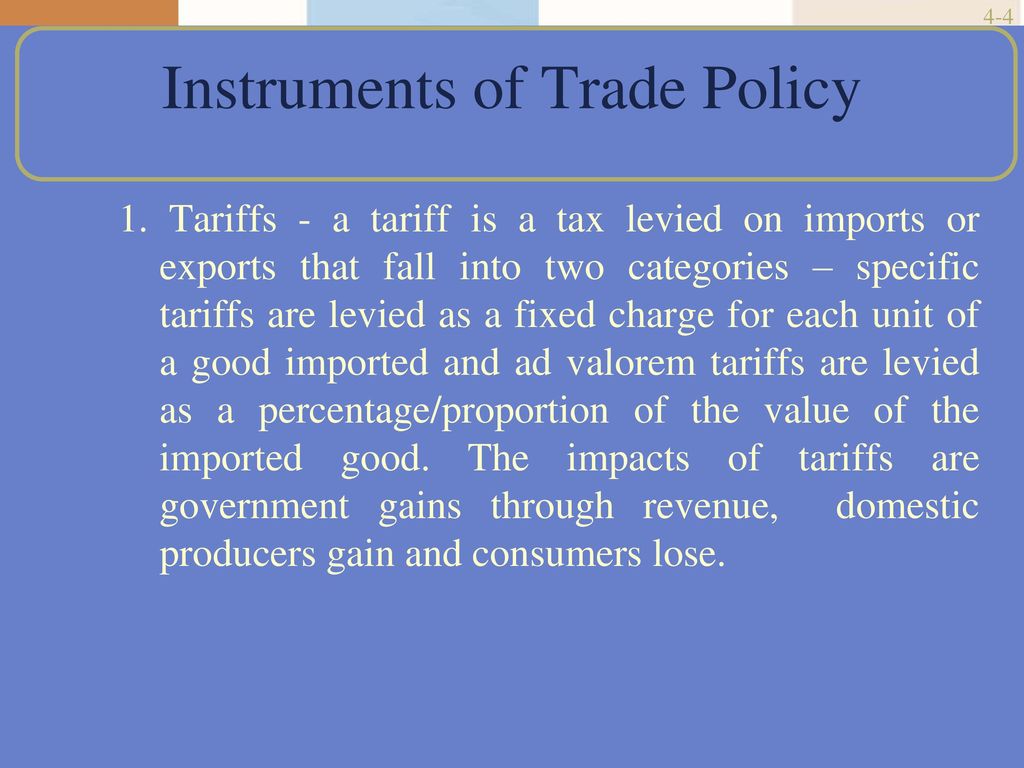

1. Tariffs: The Price of Entry

A tariff is a tax levied on imported goods or services. It's one of the oldest and most straightforward trade policy instruments. Tariffs can be either specific (a fixed charge per unit) or ad valorem (a percentage of the good's value).

The primary effect of a tariff is to raise the price of imported goods, making them less competitive compared to domestically produced goods. This can protect domestic industries from foreign competition, allowing them to grow and maintain employment.

However, tariffs also have drawbacks. They increase costs for consumers, limit choices, and can lead to retaliatory tariffs from other countries, resulting in trade wars that harm everyone involved. According to the World Trade Organization (WTO), a tariff should be transparent and non-discriminatory, but this ideal is often challenged in practice.

2. Subsidies: Giving a Helping Hand

A subsidy is a government payment to a domestic producer. These payments can take many forms, including cash grants, low-interest loans, tax breaks, and government equity participation.

Subsidies are intended to lower production costs, making domestic producers more competitive in both domestic and international markets. They can help industries overcome temporary difficulties, encourage innovation, and support strategic sectors like agriculture or renewable energy.

However, subsidies can also distort trade patterns by creating an unfair advantage for domestic producers. They can lead to overproduction, lower prices for consumers, and harm producers in other countries who cannot compete with the subsidized prices. The Organization for Economic Co-operation and Development (OECD) closely monitors subsidies to ensure they don't unduly distort trade.

3. Quotas: Limiting the Supply

A quota is a direct restriction on the quantity of a good that can be imported into a country. Unlike tariffs, which affect prices, quotas directly limit the volume of imports.

Quotas can be absolute, setting a fixed limit on imports, or they can be tariff-rate quotas, allowing a certain quantity of imports at a lower tariff rate, with higher tariffs applying to imports exceeding that quantity. They are often used to protect domestic industries from foreign competition or to address concerns about national security.

While quotas can be effective in limiting imports, they also tend to raise prices for consumers and reduce the availability of goods. They can also be difficult to administer and can create opportunities for corruption. The Peterson Institute for International Economics has extensively researched the negative economic consequences of quotas.

4. Administrative Policies: Hidden Barriers

Administrative policies encompass a wide range of bureaucratic rules and regulations that can be used to restrict imports or boost exports. These policies can include product standards, safety regulations, customs procedures, and licensing requirements.

While many administrative policies serve legitimate purposes, such as protecting public health or safety, they can also be used as subtle barriers to trade. For example, requiring overly complex or time-consuming customs procedures can discourage imports, even if tariffs and quotas are low.

The impact of administrative policies can be difficult to quantify, but they can have a significant effect on trade flows. Transparency and predictability in these policies are crucial to ensure that they do not unfairly restrict trade. The International Trade Centre (ITC) works to help businesses navigate the complexities of international trade regulations.

The Interplay of Instruments

These four instruments of trade policy are not mutually exclusive; they are often used in combination to achieve specific policy goals. For example, a country might impose a tariff on imported goods while also providing subsidies to domestic producers of those goods.

The choice of which instrument to use depends on a variety of factors, including the specific industry involved, the political context, and the country's overall trade strategy. Trade agreements, such as those negotiated through the WTO, often aim to reduce or eliminate these trade barriers to promote freer trade among member countries.

The Human Element

It's important to remember that behind every trade policy decision are real people – business owners, workers, and consumers. Trade policies can have a profound impact on their livelihoods, their access to goods and services, and their overall quality of life.

A well-designed trade policy can create opportunities for economic growth and prosperity, but a poorly designed policy can lead to job losses, higher prices, and reduced consumer choice. Striking the right balance between protecting domestic industries and promoting free trade is a constant challenge for policymakers.

Looking Ahead

The global trade landscape is constantly evolving, driven by technological advancements, shifting geopolitical dynamics, and changing consumer preferences. New challenges, such as climate change and the rise of digital trade, are also shaping the future of trade policy.

As we move forward, it's crucial to foster a deeper understanding of the complexities of international trade and the tools that governments use to manage it. By promoting greater transparency, cooperation, and a focus on mutual benefit, we can harness the power of trade to create a more prosperous and equitable world for all.