What Are The Stages Of The Business Cycle

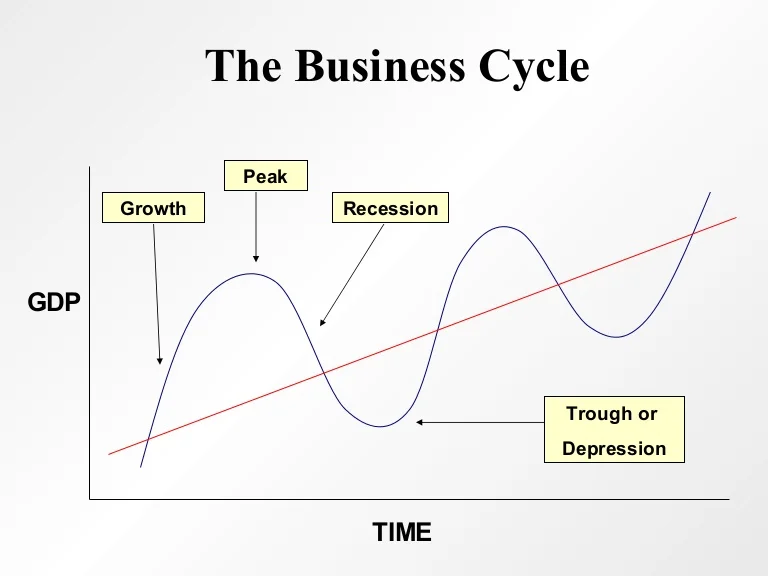

The global economy is a dynamic entity, constantly fluctuating between periods of growth and contraction. These fluctuations, known as the business cycle, are a fundamental aspect of economic activity. Understanding the stages of this cycle is crucial for businesses, investors, and policymakers alike to make informed decisions and navigate the ever-changing economic landscape.

