What Is A No Score Loan Through Manual Underwriting

Imagine Sarah, a hardworking single mother, juggling two jobs and raising her children. She dreams of owning a home, a safe haven for her family. But despite her diligent efforts, her credit score is less than stellar, a result of past financial struggles. The automated loan application systems repeatedly reject her, leaving her feeling defeated. Is homeownership just a distant fantasy?

The answer, thankfully, might be no. There's a pathway called "no-score" lending, achieved through manual underwriting, offering a beacon of hope for individuals like Sarah. It's a process where lenders look beyond the credit score, assessing a borrower's creditworthiness based on a holistic view of their financial situation.

What Exactly is Manual Underwriting?

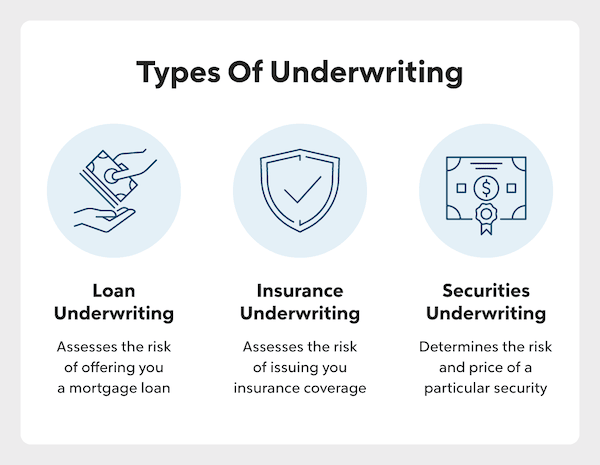

Manual underwriting is a traditional method of evaluating loan applications. Unlike automated underwriting systems that rely heavily on credit scores, manual underwriting involves a loan officer or underwriter personally reviewing a borrower's financial history and current circumstances.

This process allows for a more nuanced understanding of the borrower's ability to repay the loan, taking into account factors that a credit score might overlook.

Essentially, it is a human-driven process, making it more flexible and considerate of individual situations.

The Limitations of Credit Scores

Credit scores are statistical snapshots, often based on past behaviors. They are calculated using algorithms that analyze credit history, payment history, amounts owed, length of credit history, and new credit.

While useful for quickly assessing risk, credit scores don't always tell the whole story. They may not accurately reflect a borrower's current financial stability or their potential for future success.

For example, a past medical emergency that led to debt, or a period of unemployment, can negatively impact a credit score, even if the borrower is now employed and financially responsible.

No-Score Loans: A Second Chance

No-score loans, also referred to as alternative credit loans, are specifically designed for individuals with limited or no credit history, or those with a damaged credit score. They are often secured through manual underwriting.

This type of loan gives lenders the flexibility to consider factors beyond the traditional credit score. It enables them to assess the borrower's overall financial health.

This opens doors for borrowers who might be denied by conventional lending practices, offering a chance at homeownership, starting a business, or other significant investments.

