What Is A Self Managed Super Fund

Imagine a serene Sunday morning. You're sipping coffee, reviewing your investment portfolio not with a sense of obligation, but with genuine interest. You understand every asset, every strategy, every decision – because you're the one making them. This level of control and engagement is the core promise of a self-managed super fund (SMSF), a path increasingly explored by Australians seeking greater ownership over their retirement savings.

At its heart, an SMSF is a retirement savings vehicle that puts you, the member, in charge. It's essentially a private superannuation fund that you manage for your own benefit. This article dives into what an SMSF truly entails, exploring its benefits, responsibilities, and whether it aligns with your financial goals.

Understanding the SMSF Landscape

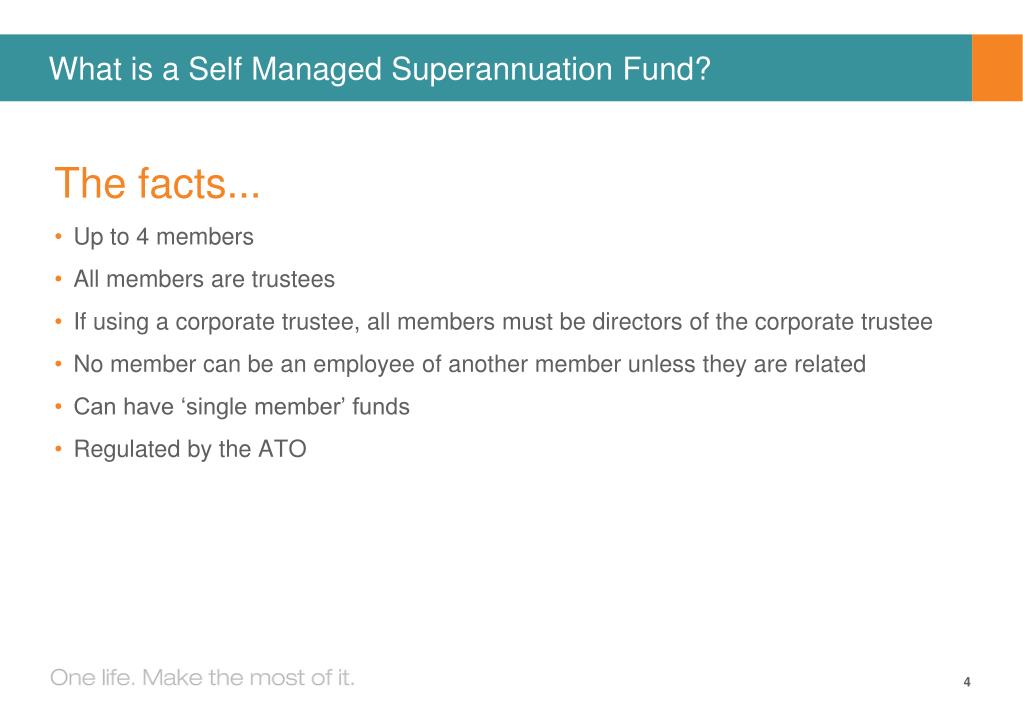

An SMSF, unlike industry or retail super funds, is not managed by professional fund managers. Instead, the members of the fund are also its trustees, bearing the responsibility for all investment decisions and compliance matters.

The rise of SMSFs reflects a growing desire for control and customisation in retirement planning. Many individuals want to directly influence how their superannuation is invested, aligning it with their personal values and financial aspirations.

The Appeal of Control and Flexibility

One of the primary attractions of an SMSF is the unparalleled control it offers. Trustees can invest in a wide range of assets, including direct property, shares, and even collectibles, as long as these investments adhere to superannuation laws.

This flexibility allows for tailored investment strategies that reflect individual risk tolerances and long-term goals. For example, someone with a passion for property might choose to invest a significant portion of their SMSF assets in real estate.

Moreover, SMSFs can be used for more complex financial planning strategies, such as borrowing to invest in property. This increased flexibility must be carefully managed with sound professional advice.

The Responsibilities of Trusteeship

However, the freedom of an SMSF comes with significant responsibilities. Trustees are legally obligated to manage the fund in accordance with superannuation laws, including adhering to strict investment rules and reporting requirements.

This includes ensuring the fund's investments are solely for the purpose of providing retirement benefits to its members. The Australian Taxation Office (ATO) closely monitors SMSFs to prevent non-compliance.

Trustees must also maintain accurate records, prepare financial statements, and arrange for an annual audit by an approved auditor. Failure to comply can result in penalties and even disqualification as a trustee.

Setting Up an SMSF: Key Considerations

Establishing an SMSF involves several crucial steps. Firstly, all members must agree to become trustees of the fund. A trust deed, outlining the fund's rules and objectives, must be established.

Next, the SMSF must be registered with the ATO and obtain an Australian Business Number (ABN) and Tax File Number (TFN). A separate bank account must also be set up for the fund's transactions.

It's highly recommended to seek professional advice from a financial advisor, accountant, and legal professional throughout this process. They can guide you through the complexities of superannuation law and ensure compliance.

Is an SMSF Right for You?

Deciding whether an SMSF is the right choice requires careful consideration of your individual circumstances. Factors to consider include your financial knowledge, time commitment, and available capital.

