What Are The Four Phases Of The Business Cycle

Economic turmoil got you worried? Understanding the business cycle's phases is critical to navigating uncertainty and preparing for what's next.

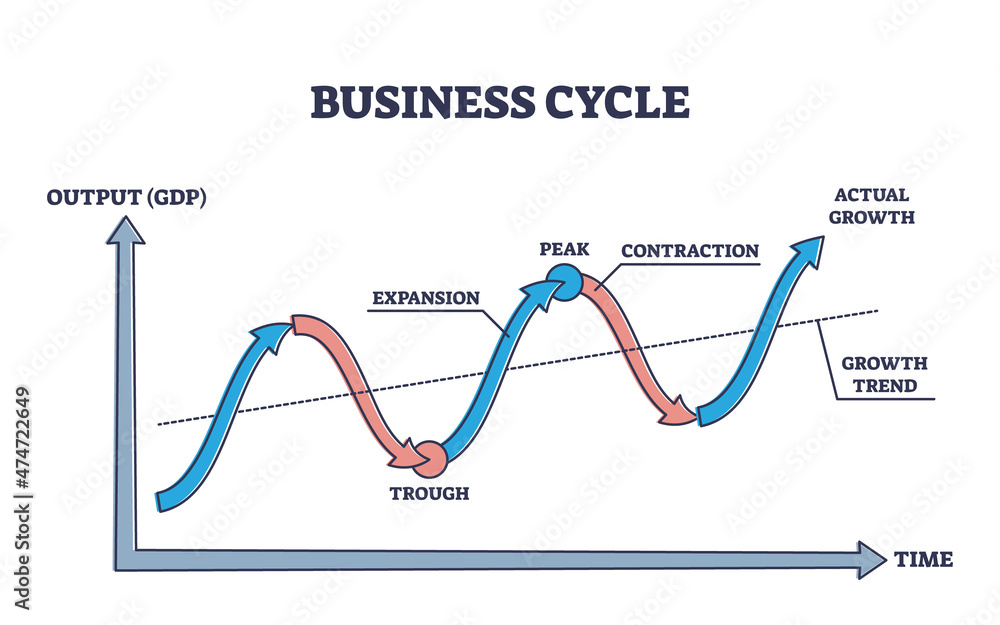

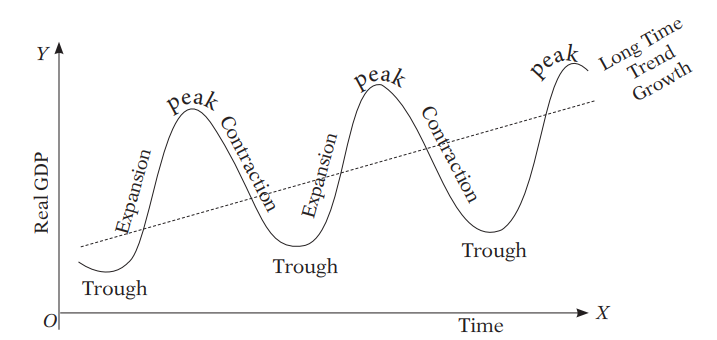

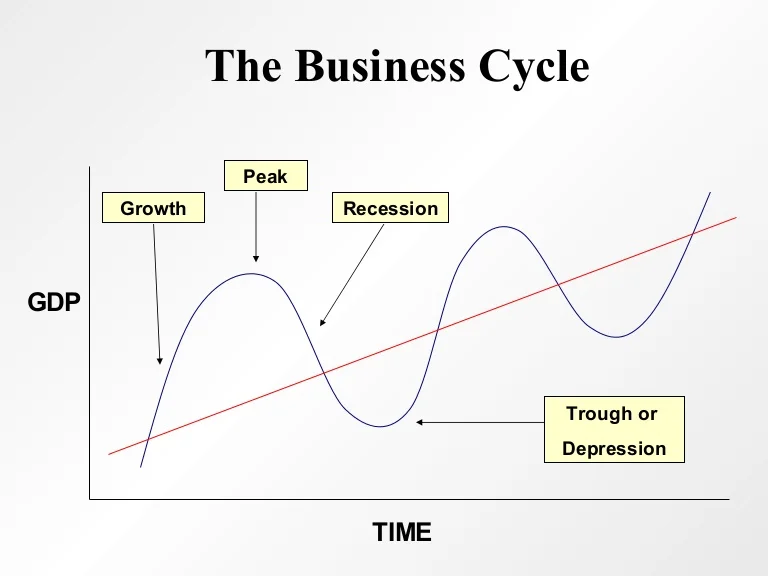

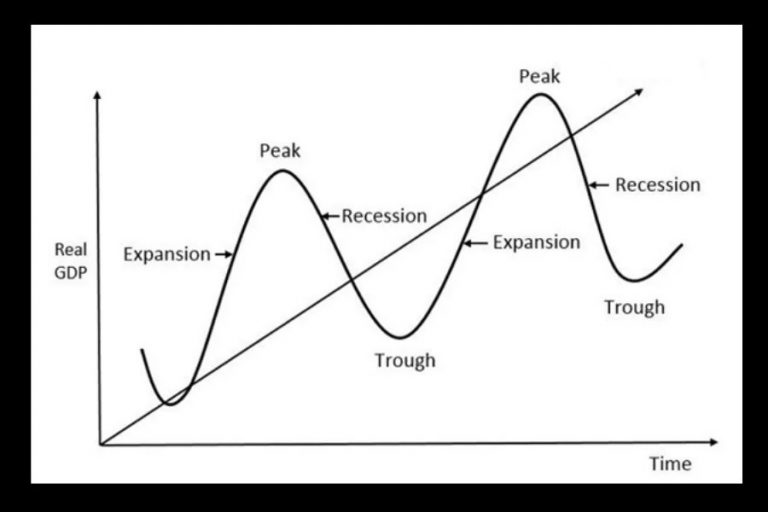

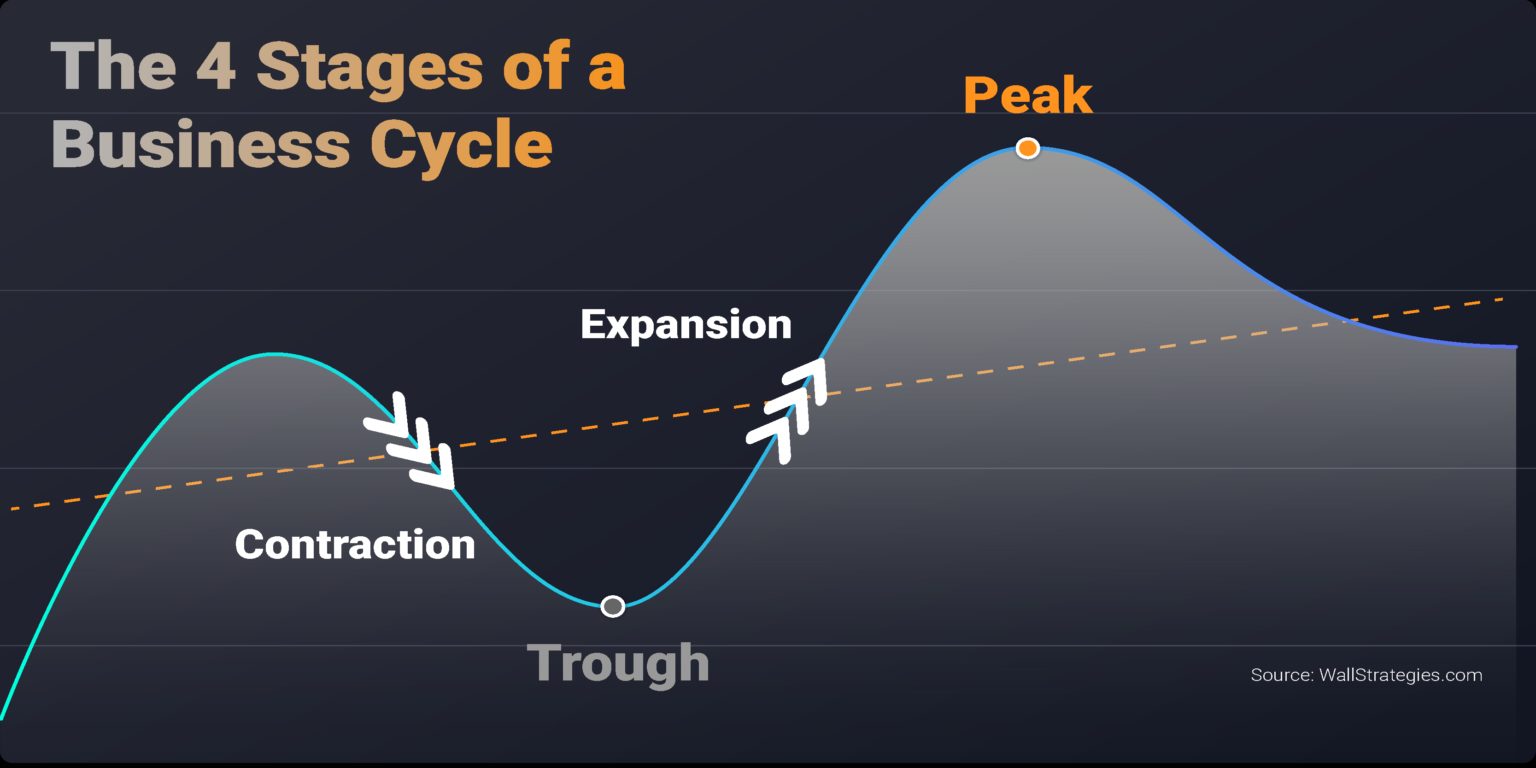

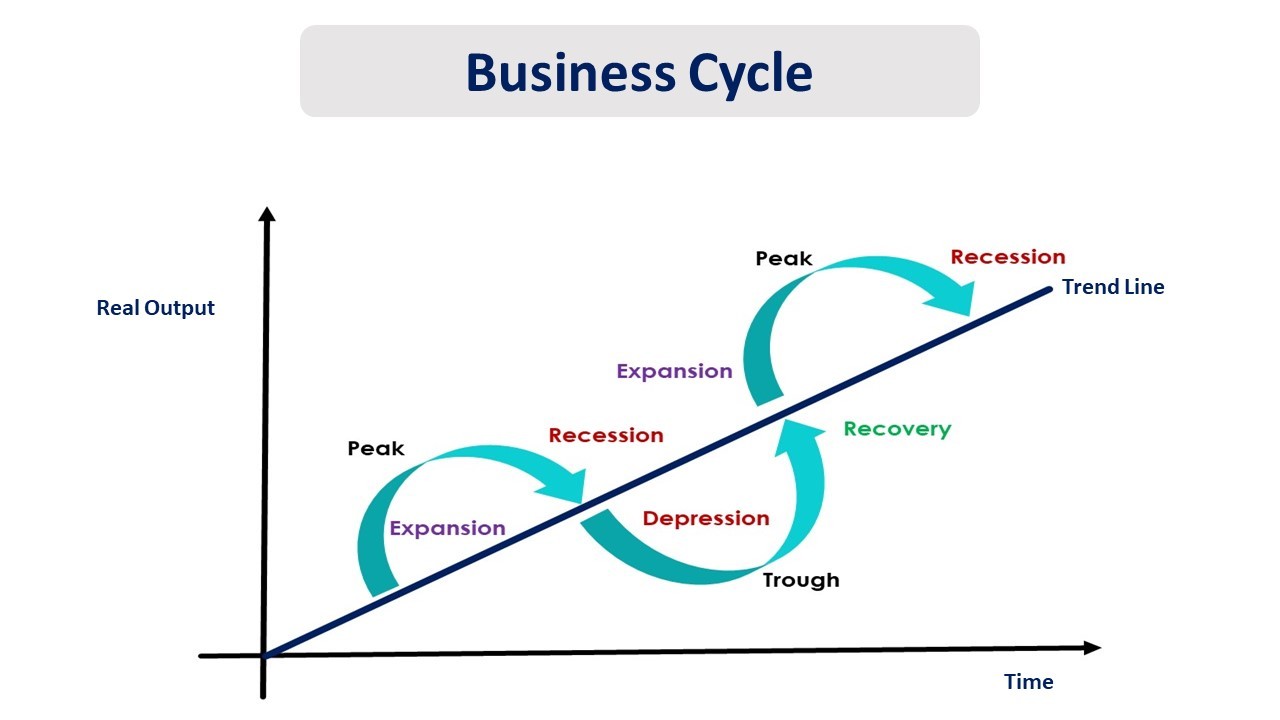

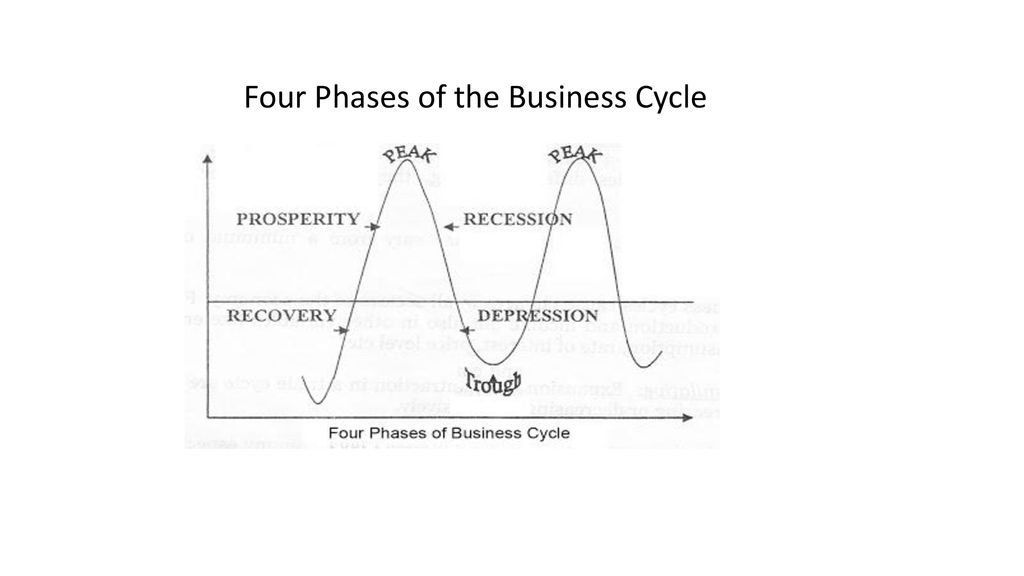

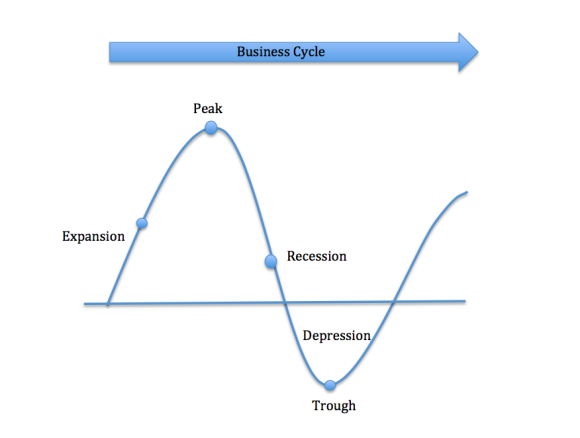

The business cycle, a recurring pattern of expansion and contraction in economic activity, impacts everyone from investors to everyday consumers. Understanding its four distinct phases – Expansion, Peak, Contraction (Recession), and Trough – empowers individuals and businesses to make informed decisions and weather economic storms.

