What Can Be Used For Collateral To Secure A Loan

Imagine you're standing on the precipice of a dream. Perhaps it's a cozy bakery you've always envisioned, a tech startup bubbling with innovation, or simply consolidating debts to breathe a bit easier. The only hurdle? Securing the necessary funding. But what if you don't have a suitcase full of cash? That’s where collateral comes in, offering a tangible promise to lenders and opening doors you thought were closed.

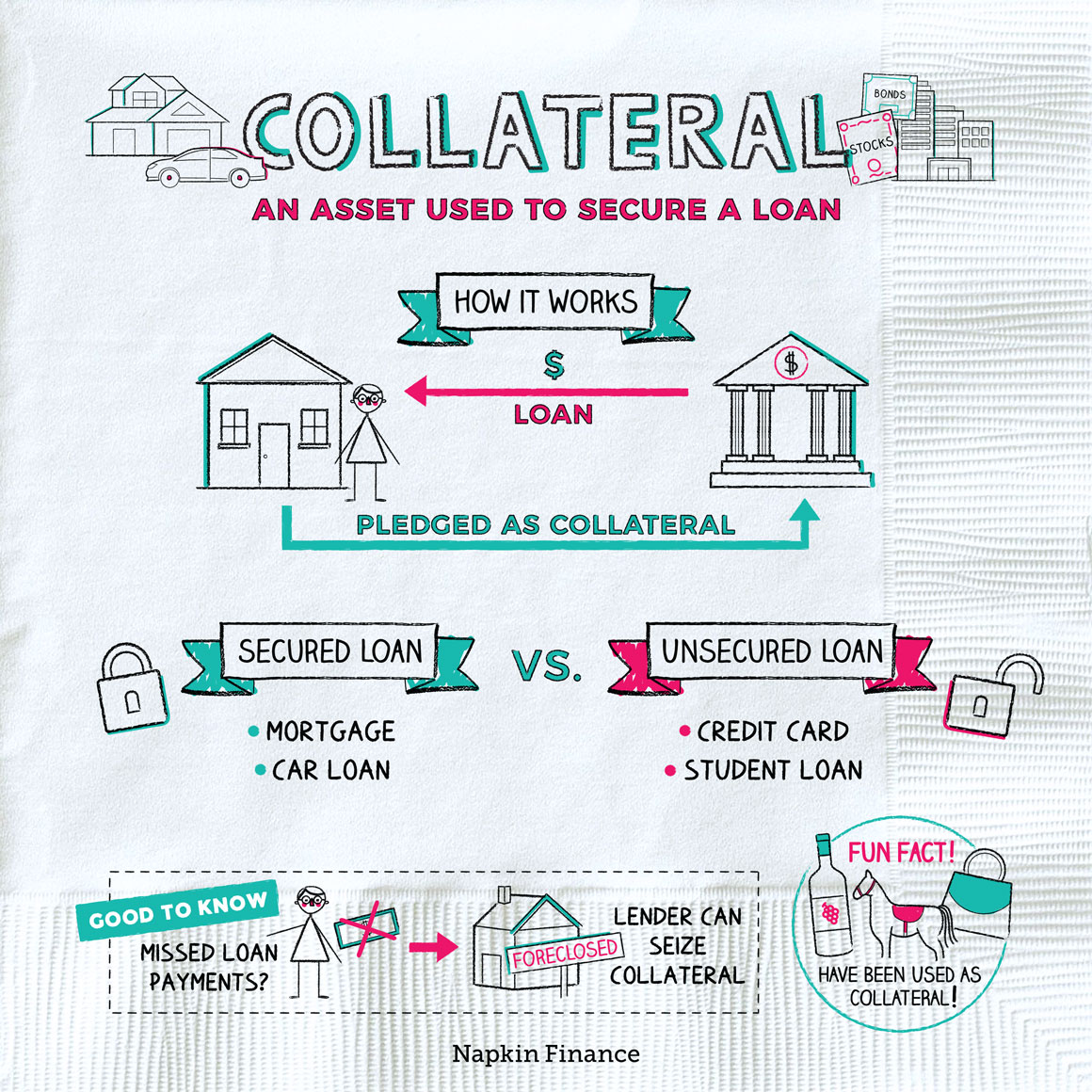

At its core, collateral is an asset you pledge to a lender as security for a loan. This article will explore the diverse landscape of what can be used as collateral, from the obvious to the more creative, highlighting the benefits and considerations of each.

