What Is A Budget And Why Is It Important

Imagine your favorite bakery, overflowing with the aroma of warm bread and sweet pastries. Behind the scenes, the baker isn't just tossing ingredients together haphazardly. They're carefully measuring flour, sugar, and butter, ensuring each batch delivers that perfect, consistent flavor we all crave. This meticulous planning, this allocation of resources, is, in essence, a real-world example of budgeting.

At its core, a budget is a financial roadmap, a plan for how you'll manage your income and expenses over a specific period. Understanding the concept and importance of budgeting is not about restriction; it's about empowerment, allowing you to take control of your finances and work towards your goals. Let's delve into why creating and sticking to a budget can be transformative.

The Nuts and Bolts of Budgeting

A budget is more than just a list of numbers; it's a reflection of your priorities and a tool for achieving them. Essentially, it's an itemized summary of expected income and expenses. This process helps you understand where your money is coming from and where it's going.

There are several budgeting methods you can explore, each tailored to different needs and preferences. The 50/30/20 rule, for instance, suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Other methods, like zero-based budgeting, require you to allocate every dollar you earn to a specific category, ensuring no money is left unaccounted for.

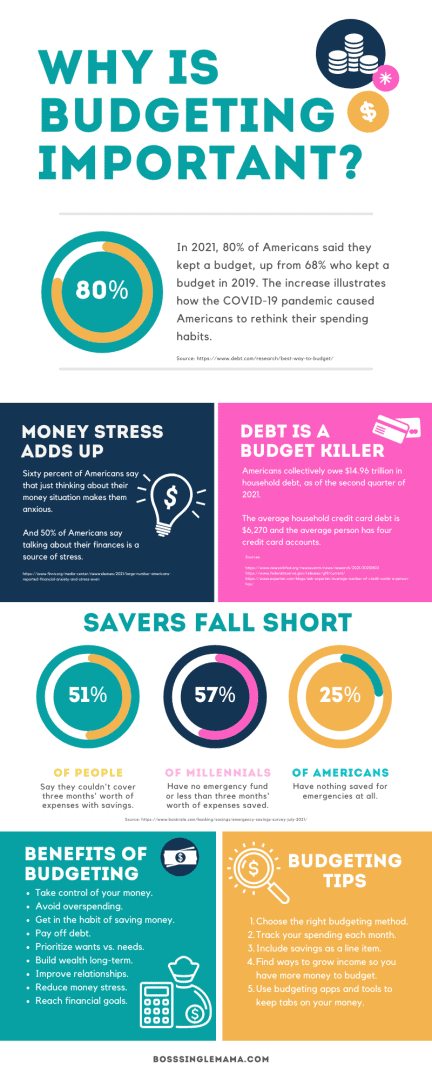

Why Budgeting Matters: A Financial Compass

Budgeting is essential for several reasons, all of which contribute to financial well-being. The most basic reason is that it offers clarity. It is your financial road map.

One of the most significant benefits of budgeting is its ability to help you track your spending. When you know exactly where your money is going, you can identify areas where you might be overspending and make necessary adjustments. This awareness is the first step toward curbing impulsive purchases and making more informed financial decisions.

Beyond tracking expenses, budgeting is crucial for achieving financial goals. Whether it's saving for a down payment on a house, paying off debt, or building a retirement nest egg, a budget provides a framework for setting targets and monitoring progress. By allocating a specific portion of your income to these goals, you're more likely to achieve them.

Budgeting for Unexpected Turns

Life is full of surprises, and not all of them are pleasant. A well-structured budget includes an emergency fund to cover unexpected expenses such as medical bills, car repairs, or job loss. Having this financial cushion can prevent you from going into debt or derailing your long-term financial plans.

The Federal Emergency Management Agency (FEMA) emphasizes the importance of financial preparedness in its disaster preparedness guides. While they focus on broader disaster scenarios, the principle applies equally to personal finance: being prepared for the unexpected can significantly reduce stress and financial hardship.

Budgeting as a Journey, Not a Destination

Creating a budget is not a one-time task; it's an ongoing process that requires regular review and adjustments. Your income, expenses, and financial goals will likely change over time, so your budget should evolve accordingly. Regularly reviewing your budget allows you to stay on track and make necessary corrections.

There are numerous apps and tools available to simplify the budgeting process. From simple spreadsheet templates to sophisticated financial management software, these resources can help you track your spending, set goals, and monitor your progress.

Learning about budgeting is an act of self-care, just like that careful baker pouring ingredients into their recipe with love. It’s about understanding your resources, setting your intentions, and creating a life where you have more control over your financial well-being. Embrace budgeting not as a restriction, but as a tool for building the future you dream of.