What Do I Need To File My Taxes H&r Block

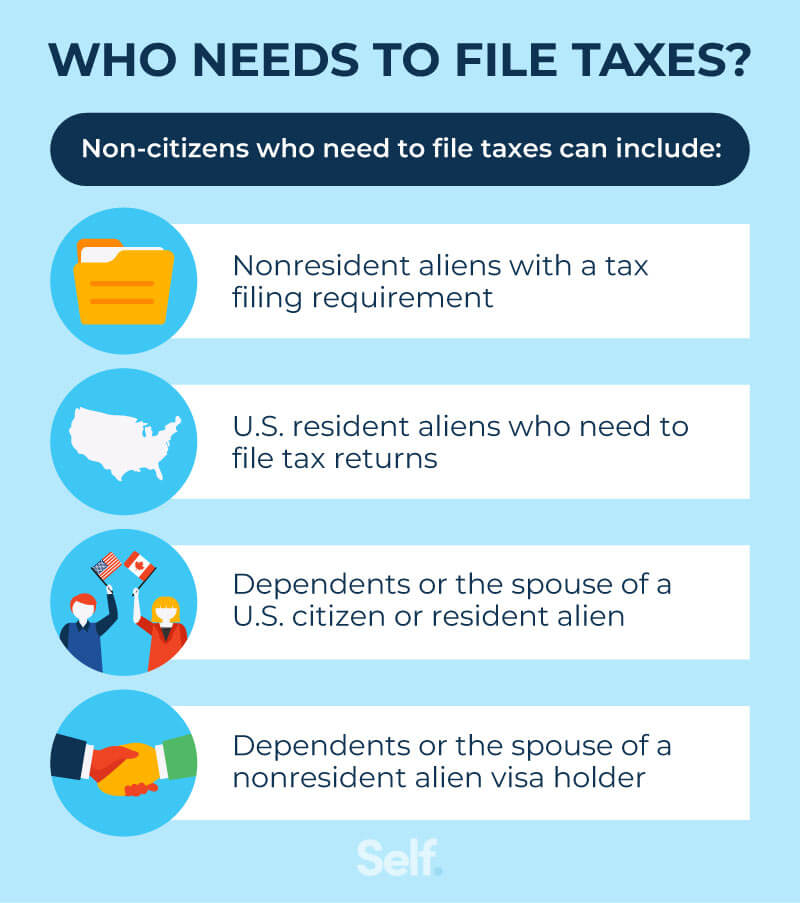

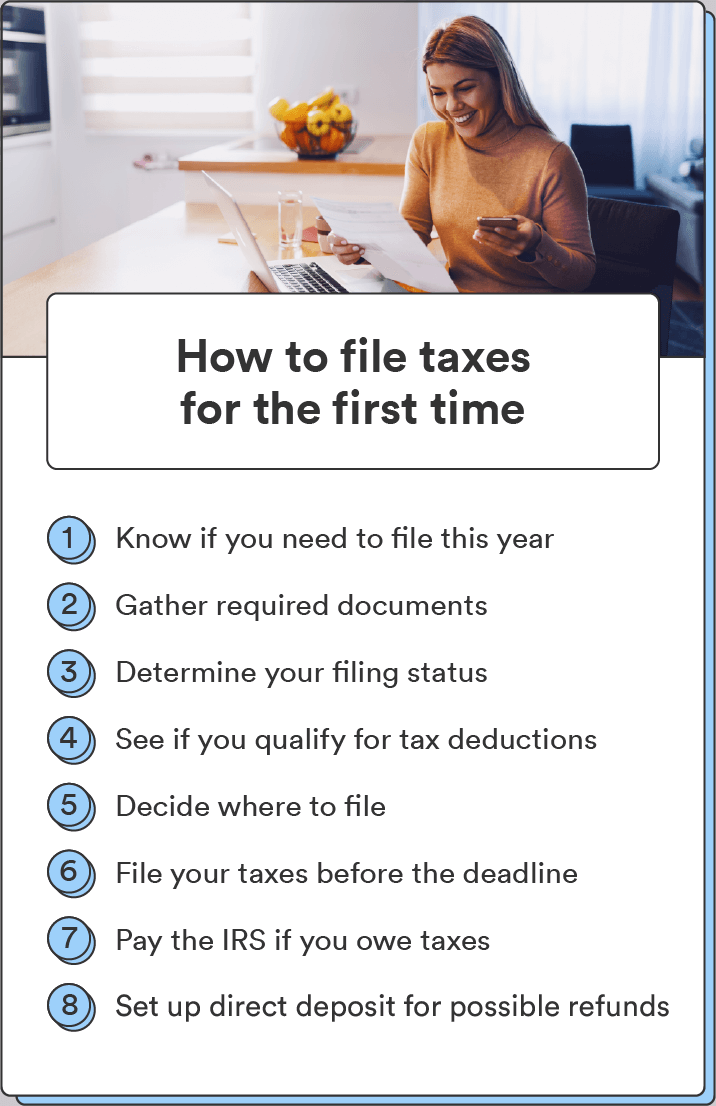

Tax season is rapidly approaching, and understanding what documents you need is crucial to avoid delays and ensure accuracy. This guide outlines the essential information and documents you'll need when filing your taxes with H&R Block.

Missing key documents can lead to processing delays and potential errors on your tax return. Preparing beforehand will streamline the filing process and help you maximize potential refunds.