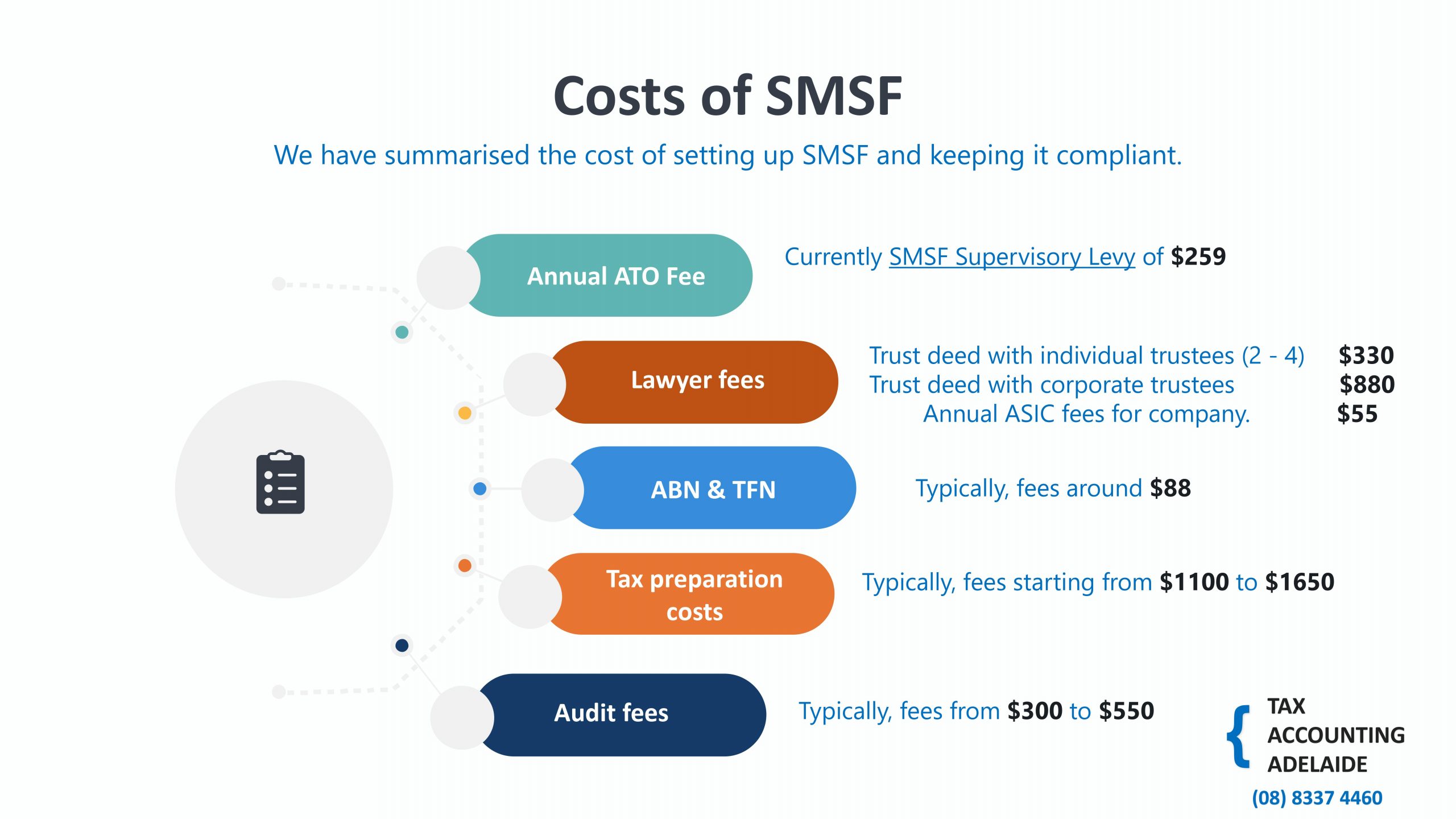

Generally, an SMSF is more suitable for individuals with a higher superannuation balance, as the costs associated with running an SMSF can be significant. According to the Australian Prudential Regulation Authority (APRA), SMSFs typically require a minimum balance to be cost-effective.

It's also essential to honestly assess your willingness to take on the responsibilities of trusteeship. Running an SMSF requires ongoing effort and a commitment to staying informed about changes to superannuation laws.

The Role of Professional Advice

Navigating the SMSF landscape can be challenging, and seeking professional advice is highly recommended. A financial advisor can help you determine if an SMSF aligns with your financial goals and risk tolerance.

An accountant can provide assistance with tax planning, financial reporting, and compliance matters. A legal professional can help you establish and maintain a compliant trust deed.

Engaging these experts can significantly reduce the risk of non-compliance and ensure your SMSF is managed effectively. Remember that the fees for professional advice are an expense of the SMSF.

The Future of SMSFs

The SMSF sector continues to evolve, with ongoing regulatory changes and technological advancements. The ATO is increasingly focused on ensuring SMSF compliance and protecting members' retirement savings.

Technology is also playing a greater role in SMSF administration, with the emergence of software solutions that simplify record-keeping and compliance tasks. These tools can help trustees manage their funds more efficiently.

As the superannuation landscape continues to change, it's essential for SMSF trustees to stay informed and adapt their strategies accordingly. This proactive approach is crucial for ensuring the long-term success of their retirement savings.

A Path to Greater Control

An SMSF offers a compelling pathway for individuals seeking greater control over their retirement savings. It empowers trustees to make their own investment decisions and tailor their strategies to their specific needs and goals.

However, this control comes with significant responsibilities and requires a strong commitment to compliance. Thorough research, professional advice, and a proactive approach are essential for success.

Ultimately, the decision of whether to establish an SMSF is a personal one. Carefully weigh the benefits and responsibilities, seek expert guidance, and determine if it's the right path to secure your financial future.