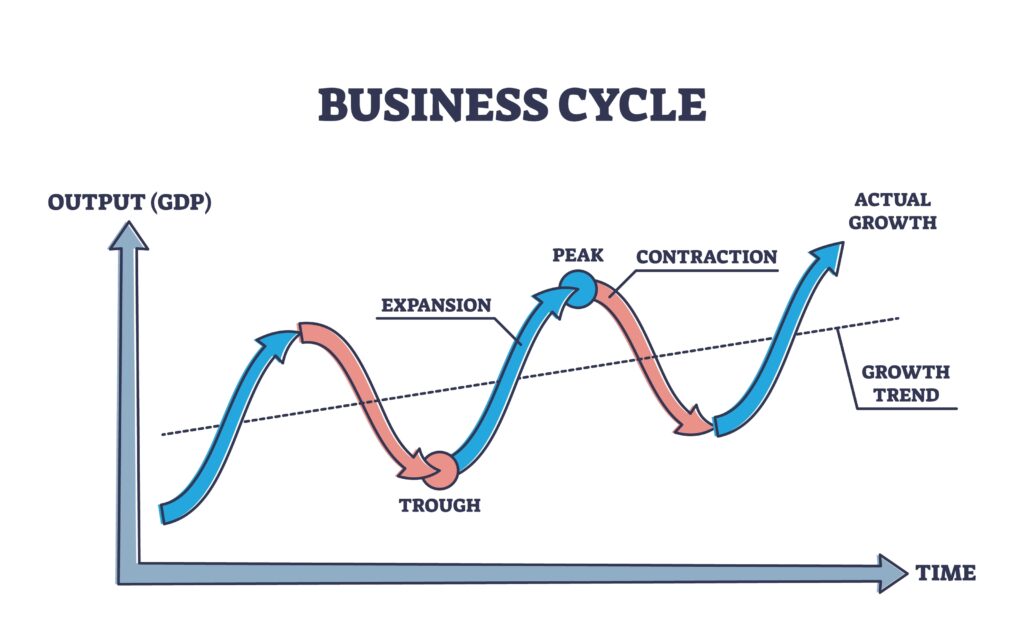

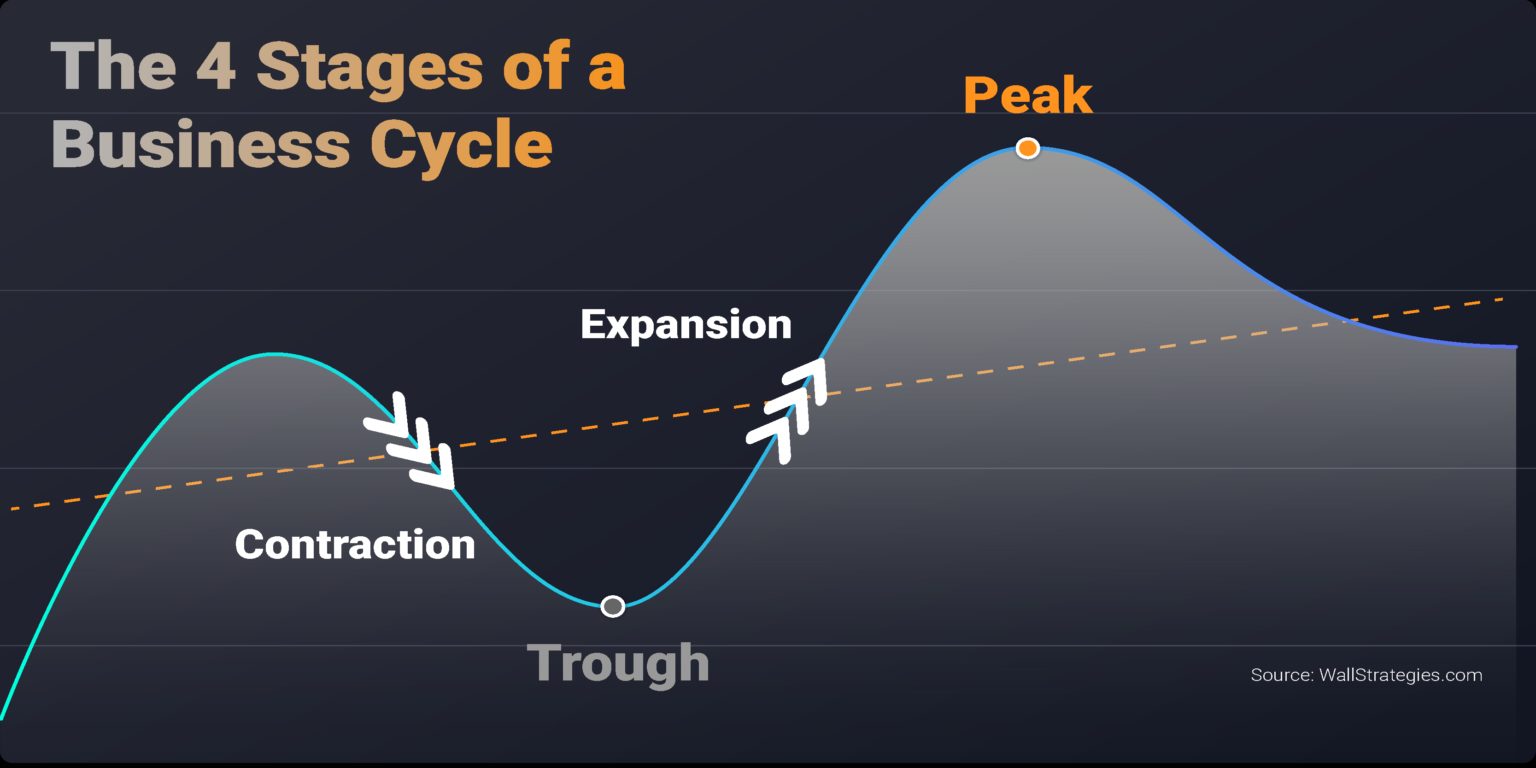

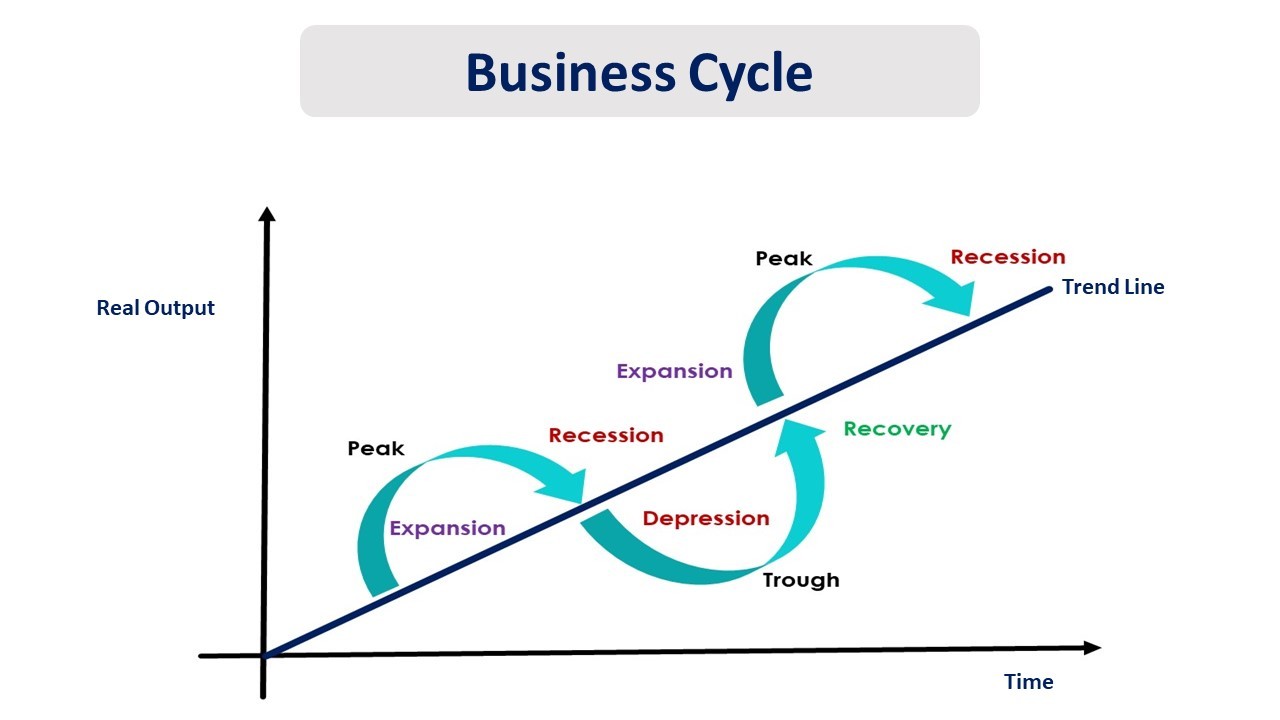

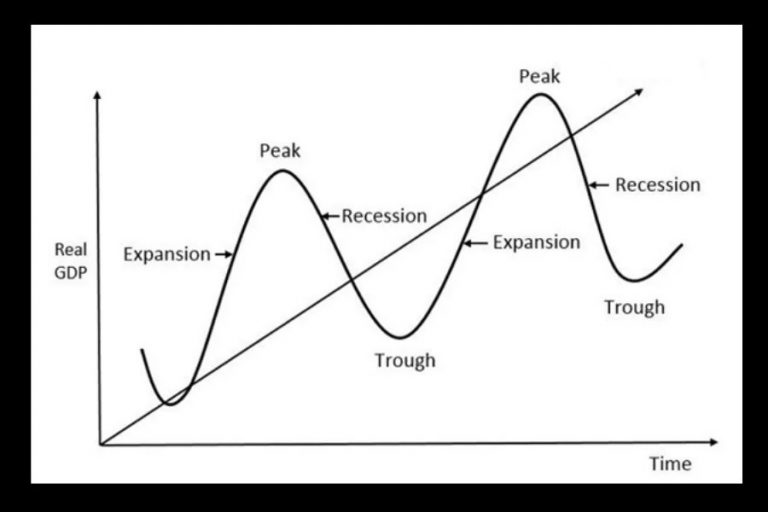

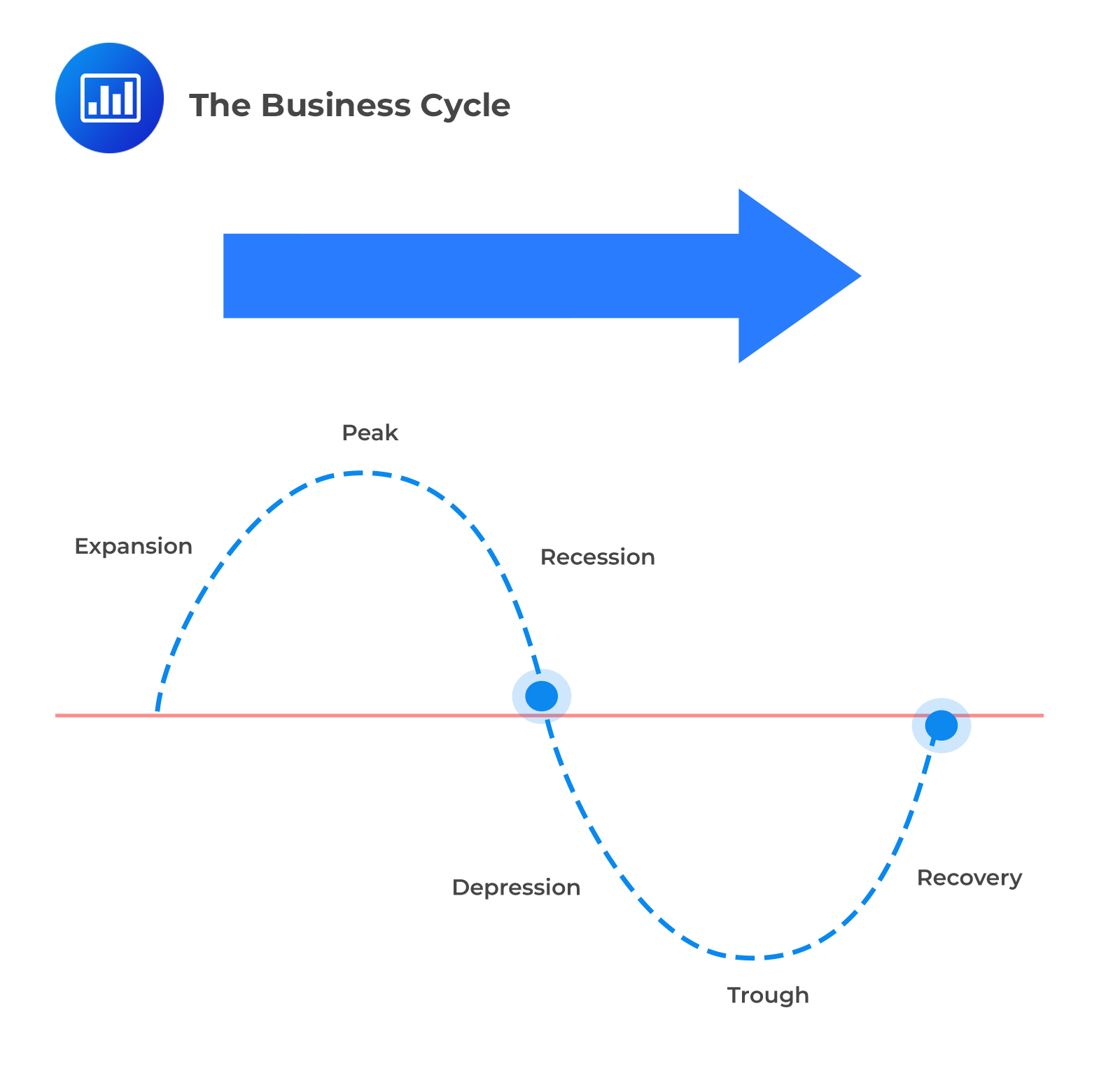

The business cycle, in essence, describes the recurring pattern of expansion and contraction in economic activity. This article will delve into the distinct stages of the business cycle – expansion, peak, contraction (recession), and trough – providing insights into their characteristics, indicators, and potential impacts. We will explore how these phases influence everything from employment rates and inflation to investment strategies and government policies, drawing on data from reputable organizations such as the National Bureau of Economic Research (NBER) and the Federal Reserve.