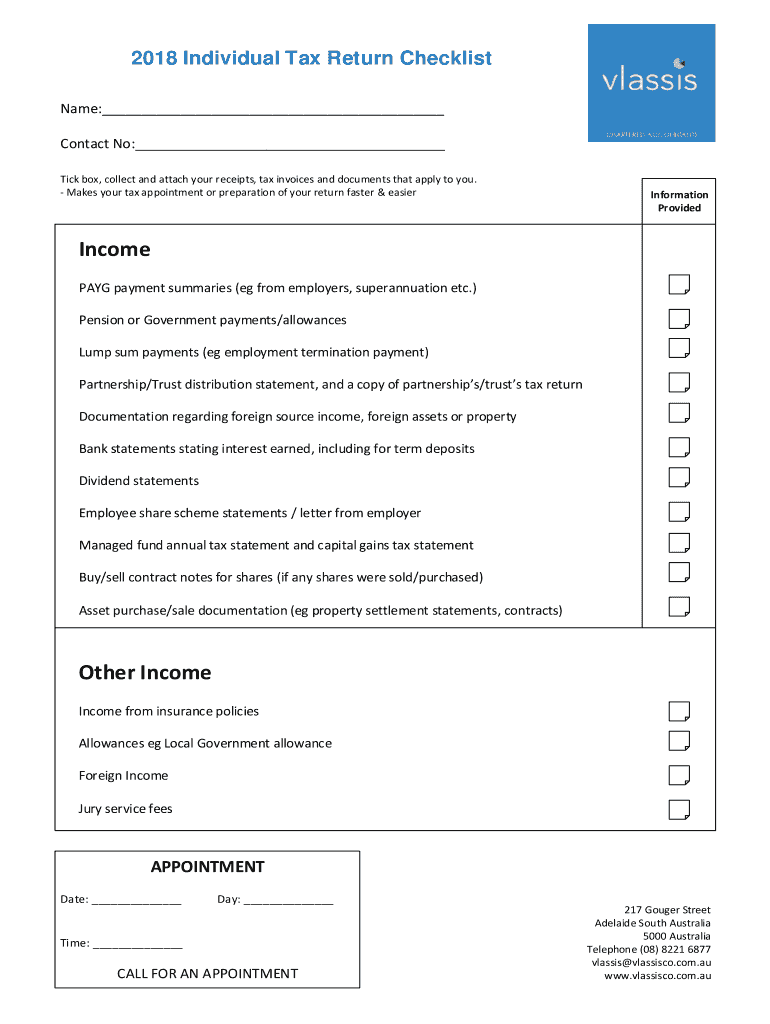

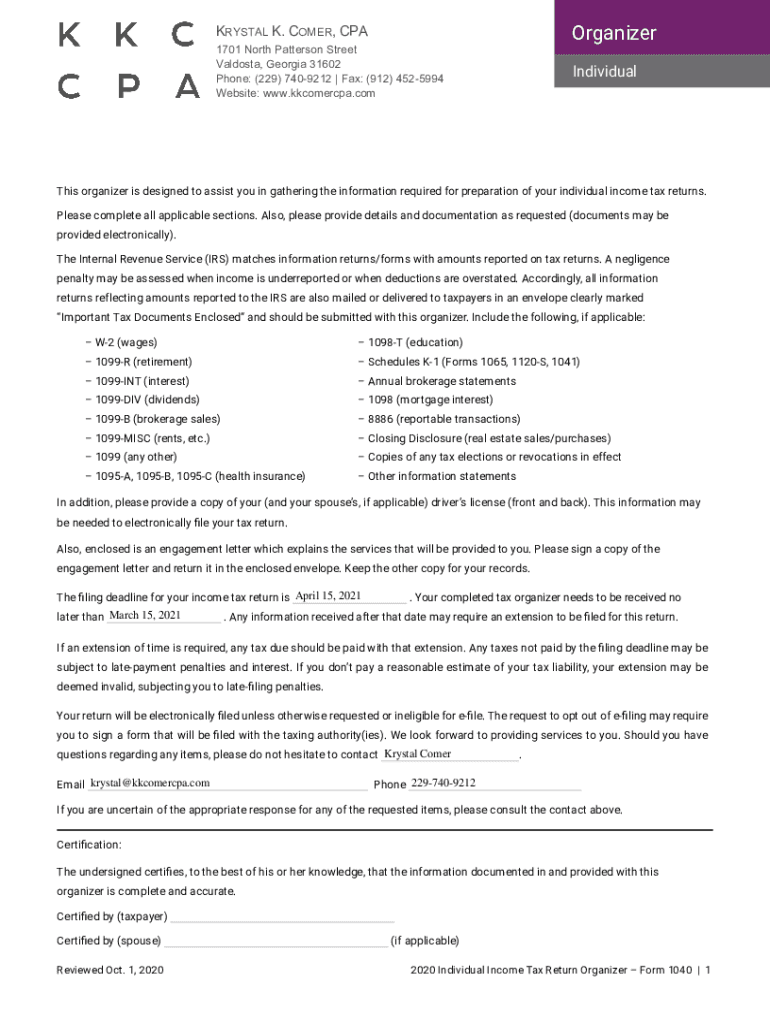

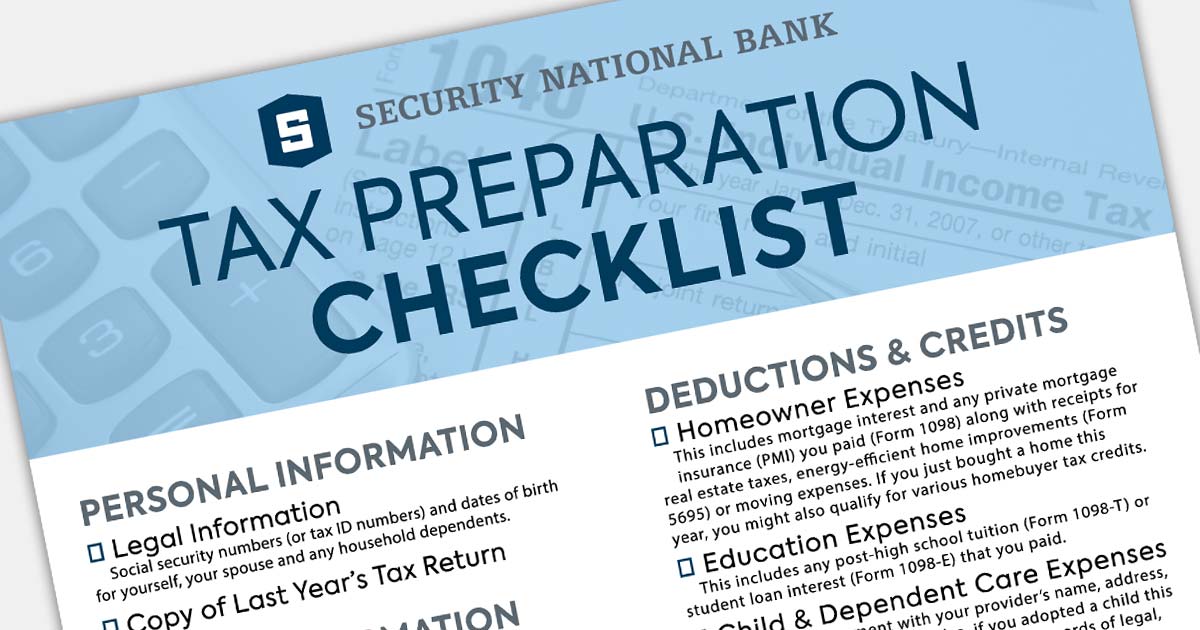

Essential Documents and Information

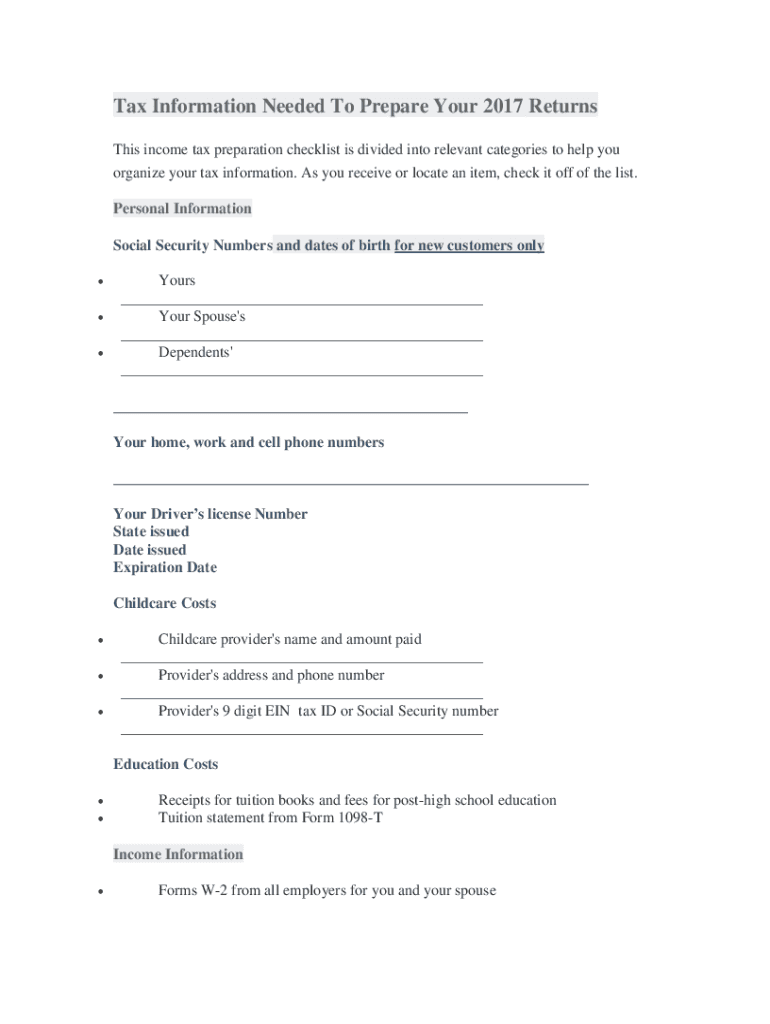

Personal Information

You'll need your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse (if filing jointly), and any dependents. Include dates of birth for yourself, your spouse, and dependents. This information confirms identities and eligibility for credits and deductions.

