What Do You Need To Make To Buy A House

The dream of homeownership is slipping further out of reach for many Americans as rising home prices, interest rates, and inflation create a perfect storm of financial challenges.

Navigating this complex landscape requires a clear understanding of the income, savings, and credit score needed to qualify for a mortgage and afford the ongoing costs of owning a home.

Income: The Foundation of Affordability

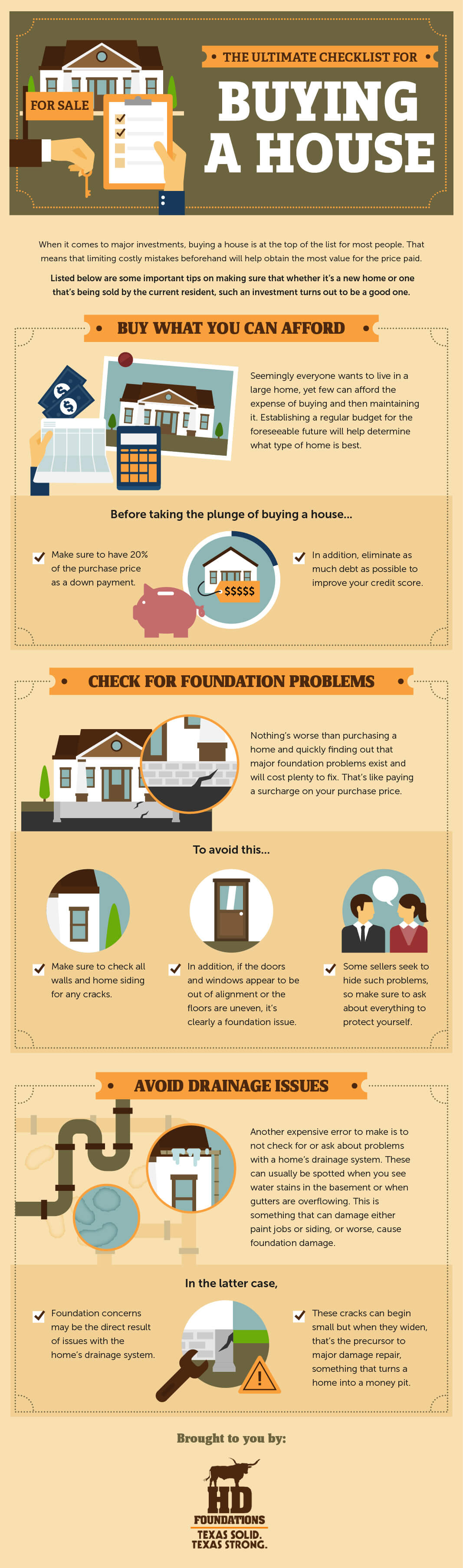

Lenders assess your debt-to-income ratio (DTI) to determine how much of your monthly income is already allocated to debt payments.

A generally accepted DTI is 43% or less, meaning no more than 43% of your gross monthly income should go towards debt, including the new mortgage payment.

According to the National Association of Realtors (NAR), the median household income in the U.S. was approximately $73,298 in 2022. However, the income required to buy a home varies greatly depending on location and the price of the home.

Regional Disparities

In expensive markets like San Francisco, CA, or New York, NY, the income needed to purchase a median-priced home can easily exceed $200,000.

Conversely, in more affordable regions like the Midwest, a household income of $70,000 to $80,000 might suffice.

Use online affordability calculators to estimate the income needed based on your desired location and home price; these tools, offered by banks and real estate websites, provide tailored insights.