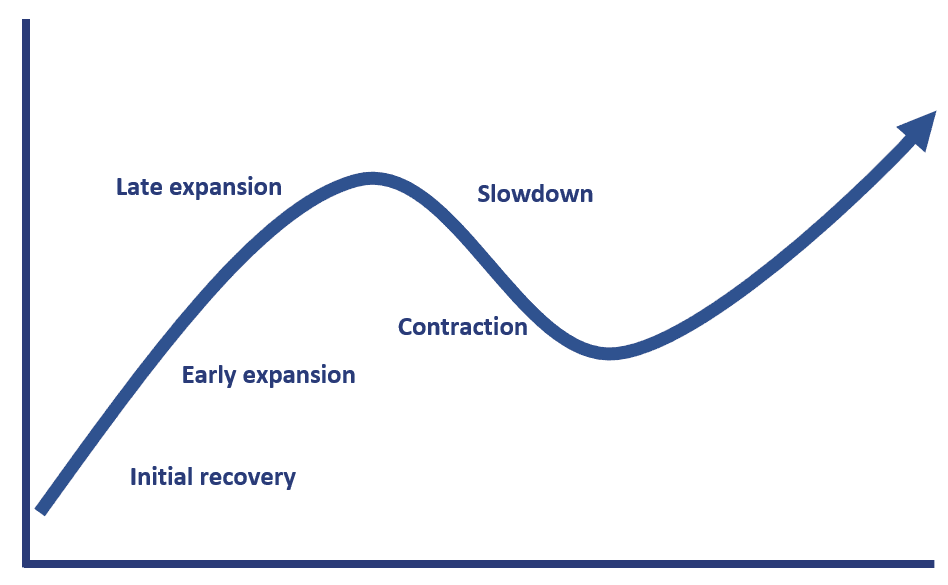

Expansion: The Ascent

The expansion phase is characterized by a period of sustained economic growth. During this stage, gross domestic product (GDP) rises, indicating an increase in the production of goods and services.

Employment rates typically improve, as businesses hire more workers to meet rising demand. Consumer confidence increases, leading to greater spending and investment.

The Federal Reserve often monitors inflation during this phase, potentially raising interest rates to prevent the economy from overheating.

Key Indicators of Expansion

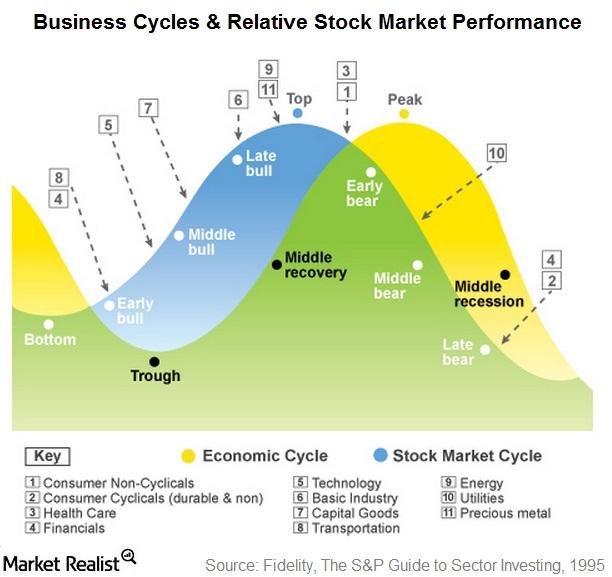

Several indicators signal an expansionary phase. These include rising stock prices, increased manufacturing activity, and a growing housing market.

Consumer spending tends to be high, and business investment increases as companies anticipate continued growth. Declining unemployment claims further confirm the upward trend.