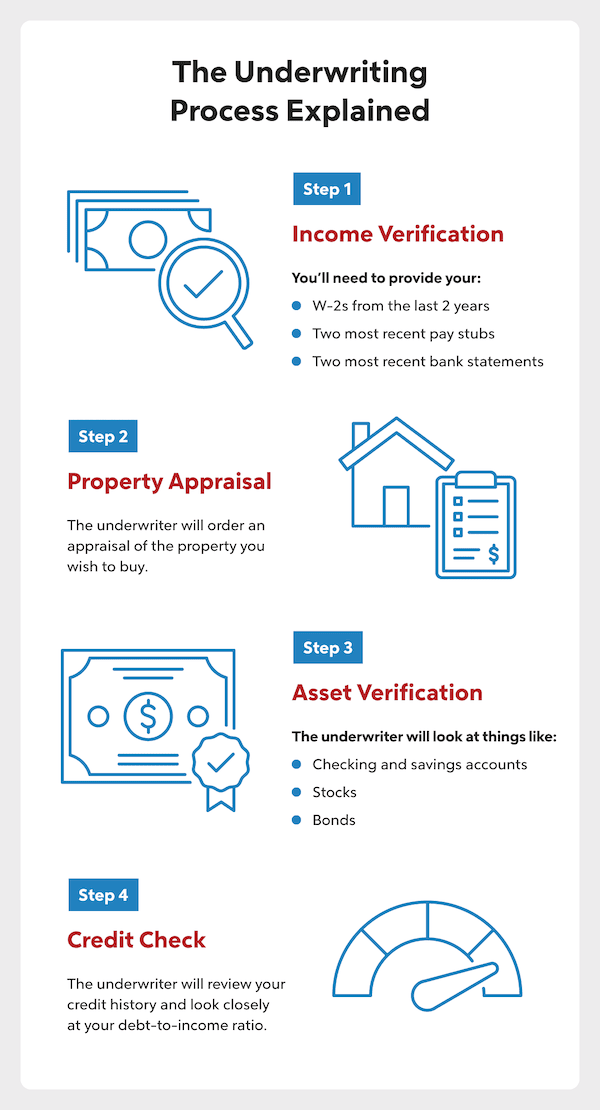

How Manual Underwriting Works

The manual underwriting process is detailed and thorough. It focuses on verifying and documenting a borrower's income, assets, and debt obligations.

Lenders will typically request bank statements, pay stubs, tax returns, and other documentation to verify the borrower's financial stability. They will also look for compensating factors that demonstrate the borrower's ability to repay the loan.

Compensating factors can include a stable employment history, a low debt-to-income ratio, a significant down payment, or a history of responsible financial management (even if not reflected in a traditional credit score).

The Benefits of Manual Underwriting

The primary benefit of manual underwriting is its ability to provide access to credit for those who are often excluded by automated systems. It offers a more equitable and inclusive approach to lending.

It allows lenders to consider individual circumstances and to look beyond a single number. This can be life-changing for borrowers with non-traditional credit profiles.

Furthermore, manual underwriting can reduce the risk of algorithmic bias, which can occur when automated systems perpetuate existing inequalities. Human judgement allows for consideration of factors that algorithms may overlook.

Potential Drawbacks

While manual underwriting offers significant benefits, it's important to acknowledge the potential drawbacks. The process is often more time-consuming and labor-intensive than automated underwriting.

This increased effort can translate to higher costs for the lender, which may then be passed on to the borrower in the form of higher interest rates or fees. It's essential to shop around and compare offers from different lenders.

Additionally, manual underwriting requires a skilled and experienced underwriter. The accuracy and fairness of the assessment depend on the underwriter's judgement and expertise. It is critical to choose lenders that value fair and ethical practices.

Who Benefits from No-Score Loans?

No-score loans are particularly beneficial for several groups. First-time homebuyers with limited credit history can benefit. So do immigrants who have not yet established a credit profile in the United States.

Self-employed individuals with fluctuating income streams may also find manual underwriting helpful, as it allows lenders to consider the overall stability of their business rather than relying solely on a credit score. Survivors of domestic abuse or identity theft whose credit has been damaged can also rebuild their financial lives through these loans.

Finally, anyone who has experienced a major life event that negatively impacted their credit, such as a job loss or medical emergency, can benefit from a more personalized assessment of their financial situation.

Finding Lenders Offering Manual Underwriting

Finding lenders that offer manual underwriting requires some research. Not all lenders advertise this option, so it's important to ask specifically about their underwriting process.

Community banks, credit unions, and mortgage brokers are often more likely to offer manual underwriting than large national banks. Look for lenders specializing in serving underserved communities or borrowers with non-traditional credit profiles.

You can also consult with a housing counselor or financial advisor who can provide guidance and connect you with lenders that offer manual underwriting options. The Department of Housing and Urban Development (HUD) also has resources for finding approved housing counseling agencies.

The Future of Lending

As technology continues to evolve, the future of lending is likely to involve a combination of automated and manual underwriting processes. While algorithms can efficiently process vast amounts of data, human judgement remains essential for ensuring fairness and equity.

The rise of fintech companies is also creating new opportunities for alternative credit scoring models. These models incorporate non-traditional data sources, such as utility bill payments and rental history, to provide a more comprehensive picture of a borrower's creditworthiness.

Ultimately, the goal is to create a lending system that is both efficient and inclusive, providing access to credit for all individuals regardless of their credit score. A move towards more inclusive lending models will foster financial empowerment and economic growth within communities.

Back to Sarah, equipped with the knowledge of no-score loans through manual underwriting, she feels a renewed sense of hope. She begins gathering her financial documents and reaches out to a local credit union known for its commitment to serving the community. The process is thorough, but Sarah is determined. She knows that with hard work and the support of a lender willing to look beyond her credit score, her dream of owning a home might finally come true. Her story serves as a reminder that financial setbacks don't define a person's potential and that opportunities are available for those willing to explore alternative pathways.