The Foundation: Traditional Collateral Options

Let's start with the familiar. These are the assets lenders typically feel most comfortable with, offering a sense of security rooted in established markets.

Real Estate: A Solid Foundation

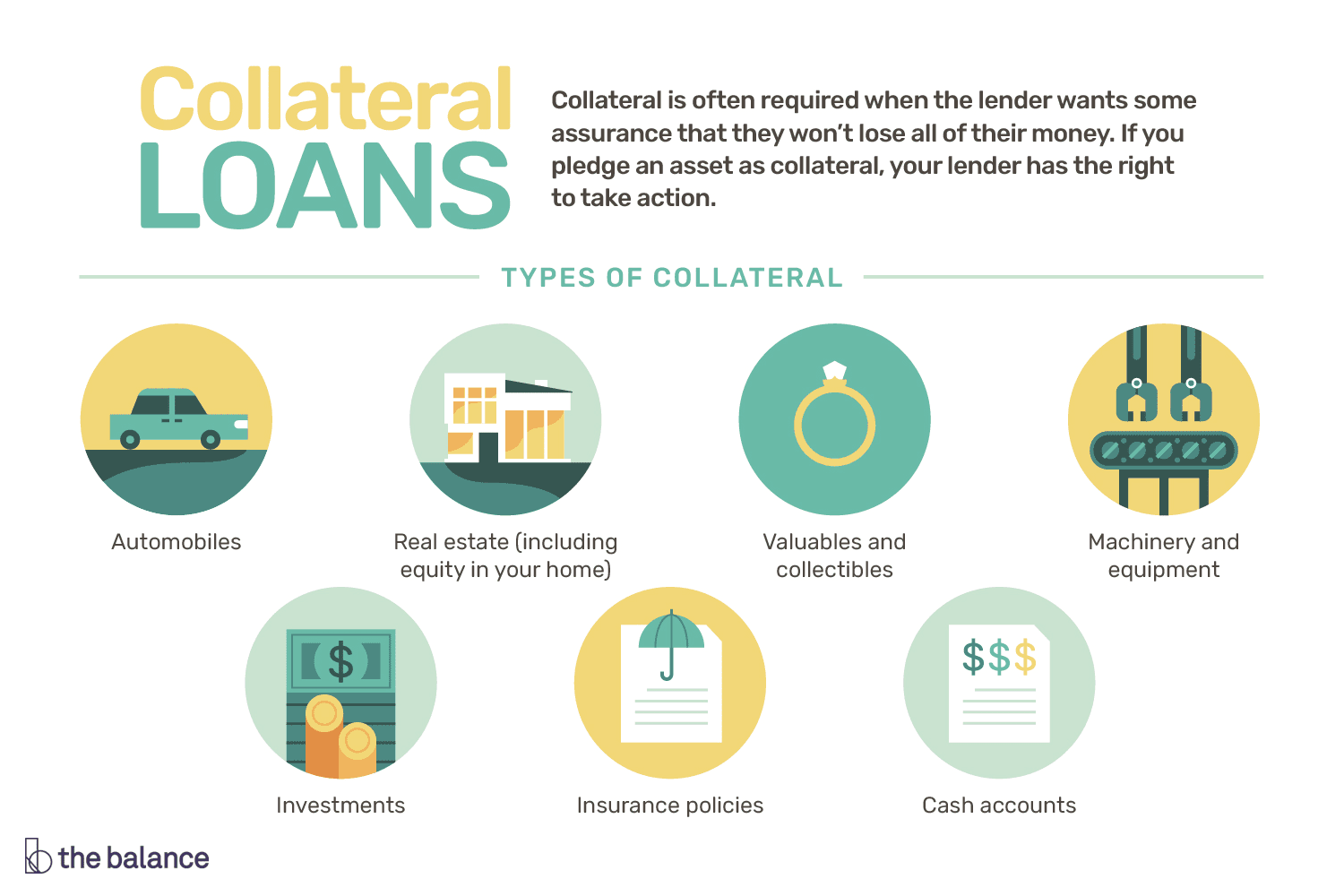

Unsurprisingly, real estate tops the list. Homes, land, and commercial properties are often seen as the gold standard of collateral.

