What Credit Score Do You Need For Discover Credit Card

Securing a credit card can be a crucial step in building a strong financial future. Discover, a major credit card issuer, offers a variety of cards designed to appeal to different consumers. But what credit score do you need to unlock the benefits of a Discover card?

Understanding the credit score requirements is essential for anyone considering applying. This knowledge can save potential applicants from unnecessary hard inquiries on their credit reports and increase their chances of approval.

Credit Score Tiers and Discover Card Approval

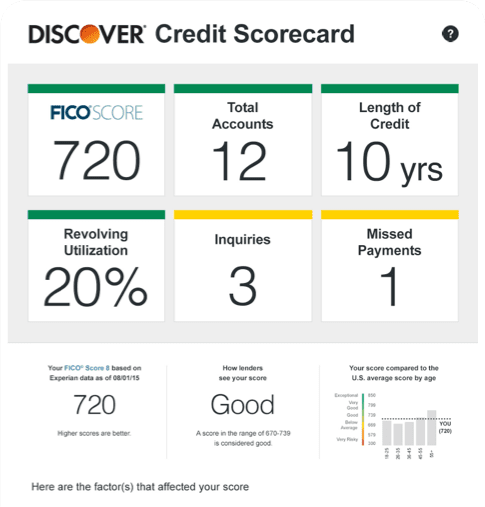

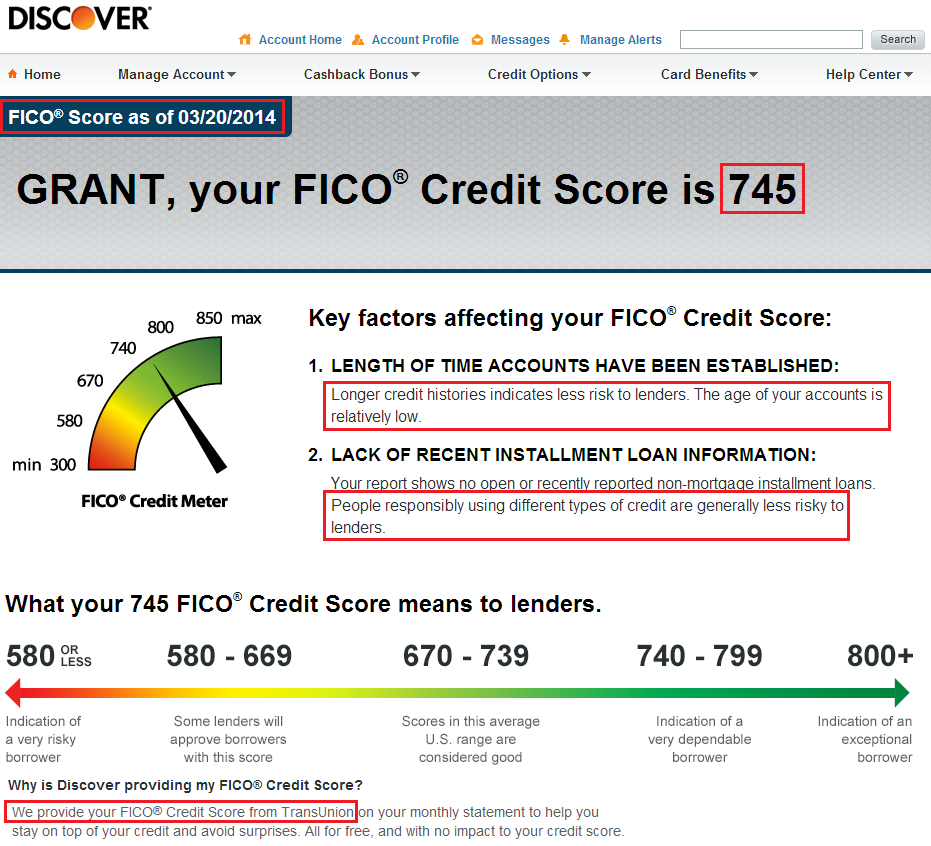

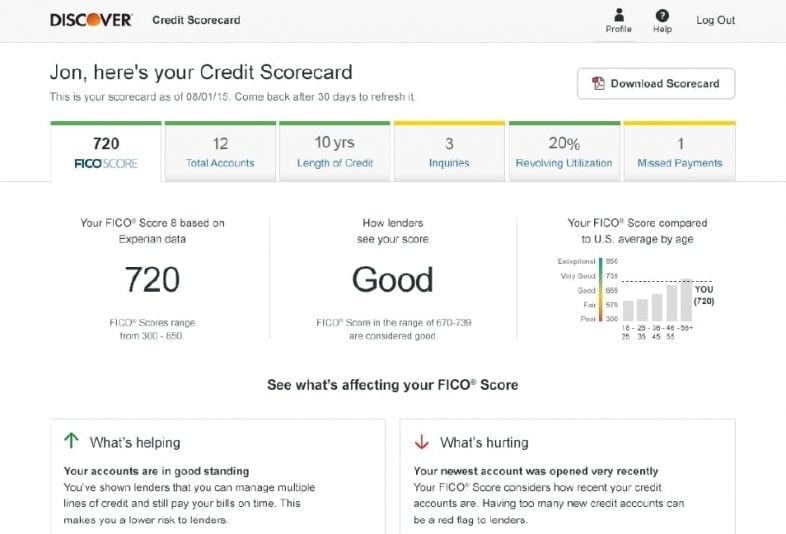

Generally, Discover credit cards are accessible to individuals with good to excellent credit. Credit scores are typically categorized into ranges: poor (300-579), fair (580-669), good (670-739), very good (740-799), and excellent (800-850).

Most Discover cards, including their popular cash back and travel rewards cards, require a credit score in the "good" to "excellent" range, typically 670 or higher, according to numerous credit score analysis websites.

However, Discover also offers options for those with less-than-perfect credit. The Discover it Secured Credit Card is specifically designed for individuals with limited or no credit history, or those looking to rebuild their credit.

The Discover it Secured Credit Card: An Exception

Unlike its unsecured counterparts, the Discover it Secured Credit Card doesn't rely as heavily on a traditional credit score. Instead, approval is largely based on the applicant's ability to provide a security deposit.

The security deposit, which typically ranges from $200 to $2,500, acts as the credit limit for the card. This significantly reduces the risk for Discover, making it accessible to a wider range of applicants, including those with fair or even poor credit.

While a lower credit score might not automatically disqualify an applicant for the secured card, Discover still considers factors like income, debt levels, and overall financial stability.

Factors Beyond Credit Score