The Four Phases Unveiled

1. Expansion: Growth Takes Hold

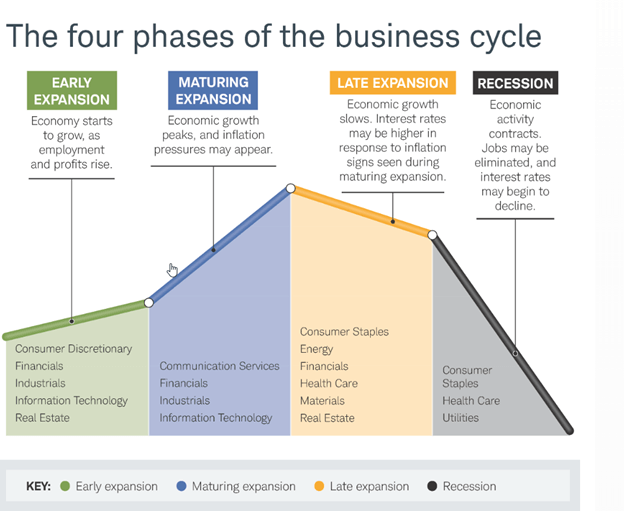

This phase is characterized by increasing economic activity. Key indicators like GDP, employment, and consumer spending rise.

Businesses invest and expand, fueling further growth. Optimism is high, and credit is readily available.

2. Peak: The Crest of Prosperity

The peak represents the highest point of economic activity. Demand may start to outstrip supply, leading to inflation.

Unemployment is typically low at this stage. It's a period of maximum output and prosperity, but also potential vulnerability.

3. Contraction (Recession): The Downturn Begins

This phase is marked by a decline in economic activity. GDP falls for two consecutive quarters, signaling a recession.