Their inherent value and relatively stable market (though subject to fluctuations, of course) make them attractive to lenders. A mortgage is, after all, a loan secured by your home.

Vehicles: Cars, Trucks, and More

Cars, trucks, motorcycles, even boats and RVs can be used as collateral. The loan amount will depend on the vehicle's assessed value, age, and condition.

Lenders will typically require full coverage insurance to protect their investment. Keep in mind that vehicles depreciate over time, which can impact the loan's terms.

Savings and Investments: Liquid Assets

Cash is king, and readily accessible savings accounts, certificates of deposit (CDs), and investment accounts make excellent collateral. These are considered liquid assets, easily converted to cash if needed.

Lenders may require you to temporarily freeze or assign these accounts, preventing you from withdrawing funds until the loan is repaid.

Beyond the Basics: Exploring Alternative Collateral

The world of collateral isn't limited to bricks, mortar, and bank accounts. For entrepreneurs and individuals with unique assets, other options exist.

Equipment and Inventory: For Businesses

For businesses, equipment like machinery, computers, and vehicles can serve as collateral for a loan to expand or upgrade their assets. Inventory, too, can be used, although it’s considered riskier due to potential spoilage or obsolescence.

Lenders will carefully assess the value and marketability of the equipment or inventory. They might conduct regular inspections to ensure it's well-maintained.

Accounts Receivable: Future Income

Businesses can also use their outstanding invoices, known as accounts receivable, as collateral. This is called accounts receivable financing or factoring.

The lender essentially advances funds based on the value of these invoices, collecting payment directly from the business's customers. This provides immediate cash flow but often comes with higher interest rates.

Life Insurance: A Safety Net

A life insurance policy with a cash value component can be used as collateral. The lender can access the cash value if you fail to repay the loan.

This option offers a unique benefit: it provides both financial security and access to capital. However, borrowing against a life insurance policy can reduce the death benefit.

Intellectual Property: Ideas with Value

Patents, trademarks, and copyrights – collectively known as intellectual property (IP) – can be used as collateral, particularly for businesses in the technology and creative industries.

Valuing IP can be complex, requiring specialized appraisers to determine its market value and potential for future revenue generation. This is less common, but increasingly relevant in a knowledge-based economy.

The Importance of Appraisal and Valuation

Regardless of the asset, accurate appraisal and valuation are crucial. Lenders need to determine the fair market value of the collateral to assess their risk.

They'll typically hire independent appraisers or use established valuation methods. This process protects both the borrower and the lender, ensuring a fair and transparent transaction.

Quoting Investopedia: "Collateral reduces the risk for the lender. If the borrower defaults on the loan, the lender can seize the collateral and sell it to recoup some or all of its losses."

Weighing the Risks and Rewards

Using collateral to secure a loan isn't a decision to be taken lightly. It involves inherent risks.

The most significant risk is losing the asset if you default on the loan. This can have devastating consequences, especially if it's your home or business equipment.

However, the rewards can be substantial. Collateral can help you secure a loan with better terms, lower interest rates, and a higher borrowing limit.

It demonstrates your commitment to repaying the loan and reduces the lender's risk, making them more willing to lend to you.

Making Informed Decisions

Before pledging any asset as collateral, take the time to understand the loan terms, the lender's requirements, and the potential risks. Consult with a financial advisor to assess your options and make informed decisions.

Consider the long-term implications of potentially losing the asset. Ensure you have a solid plan for repayment and a contingency plan in case of unforeseen circumstances.

According to the Small Business Administration (SBA), understanding your collateral options is a crucial step in securing funding for your business. They offer resources and guidance to help entrepreneurs navigate the lending process.

The Human Element: Beyond Assets and Numbers

Ultimately, securing a loan with collateral is about building trust and demonstrating your financial responsibility. It's about showing the lender that you're serious about repaying the loan and committed to achieving your goals. It's a testament to your belief in your vision.

It's important to remember that while collateral provides security for the lender, it also represents something valuable to you – a home, a business, a dream. Treat it with respect and approach the lending process with diligence and care.

And as you navigate the world of finance, remember that the most valuable collateral you possess is your own integrity and determination. Those qualities, combined with a sound financial plan, will pave the way to success, regardless of the assets you pledge along the way.