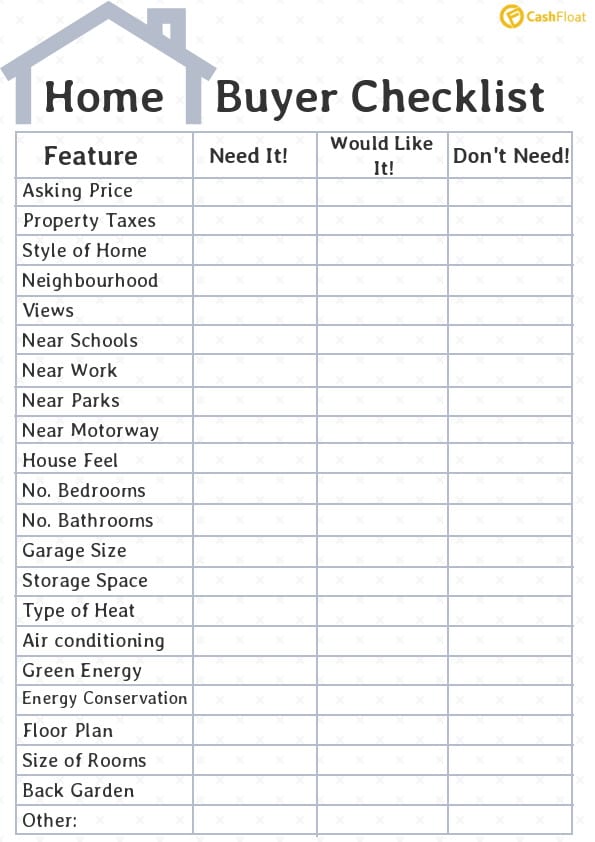

Savings: The Down Payment Hurdle

The down payment is typically the largest upfront cost associated with buying a home.

While a 20% down payment was once the standard, many lenders now offer mortgages with down payments as low as 3% or even 0% for certain qualified buyers, such as veterans.

Even with a smaller down payment, you'll need sufficient savings to cover closing costs, which can range from 2% to 5% of the loan amount.

Calculating Savings Needs

For a $300,000 home with a 5% down payment, you'd need $15,000 for the down payment alone, plus an additional $6,000 to $15,000 for closing costs, totaling between $21,000 and $30,000.

Consider exploring first-time homebuyer programs that offer down payment assistance grants or loans.

These programs, often administered by state and local governments, can significantly reduce the upfront financial burden.

Credit Score: Your Financial Reputation

Your credit score is a crucial factor in determining your eligibility for a mortgage and the interest rate you'll receive.

A higher credit score typically translates to a lower interest rate, saving you thousands of dollars over the life of the loan.

Lenders generally prefer borrowers with credit scores of 740 or higher, but you may still qualify with a score in the 600s, albeit with a higher interest rate.

Improving Your Credit

Check your credit report regularly for errors and dispute any inaccuracies.

Pay your bills on time and keep your credit card balances low to improve your credit score.

Consider a secured credit card or a credit-builder loan to establish or rebuild credit.

Beyond the Mortgage: Ongoing Expenses

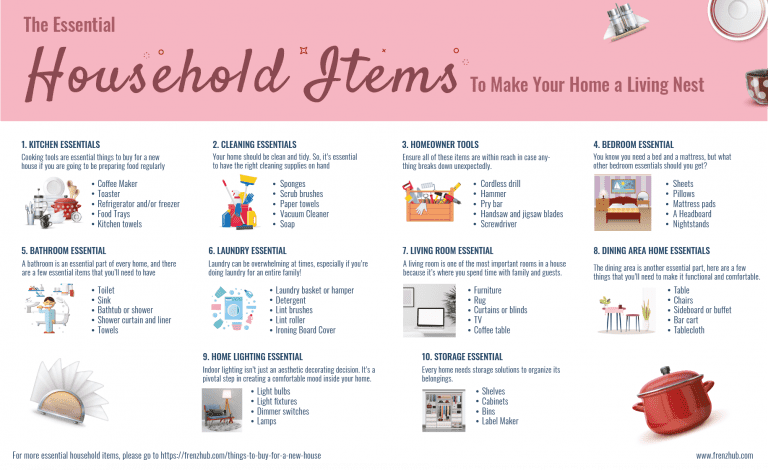

Remember that homeownership entails ongoing expenses beyond the mortgage payment.

These include property taxes, homeowner's insurance, and potential maintenance costs.

Factor in these expenses when determining affordability to avoid financial strain.

Allocate at least 1% of your home's value annually for maintenance and repairs.

The Path Forward

Assessing your financial situation, exploring first-time homebuyer programs, and improving your credit score are critical steps.

Consulting with a financial advisor and a mortgage lender can provide personalized guidance.

The real estate market is constantly evolving, and staying informed is key to making a sound financial decision.