What Happens If A Partner Wants To Leave The Partnership

Partnership dissolution looms as one partner expresses intent to withdraw, triggering complex legal and financial ramifications. This unexpected departure forces remaining partners to navigate critical decisions impacting the business's future viability.

This article dissects the immediate aftermath of a partner's exit, outlining the legal processes, financial assessments, and potential business restructuring required to ensure continuity and mitigate potential losses. Understanding these crucial steps is vital for all partnerships facing similar challenges.

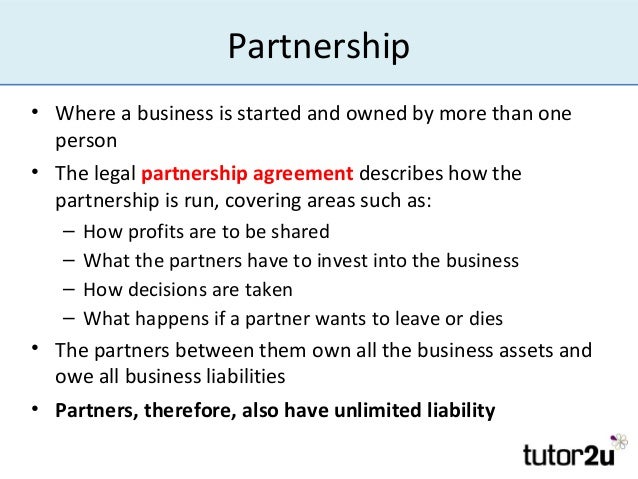

Immediate Legal Implications

The partnership agreement is now paramount. It dictates the procedures for a partner's exit, including required notice periods and valuation methods.

A formal written notice of intent to withdraw is crucial. This initiates the process and establishes a clear timeline.

Consulting with a business attorney is highly recommended. They can provide guidance on legal obligations and protect the remaining partners' interests.

Financial Assessment & Valuation

A comprehensive financial audit must be conducted. This will determine the departing partner's share of assets and liabilities.

Valuation methods outlined in the partnership agreement should be strictly followed. Disputes can arise if these are ambiguous or unfair.

Consider engaging an independent appraiser to ensure an unbiased valuation. This can prevent future legal challenges.

The Buyout Process

The remaining partners typically have the option to buy out the departing partner's stake. This allows the business to continue operating.

Negotiations regarding the buyout price and payment terms are critical. Compromise is often necessary to reach a mutually acceptable agreement.

Financing options, such as loans or investments, may be required to fund the buyout. Explore these options early in the process.

Partnership Dissolution: An Alternative

If a buyout is not feasible, the partnership may face dissolution. This involves winding up the business's affairs.

Assets are liquidated to pay off debts and distribute remaining funds among the partners. The process can be complex and time-consuming.

Dissolution can have significant tax implications for all partners. Seek professional tax advice.

Restructuring the Business

Following a partner's exit, the business structure may need to be restructured. This could involve forming a new partnership or incorporating as a limited liability company (LLC).

Redefining roles and responsibilities is crucial. Ensure that the remaining partners can effectively manage the workload.

Update all relevant business documents, including contracts and licenses, to reflect the new structure.

Impact on Existing Agreements

Review all existing contracts and agreements. Determine if the partner's departure triggers any termination clauses or requires renegotiation.

Notify clients and vendors of the change in partnership. Transparency is essential for maintaining business relationships.

Address any concerns or questions from stakeholders promptly and professionally. This can help minimize disruption.

Potential for Legal Disputes

Disagreements over valuation, buyout terms, or the interpretation of the partnership agreement can lead to legal disputes. Litigation can be costly and time-consuming.

Mediation or arbitration may offer alternative dispute resolution methods. These can be more efficient and less adversarial than court proceedings.

Document all communications and decisions throughout the process. This can provide valuable evidence in case of a dispute.

Next Steps & Ongoing Considerations

Immediate action is crucial to protect the business. Prioritize legal and financial consultations.

The remaining partners must communicate openly and honestly. This will help maintain trust and navigate the challenges ahead.

Seek expert advice and consider all options carefully. The future of the business depends on informed decision-making.