Income Documentation

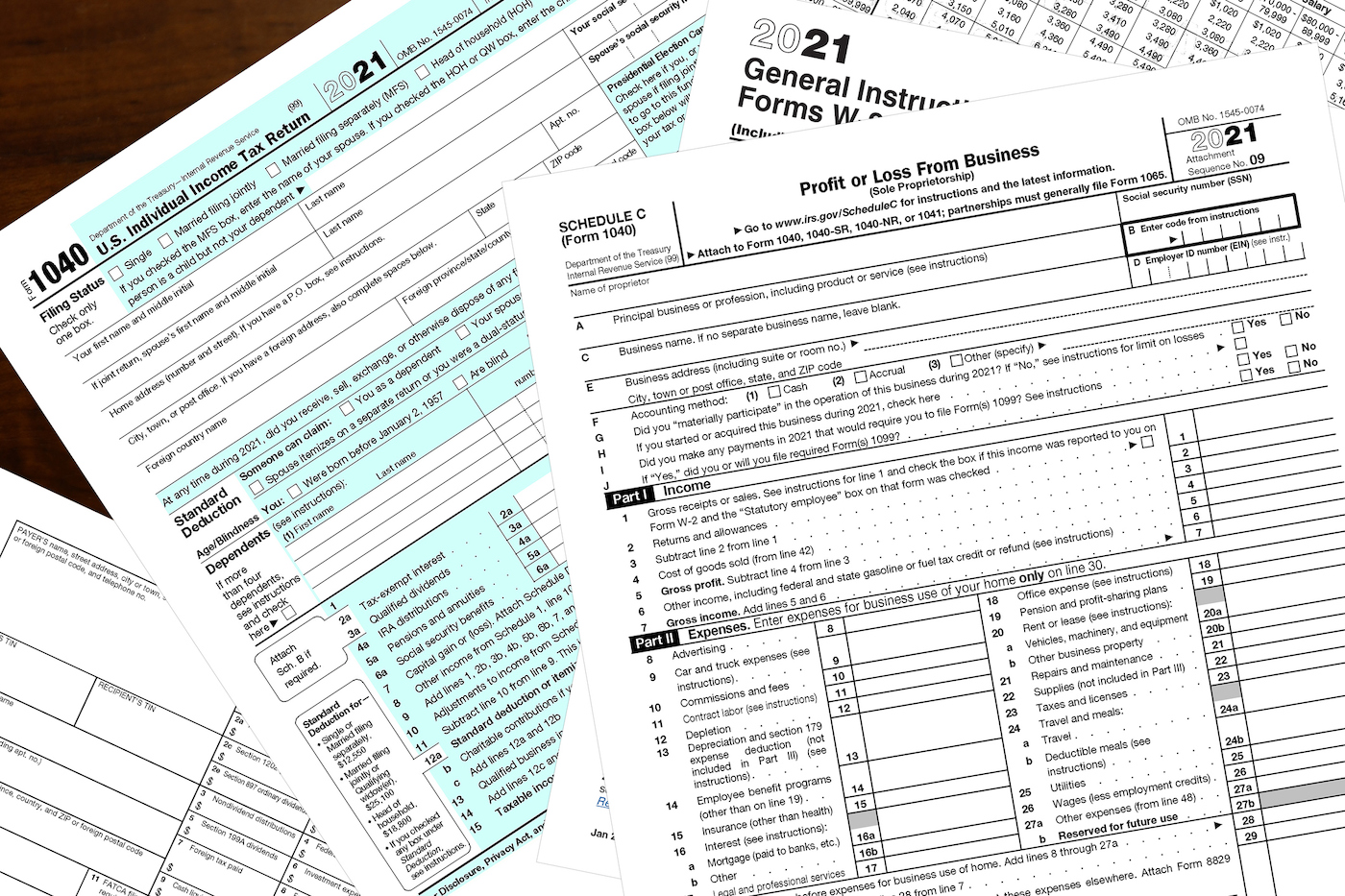

The most common form is the W-2, received from your employer, detailing your wages and taxes withheld. Also gather any 1099 forms, which report income from sources like freelance work, contract jobs, or interest earnings. These documents are essential for accurately reporting your income to the IRS.

Other income-related documents include records of alimony received, unemployment compensation, and any income from savings accounts or investments. Remember to keep records of any income received outside of regular employment.

Deduction and Credit Information

If you own a home, gather your Form 1098 for mortgage interest paid. Property tax statements are also important. These documents support potential deductions related to homeownership.

For those claiming education credits, have your Form 1098-T (Tuition Statement) readily available. If you paid for childcare, have the provider's name, address, and tax identification number. This information is needed to claim the Child and Dependent Care Credit.

If you made contributions to a retirement account (IRA), have records of those contributions. Also, keep documentation for any medical expenses paid, as they could qualify for itemized deductions. Supporting documentation is vital for substantiating deductions.

Health Insurance Information

If you purchased health insurance through the Health Insurance Marketplace, you'll need Form 1095-A. This form reports the amount of premium tax credit you received. Accurate reporting of healthcare coverage is essential to avoid penalties.

Even if you obtained health insurance through your employer, understanding the requirements can avoid issues. H&R Block advisors can provide further guidance regarding health insurance-related information.

Additional Considerations

If you made any charitable contributions, gather receipts and documentation. Records of estimated tax payments made throughout the year are also crucial. Accurate record keeping will greatly aid your tax professional.

Self-employed individuals will need to provide records of income and expenses related to their business. These records are critical for calculating self-employment tax and eligible deductions.

Using H&R Block Services

H&R Block offers various options for filing, including in-person consultations, online filing, and virtual assistance. Choose the option that best fits your needs and comfort level. Ensure you have all required documents organized before engaging with H&R Block.

Consulting with a tax professional at H&R Block can provide personalized guidance based on your individual tax situation. They can help you identify potential deductions and credits you may be eligible for.

H&R Block's online platform provides tools and resources to help you navigate the tax filing process. Utilize these resources to ensure a smooth and accurate filing experience.

Next Steps

Gather all necessary documents immediately to avoid delays. Schedule an appointment with H&R Block or begin your online filing process. Staying ahead of the deadline will ensure a stress-free tax season.

Visit the H&R Block website or contact their customer service for more detailed information and support. Stay informed about any updates or changes to tax laws.