Unemployment rises, and consumer spending decreases. Businesses cut back on investment and production.

4. Trough: Rock Bottom

The trough represents the lowest point of economic activity during a cycle. Economic activity bottoms out and often remains stagnant for some time.

Unemployment is high, and consumer confidence is low. This phase sets the stage for the next expansion.

Real-World Impact: A Case Study

The 2008 financial crisis exemplified a severe contraction. The housing market collapse triggered a ripple effect, leading to widespread job losses and economic hardship.

Understanding the cyclical nature of the economy, policymakers can implement measures to mitigate the effects of contraction. This might include monetary policies by the Federal Reserve, or fiscal policies from Congress.

Data and Trends

According to the National Bureau of Economic Research (NBER), the official arbiter of U.S. recessions, the COVID-19 pandemic caused a short but sharp recession in 2020. Data from the Bureau of Economic Analysis (BEA) shows a subsequent rapid expansion.

Monitoring indicators like the Consumer Price Index (CPI) and the Unemployment Rate provides real-time insight into the current phase. This data helps predict potential shifts in the business cycle.

Looking Ahead

Economists are currently debating whether the U.S. economy is heading for another contraction. Factors like inflation and rising interest rates are raising concerns.

Staying informed about economic indicators and the business cycle will equip you to make sound financial decisions. Consulting with financial advisors can provide personalized guidance during uncertain times.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)