What Are The Best Tech Stocks To Buy Now

Inflation is cooling, but uncertainty still grips the market. Which tech stocks offer the best potential for growth amidst this volatility?

This article cuts through the noise to identify promising tech investments, providing a snapshot of leading companies, their recent performance, and expert insights to guide your investment decisions. We focus on tangible data and current market analysis to highlight opportunities.

The FAANG Stocks: A Reassessment

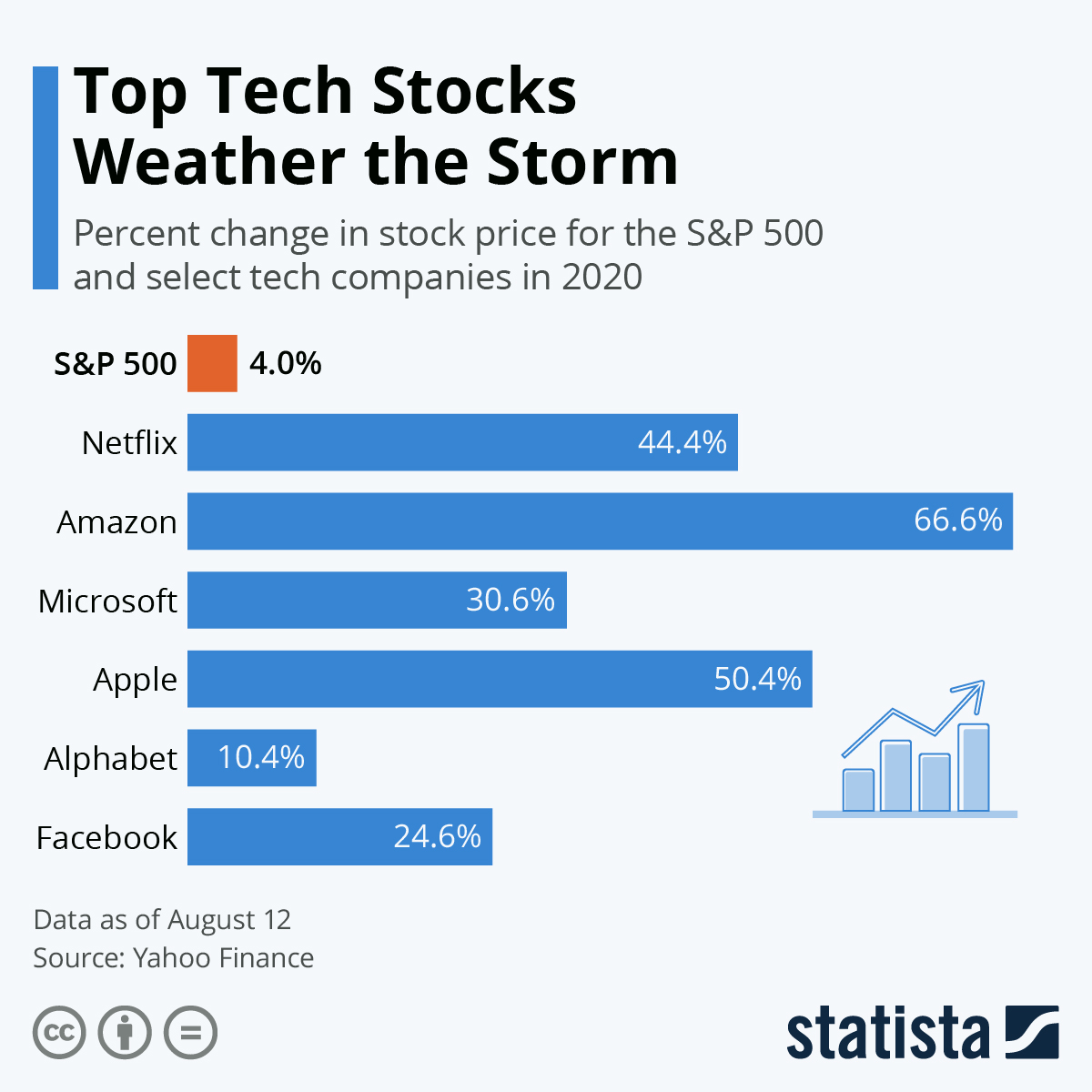

Meta Platforms (META) has shown resilience. It has demonstrated strong growth in user engagement and advertising revenue.

Analysts at Goldman Sachs recently increased their price target, citing effective cost management and AI advancements. This makes Meta a contender for growth investors.

Apple (AAPL) remains a stalwart. It shows a strong brand loyalty and expanding ecosystem.

Despite recent concerns about iPhone sales in China, Apple's services division continues to deliver steady revenue. This makes it a stable choice for value investors.

Amazon (AMZN) is seeing a resurgence. This is due to its dominant e-commerce platform and expanding cloud services (Amazon Web Services - AWS).

AWS is poised to benefit from the increasing adoption of cloud computing. This makes Amazon a top pick for long-term growth.

Beyond FAANG: Emerging Tech Leaders

NVIDIA (NVDA) is at the forefront of the AI revolution. Its GPUs are essential for training AI models and powering data centers.

Demand for NVIDIA's chips is skyrocketing, leading to substantial revenue growth and earnings. Experts predict a sustained upward trend.

Microsoft (MSFT) continues to innovate. It integrated AI into its products, including Microsoft 365 and Azure.

Microsoft's cloud business and enterprise software solutions provide a stable and growing revenue stream. This makes it a relatively safe investment.

Palantir Technologies (PLTR) is gaining traction. It has garnered attention for its data analytics platforms that serve both government and commercial clients.

Despite concerns about valuation, Palantir's long-term growth potential and unique capabilities in data analysis make it a noteworthy investment.

Semiconductor Sector: A Critical Focus

The semiconductor industry is critical. It is driven by the growing demand for chips in various sectors.

Taiwan Semiconductor Manufacturing (TSM) is the world’s largest contract chipmaker. It plays a crucial role in the global technology supply chain.

Advanced Micro Devices (AMD) competes with NVIDIA. It offers competitive CPUs and GPUs.

Both TSM and AMD are well-positioned to benefit from the expanding demand for semiconductors.

Considerations and Next Steps

Before investing, conduct thorough research. Assess your risk tolerance and consult a financial advisor.

Keep a close watch on economic indicators, company earnings reports, and industry trends. This is to stay informed.

The tech sector is dynamic, requiring continuous evaluation of your investment portfolio. Monitoring these stocks closely will prove crucial in navigating the evolving tech market.