What Happens If I Stop Paying A Credit Card

Ignoring your credit card bill isn't just a minor oversight; it triggers a cascade of negative consequences that can severely damage your financial health.

This article breaks down the immediate and long-term repercussions of missed credit card payments, offering a clear understanding of the potential fallout and how to mitigate the damage.

Immediate Consequences: Late Fees and Increased Interest

The moment you miss your payment due date, late fees kick in. According to the Consumer Financial Protection Bureau (CFPB), these fees can range from $29 for the first missed payment to $40 for subsequent missed payments.

Furthermore, your credit card issuer may increase your Annual Percentage Rate (APR), also known as the penalty APR. This could jump significantly, making future balances much more expensive to carry.

CreditCards.com reports that the average penalty APR can be as high as 29.99%, dramatically increasing the cost of borrowing.

The 30-Day Mark: Credit Score Damage Begins

Missing a payment by 30 days triggers a significant red flag. Credit card companies typically report delinquencies to the major credit bureaus (Equifax, Experian, and TransUnion) after this period.

This is where the damage to your credit score truly begins. According to Experian, even a single late payment can drop a good credit score by 50-100 points.

A lower credit score makes it harder to get approved for loans, rent an apartment, or even secure certain jobs.

The 60-Day Mark: Intensifying Collection Efforts

At 60 days past due, the situation escalates. Expect more frequent calls and letters from your credit card company demanding payment.

The issuer might restrict or even close your credit card account, further impacting your credit utilization ratio, a key factor in credit score calculations.

The 90-Day Mark: Serious Delinquency and Potential Charge-Off

Reaching 90 days past due signals a serious delinquency. Your credit card company is now likely to increase collection efforts, potentially involving third-party collection agencies.

They may initiate a charge-off. A charge-off doesn't erase the debt, but it indicates to other lenders that the debt is unlikely to be repaid.

This severely damages your credit report and remains on it for seven years, according to the Fair Credit Reporting Act (FCRA).

Legal Action and Collection Agencies

If the debt remains unpaid, the credit card company or a collection agency might pursue legal action. This could result in a lawsuit and a court order to garnish your wages or levy your bank account.

Collection agencies are known for aggressive tactics, and dealing with them can be stressful and overwhelming.

According to the Federal Trade Commission (FTC), you have the right to request that a collection agency validates the debt and ceases communication under certain circumstances.

Long-Term Financial Implications

The consequences of stopping credit card payments extend far beyond immediate fees and interest. A damaged credit score impacts almost every aspect of your financial life.

It increases the cost of borrowing, making it more expensive to purchase a car or a home. It can also affect your insurance premiums and employment opportunities.

Rebuilding a damaged credit score requires time, discipline, and a consistent history of on-time payments.

Debt Settlement and Bankruptcy

In extreme cases, individuals facing overwhelming credit card debt may consider debt settlement or bankruptcy. Debt settlement involves negotiating with creditors to pay a lower amount than what is owed.

Bankruptcy, while a more drastic step, can provide a fresh start by discharging certain debts. However, it has a significant negative impact on your credit score and remains on your credit report for up to 10 years.

Preventative Measures and Resources

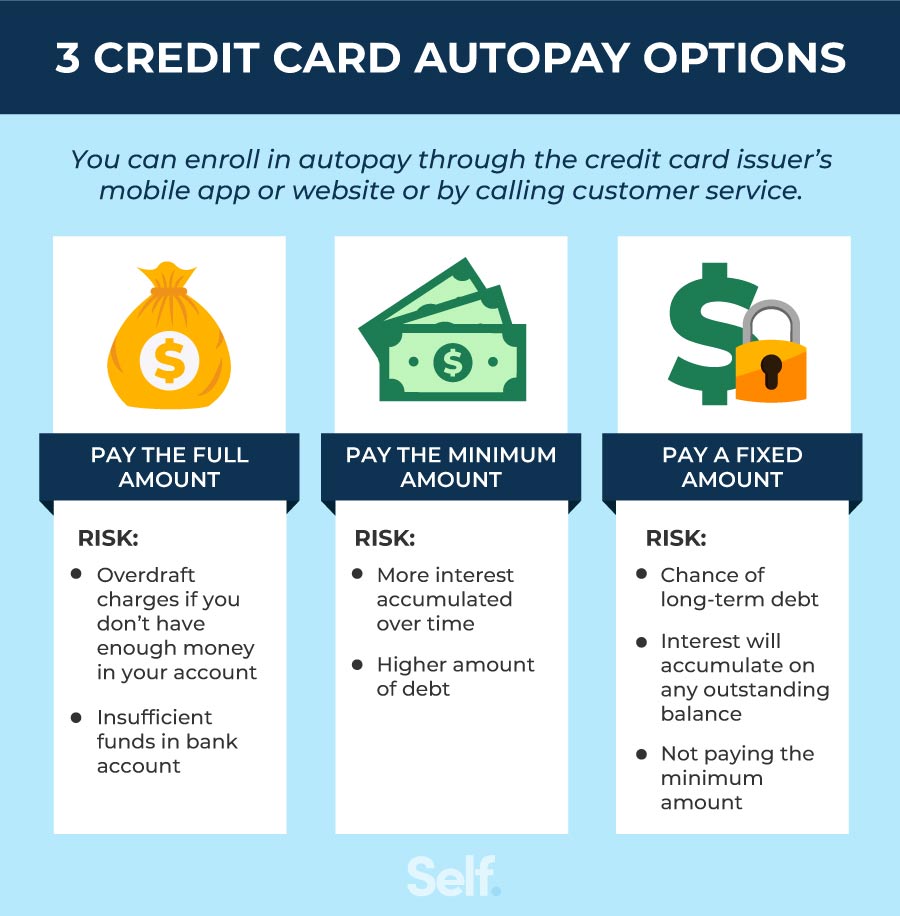

The best way to avoid the consequences of stopping credit card payments is to prevent the situation from happening in the first place.

Create a budget, track your spending, and prioritize making at least the minimum payment on time. If you're struggling, contact your credit card issuer to explore hardship programs or repayment plans.

Resources like the National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA) offer free or low-cost credit counseling services to help you manage your debt and improve your financial situation.

:max_bytes(150000):strip_icc()/Why-your-credit-card-was-declined-And-what-to-do-4159790_V32-fb2b6ae205aa4728b152a9d7a5497d51.png)