What Credit Score Is Needed For Verizon Credit Card

In an era where digital connectivity is paramount, having the right tools for managing expenses related to communication services is essential. For many, the Verizon Credit Card presents an attractive option, offering rewards and benefits tied directly to their Verizon services. However, the crucial question remains: what credit score is needed to unlock these advantages?

This article delves into the credit score requirements for the Verizon Credit Card, providing insights into the factors that influence approval, alternative options for those with less-than-perfect credit, and strategies for improving your creditworthiness to qualify for this popular card. Understanding these requirements is paramount for anyone seeking to leverage the card's benefits while managing their financial health responsibly.

Credit Score Threshold for Verizon Credit Card Approval

While Verizon and Synchrony Bank, the issuer of the Verizon Credit Card, do not explicitly publish a minimum credit score requirement, data points and anecdotal evidence suggest that a good to excellent credit score is generally needed for approval. This typically translates to a FICO score of 670 or higher.

Individuals with scores in the "good" range (670-739) may have a decent chance of approval, but those with scores in the "excellent" range (740-850) are more likely to be approved and may receive more favorable terms, such as a higher credit limit.

However, it's important to note that credit score is not the only factor considered. Synchrony Bank also evaluates your credit history, income, and overall financial profile.

Factors Beyond Credit Score

Beyond your credit score, several other elements play a critical role in the approval process. A strong credit history, demonstrating responsible borrowing and repayment behavior, is crucial.

Synchrony Bank will examine the length of your credit history, the number of open accounts, and the presence of any negative marks, such as late payments, collections, or bankruptcies.

Your income and employment status are also significant factors. A stable income demonstrates your ability to repay the debt incurred on the credit card.

Alternatives for Those with Lower Credit Scores

If your credit score falls below the recommended range, don't despair. Several alternatives can help you build or rebuild your credit while still accessing financial tools. Secured credit cards are a popular option.

These cards require a security deposit, which typically serves as your credit limit. Responsible use of a secured credit card can help you establish a positive credit history. Credit builder loans are another possibility.

These loans are designed to help individuals with limited or damaged credit build a positive payment history. Consider becoming an authorized user on a trusted friend's or family member's credit card, as their responsible usage can positively impact your credit score.

Strategies for Improving Your Credit Score

Improving your credit score is a journey that requires discipline and consistent effort. Start by reviewing your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors or inaccuracies.

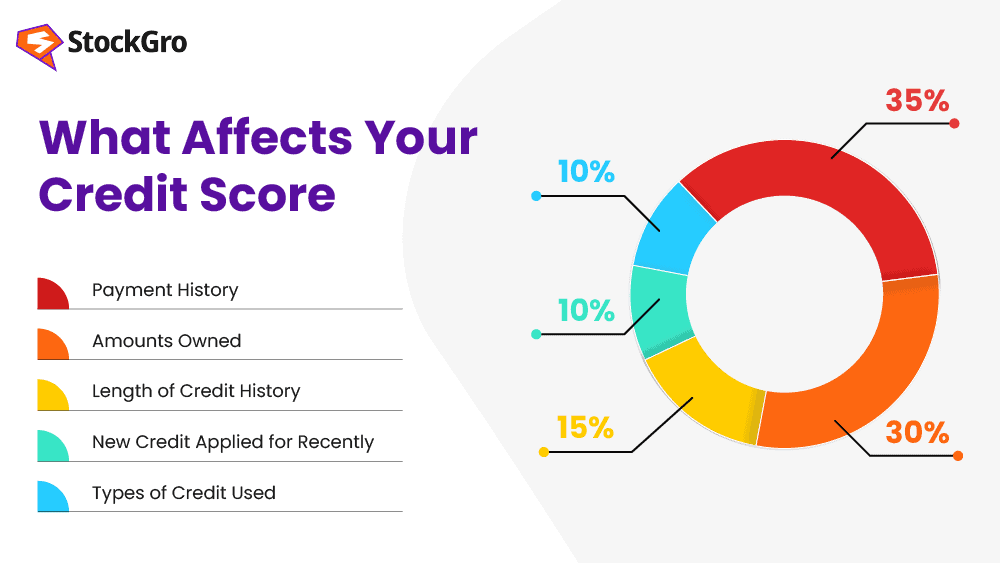

Dispute any errors promptly to ensure your credit report accurately reflects your financial history. Make all your payments on time, as payment history is a crucial factor in determining your credit score.

Keep your credit utilization low by using only a small portion of your available credit. Ideally, aim to keep your credit utilization below 30%.

The Future of Credit Card Approvals

The landscape of credit card approvals is continuously evolving, with increasing emphasis on alternative data sources and sophisticated algorithms. Lenders are exploring new ways to assess creditworthiness beyond traditional credit scores.

This shift could potentially open doors for individuals with limited or non-existent credit histories to access credit products like the Verizon Credit Card in the future. Staying informed about these changes and proactively managing your financial profile will be key to navigating this evolving landscape.

Ultimately, while a good to excellent credit score is generally recommended for the Verizon Credit Card, a holistic approach to financial management, including responsible credit use, timely payments, and proactive credit monitoring, can significantly improve your chances of approval and unlock the benefits of this valuable financial tool.