Peak: The Summit

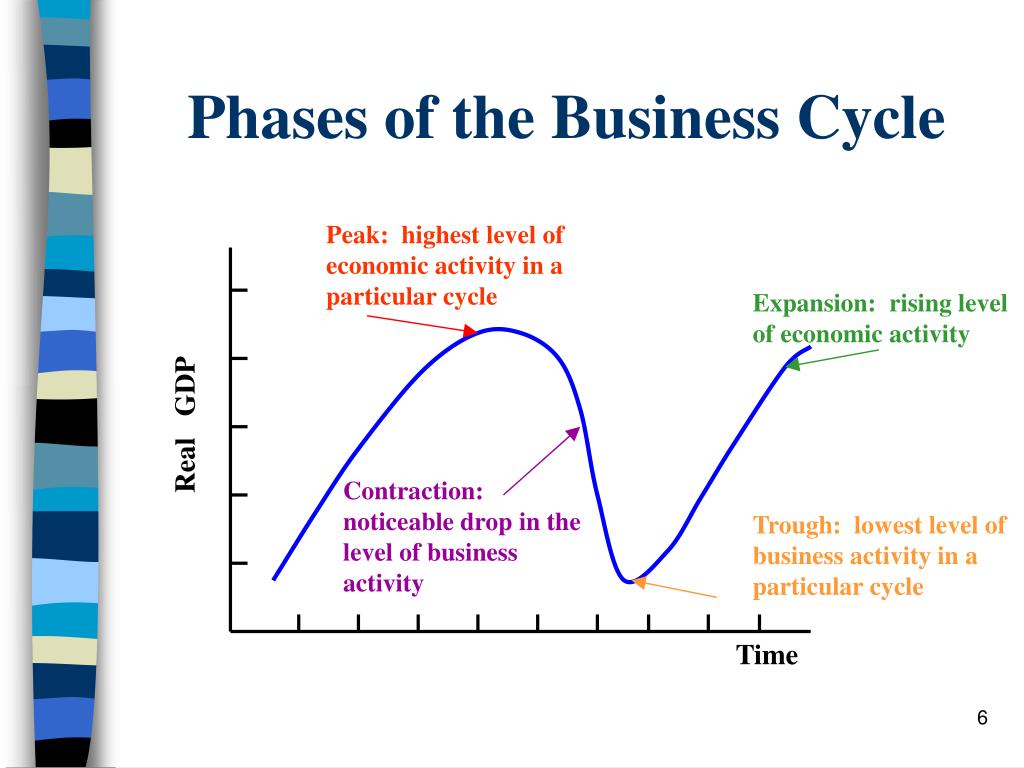

The peak represents the highest point of economic activity in the business cycle. It marks the end of the expansion and the beginning of a contraction.

At the peak, the economy is operating at or near its full capacity. Inflationary pressures may be building, as demand outstrips supply.

Consumer and business confidence may begin to wane as concerns about the future arise.

Recognizing the Peak

Identifying the peak can be challenging in real-time. It often becomes apparent only in retrospect, after the economy has already entered a contraction.

However, certain warning signs, such as slowing sales growth, rising interest rates, and decreasing consumer sentiment, may indicate that the peak is near. The NBER is the official arbiter of business cycle dates in the United States.

Contraction (Recession): The Descent

The contraction phase, often referred to as a recession, is a period of declining economic activity. GDP falls for two or more consecutive quarters, signaling a significant slowdown.

Unemployment rises as businesses reduce their workforce in response to lower demand. Consumer and business confidence plummets, leading to decreased spending and investment.

This phase can be particularly challenging for individuals and businesses, as incomes decline and uncertainty increases.

Characteristics of a Recession

During a recession, business profits typically decline, and bankruptcies may increase. Stock prices often fall sharply, reflecting investor pessimism.

The housing market may weaken, with declining home sales and prices. The Federal Reserve often lowers interest rates to stimulate economic activity during a recession.

Trough: The Nadir

The trough represents the lowest point of economic activity in the business cycle. It marks the end of the contraction and the beginning of a new expansion.

At the trough, economic activity is at its lowest level. Unemployment is typically high, and consumer and business confidence are very low.

However, the trough also presents opportunities for investors and businesses, as asset prices may be depressed, and the stage is set for a recovery.

Signs of a Trough

Identifying the trough can be difficult, but certain indicators may suggest that the economy is nearing the bottom. These include a slowing rate of decline in economic activity and a gradual improvement in consumer and business sentiment.

Increased government spending and Federal Reserve policies aimed at stimulating the economy can also signal that the trough is approaching. As conditions stabilize, businesses may begin to plan for future growth.

Looking Ahead

Understanding the stages of the business cycle is essential for navigating the economic landscape. By monitoring key indicators and staying informed about economic trends, businesses, investors, and policymakers can make more informed decisions and mitigate potential risks.

While predicting the exact timing and duration of each stage remains challenging, a solid understanding of the business cycle can provide valuable insights into the direction of the economy and the opportunities and challenges that lie ahead. As economic conditions continue to evolve, staying informed and adaptable will be crucial for success.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)