Even with a qualifying credit score, approval for a Discover card isn't guaranteed. Discover, like all credit card issuers, considers a range of factors when evaluating applications.

These factors include income, employment history, debt-to-income ratio, and overall creditworthiness. A strong credit history, demonstrating responsible credit management, can significantly increase the chances of approval.

Conversely, factors like a high debt-to-income ratio or a history of late payments can negatively impact the application, even with a good credit score.

Checking Your Credit Score and Improving Your Chances

Before applying for a Discover card, it's advisable to check your credit score. Several free resources are available, including annualcreditreport.com, which provides free credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion.

If your credit score falls below the recommended range, taking steps to improve it can increase your chances of approval. Strategies include paying bills on time, reducing debt balances, and avoiding new credit applications.

Consider becoming an authorized user on someone else's credit card, but only if they use their card responsibly.

Impact and Conclusion

Understanding the credit score requirements for Discover credit cards empowers consumers to make informed decisions about their financial future. By knowing the necessary credit score range and other relevant factors, individuals can strategically choose cards that align with their credit profile and financial goals.

The availability of the Discover it Secured Credit Card offers a valuable opportunity for individuals with limited or damaged credit to build or rebuild their credit history. Responsible use of this card can pave the way for accessing more favorable credit options in the future.

In conclusion, while most Discover cards target individuals with good to excellent credit, the Discover it Secured Credit Card provides a pathway for those with fair or poor credit to enter the Discover ecosystem and begin their journey toward better financial health.

:max_bytes(150000):strip_icc()/discover-business-card_FINAL-62720016f74d497d90e0dc0896ca0be4.png)